Futures Bounce, Oil Slides After Report Of Iran Backchannel Outreach

It was shaping up as a catastrophic, margin-call driven Wednesday session after Japan's Nikkei tumbled about 4% and Korea's Kospi suffered its biggest drop ever, plunging by a record 12%. But after initially plunging overnight, S&P futures rose as much as 0.4% after the New York Times reported that operatives from Iran’s Ministry of Intelligence used backchannels to contact the Central Intelligence Agency a day after US-Israeli attacks began. The report also stated that US officials are skeptical that either the Trump administration or Iran is ready for an offramp. Then futures faded modestly after Treasury Secretary Scott Bessent said a proposed 15% global tariff may take effect this week, bringing trade tensions back into focus as traders followed developments in the Middle East. As of 8:00am ET, futures for the S&P 500 - extremely illiquid and jittery - were little changed after rising as much as 0.4%, while Nasdaq futures were also modestly in the green with Mag7 and Semis leading in premarket trading, and Cyclicals outperforming Defensives. Asia’s benchmark index plunged the most in nearly a year, led by a record selloff in South Korean equities which crashed 12% in one session. The yield curve is bear steepening with yields +1-2bp and USD sees some profit-taking following its best 2-day gain since Apr 2025. In the commodity space, crude prices are higher by 1-2%, WTI and Brent, as natgas sees a slight pullback; precious & base metals are surging on the US pullback with Ags adding to gains. The Energy complex seems to be reflecting a view that markets need more information before finding a level as there are mechanical reasons why the US commerce guarantee will not reverse recent price gains. Aside from US / Iran update, the macro data focus is on ADP, Mtge Applications, and ISM-Srvcs.

In premarket trading, Mag 7 were mixed: Nvidia rose 0.6% after billionaire Leo KoGuan said he bought 1 million shares of the semiconductor giant and that he is “convinced AI is NOT a bubble, it is only the beginning.” (Tesla +1.1%, Meta +0.05%, Microsoft -0.5%, Alphabet -0.4%, Amazon -0.3%, Apple -0.4%)

- Cryptocurrency-linked stocks are rallying as Bitcoin rebounds after a selloff spurred by the escalating conflict in the Middle East.

- Gitlab (GTLB) drops 8% after the software company’s forecast for fiscal 2027 adjusted EPS fell short of the average analyst estimate.

- Latham Group (SWIM) jumps 20% after the swimming pool designer’s net sales forecast for the full year surpassed the average analyst estimate.

- Moderna (MRNA) rises 11% after the biotechnology company agreed to pay Genevant, a subsidiary of Roivant Sciences, and Arbutus $950 million to settle litigation related to the delivery technology behind its Covid shot. Analysts note that the settlement value was better than feared and that this should lift some litigation overhang on the stock.

- SSR Mining Inc. (SSRM) rises 8% after entering into an agreement to sell its 80% ownership stake in the Çöpler mine in Turkey to Cengiz for $1.5 billion in cash.

- Staar Surgical (STAA) falls 10% after the health care supplies firm reported net sales for the fourth quarter that missed Wall Street’s estimates.

- Webtoon (WBTN) declines 13% after the storytelling platform reported revenue for the fourth quarter that missed the average analyst estimate

In other corporate news, the architect of Alibaba’s AI model has surprisingly quit as tech lead for Qwen. Anthropic is on track to generate annual revenue of almost $20 billion, more than doubling it run rate from late last year. The CEOs of Nvidia and Microsoft deliver keynote speeches at the Morgan Stanley TMT conference later today in San Francisco. And a billionaire Tesla ‘whale’ says he bought shares in Nvidia, convinced AI is not a bubble. Novo Nordisk shares are higher after the FDA issued 30 warning letters to telehealth companies for “making false and misleading claims regarding compounded GLP-1 products offered on their websites.” Sinclair’s The Tennis Channel is added to Amazon as part of a broader push into the online TV market. Intel says Craig Barratt, a board member since November, to become chair following the annual shareholders meeting on May 13.

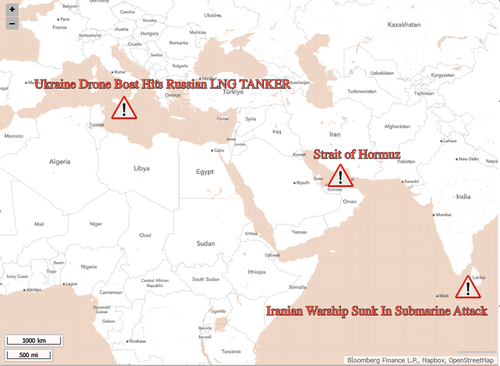

Markets have endured days of volatility after the US-Israeli attack on Iran destabilized the Middle East, curbing energy supplies and damaging infrastructure. The main focus remains on crude as traders weigh President Donald Trump’s plan to insure and escort tankers passing through the Strait of Hormuz, with traffic in the vital waterway all but halted.

“We’re in a headline market,” said Guillermo Hernandez Sampere, head of trading at asset manager MPPM. “Rapid movements with higher volatility will remain for a longer period until supply chains are secure again. It will take some time to calm markets.”

