From Blockchain To Ball-And-Chain: Are We Being Borg'd?

Authored by Patti Johnson via The Burning Platform blog,

Tokenized Tyranny: How Elites Are Digitizing Our World for Total Control

I’ve followed investigative journalist Whitney Webb’s work for years, and her once-distant warnings now feel eerily prophetic as they unfold in real time. What she has consistently exposed, the systematic digitization and commodification of everything from natural ecosystems to human life itself, is no longer speculative theory. It’s happening before our eyes.

When I first encountered Whitney’s reporting, I found it hard to believe. Could this level of control and financialization truly be underway? It seemed too dystopian, too extreme. Yet after digging deeper the evidence was undeniable. What she described was not exaggeration. It was an accurate and meticulously documented reality.

The tokenization of nature and humanity represents a deliberate strategy by the world’s most powerful financial institutions. Figures like BlackRock’s Chairman and CEO Larry Fink have openly championed turning the planet’s resources, and increasingly aspects of human existence, into fractionalized, tradable digital assets on blockchain-based ledgers. This creates new avenues for elite profit and unprecedented surveillance and control.

With Fink now serving as Interim Co-Chair of the World Economic Forum’s Board of Trustees (alongside André Hoffmann), the technocratic elite have gained an ideal global platform to accelerate this agenda. What better forum than the WEF to mainstream and fast-track “total control” from cradle to grave.

The process begins with assigning unique digital identifiers to virtually everything: land, water, forests, carbon credits, even personal behaviors and biological data. These are then logged on universal ledgers, where ownership is sliced into tradable fractions, much like stocks. But this goes far beyond traditional finance. It encompasses the Earth’s finite resources and, ultimately, the very essence of human life, all reduced to programmable, monetizable units in a centralized system of power.

This is tokenized tyranny in action: a quiet revolution that could redefine ownership, freedom, and existence itself..

Nature on the Chopping Block: From Forests to Fractional Shares

For nature, tokenization means chopping up wild places like the Amazon rainforest into digital securities. Each token represents a piece of land or ecosystem service such as clean air or biodiversity. Companies like O.N.E. Amazon, which is tied to U.S. intelligence and crypto investors, plan to issue these tokens backed by preservation deals. They cap the supply to make them scarce like digital gold. They install massive sensor networks and satellites to monitor every hectare in real time and collect data on everything from tree growth to animal movements. The data feeds into AI systems that manage the assets:

Each initiative will be structured under a transparent, science-based framework ensuring traceability, accountability, and full respect for Panama’s sovereignty. Future projects may also explore nature-backed digital instruments as mechanisms to channel private investment into measurable conservation outcomes.

Juan Carlos Navarro, Minister of Environment of Panama, stated: “As part of the partnership, O.N.E Amazon will pilot its proprietary Internet of Forests (IoF™️), an advanced monitoring system powered by satellites, LiDAR, and ground sensors, to provide real-time ecological intelligence that supports environmental governance and transparency.”

“O.N.E Amazon was created to align global capital with the conservation of our planet’s most valuable ecosystems. Together with Panama, we aim to demonstrate how innovation, transparency, and shared purpose can turn conservation into a true economic opportunity, one that benefits both nature and people. O.N.E Amazon is more than a financial instrument, it is a new contract between humanity, capital markets, and nature. When innovation meets purpose, markets become engines of regeneration,” said Rodrigo Veloso, Founder and CEO of O.N.E Amazon.

Panama and O.N.E Amazon Sign a Letter of Intent to Protect the Darién Region and Pioneer New Models of Conservation Finance

Whitney calls this tokenization of nature “borgifying” the environment (Remember Star Trek and the Borg). It turns planet earth into a controllable grid.

Involved parties include former BlackRock executives, Trump administration figures, and firms linked to stablecoins like Tether. They push this under the banner of sustainability while securing profits through inequitable deals with indigenous groups. Those groups get minimal shares and lose autonomy over their lands.

Greenwashing in Action: Tokenized Nature Happening Now

This is already unfolding through initiatives like Natural Asset Companies (NACs), backed by the Intrinsic Exchange Group and the Rockefeller Foundation. They aim to list ecosystems on stock exchanges as new asset classes. This assigns financial value to untouched nature and creates markets for trading shares in forests or rivers. Clean Air and Water Are Worth Money as ‘Natural Asset’ Companies Attract Cash

The WEF (World Economic Forum) is involved in turning nature into a commodity for investors to profit:

Finance Solutions for Nature: Pathways to returns and outcomes is out now! This insight report by World Economic Forum and McKinsey & Company provides a practical framework for investors to unlock capital for nature. Key takeaways: A portfolio approach is essential: 10 priority solutions can offer investors and issuers pathways to investable returns and nature outcomes at scale. Model transactions need to be replicated: Over 20 examples of existing transactions show that success in nature finance isn’t just theory — but needs replication. Markets can’t solve nature loss alone: Traditional finance has a central role, but needs enabling policies, robust data, better de-risking mechanisms, and shifting norms to recognize nature’s full value.

