Tehran Denies Mining Hormuz, But Says War Isn't Ending Soon

Summary:

-

Iran's top security official to Trump: 'we will not relent until you are sorry'

-

Oil pares gains after report that Iran lets some ships cross strait, denies mining Hormuz

-

Bloomberg: Trump admin set to temporarily suspend Jones Act shipping rules to help cool rising oil prices.

-

Ayatollah Mojtaba in first public message says the closure of the Strait of Hormuz should be continued as a tool to pressure the enemy

-

Mojtaba vows to keep attacking US bases, and signals 'new fronts' could soon open

-

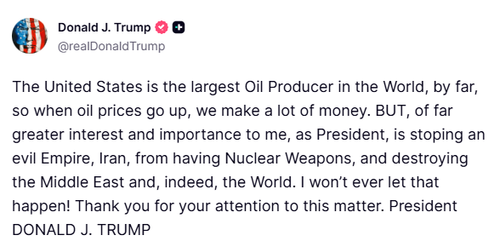

President Trump simultaneously says the US is stopping Iran "from having Nuclear weapons" and "destroying" the Middle East and "the World".

-

Shipping turmoil escalates as multiple vessels (at least six) struck overnight

-

Brent crude oil prices top $100 amid "the largest supply disruption in the history of the global oil market," the IEA reports.

-

Energy Secretary Chris Wright says the US Navy is not yet ready to escort tankers through the Strait of Hormuz, as military assets remain focused on degrading Iran’s offensive capabilities.

-

Dubai suffers significant drone attacks

-

Northern Israel hammered by Hezbollah, "largest wave" of missiles since war began

-

IDF says it struck key Iranian nuclear development site

-

US Intel assesses Iranian regime remains intact

-

Oman port operations halted

-

Trump proclaims "we won"

* * *

Update(1205ET): Some fresh development impacting closely watched oil prices:

OIL PARES GAINS AFTER REPORT IRAN LETS SOME SHIPS CROSS STRAIT

IRAN ALLOWED SOME SHIPS TO CROSS STRAIT, DEPUTY FM SAYS: AFP

IRAN DEPUTY FM SAYS NOT LAYING MINES IN HORMUZ STRAIT: AFP

IRAN DEPUTY FOREIGN MINISTER TAKHT-RAVANCHI SPEAKS TO AFP

Reuters reports say at least a dozen explosive mines have been put in shipping lanes. As for Iran's denial, this doesn't mean the war shows signs of immediately stoppage, instead per the AFP:

Iran wants to ensure that a war will not be imposed again on it in the future, deputy foreign minister Majid Takht-Ravanchi told AFP, as the conflict raged with the United States and Israel. "We want to see that war is not going to be imposed again on Iran," said Takht-Ravanchi in an interview in Tehran.

"When the war started last June, after 12 days there was so called cessation of hostilities... but after eight or nine months, they regrouped and they did it again."

* * *

Update(0940ET): Coming near in time to each other Thursday morning, President Trump and Iran's Ayatollah Mojtaba Khamenei issued public statements. This marks the first public statement by supreme leader Mojtaba since replacing his slain father. The statement has been posted to Iranian state TV sources, and below are the most crucial remarks.

Mojtaba says the closure of the Strait of Hormuz should be continued as a tool to pressure the enemy. He additionally states that "all US bases should immediately be closed in the region and those bases should be attacked." Indeed these attacks have been ongoing this week, as the cross Gulf drone and missile strikes continue, also reportedly most recently in northern Iraq, and around Erbil. On the question of base attacks, he claimed that Iran "only" targets military bases and sites, and says this will continue. However, he did try to assure angry Gulf neighbors, who have been pummeled by Iranian missiles and drones for close to two weeks now, that Iran believes in "friendship with our neighbors". The message further praises 'martyrs' of the Islamic Republic and is one that emphasizes Iran is not backing down, despite the immense daily US-Israeli bombings. He also 'thanked' regional militias for their 'support' - at a moment Shia Iraq militant groups are said to be launching strikes on US targets inside neighboring Iraq. Ominously, the new Ayatollah is warning of opening "other fronts".

Click, add to cart, get it done...