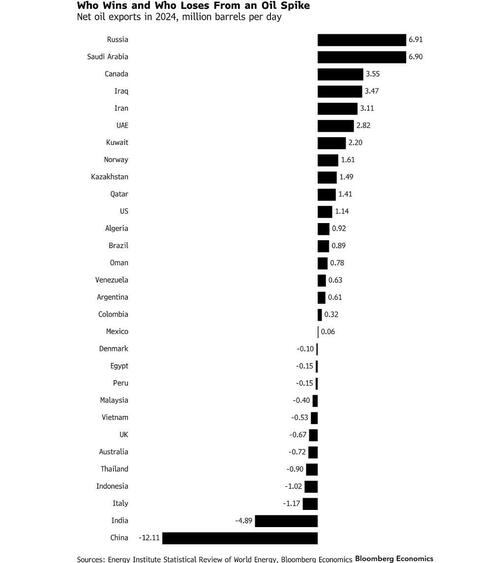

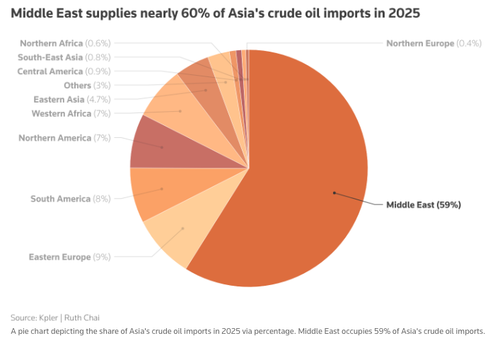

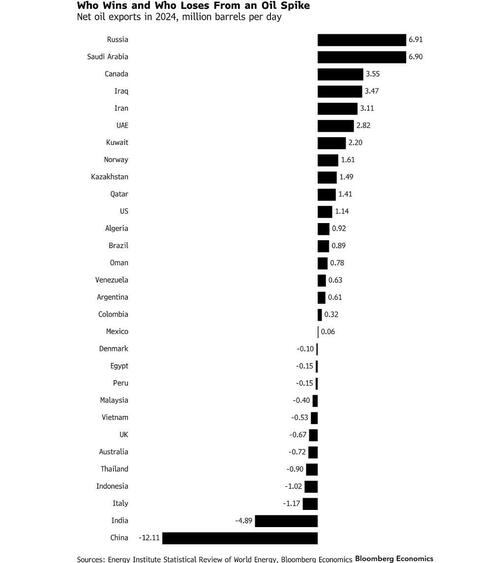

Trump on Tuesday said the US will ensure the free flow of energy through the Persian Gulf with insurance guarantees and even naval escorts. But the shipping industry sees it at best as only a partial solution to a historic crisis. Meanwhile, China may need to lean on US gas supplies to cover potential shortfalls. South Korea imports nearly all of its oil and gas, and Asia’s dependence on oil is illustrated in the table below. Indeed, while the US is relatively immune as a “gigantic energy superpower,” according to Barclays’ global chairman of research Ajay Rajadhyaksha, Asian economies like China, India, South Korea and Japan are more dependent on oil flow through the Strait of Hormuz.

Goldman’s David Solomon said he wasn’t surprised to see volatility measures climb. “It’s going to take a couple of weeks for markets to really digest the implications,” he said. Meanwhile, derivative strategists note a shift higher at the front end of the VIX futures curve signaling a market that is rapidly pricing short-term risk, without an escalation to full-on panic. Although risk assets face a “significant headwind” from rising geopolitical tensions and AI disruption, underlying growth and earnings growth mean the depth and extent of a correction will be limited, note Goldman strategists led by Peter Oppenheimer.

Mohit Kumar, chief strategist for Jefferies in Europe, said the firm’s US clients are generally more optimistic than those in Europe and Asia. The gap reflects US investors’ greater focus on Trump’s actions, which could lead them to underestimate Iran’s response. For Aneeka Gupta, director of macro-economic research at Wisdomtree, the real test for markets will be whether oil and the dollar remain higher long enough to significantly change the behavior of central banks.

“If the shock is short-lived, energy settles, and dollar strength doesn’t become persistent, then the macro impact is mostly a risk premium event — volatility up, but growth intact,” she said.

In geopolitics, German Chancellor Merz says the EU won’t accept US trade deal on worse tariff terms. Several Chinese financial firms are scaling back exposure to Middle Eastern debt, while regulators are stepping up oversight as the conflict raises concerns over the nation’s extensive lending in the region.

In Europe, the Eurostoxx 50 is up some 1.6% posting a modest rebound from the worst two-day decline since April triggered by shocks from the Middle East conflict. Stocks turned green for the year following the NYT report that Iran is trying to backchannel with the US. Positive earnings news also buoys sentiment. The sector breakdown shows a preference for tech, industrial and financials.Here are some of the biggest movers on Wednesday:

- ASM International shares rise as much as 5.8% after the chip equipment firm guided 1Q revenue ahead of expectations, driven both by strong demand from advanced chipmakers amid AI infrastructure rollout, and a rebound in sales from Chinese clients.

- Scor shares gain as much as 4.8% following its fourth-quarter report, with net income coming in significantly ahead of expectations and analysts highlighting solvency “reassuringly ahead.”

- Galliford Try shares rally as much as 6.8% after the UK construction firm beat expectations in the first half and raised its guidance for the full year, stating it has improved confidence from its high level of revenue visibility over the coming years.

- Bayer shares drop as much as 4.2% after the German conglomerate forecast little change in profit and sales in 2026.

- Adidas shares fall as much as 7.8% after the German sportswear maker’s 2026 operating profit forecast missed analysts estimates.

- Continental shares fall as much as 3.2% with analysts disappointed by aspects of the German auto supplier’s 2026 guidance following a pre-release earlier in the year.

- Aroundtown drops as much as 4.9% as Jefferies says the German real estate firm’s funds from operations “landed at the low end of guidance.”

- Redcare Pharmacy shares slide as much as 17% after the online pharmacy reported earnings that missed expectations and gave cautious guidance for this year that disappointed across the board, according to analysts.

- Vistry shares plunge as much as 25% to the lowest since 2016 as the UK homebuilder guides to a lower margin following increased sales incentives to generate cash in a challenging market.

- Traton shares dive as much as 5.8% after the truck maker issued broad growth and margin targets for this year that fell significantly short of expectations at the midpoint.

- Weir Group shares fall as much as 9% after the British engineering company reported adjusted operating profit for the full year that met the average analyst estimate.

Earlier in the session, Asia looked like a missile crater as stocks extended their selloff for a third straight day. The MSCI Asia Pacific Index dropped as much as 4.5%, the most since April 7, driven by sharp losses in Korean equities and regional tech heavyweights including TSMC, Samsung Electronics and SK Hynix. Korea’s benchmark Kospi plunged 12%, its biggest drop ever, as the Iranian war triggered the biggest-ever selloff in what had been the world’s hottest stock market. The Kospi’s rout triggered a 20-minute trading halt early in the session. Benchmarks in Taiwan and Japan slid around 4% each, with virtually all major regional equity indexes in the red. China’s onshore CSI 300 Index wiped out its year-to-date gains.

