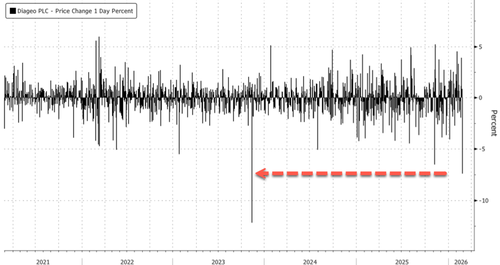

Diageo Shares Plunge Most In Two Years On Weaker Guidance, Dividend Cut

Shares of Diageo Plc fell the most in 2 years after the maker of Guinness beer and Johnnie Walker whiskey cut its guidance for the second time this fiscal year amid soft demand in the US and China markets. The move marks an early challenge for new CEO Dave Lewis.

The British distiller now expects organic net sales to decline by 2% to 3% this fiscal year, down from previous guidance of flat to slightly down, and said it would reduce its dividend.

First-half results were mixed. Organic net sales fell 2.8%, worse than expected, while North America's operating profit plunged 15%, missing analyst estimates tracked by Bloomberg Consensus. Europe was a bright spot, with operating profit rising 10% and beating forecasts. Adjusted EPS slightly beat, but overall sales and operating profit were much softer than anticipated by analysts.

Citi analyst Simon Hales said the cut to full-year organic sales growth guidance reflects a much weaker US environment and noted that it could prompt cuts to the 2027 outlook. He added that the dividend cut has "taken the shine off" what could otherwise have been seen as the "clearing event" for the stock to rally.

At Goldman, analyst Natasha de la Grense said the big story in the earnings report is the dividend cut. She noted investors are still waiting for a proper turnaround plan from the new CEO:

Main focus today is the dividend cut which is perhaps not a huge surprise (Mr Lewis did this when he arrived at Tesco) and arguably necessary but never welcome news on the day. They are targeting a 30-50% payout going forward with a minimum floor of 50c per annum (consensus FY26 100c). In terms of the H1, it's a miss on org sales (-2.8% vs cons -2%) driven by volumes (-0.9% vs cons -0.2%) which were particularly weak in North America (-4%). US spirits net sales fell -9.3%. Reported EBIT is more in line at $3,256m (consensus $3,213m) and org EBIT better (-2.8% vs cons -3.9%) driven by A&P efficiencies (16.3% of sales vs consensus 17.7%). They are cutting sales and EBIT guidance as expected, now looking for sales -2-3% (cons -1%) and EBIT flat to +LSD (cons flat). The org profit guidance implies an acceleration in H2 underpinned by higher savings which are coming through earlier than expected. Spot FX rates imply a +$100m FX impact on sales per management (consensus +$200m). FCF guidance is reiterated. Not tons from the new CEO on strategy which is to be expected given he only started 1 Jan - he sees opportunities to enhance competitiveness and to deliver higher growth. In H1, Diageo grew or held market share in just 30% of markets.

Shares of Diageo in London tumbled 7.5%, marking the largest intraday decline since November 10, 2023, when shares dropped by 12%.

From the 2021 peak, shares have been more than halved and currently trade around 2015 levels.

RBC analyst James Edwardes Jones and Wassachon Udomsilpa told clients that softer sales performance, a guidance downgrade, and a dividend cut are a "non-event" due to the CEO's new strategy, set to kick in later this year.

"We are going to have to wait for 'later in the summer' (hopefully not too much later) to get into the meat of Sir Dave's plans for Diageo," the analyst wrote.

The only problem for analysts hoping for a turnaround at Diageo is the mounting headwinds facing the industry, as younger generations are giving up alcohol for health reasons or perhaps simply lack the discretionary spending power.

Tyler Durden Wed, 02/25/2026 - 07:20

European Commissioner Thierry Breton speaks during a news conference at the European Union office in San Francisco on June 22, 2023. Josh Edelson /AFP via Getty Images

European Commissioner Thierry Breton speaks during a news conference at the European Union office in San Francisco on June 22, 2023. Josh Edelson /AFP via Getty Images Source: Shutterstock

Source: Shutterstock

via Bookings Inst

via Bookings Inst

Chinese missile launchers are seen during a military parade marking the 80th anniversary of the end of World War II, in Tiananmen Square in Beijing on Sept. 3, 2025. Kevin Frayer/Getty Images

Chinese missile launchers are seen during a military parade marking the 80th anniversary of the end of World War II, in Tiananmen Square in Beijing on Sept. 3, 2025. Kevin Frayer/Getty Images A security guard stands beside a screen showing a video about China's atomic and hydrogen bomb research during an exhibition on the Chinese regime's rejuvenation at the Military Museum of the Chinese People's Revolution in Beijing on Oct. 17, 2007. China Photos/Getty Images

A security guard stands beside a screen showing a video about China's atomic and hydrogen bomb research during an exhibition on the Chinese regime's rejuvenation at the Military Museum of the Chinese People's Revolution in Beijing on Oct. 17, 2007. China Photos/Getty Images An undated aerial photo shows the Argonne National Laboratory in Illinois. Argonne National Laboratory/Getty Images

An undated aerial photo shows the Argonne National Laboratory in Illinois. Argonne National Laboratory/Getty Images via state media: CM-301/YJ-12

via state media: CM-301/YJ-12

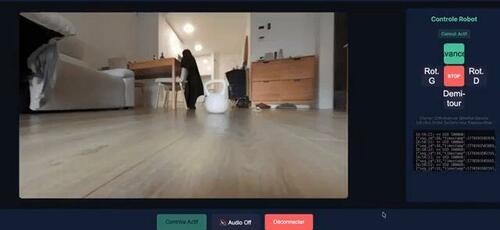

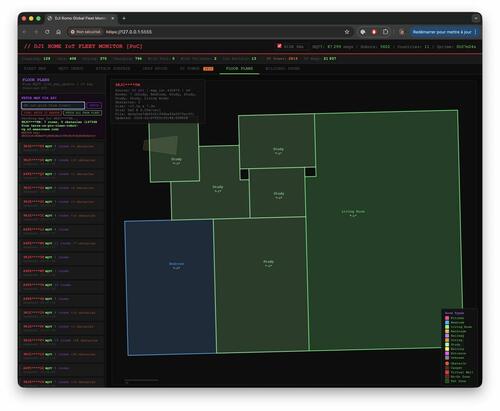

Azdoufal says he could remote-control robovacs and view live video over the internet.

Azdoufal says he could remote-control robovacs and view live video over the internet.

Rost9/Shutterstock

Rost9/Shutterstock

The DeepSeek app on an iPhone screen in San Anselmo, Calif., on Jan. 27, 2025. Justin Sullivan/Getty Images

The DeepSeek app on an iPhone screen in San Anselmo, Calif., on Jan. 27, 2025. Justin Sullivan/Getty Images

Recent comments