What Have You Learned In The Last 6 Hard Years?

Authored by Jeffrey Tucker via The Epoch Times,

The last six years have been a time of astonishing revelation about many features of public life that had been previously hidden.

I’m not just speaking of the Epstein files though they are part of it.

We’ve all seen and experienced things over these years that (at least to me) would have been nearly inconceivable before. It’s shaken us and forced people to recalibrate their understanding of the world.

If you have changed your mind on some important matters, congratulations? That’s a sign of humility, curiosity, adaptability, and adherence to facts over bias. This is a virtue. People who report no change are either omniscient, which is doubtful, not paying attention, or just too doggedly attached to prior views that nothing can unsettled them.

I have a huge archive of my own writings over decades and I look through sometimes just to test how and to what extent my own outlook has shifted. Indeed it has. There is value in my old books and articles but reading them now, I detect a kind of naivete, a simplicity in theory and understanding. I don’t think it is just maturing here. There is more going on.

Below I list some of the issues on which our times have introduced depth and complexity that defy conventional ideological categories.

I suspect you might have undertaken a similar journey yourself but likely with different starting points and different conclusions. We all process this new transparency in different ways. I can only chronicle my own, which I’ve summarized in ten points.

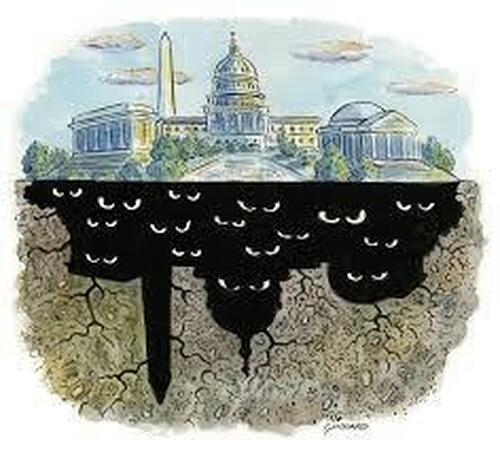

1. We were introduced to a new conception of what government is in real life.

Perhaps we once thought of government as the people we elect. That’s supposed to be how it works. As it turns out, gradually over a century and a bit more, an unelected bureaucracy has come to take power. It runs circles around the elected representatives of the people. It has deep links throughout society. The administrative state also has the institutional knowledge and holds on for dear life from the turning of one leader to another.

The U.S. Constitution says that the president is head of the executive branch. Trump has attempted to control its 444 agencies but has been stopped by a flurry of lawsuits. As it turns out, the machinery of state is impervious to elected leaders and designed to be exactly that. The same is true of Congress, which has its own staff that migrates and lasts through every political turning. This is not democracy. This is an entrenched and unelected oligarchy. It needs to change, lest the people be disenfranchised forever.

2. We newly understand what industry capture means.

In the past, it’s not been entirely clear how agency government works with industry. Two views have prevailed: agencies existed in an antagonistic relationship to business in ways that harm enterprise, or agencies work to protect the people against the depredations of corporations. Now that we’ve had a closer look, we see a more symbiotic relationship between large and powerful corporations and the agencies that are supposed to control them. We see this in agriculture, pharmaceuticals, education, technology, and munitions. This problem is pervasive.

3. Academia, as it turns out, is not the bee’s knees.

University intellectuals have long been valorized as the best and the brightest, the institutions guarding an independent version of truth that rises above the exigencies of the mutating public mind. But think about the major controversies of our time that academia has in general done little to nothing to resolve and much to promote: transgender issues, woke ideology, lockdowns for infectious disease, censorship, welfare corruption, the integrity of science, the problem of citizenship, and on and on. Academia in general has given off the appearance of aloofness to it all or merely being a participant in sketchy financial dealings. Think of it: when Trump started cutting the funding of elite universities, there was no real outcry at all. This is because academia has lost its once-high status in American life.

4. Big Media mostly is hopelessly partisan.

There was a time when we might have believed that the watchdog media was the essential bulwark to stand between the citizens and political power, holding elected leaders to account. This old view has been proven unsustainable in light of the last decade in which its blatant partnership has been unbearably obvious. The war on Trump that began in 2016 led inexorably to a complete takeover of the newsroom which then diminished trust in media, which is at historic lows. What’s more, we’ve learned that the biggest media players also operate in a cooperative relationship with state priorities, much more so than we knew before.

5. Big business partners with big government.

There was a reason why during the recent respiratory pandemic that your local small businesses were closed whereas the big-box stores were open. There is a reason why when the opening started happening, capacity restrictions hit small coffee shops but large eat-in restaurants thrived. It’s because of their pull in Washington and state houses. The big guys have political pull whereas the small guys do not. The big guys deploy the power of government to hurt the competition. Is this how it works? Maybe I knew this abstractly but seeing it all unfold in real time was remarkable.