Taking a quick look at earnings, Out of the 481 S&P 500 companies that have reported so far in the earnings season, 73% have managed to beat analyst forecasts, while 22% have missed.

In FX, the improvement in sentiment has weighed on the greenback with the Bloomberg Dollar index down 0.2%, snapping a two-day run of gains. The yen gained during APAC trade amid intervention talk from Japan’s Katayama.

In rates, a selloff in global bonds eased, with the yield on 10-year Treasuries rising two basis points to 4.08%.

In commodities,WTI crude trimmed gains after the New York Times reported that Iranian operatives made an offer to the US to discuss terms for ending the conflict a day after attacks began.

Treasuries are down a handful of ticks with yields up 1-2bps across the curve. Spot gold and silver are higher by 2% and 5.1%. Bitcoin has also marched higher, up 4.4%. Brent crude retreated from an intraday high to trade near $82 a barrel. Bitcoin jumped to nearly $70,000, suggesting some return of risk appetite.

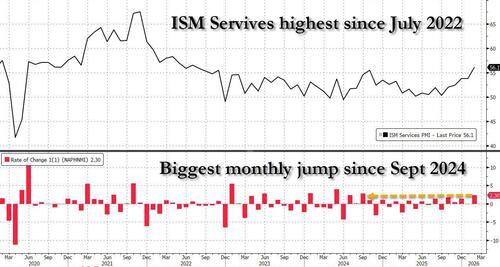

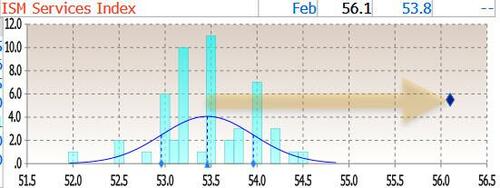

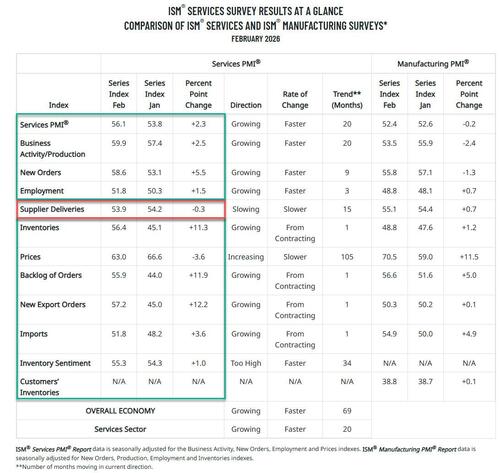

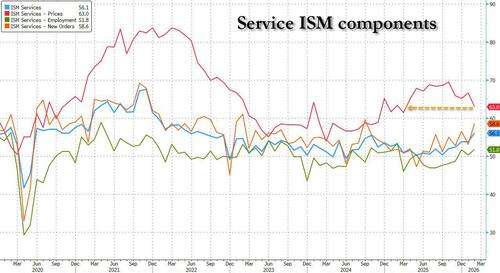

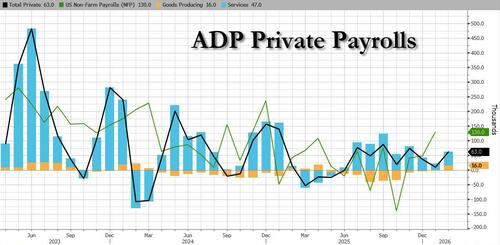

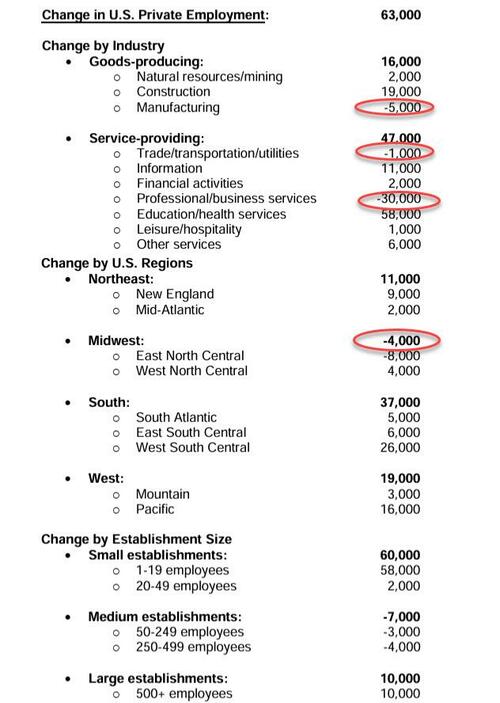

Looking at the day ahead, data releases include the final services and composite PMIs for February from the US and Europe. In the US there’s also the ISM services index and the ADP’s report of private payrolls for February, whilst in the Euro Area we’ll get the unemployment rate for January. From central banks, we’ll hear from ECB Vice President de Guindos, the ECB’s Muller, Cipollone and Villeroy, along with Bank of Canada Governor Macklem. Otherwise, the Fed will release their Beige Book.

