A Panicking Oracle Plans To Raise Up To $50 Billion, As Its Stock And Bonds Crater

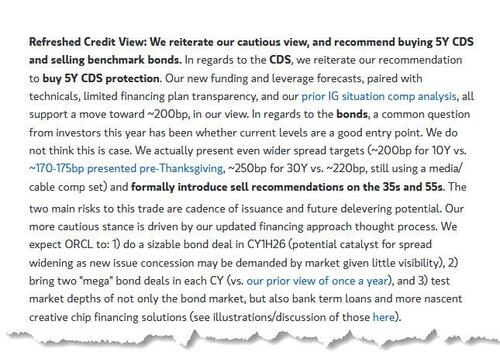

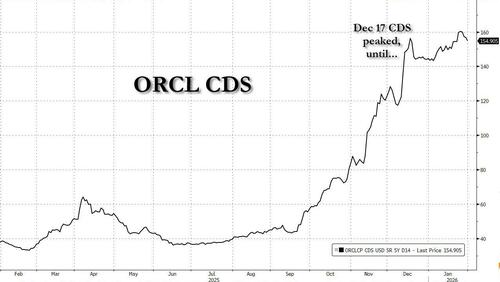

Just over a month ago, on Dec 17, alongside the news that Abu Dhabi was set to invest billions in OpenAI thus preventing a year-end tech rout, we said that ORCL CDS - which on that day hit the widest level since the 2008 financial crisis at 156bps - "may have gone a bit too far"...

... and sure enough, for the next month or so, Oracle CDS tightened rather notably. However, we certainly did not expect the company to just sit there and do nothing, as the market started asking questions again about where the tens of billions in committed funding would come from. After all, we were the first to lay out back in November the case why Oracle CDS should be trading much wider than it was at the time (see "Oracle Is First AI Domino To Fall After Barclays Downgrades Its Debt To Sell.")

And since nothing changed, the questions started coming in once more.

First, it was Morgan Stanley's analysts (here for pro subs) with a major cut to their ORCL price target. The reason: "GPUaaS is a sizable revenue opportunity, but our collaborative deep dive across the equity, credit and GVAT teams suggests the buildout will push EPS below targets and drive materially higher funding needs. Equity valuation appears to reflect this, while credit still looks rich."

Source

Source

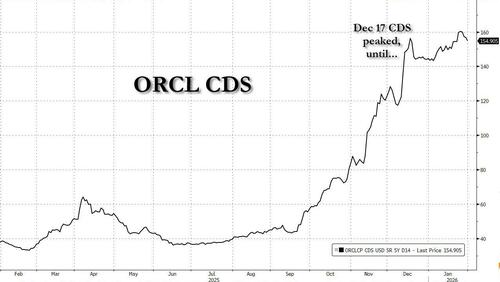

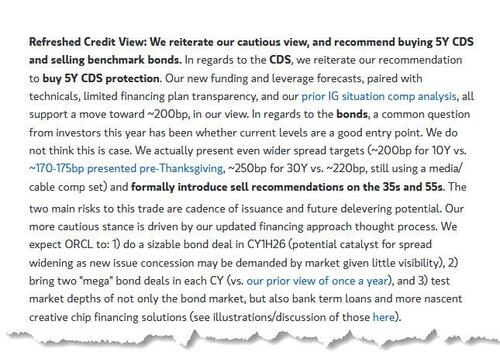

If that wasn't bad enough, in the same report the bank's credit analysts said that they "reiterate our recommendation to buy 5Y CDS protection. Our new funding and leverage forecasts, paired with technicals, limited financing plan transparency, and our prior IG situation comp analysis, all support a move toward ~200bp, in our view. In regards to the bonds, a common question from investors this year has been whether current levels are a good entry point. We do not think this is case. We actually present even wider spread targets (~200bp for 10Y vs. ~170-175bp presented pre-Thanksgiving, ~250bp for 30Y vs. ~220bp, still using a media/ cable comp set) and formally introduce sell recommendations on the 35s and 55s."

Source

Source

And then it went from bad to worse for Oracle just three days later, when on Jan 26 TD Cowen's Michael Elias, published a report which crushed ORCL, not only sending its stock to a new 7 month lows, but pushing its CDS wll above the Dec 17 high.

That's because according to Elias, who certainly does not mince his words when it comes to criticism of Oracle, the company is considering cutting 20,000 to 30,000 jobs and selling some of its activities as US banks pull back from financing the company’s AI data-center expansion. The job cuts would free up $8 billion to $10 billion in in much needed cash flow. Recall that according to Barclays, absent dramatic changes to its business, the company could run out of cash as soon as the end of 2026. Oracle is also weighing a sale of its health-care software unit, Cerner, which it acquired for $28.3 billion in 2022.

Below we excerpt from Elias' note "Oracle: Ability To Procure Incremental U.S. Data Center Capacity Faces Challenges Amid Financing Struggles, Raising Questions On The Potential For Incremental U.S. RPO Growth", also available to pro subs.