Finance Solutions for Nature: Pathways to Returns and Outcomes | World Economic Forum

Another example is Estonia’s Single Earth, which tokenizes forests, swamps, and biodiversity to back its MERIT token. It allows companies to buy fractional ownership for carbon offsets while claiming to make nature the new gold:

“Single.Earth closes the $700 billion nature financing gap by channeling ESG (Environmental Social Governance)-driven company funds to high-impact landowners, while assessing ecological data for maximum impact globally.

Bridging Nature and Finance, Climate and Biodiversity, Corporate Sustainability through Nature Financing Enterprises buy tokens to balance their impact on nature and boost ESG scores, securing a greener financial future.”

In the Central African Republic, the Sango Project is tokenizing land, timber, and diamond reserves to attract investors. It turns national resources into blockchain assets. Even traditional commodities are involved, with platforms tokenizing oil and gas reserves or renewable energy sources:

“The Central African Republic (CAR) has extended its Sango blockchain project to tokenization of its land and natural resources. The country, one of the poorest and most crypto-friendly in the world, is also one of the most active in crypto innovation.”

Central African Republic expands Sango project to land, resource tokenization

In 2023 Australia’s National Australia Bank issued a green stablecoin tied to verified agricultural assets and carbon credits. Their tokenized farms could soon serve as loan collateral. National Australia Bank eyeing a ‘green’ stablecoin – Ledger Insights – blockchain for enterprise

Eco-Dystopia Ahead: When Nature Becomes a Profit Machine

In a future society under this system, nature becomes a Wall Street product where investors buy fractions of forests or rivers without ever setting foot there. Any “conservation” is dictated by profit motives rather than ecological needs. Entire regions could be locked into debt-like swaps where countries trade resource rights for loans. This leads to foreign-owned wind farms or bioenergy plants that displace locals.

Whitney explains that this creates a tokenized world where natural disasters or climate events can spike token values. It encourages exploitation disguised as green finance. Ecosystems are managed by algorithms that prioritize financial returns over life itself. In the guise of saving ecosystems, they are tokenizing the world and making profit from their exploitation of planet earth.

Humans as Assets: The Financialization of Flesh and Blood

When it comes to human resources, Whitney extends tokenization to the financialization of people themselves. Human potential, data, and behaviors are tokenized into investable assets. This builds on impact investing where elites bet on social outcomes like reducing poverty or improving education through human capital bonds. It turns individuals into data points on a ledger.

Personal information, health records, DNA, and even daily actions get digitized and fractionalized and linked to digital IDs and programmable currencies that track and control spending. It all connects to broader agendas from groups like the World Economic Forum. Humans are seen as resources to be optimized. Blockchain ensures every aspect of life from skills to biometrics becomes a tradeable commodity.

From Blockchain to Ball and Chain

Blockchain is often sold as a liberating technology. It’s sold as a super-secure, shared digital notebook where transactions get recorded in unbreakable blocks that form a chain. These spread across thousands of computers worldwide so no single boss can tamper with it. It promises privacy and freedom from banks or governments. But from my skeptical angle, like the one Whitney Webb takes, it’s actually shaping up to be a high-tech ball and chain designed to track and control every aspect of our lives. This happens despite those privacy boasts. While blockchain claims to be decentralized and anonymous, most versions, like Bitcoin’s, create a permanent, public ledger where every transaction is traceable forever. This makes it easy for powerful entities from governments to corporations to follow your money trail. They link it to your identity through exchanges or data leaks. They can build detailed profiles on your habits, associations, and whereabouts.

Elites are co-opting this tech. They push for things like central bank digital currencies built on blockchain that tie your finances to digital IDs with biometrics. This turns everyday spending into a surveilled activity. In the future non-compliant behavior like buying the “wrong” things or associating with certain people could get you flagged, frozen out, or punished. This could mean a world where your blockchain-tracked data feeds into AI systems that predict, manipulate, reward or punish your actions.

The ultimate goal is to enforce rules through programmable money. The programmable money can expire, restrict purchases, and track everything you purchase automatically. This is being pushed under the guise of security and efficiency. Critics on X say that because blockchains are so public and open, it’s easy for others to watch everything you do and even jump ahead of your trades to make quick money off you.

They argue that without true privacy, decentralization just hands control to the most resourced spies. This echoes Webb’s expose on how Bitcoin’s traceability makes it a tool for destroying real financial privacy in favor of elite-controlled systems.

The Blockchain Enabler: Fueling Human Tokenization at Scale

This blockchain backbone is exactly what’s needed to make the tokenization of human resources possible on a massive scale. Without it, you couldn’t reliably slice up and trade fractions of someone’s skills, behaviors, or biometric data. Blockchain provides the immutable ledger that records every tokenized “share” of human capital.