Markets Snapshot

- S&P 500 mini +0.1%

- Nasdaq 100 mini +0.2%

- Russell 2000 mini +0.3%

- Stoxx Europe 600 +1.1%

- MSCI Asia Pacific Index fell 4%

- Japan’s Nikkei Index fell 3.6%

- China’s CSI 300 Index fell 1.1%

- Hong Kong’s Hang Seng Index fell 2%

- Taiwan’s Taiex Index fell 4.4%

- South Korea’s Kospi Index fell 12%

- Australia’s S&P/ASX 200 Index fell 1.9%

- New Zealand’s S&P/NZX 50 Gross Index fell 0.7%

- India’s NSE Nifty 50 Index fell 1.8%

- DAX +1.3%

- CAC 40 +0.9%

- 10-year Treasury yield +2 basis points at 4.08%

- VIX -0.6 points at 23.02

- Bloomberg Dollar Index -0.2% at 1200.93

- euro +0.2% at $1.1636

- WTI crude +1.6% at $75.79/barrel

Top Overnight News

- A day after the attacks began, operatives from Iran’s Ministry of intelligence reached out indirectly to the CIA with an offer to discuss terms for ending the conflict. US officials are skeptical – at least in the short term – that either the Trump administration or Iran is really ready for an offramp. NYT

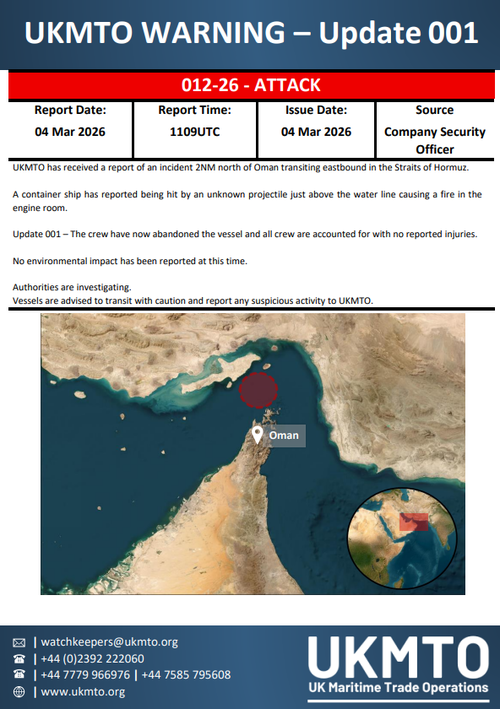

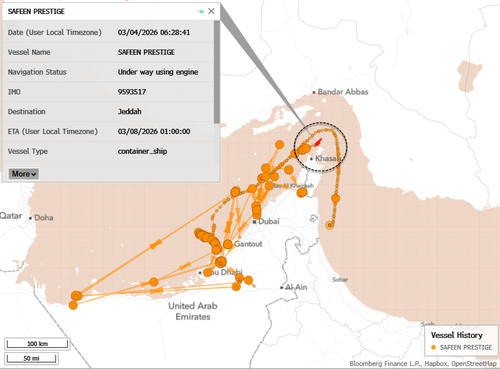

- Oil edged higher near $83 a barrel, with traffic in the Strait of Hormuz all but halted. Donald Trump’s plan to protect vessels with insurance backstops and naval escorts is only a partial fix, shippers said. BBG

- The CIA is working to arm Kurdish forces with the aim of fomenting a popular uprising in Iran. The Trump administration has been in active discussions with Iranian opposition groups and Kurdish leaders in Iraq about providing them with military support. CNN

- The son of former Iranian Supreme Leader, Mojtaba Khamenei, has emerged as his most likely successor, suggesting the country is moving in a hardline direction. NYT

- China’s legislature signaled a desire for steady relations with the US as the countries prepare for a planned summit between Xi Jinping and Trump in the coming weeks. BBG

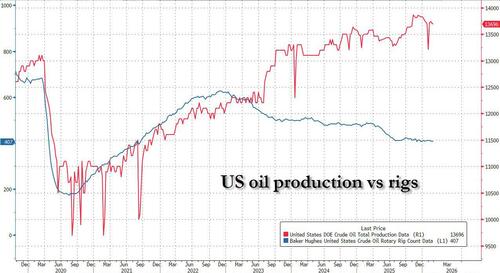

- US shale drillers cannot increase production quickly enough to solve an oil supply crisis caused by the war in Iran, industry bosses have warned, saying a big rise in output would take months to materialize. FT

- Gauges of China’s manufacturing and services activity sent mixed signals about the economy, showing pockets of weakness alongside improvement as markets wait for the country’s leaders to set growth targets for the year ahead.

- Bank of Japan Gov. Kazuo Ueda reaffirmed his commitment to further interest-rate increases amid deepening concerns over instability in the Middle East. WSJ

- Anthropic is on track to generate annual revenue of almost $20 billion, more than doubling its run rate from late last year, people familiar said. Separately, OpenAI CEO Sam Altman told employees that the company has no say over what the Pentagon does with its AI software. BBG

Trade/Tariffs

- Japan and the US are reportedly working to include nuclear power, copper smelting and refining facility projects in the second round of deals under the USD 500bln investment package.

- Japanese Trade Minister Akazawa is to travel to the US on Thursday to discuss Japan-US investment and will meet with US Commerce Secretary Lutnick.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks extended losses with markets roiled by the widening conflict in the Middle East, with the UAE considering taking military action to stop Iranian missile and drone strikes on the country, while it was also estimated that Saudi Arabia could attack Iran soon. ASX 200 slumped with the index dragged lower by underperformance in the commodity-related sectors, while better-than-expected Australian GDP data for Q4 failed to inspire a turnaround. Nikkei 225 dipped beneath the 54,000 level with mining and materials the worst performers amid disruption concerns. KOSPI saw a double-digit percentage drop and had triggered a circuit breaker with declines led by shipbuilders and shipping firms, while large exporters such as Samsung, SK Hynix and Hyundai Motor also suffered. Hang Seng and Shanghai Comp conformed to the bloodbath in the region as participants digested mixed Chinese PMI data in which the official NBS Manufacturing and Non-Manufacturing PMIs disappointed, but the private sector RatingDog PMI accelerated to multi-year highs, while attention is also on the Two Sessions, which began today in Beijing, while the focus will be on the Work Report on Thursday.

Top Asian News

- China NPC spokesperson said will continue to expand domestic demand this year. Will foster new growth points in services consumption. Will promote high-quality employment this year. To reduce residents’ concerns about expanding consumption. Will promote the allocation of more resources to areas related to people’s livelihood, enabling people to consume, dare to consume and be willing to consume.