In June 2025, we were the first to highlight via our channel checks Oracle's intention to procure ~5GW of data center capacity in support of OpenAI workloads, which proved accurate as Oracle in late 3Q25 leased ~5.2GW of U.S. data center capacity (which we highlighted in October) including: 1) 1.4GW in Shackleford, Texas, 2) 902MW (critical IT) in Port Washington, Wisconsin, 3) 1.0GW in Saline Township, Michigan, 4) 1.2GW in Doña Ana County, New Mexico, and 5) an incremental 672MW (critical IT) expansion in Abeline, Texas. Amidst the largest ramp in data center demand in history, there has been a material increase in the demand for frontend construction loans/project financing from private data center operators, particularly concentrated with Oracle given timing, leading to ~$58B of debt being raised for Oracle/OpenAI data center projects ($38B for Shackleford/Wisconsin and $20B for New Mexico) in a two-month period, with more behind it.

However, with Oracle to procure what our channel checks now indicate is ~3MM GPUs (and other IT gear) to support its existing OpenAI agreement, both equity and debt investors have raised questions regarding Oracle's ability to finance this buildout, as demonstrated by widening of Oracle's CDS spreads and pressure on Oracle's stock/bonds. Assuming a conservative $30MM/MW in IT fit out costs, the implied ~$156B capex requirement, coupled with separate questions on OpenAI's ability to fund its ~$1.4T in outstanding multi-year commitments, has led to multiple U.S. banks to pull back from lending to Oracle-linked data center projects. Furthermore, our channel checks indicate that multiple Oracle data center leases that were under negotiation with private operators struggled to secure financing, in turn preventing Oracle from securing the data center capacity via a lease. In cases where U.S. banks are still open to lending, our checks indicate that borrowing cost spreads for Oracle-linked data center projects have widened to Non-IG levels (i.e. now SOFR+300-450bps vs. SOFR+225-250bps in September).

As the borrowing costs for operators rise, the result has been a slowdown in +100MW U.S. Oracle data center leasing by private operators as the market digests the current Oracle financing requirements. Importantly, our channel checks indicate that banks in Asia are still willing to lend (at a slight premium relative to historical rates) to data center operators undertaking Oracle leases as these banks look to gain exposure to the AI sector, providing a path for international Oracle expansion in support of incremental RPO. However, the pullback in U.S. financing has raised questions regarding Oracle's ability continue growing its revenue (RPO) in the U.S. if it continues facing challenges securing U.S. data center capacity to support OCI customer contracts.

The punchline: amidst these surging capital requirements, which can no longer be met by US-based banks, TD's latest channel checks indicate that Oracle is now requiring 40% upfront customer deposits as it looks to mitigate the incremental capex requirement for incremental revenue (RPO) growth.

Furthermore, the channel checks indicate that Oracle is evaluating multiple paths forward to address financing questions including:

- a RIF of 20-30K employees which could drive ~$8-10B of incremental free cash flow,

- asset divestitures (potentially Cerner) which would allow Oracle to reduce its debt load,

- vendor financing

- Bring Your Own Chip (BYOC) which was highlighted as a potential on Oracle's latest earnings call

In the event of BYOC (which the TD channel checks confirm is a potential), TD questions if any existing Oracle/OpenAI contracts would need to be re-cut given the current $/GPU/hour pricing structure which includes the cost of the GPUs. In the interim, Elias writes that the near-term incremental demand needs of OpenAI have shifted to be fulfilled by Microsoft and to a lesser extent Amazon.

It's not just Morgan Stanley and TD: Sanchit Vir Gogia, chief analyst at Greyhound Research, said the banking divergence as a critical warning sign. “The difference in sentiment between US and Asian banks isn’t just a minor detail; it’s the first serious sign of financial friction in Oracle’s hyperscale ambitions,” he said. The $300 billion OpenAI deal may look impressive, he added, but “when you look closer, it’s built on backlog with no guaranteed revenue and massive capex requirements.”

Gogia argued that enterprises need to fundamentally rethink how they view Oracle cloud contracts. “CIOs need to treat Oracle’s cloud buildout not as a service agreement, but as a shared infrastructure risk,” he said. “If they can’t fund it, they can’t build it. And if they can’t build it, you can’t run your workloads.”

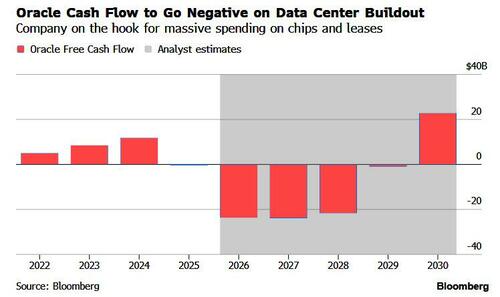

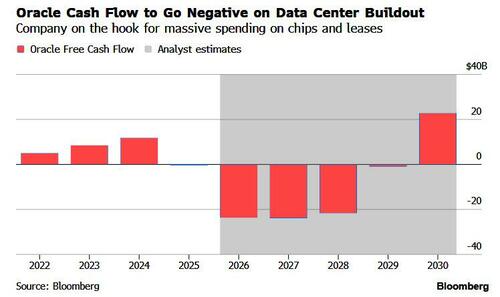

And all of this, of course, takes place against a background of historic cash incineration by Oracle and negative cash burn as far as the eye can see, making what until recently was unthinkably, all too possible.