As for President Trump, he's still seeking to try and calm global oil prices, posting "The United States is the largest Oil Producer in the World, by far, so when oil prices go up, we make a lot of money. BUT, of far greater interest and importance to me, as President, is stopping an evil Empire, Iran." This once again echoes lines from the Bush era war in Iraq. He also said he's stopping Iran "from having Nuclear weapons" and "destroying" the Middle East and "the World".

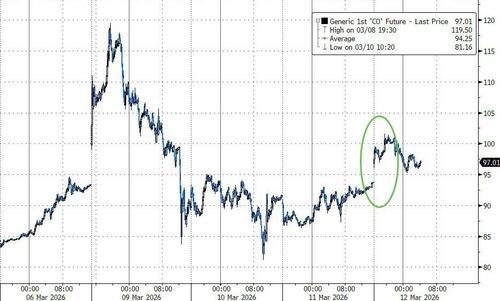

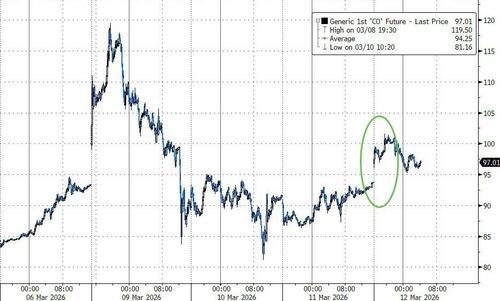

WTI Crude as the rival messages went out almost simultaneously:

An earlier Thursday threat from Iranian leadership:

* * *

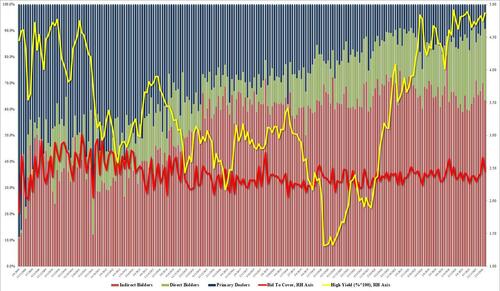

Brent crude futures in Asian trading jumped above $101/bbl overnight, despite news of a planned record emergency SPR release by the International Energy Agency's 32 member countries, in an effort aimed at capping triple-digit oil prices.

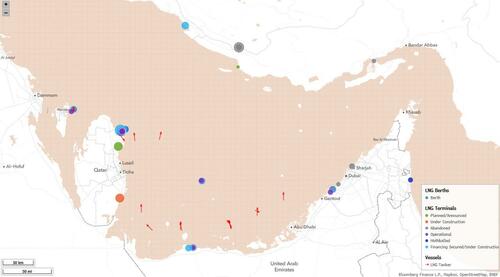

Today's focus is on reports that IRGC forces struck two foreign oil tankers in the Gulf area, bringing the total to six vessels hit over the past 24 hours. Iranian kamikaze drones also struck an energy export hub in Oman, while IRGC naval mine threats in the Strait of Hormuz soared by midweek.

The Wall Street Journal reported that two oil tankers were struck in Iraqi waters. The U.K. maritime security agency UKMTO also said a containership was hit off the coast of Dubai, adding to earlier reports that three cargo vessels were struck around the Strait of Hormuz area. Also worth recalling is the dramatic video from yesterday showing an IRGC drone slamming into a critical tank farm in Oman.

The market reaction to the overnight hostilities, as Operation Epic Fury rages on this week and IRGC forces lob missiles and bombs at Gulf states, was a surge in Brent crude futures to the $101 handle.

The insane videos of tanker attacks just keep coming...