- Chinese banks reportedly halt Abu Dhabi loans as creditors cut Middle East, Bloomberg reported; most Asian banks are currently adopting a wait-and-see approach but there are early signs some are mulling pausing deals.

- Abu Dhabi Ports confirms the continuation of all its operations in light of regional developments; expect a decrease in the number of arriving ships with the decline in shipping traffic in the Strait of Hormuz, Al Arabiya reported.

- Cosco Shipping (1919 HK) suspends new bookings on relevant routes amid escalating Middle East conflict.

European bourses (STOXX 600 +1.2%) have broadly rebounded following this week's selloff, with the IBEX 35 (+1.6%) and DAX 40 (+1.6%) outperforming this morning, which was boosted following the New York Times report (see below). On the data front, EZ and UK final composite PMIs failed to move indices. In addition, Swiss inflation for February came in hotter-than-expected but the SMI didn’t react much to the data on the open. Sectors display a positive picture. Technology (+2.5%) sits clearly at the top after ASM International (+6.5%) beat Q4 revenue and Q1 revenue outlook estimates. Regarding China, the Co. also anticipates a rise in sales, showing notable improvement from the earlier forecast of a double-digit decline. Energy (-0.6%) is the worst-performing sector. Consumer Products and Services (+0.8%) was initially softer, after being on by Adidas (-6.9%), but reversed higher on the broader risk tone. Adidas reported Q4 revenue that missed expectations, while an operating profit of "around" EUR 2.3bln in 2026 fell short of analyst estimates.

Top European News

- German VDMA Engineering Association said January orders -6% Y/Y (domestic -8% and foreign at -5%).

- French Finance Minister said they will hold a meeting of G7 Finance Ministers and Central Bankers early next week.

FX

- DXY is choppy within a 98.90-99.33 range and well within Tuesday's 98.44-99.68 parameters. Focus remains on the Middle Eastern conflict, which continues to expand across the region. Analysts at ING highlight that near-term drivers of risk will probably be whether energy prices can reverse lower if the Strait of Hormuz can somehow reopen, and also whether central banks will be able to cut rates to support activity, or at least not tighten policy. Elsewhere, the data calendar for the US is very light, although ISM Services is scheduled later, while there were recent Fed speakers, in which the main message was that policy was well-positioned, and it is too soon to gauge the impact of the war in Iran on inflation. USD eased on NYT reports that Iran reached out to the US a day after the war started, although US officials are reportedly sceptical that either the Trump administration or Iran is ready for an off-ramp in the short term at least.

- EUR is flat against the USD and trades on either side of 1.1600, with the single currency not helped by President Trump threatening to halt all trade with Spain, citing the country's refusal to allow American military forces to use joint air bases for operations against Iran. Meanwhile, no EUR move was seen on the final PMIs, which are outdated amid the geopolitical developments since the survey period.

- GBP holds above 1.3300 vs the USD following recent underperformance, not helped by President Trump publicly expressing frustration with UK PM Starmer, stating "I'm not happy with the UK" and "This is not Winston Churchill that we're dealing with," after Britain refused to join offensive strikes.

- CHF is off best levels in choppy trade, with USD/CHF recouping from intraday lows of 0.7790 in the aftermath of hotter-than-expected Swiss CPI and ahead of the SNB meeting on March 19th. On that note, SNB Vice Chair said they are ready to intervene in the FX market - echoing similar commentary on Monday.

- JPY outperforms amid the ongoing geopolitical woes. USD/JPY was choppy overnight amid a quiet calendar for Japan and ongoing uncertainty regarding the Iranian conflict and effects on inflation, as well as the ramifications for BoJ monetary policy. The pair is subdued within a 157.16-157.86 range vs yesterday's 157.15 low. USD/JPY saw some volatility following NYT reports that US officials are sceptical of either Iran's or the US' willingness to off-ramp in the short term, relating to Iran's Intelligence Ministry reportedly reaching out to the CIA indirectly a day after the conflict started with an offer to discuss terms.

Fixed Income

- Mixed trade at the time of writing, with USTs bearish while peers are firmer but only modestly. Benchmarks recouped some ground late US and during the early APAC session. However, they then faded again as energy prices continued to climb.

- USTs at the low end of 112-27 to 113-05+ parameters. Focus remains on the geopolitical front with the conflict still ongoing and showing no sign of letting up in the near-term at least. An event of focus is the funeral of Khamenei, after which we may get the formal appointment of his successor, widely expected to be Mojtaba Khamenei, the second eldest son. Elsewhere, the US day is headlined by ISM Services and then numerous mega-cap presentations at a Morgan Stanley conference.

- Bunds were in line with USTs late-US and into the early APAC session. Thereafter, the benchmark waned from best but remains just about in the green. Specifics for the space have been light, aside from geopols. No move to Final PMIs. For the most part, Europe is waiting for further clarity on the energy situation, Trump's displeasure with Spain and the Hungarian opposition to Ukraine amid the Druzhba closure. Currently, the benchmark holds just below the 129.00 mark in a 128.80 to 129.32 band.

- Gilts gapped higher by 37 ticks before climbing a handful more to a 91.91 peak. A bounce that wasn't too surprising, given the overnight moves in peers. However, one that leaves it shy of Tuesday's opening level/high of 92.47 and still a significant distance from the week’s 93.55 open. For the UK, focus is firmly on the above events. Note, Goldman Sachs has stuck to its BoE call of three 25bps cuts this year, but has pushed out the timing by one month; as such, they now expect the first move in April not March.

- Upside was seen across benchmarks as energy prices (namely nat gas) fell on reports that Operatives from Iran’s Ministry of Intelligence reached out indirectly to the CIA a day after the conflict began, with an offer to discuss terms for ending the conflict, New York Times reports citing sources. US officials are reportedly sceptical that either the Trump administration or Iran is ready for an off-ramp in the short term at least.