6. The science is skewed at best.

Like you, I used to think that peer-reviewed publications in prestigious journals were likely approximating some truth. Then I watched as these same journals and publications ran articles that were obviously manipulated, false, and some just completely made up to fit with a prevailing political agenda. Once we found out that these venues are funded by the very industries they cover, it started to make sense. Now most of us have come to doubt the truth of much if not most of what they publish. This is supposed to be the age of science and yet we cannot presume to trust what appears under the name science.

7. Courage is scarce.

I once believed that when people thought the right things—freedom matters, humans have rights, we should follow laws, censorship is wrong, bureaucrats should not rule outside their realm of competence—that we have won most of the battle. What I did not understand entirely is that the courage to act on convictions is far more rare than convictions themselves. Indeed, without the courage to stand up for truth at some risk to reputation and financial well-being, it’s not clear that one’s convictions matter much. Not only that, such courage is exceedingly rare. Most people can be cowed by fear of the unknown. I did not know this.

8. The left and right are fuzzy concepts.

We all used to think we understood what was right and what was left, as if they are fixed categories. Same with the word libertarian: we thought we could predict views and actions based on those labels. I no longer believe that. I’m now allied with people schooled on the left in ways I never imagined possible, and with others on the right who I once seriously doubted. Nor do these words seem to mean much now that the left seems to push things that make zero sense according to their previous principles, and the right has warmed up to topics that were only of interest to the left. In general I’m glad for this but I’m waiting for all of it to settle in some ways that it is not now.

9. Food matters as much as medicine.

I once believed that concern over chemicals in food and large-scale industrial agriculture was wildly overwrought. But after discovering the problems in the medical world and Big Tech, it seemed obvious to consider the ways in which government intervention in agriculture is also creating cartels and distortions. Put that together with genuine concerns over health and you see the problem that has been highlighted by Robert F. Kennedy, Jr. This issue that I had completely dismissed ten years ago is now front and center in my thinking, along with a passion to see the restoration of small regenerative agriculture.

10. You can make a difference.

Here is what has shocked me most. I’m now connected with a large group of Americans who are deeply concerned for the future of freedom in every sector: education, medical, agriculture, technology, and citizenship rights including voting integrity. I’ve seen this movement blossom from nearly non-existent to becoming enormously powerful and influential, not only in the United States but all over the world. Things are changing today and not because the establishment wants it that way. Things are changing because people are learning, gathering, acting, and insisting on change. This inspires me to no end. We need more of this in every area of life.

Tyler Durden Sat, 02/21/2026 - 11:40

The IRS in Washington. Madalina Kilroy/The Epoch Times

The IRS in Washington. Madalina Kilroy/The Epoch Times OpenAI employees were sufficiently alarmed by future mass murderer Jesse Van Rootselaar's interactions with ChatGPT that they urged managers to call the police

OpenAI employees were sufficiently alarmed by future mass murderer Jesse Van Rootselaar's interactions with ChatGPT that they urged managers to call the police Van Rootselaar at a gun range: He captioned this social media post "I blew up their desert eagle!"

Van Rootselaar at a gun range: He captioned this social media post "I blew up their desert eagle!"  Six days after Van Rootselaar's (left) mass murder-suicide, another man-in-a-dress, Robert Dorgan,

Six days after Van Rootselaar's (left) mass murder-suicide, another man-in-a-dress, Robert Dorgan,

Imran Ahmed

Imran Ahmed

via AFP

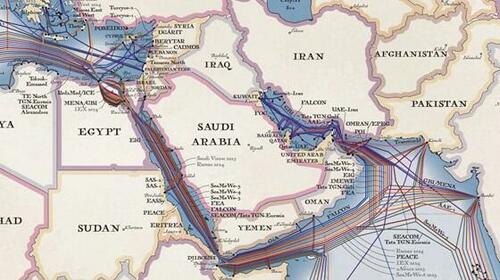

via AFP MEE: Saudi Arabia is surrounded by major fiber-optic cables - but the Trans Europe Asia System will be the first such project to cross the country (telegeography.com)

MEE: Saudi Arabia is surrounded by major fiber-optic cables - but the Trans Europe Asia System will be the first such project to cross the country (telegeography.com)

Saudi Aramco

Saudi Aramco Al Hol camp last year, AFP/Getty Images

Al Hol camp last year, AFP/Getty Images FDA Commissioner Dr. Marty Makary in Washington on July 29, 2025. Saul Loeb/AFP via Getty Images

FDA Commissioner Dr. Marty Makary in Washington on July 29, 2025. Saul Loeb/AFP via Getty Images The U.S. Food and Drug Administration in White Oak, Md., on June 5, 2023. Madalina Vasiliu/The Epoch Times

The U.S. Food and Drug Administration in White Oak, Md., on June 5, 2023. Madalina Vasiliu/The Epoch Times

Recent comments