Goldman's Rich Privorotsky on the overnight energy market moves:

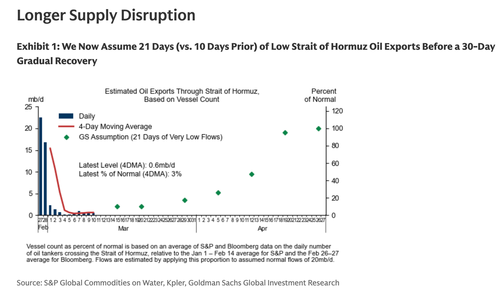

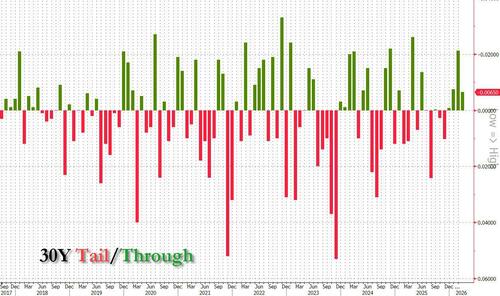

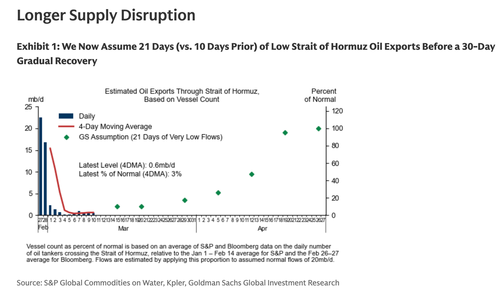

A series of attacks across the Gulf has sent oil up nearly another 10% (fading to up 5%), with Brent back briefly through the $100 level. The move in products looks even more acute, with distillates leading. Quite telling yesterday that, after yet another Whitehouse jawbone and the IEA’s record reserve release announcement, oil still failed to come in meaningfully. Overnight Reuters reported, “Iran has laid about a dozen mines in Strait of Hormuz, sources say” … if that is confirmed it's not quickly reversible.

Goldman expects longer disruptions on the Hormuz chokepoint:

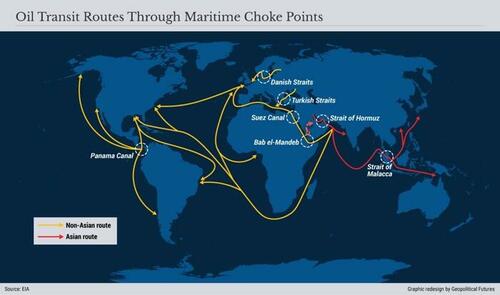

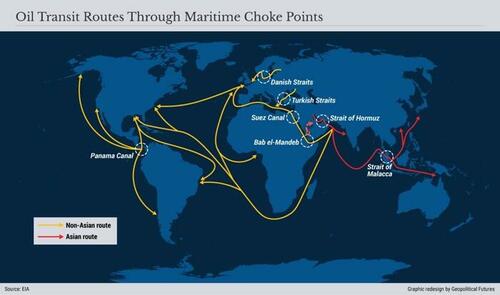

Here's where things get even more complicated: Six commercial vessels and oil infrastructure in the Gulf area were hit in IRGC strikes, and attention is now shifting to another critical maritime chokepoint.

Overnight, Iran's semi-official Fars News Agency warned that the Houthis in Yemen and other Iran-backed groups could move to shut the Bab el-Mandeb Strait at the southern tip of the Arabian Peninsula.

The overnight chaos sent Brent crude back over $101/bbl, but it has since fallen to $96/bbl by 0630 ET. This comes after the IEA's 32 member countries agreed on a "record" 400 million barrel release to cap energy prices. U.S. Energy Secretary Chris Wright announced that the U.S. will contribute 172 million barrels. As we explained to readers on Wednesday, this SPR dump is likely to have only a minimal impact.

Meanwhile, President Donald Trump told supporters in Kentucky last night that Operation Epic Fury was effectively over almost as soon as it began. "It's just a question of when—when do we stop?" he said.

"Let me say we've won. You know, you never like to say too early you won. We won. We won, in the first hour it was over, but we won," Trump said.

He added, "We don't want to leave early, do we? We've got to finish the job."

It is clear that U.S.-Israeli operations have dealt a major blow to the IRGC's conventional military capabilities, but the lingering threat will be asymmetric warfare, including drone attacks, naval mines, the potential sabotage of undersea cables, and a wide range of other low-cost, high-disruption weapons.