- Germany sold EUR 0.96bln vs exp. EUR 1.0bln 2.30% 2033 Green Bund: b/c 1.76x (prev. 3.57x), average yield 2.53% (prev. 2.39%), retention 4.0% (prev. 15.6%)

- Australia sold AUD 900mln October 2037 bonds, b/c 3.74, avg. yield 4.8573%.

Commodities

- Crude benchmarks are firmer this morning as geopolitical tension in the Middle East continues to underpin the complex, with WTI (+1.1%) and Brent (+1.6%) trading at the upper ranges of USD 74.37-77.23/bbl and USD 81.28-84.48/bbl, respectively. Saudi Arabia announced that there was an attempt to attack Ras Tanura refinery, however, there was no damage reported at the refinery.

- European Nat Gas has slipped some 7% following reports that Iran's Ministry of Intelligence reached out to the CIA indirectly a day after the conflict began with an offer to discuss terms for ending the conflict, although US officials are reportedly sceptical that either the Trump administration or Iran is ready for an off-ramp in the short term at least. Crude futures dipped modestly on these reports.

- Spot gold continued its rebound, shrugging off recent USD strength that hampered price action yesterday for the yellow metal, trading just below the USD 5,200/oz mark. Haven demand has underpinned gold prices as the conflict in the Middle East reaches its fifth day. Modest upside was seen on the aforementioned NYT reports as the USD eased.

- Copper prices are trading higher thus far in the European session, tracking mild tailwinds following China’s manufacturing PMI data, which showed the greatest improvement in manufacturing conditions in more than five years. At the time of writing, 3M LME copper trades at the upper range of 12.94-13.1k/t.

- Saudi Aramco's Ras Tanura refinery (550k BPD) was reportedly struck again by an unknown projectile, according to sources; no damage was reported.

- UKMTO receives report of an incident 10NM east of UAE's Fujairah, according to an advisory note; an oil tanker in the Gulf suffered an explosion and the wreckage of an unknown projectile was found on its deck and all crew members are fine.

- IRGC say they have complete control of the Strait of Hormuz, according to AFP.

- Russia's Deputy PM Novak said we are ready to increase oil supplies to China and India in case of additional demand.

- Shanghai Futures Exchange are to adjust price limits and margin ratios for FU2604 fuel oil futures contract.

- Goldman Sachs said Brent could reach USD 100/bbl if the Strait of Hormuz remains closed for 5 more weeks.

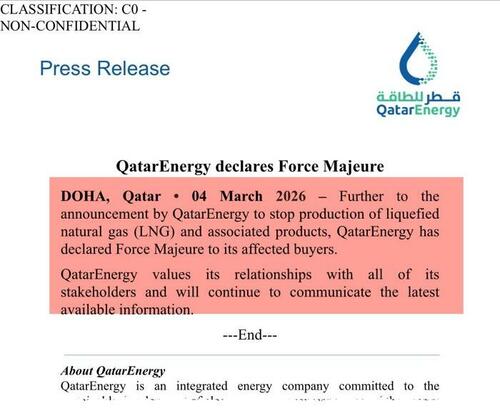

- Qatar Gulf International Services noted stoppage of certain operations and services related to energy sector activities.

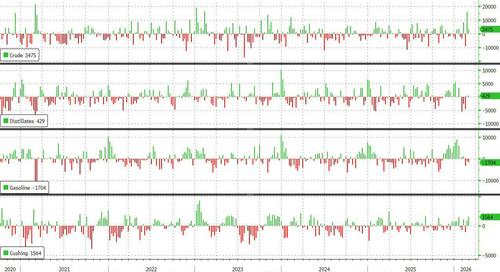

- US Private Energy Inventories (bbls): Crude +5.6mln (exp. +2.3mln), Distillate +0.5mln (exp. -2.6mln), Gasoline -3.3mln (exp. -0.8mln), Cushing +1.5mln.

Central Banks

- Fed's Hammack (2026 voter) says it is too soon to determine the economic impact of the Middle East conflict, NY Times reports. Supports holding rates steady for "quite some time."

- Fed's Kashkari (2026 voter) said Fed can sit tight as war clouds the outlook, via WSJ interview; 1 or 2 cuts later this year could be appropriate if inflation cools, but war in the Middle East could also create conditions that would justify extended pause.

- BoJ Governor Ueda said wages are expected to rise for a broad range of sectors in this year's wage negotiations, and that annual real wages to gradually turn positive.

- BoJ Governor Ueda said the central bank communicates closely with the government. Added that wages need to increase significantly for Japan to sustainably achieve BoJ’s price target. Mechanism in which wages and prices rise in tandem becoming embedded in Japan’s economy. Exchange rate fluctuations are now more likely to influence corporate behaviour. The impact of FX movements on prices is being closely watched. If economic activity and inflation align with forecasts, interest rate increases will continue. A rate hike would be appropriate if the economic outlook evolves as expected. General views on the economy were exchanged with Takaichi last month. The BoJ will carefully assess how Middle East developments affect domestic and global economic conditions. Persistently high oil prices could lift underlying inflation by pushing up medium- and long-term household and corporate inflation expectations. The BoJ will closely monitor the economic implications of the Middle East conflict. Developments in the Middle East could significantly affect both the global and Japanese economy through energy prices and market channels. Higher energy prices may also influence inflation expectations. Elevated oil prices worsen Japan’s terms of trade, weighing on the economy and underlying inflation dynamics. Oil prices have been rising sharply.

- SNB Vice Chair said they are ready to intervene in the FX market.

- CNB's Deputy Governor Frait said the development over the past week may lower space to reduce interest rates and cannot say today how he will vote at next meeting.

- Bank of Korea Governor Rhee said to hold meeting to review markets, adds to closely monitor for excessive moves in FX and interest rates, will respond if needed on the forex market to prevent herd-like behaviour.

- Goldman Sachs expects the BoE to cut by 25bps in April, July and November 2026 (prev. forecast March, June and September 2026).

Geopolitics: Middle East

- US officials are sceptical of either Iran's or the US' willingness to off-ramp in the short term, relating to Iran's Intelligence Ministry reportedly reaching out to the CIA indirectly a day after the conflict started with an offer to discuss terms, NYT reports.