So with the company facing a creeping squeeze of corporate distress and junk bond spreads as sentiments turns apocalyptic, amid growing speculation it will be forced to lay off tens of thousands and liquidate its best assets, Oracle has predictably panicked, and on Sunday it unexpectedly announced plans to raise $45 billion to $50 billion this year through a combination of debt and equity sales to build additional cloud infrastructure capacity.

The company plans to raise half of the funds via equity-linked and common equity issuances, including mandatory convertible preferred securities and through an at-the-market equity program of as much as $20 billion, something will will certainly depress its stock for the foreseeable future as it sells stock on even the smallest of breakouts. The rest of its funding target would be raised via a single issuance of bonds early in 2026. The company borrowed $18 billion in 2025 in what was one of the year’s largest corporate bond offerings.

Of course, as noted above, if Oracle does not raise the money, it may very well find itself in a liquidity crisis or much worse, so all David Ellison is doing, is whatever the market said he should have done long ago.

According to Bloomberg, Oracle is raising money to build additional capacity to meet the contracted demand from the company’s largest cloud customers, including Advanced Micro Devices, Meta Platforms, Nvidia, OpenAI, TikTok and xAI, the company said in a statement Sunday.

The announcement coincides with persistent fears about whether massive artificial intelligence-linked investments by tech companies such as Oracle will pay off. The company’s shares have fallen around 50% from its record price on Sept. 10, wiping out roughly $460 billion in market value. And the looming stock sales will lead to even bigger losses.

Developing AI data centers - without concurrently collecting cash from its clients - has pushed Oracle’s free cash flow negative, where it is expected to stay until 2030. As a result of its terribly structured deals, the company is on the hook for tens for billions of dollars in spending in the coming years, largely on semiconductors and leases.

Issuing equity would help send a message to the market that Oracle is serious about maintaining its investment-grade debt rating, wrote John DiFucci, an analyst at Guggenheim, in a January note.

“If Oracle can complete the raise successfully it will start digging itself out of the considerable hole it has found itself in,” said Gil Luria, an analyst at DA Davidson & Co.

Actually, even if Oracle can complete the raise, it still is facing massive funding shortfalls; and if it can't it could very well be lights out.

Making matters worse, the debt market will not have an appetite for this much investment-grade debt from Oracle given its existing commitments and trading in its credit default swaps, Luria said. Issuing equity may also hurt the company’s stock price, which in turn will spill over into its bonds.

Making this significant of an announcement on a Sunday afternoon is unusual for a mature company like Oracle. The timing, “could be the management team trying to stop the endless slide in the share price by trying to give investors some hope ahead of Monday’s open,” Luria said. Judging by where futures are trading, the company could not have picked a worse day for its announcement which will likely see the stock tumble double digits when it opens for trading.

A key part of Oracle’s cloud investment is its contract with OpenAI, which has committed to spending about $300 billion to rent servers from Oracle. OpenAI is not profitable, adding to worries about the financial strains from huge capital expenditures without a clear timeline for meaningful returns. In fact, OpenAI has some $1.4 trillion in commitments to various other companies and if for some reason the company announces this money won't be forthcoming in time... well, just don't be stuck holding the world's biggest circle jerk bag.

More in the full Morgan Stanley and TD Cowen notes available to pro subs.

Tyler Durden

Sun, 02/01/2026 - 23:13

SpaceX's mega rocket Starship is prepared for a test flight from Starbase, Texas, on May 26, 2025. AP Photo/Eric Gay

SpaceX's mega rocket Starship is prepared for a test flight from Starbase, Texas, on May 26, 2025. AP Photo/Eric Gay

The office of the law firm Perkins Coie is seen in Washington, on April 10, 2025. Photo by Kevin Dietsch/Getty Images

The office of the law firm Perkins Coie is seen in Washington, on April 10, 2025. Photo by Kevin Dietsch/Getty Images via Associated Press

via Associated Press

NASA Administrator Jared Isaacman (L) speaks at a press conference at Kennedy Space Center, Florida, on Jan. 17, 2026. (T.J. Muscaro/The Epoch Times).

NASA Administrator Jared Isaacman (L) speaks at a press conference at Kennedy Space Center, Florida, on Jan. 17, 2026. (T.J. Muscaro/The Epoch Times). The Minneapolis skyline, on Jan. 11, 2026. John Fredricks/The Epoch Times

The Minneapolis skyline, on Jan. 11, 2026. John Fredricks/The Epoch Times Children watch television at ABC Learning Center in Minneapolis, Minn., on Dec. 31, 2025. AP Photo/Mark Vancleave

Children watch television at ABC Learning Center in Minneapolis, Minn., on Dec. 31, 2025. AP Photo/Mark Vancleave Students from Little Scholars in New York City, on Dec. 11, 2025. Michael M. Santiago/Getty Images

Students from Little Scholars in New York City, on Dec. 11, 2025. Michael M. Santiago/Getty Images

Recent comments