What's important from the overnight (courtesy of Bloomberg):

Energy Market

-

The Iran war is causing the largest supply disruption in the history of the global oil market, hitting 7.5% of global supply and an even bigger share of exports

-

Oil prices surged above $100 a barrel as Iran escalated attacks on Dubai and shipping assets

-

IEA members agreed to release an unprecedented 400 million barrels from emergency reserves to calm the market

IRGC Military Actions

-

Iran escalated attacks on parts of Dubai with missile alerts and a drone that fell on a building in Creek Harbour on Wednesday night

-

Iran says it maintains control over the strategic Strait of Hormuz and claims it carried out strikes on Israeli military and intelligence facilities

-

Iran's military announced the policy of reciprocal strikes has ended, stating, 'from now on, our policy will be strike after strike'

-

More than 2,100 Shahed-136 weapons have been fired so far, damaging oil infrastructure, shutting airports and destroying military hardware

US Security Warnings

-

The US State Department warned that Iran and affiliated groups could be planning attacks on oil infrastructure owned by the United States in Iraq

-

US Central Command warned that Iran is using civilian ports along the Strait of Hormuz for military operations, making them legitimate targets

-

California Governor Newsom said he's aware of potential drone strikes in California after FBI warnings that Iran has allegedly considered launching offensive drones against the West Coast

Economic Impact

-

Goldman Sachs and Citigroup told staffers in Dubai to stay away from their offices amid Iran threats

-

On the Beach suspended its full-year guidance due to a 'significant slowdown' in demand following the Middle East conflict, with shares dropping as much as 15%

-

Chinese oil refiners have begun canceling agreed refined fuel export cargoes as Beijing tightens curbs to cope with the war's impact

Diplomatic Developments

-

Iran has told regional intermediaries that for a ceasefire, the US must guarantee that neither it nor Israel will strike the country in the future

-

A former IRGC chief said Iran would agree to no ceasefire until the country reaches a 'definite outcome'

-

The UN Security Council approved a resolution condemning Iran's attacks on its Gulf neighbors including Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, UAE and Jordan

Related energy market reads:

Is it too early for Trump to be calling a "win" when asymmetric warfare is still a very big threat and will be lingering for many weeks, if not months? As one pundit has pointed out: "Endurance regimes do not need clean victory to change the game. They only need to survive the shock while making the old equilibrium too costly for their adversaries to restore."

Tyler Durden

Thu, 03/12/2026 - 09:40

Maryland Attorney General Anthony Brown, left, speaks as Gov. Wes Moore listens during a news conference in Baltimore, MD., on Sept. 24, 2024. Stephanie Scarbrough/AP Photo

Maryland Attorney General Anthony Brown, left, speaks as Gov. Wes Moore listens during a news conference in Baltimore, MD., on Sept. 24, 2024. Stephanie Scarbrough/AP Photo

President Donald Trump waves as he boards Air Force One at Joint Base Andrews, Md., on March 11, 2026. Andrew Harnik/Getty Images

President Donald Trump waves as he boards Air Force One at Joint Base Andrews, Md., on March 11, 2026. Andrew Harnik/Getty Images A banner depicting the Iranian regime's new leader, Mojtaba Khamenei, in Tehran, Iran, on March 11, 2026. Khoshiran/Middle East Images/AFP via Getty Images

A banner depicting the Iranian regime's new leader, Mojtaba Khamenei, in Tehran, Iran, on March 11, 2026. Khoshiran/Middle East Images/AFP via Getty Images Blank Social Security checks are run through a printer at the U.S. Treasury printing facility in Philadelphia, Pa., on Feb. 11, 2005. William Thomas Cain/Getty Images

Blank Social Security checks are run through a printer at the U.S. Treasury printing facility in Philadelphia, Pa., on Feb. 11, 2005. William Thomas Cain/Getty Images

U.S. Attorney Geoffrey Berman announces charges against Jeffery Epstein in 2019. Photo: Stephanie Keith/Getty Images

U.S. Attorney Geoffrey Berman announces charges against Jeffery Epstein in 2019. Photo: Stephanie Keith/Getty Images

A house for sale in Washington on May 19, 2025. Madalina Vasiliu/The Epoch Times

A house for sale in Washington on May 19, 2025. Madalina Vasiliu/The Epoch Times

West Asia News Agency via Reuters

West Asia News Agency via Reuters

Recent comments