- A number of Iranian media reported that an explosion was heard in Karaj, Iran International reported.

- Former Iranian Supreme Leader's top aide said Iran has no intention of conducting negotiations with the US, Al Jazeera citing Iranian TV.

- Iran launched over 40 missiles at Israeli and US targets a few hours ago, according to Iranian press.

- Iran has hit more than 10 tankers that ignored warnings and warns ships against transiting the Strait of Hormuz, according to FARS.

- Heavy explosions heard in east Tehran, Iran, local media reported.

- Plume of smoke rising from the US Consulate in Dubai, Iran's IRNA reported.

- US and Israeli forces have targeted Tehran, Urmia, Isfahan, and Karaj with heavy air strikes.

- Israeli army advances further into Lebanese territory, Al Jazeera reported.

- Israeli Defence Minister Katz said that any leader appointed in Iran will be an explicit target.

- IDF identifies missiles fired by Iran towards Israel and is working to intercept them.

- IDF said it has started a wave of attacks against missile launch sites, defence systems, and infrastructure belonging to the Iranian regime.

- Defence executives are to meet at the White House on Friday as strikes on Iran reduce stockpiles, according to Reuters.

- US Central Command said they destroyed 17 Iranian ships and no Iranian ships sailing in the Gulf or Strait of Hormuz or Gulf of Oman today.

- CIA is working to arm Kurdish forces to spark uprising in Iran, according to sources cited by CNN.

- US and Israel are seeking to foment an armed uprising inside Iran using an armed Kurdish fighting force, according to ITV News citing sources. ITV News understands since last year, weapons have been smuggled into Western Iran to arm thousands of Kurdish volunteers. They are expected to begin a ground operation within days. ITV have been told by Kurdish sources that American and Israeli forces have been asked to provide air cover when any such ground operation begins. ITV sources do not know if that request has been approved.

- Iran's Assembly of Experts elected Ali Khamenei's son Mojtaba as the next Supreme Leader under pressure from the Revolutionary Guards, Iran International reported citing sources.

- Two drone attacks targeted a US military base and a hotel in Iraq's Erbil early on Wednesday.

- Suspected Iranian drone attack hits CIA station in Saudi, according to WaPo reporter.

Geopolitics: Ukraine

- Russian President Putin will hold a call with Hungary's Foreign Minister later today to discuss Ukraine, according to Russia's Kremlin.

- Russia's Deputy PM Novak said we are ready to increase oil supplies to China and India in case of additional demand.

- Russian gas tanker reportedly attacked in Mediterranean Sea; Ukrainian naval drones attacked Russian gas tankers from Libya's coast, according to the Russian Transport Ministry.

US Event Calendar

- 7:00 am: United States Feb 27 MBA Mortgage Applications, prior 0.4%

- 8:15 am: United States Feb ADP Employment Change, est. 50k, prior 22k

- 9:45 am: United States Feb F S&P Global US Services PMI, est. 52.3, prior 52.3

- 9:45 am: United States Feb F S&P Global US Composite PMI, est. 52.3, prior 52.3

- 10:00 am: United States Feb ISM Services Index, est. 53.5, prior 53.8

DB's Jim Reid concludes the overnight wrap

Timing is everything in financial markets and what I thought would be a fascinating pack and create a lot of interest when I finished it on Friday has been overtaken by events. However, I still had a few great meetings yesterday in New York on the "Innovation, Jobs and Inflation: Lessons from 250 Years of Disruption" pack. Lots of debate around it. See it here. Once the Iran situation calms (assuming it does) this will be the main topic in markets again. So feel free to delve in as you wait for the next Iran headlines.

Indeed, we are in the headline-watching business at the moment, with competing stories shifting market sentiment an hourly basis yesterday. Moreover, the selloff has yet to find a floor, as fears of a more protracted Middle East conflict have led to mounting concern about a serious energy shock. So overnight, South Korea’s KOSPI (-11.13%) is currently on track for its biggest one-day fall since 2001, and futures on the S&P 500 (-0.55%) are pointing to further declines as well. That all follows a highly volatile 24 hours in markets, with the VIX index up to a 3-month high of 23.57pts, whilst Europe’s STOXX 600 (-3.08%) saw its largest daily slump since the Liberation Day tariff turmoil last April. Elsewhere, an aggressive slump in bonds saw 10yr gilts post their worst 2-day move in two years, and the EM FX carry index (-1.64%) had its worst day since Russia’s February 2022 invasion of Ukraine.

Of course, oil prices have been the main focus given the direct impact, and yesterday saw Brent crude up another +4.71% to $81.40/bbl. So that now makes it the biggest 2-day jump for oil prices (+12.31%) since the pandemic recovery in 2020, and this morning they’re up another +1.51% to $82.63/bbl. However, prices did come off their intraday peak above $85/bbl in European hours, stabilising after Trump said that the US “will begin escorting tankers through the Strait of Hormuz, as soon as possible” if necessary and that it would provide political risk insurance for ships travelling through the Gulf to “ensure the FREE FLOW of ENERGY to the WORLD”. That said, with little detail on the plan, the reversal in oil proved short-lived, with Brent falling back to $78.40/bbl before rising again, moving back above $82/bbl this morning. That came as Iran’s IRGC said in a statement that vessels sailing through the Strait of Hormuz “could be at risk from missiles or rogue drones”.

From a market perspective, the main issue is that there’s no sign of either side de-escalating, and if anything it looks as though things are still ratcheting up. For instance, the WSJ reported that Trump was open to supporting armed militias in Iran, although it said he hadn’t made a final decision. Meanwhile on the energy side, the supply issues continued to deteriorate, as Bloomberg reported that Iraq had started to shut down oil production that could halt 3mn barrels per day if the crisis persisted. And in addition to the renewed IRGC warning over the Strait of Hormuz, airstrikes have continued, with Israel carrying out a “broad wave of strikes” against Iran overnight, while we’ve seen reports of blasts in Doha and Dubai and missiles intercepted by Saudi Arabia.

This backdrop has meant energy prices have kept climbing across the board. In addition to the rise in oil, European natural gas futures soared yesterday, up another +21.98% to €54.29/MWh, building on their +39% gain on Monday. Interestingly though, if you look at the long-term history of oil prices, WTI is still a little below its 2024 average, and there’s still a long way to go before it compares to some of history’s bigger crises. So much as things are deteriorating, we’re still some distance from recessionary territory and a full-scale market correction. I looked at that in my chart of the day yesterday (link here), and Henry also put out a note (link here) looking at the criteria that have traditionally led to meaningful selloffs when an oil shock happens, none of which have occurred yet. Indeed, for all the volatility, the S&P 500 is within 2.5% of its peak, and the STOXX 600 within 5%. So despite everything that’s happened, we haven’t got to correction territory yet, let alone a bear market.

For now at least, the most obvious impact has been in the rates space, where the conflict has led to growing concern about inflation and whether central banks will be forced back into rate hikes. So in Europe, investors have priced in a growing probability of an ECB hike this year, with the chance up to 34% by last night’s close. Similarly in the US, the amount of rate cuts priced by December came down another -5.4bps on the day to 46bps. So all that pushed sovereign bond yields higher on both sides of the Atlantic, with yields on 10yr bunds (+4.0bps), OATs (+8.5bps), BTPs (+10.1bps) all spiking, whilst 10yr Treasuries (+2.5bps) saw a smaller move up to 4.06%. That’s continued overnight too, with the 10yr Treasury yield up another +0.2bps.

Meanwhile for equities, the selloff accelerated yesterday, with the US and Europe seeing even deeper losses relative to Monday. So in the US, the S&P 500 (-0.94%) gave way after holding up on Monday, though it did partially recover from an intraday low of -2.49% shortly before Europe went home. Even so, all eleven major sector groups ended the day lower, including energy. Paradoxically, software & services stocks (+1.58%) were one of the few outperformers. Then in Europe, the STOXX 600 (-3.08%) posted its biggest daily decline since the Liberation Day turmoil last year, with even deeper losses for the DAX (-3.44%) and the CAC 40 (-3.46%). And unlike on Monday, even the energy and defence names weren’t immune, with the STOXX Aerospace & Defense index (-2.74%) posting its biggest decline so far this year.

One of the big themes in yesterday’s market turmoil were sharp reversals for several recent winning trades. For instance, 10yr gilts, which had rallied by -33bps in just over three weeks, have sold off by +24bps over the past two sessions (+9.7bps yesterday). Meanwhile, gold (-4.38%) and silver (-8.23%) plunged despite the risk-off mood. Indeed, the dollar (+0.68%) was one of very few assets other than oil that were in the green yesterday.

Likewise, another 2026 winner to see a sharp reversal has been the Kospi, which is down -11.13% this morning, which would be the index’s worst daily slump since markets returned after the 9/11 attacks in 2001. Indeed, trading was paused earlier after a circuit breaker was triggered, and only yesterday the index saw a -7.24% decline as well. It was only last Thursday that I’d noted in my CoTD (see here) how the Kospi had moved from cheap to expensive after a near +50% YTD gain. Remarkable how quickly things can turn in markets.

Those declines have been echoed across Asia, albeit not quite to the same extent. That said, the Nikkei (-3.76%) is currently on course for its biggest daily decline since the Liberation Day turmoil last April, right before Trump announced the 90-day tariff extension that sparked the market rebound. And other indices are also falling significantly, with declines for the Hang Seng (-2.90%), the CSI 300 (-1.16%) and the Shanghai Comp (-1.09%). The moves also come after the PMIs in China were a little weaker than expected, with the manufacturing PMI down to 49.0 (vs. 49.2 expected), whilst the non-manufacturing PMI only rose to 49.5 (vs. 49.7 expected).

Clearly the Middle East was totally dominating attention yesterday, but there were a few other stories to look out for. Notably in the Euro Area, the flash CPI print for February surprised on the upside, which exacerbated investors’ energy-driven inflation fears. So headline CPI was up to +1.9% (vs. +1.7% expected), whilst core CPI rose to +2.4% (vs. +2.2% expected), raising expectations that the ECB might still need to hike this year.

Separately in the UK, the government also announced their Spring Statement, including the OBR’s latest economic forecasts. According to those, it showed that the headroom against the fiscal rules now stood at £23.6bn, slightly higher than the November budget. However, the forecasts were made before the latest surge in energy prices, so clearly that will change the picture. See our UK economist’s recap here

Looking at the day ahead, data releases include the final services and composite PMIs for February from the US and Europe. In the US there’s also the ISM services index and the ADP’s report of private payrolls for February, whilst in the Euro Area we’ll get the unemployment rate for January. From central banks, we’ll hear from ECB Vice President de Guindos, the ECB’s Muller, Cipollone and Villeroy, along with Bank of Canada Governor Macklem. Otherwise, the Fed will release their Beige Book.

Tyler Durden

Wed, 03/04/2026 - 08:45

Treasury Secretary Scott Bessent testifies before the Senate Committee on Banking, Housing, and Urban Affairs on Capitol Hill in Washington on Feb. 5, 2026. Madalina Kilroy/The Epoch Times

Treasury Secretary Scott Bessent testifies before the Senate Committee on Banking, Housing, and Urban Affairs on Capitol Hill in Washington on Feb. 5, 2026. Madalina Kilroy/The Epoch Times

Air cargo terminals at Dubai International Airport as seen on Feb. 21, 2019. (Photo: Shutterstock/Sorbis)

Air cargo terminals at Dubai International Airport as seen on Feb. 21, 2019. (Photo: Shutterstock/Sorbis)

In a still from video, Minnesota Attorney General Keith Ellison talks to The Epoch Times in Chicago on Aug. 22, 2024. NTD

In a still from video, Minnesota Attorney General Keith Ellison talks to The Epoch Times in Chicago on Aug. 22, 2024. NTD

Recent comments