Whether it’s your work output, health metrics, or social compliance, it links them permanently to your digital ID so the elites can monitor, value, and manipulate them in real time. It turns abstract human potential into concrete, programmable assets that can be bought, sold, or penalized without escape.

Human Commodification Unfolding: From Bonds to Biometrics

It seems truly unbelievable and dystopian but real-world implementations are creeping in through programs like social impact bonds.

There investors fund initiatives such as prisoner rehabilitation or early childhood education.

They profit if metrics like reduced recidivism are met. https://socialfinance.org/social-impact-bonds/

Byte by Byte Humans are Being Tokenized

The World Bank’s Human Capital Project measures countries’ human potential as economic assets:

“The Human Capital Project (HCP) is a global initiative launched by the World Bank to inspire and inform investments in human capital”

It paves the way for tokenized investments in workforce development. In refugee aid, organizations use blockchain combined with biometric IDs like iris scans or fingerprints to deliver and track assistance. This is how they implement the plan byte by byte as seen in UN pilots from the World Food Programme’s Building Blocks project in Jordan, where refugees scan their eyes to buy food with aid stored on a blockchain ledger. Or UNHCR’s efforts in Ukraine distributing programmable stablecoin cash directly to digital wallets. These systems make aid traceable and “efficient.” But I see them turning vulnerable people into monitored data commodities under the guise of inclusion and empowerment.

Your Skills as Tradeable Tokens

Companies are experimenting with turning workers’ skills and performance into digital tokens on blockchain platforms. They break down things like work history, credentials, or gig results into small tradable pieces. This mostly targets gig workers: drivers, delivery people, freelancers who do temporary jobs through apps. Platforms verify and tokenize these, letting people buy, sell, or trade tiny fractions of a worker’s “value” (fractionalized trading: like slicing someone’s skills into shares anyone can own and trade, similar to buying a piece of a stock). It turns personal labor into digital assets that can be bought and sold.

I know this sounds wild and hard to believe for most folks. I didn’t buy it either until I dug into the research myself. It’s all part of a larger agenda to digitize and control everything, your job and skills, your land, even nature under a single digital system run by a tiny elite of powerful companies and tech oligarchs. Critics call this endgame a form of fascist dictatorship known as technocracy, where “experts” and algorithms dictate life instead of democratic choice.

For a real-world example happening today, check out platforms like LaborX (part of Chrono.tech), a blockchain-based freelance marketplace where gig workers’ skills and work history are verified on-chain, and payments/rewards can involve tradable tokens tied to performance bringing tokenized labor closer to reality in the gig economy: https://laborx.com/

Another related case is project tokenization ideas for gig workers, as explored here: https://medium.com/@tradefin101/project-tokenization-for-gig-workers-revolutionizing-the-gig-economy-with-blockchain-20359a1ffcfd. These show early steps toward fractionalizing and trading aspects of human capital.

The Ultimate Warning: A Tokenized Hellscape Awaits

In my depiction of a tokenized future, society looks like a giant database where people own nothing tangible, as the WEF slogan suggests. The WEF idea of happiness is enforced through surveillance. Everyone carries a digital ID that opens access to jobs, services, or even basic rights. Tokens represent shares in human capital markets that reward or punish based on compliance.

Governments and corporations use this to engineer behaviors like tying aid to biometric scans or tokenizing refugee programs for “inclusion.” But it really cements a system of digital serfdom. I see this leading to a loss of freedom where the elite overlords hold all the tokens. They manipulate markets to siphon wealth while the masses are reduced to monitored data streams in a hyper-financialized digital prison.

Technocracy Tokenopoly

The world’s billionaire elite, already far beyond any need for more wealth, now crave absolute power and control. They are quietly fulfilling the 1930s vision of the Technocracy movement led by Howard Scott and Technocracy Incorporated which declared that scientists, engineers, and technical experts should replace democratic governments and elected leaders. They viewed traditional republics and ordinary citizens as too irrational and uninformed to govern effectively, insisting only a data-driven, expert-ruled system could rationally manage resources and society for maximum efficiency.

Today this technocratic ideal unfolds through the tokenization of everything: rainforests, rivers, biodiversity, human labor, skills, behaviors, and data all turned into tradable blockchain assets under the guise of sustainability and inclusion. Earth and humanity become pieces in a high-stakes game, satirized in Tokenopoly, where players buy and sell properties like the Amazon Rainforest, Nile River, Niagara Falls, CAR resources, Human Labor, and Biodiversity Credits, with cards commanding “Collect 100 Tokens” or “Go Directly to Digital Wallet.” Using AI, surveillance grids, programmable money, and immutable ledgers, the elite claim dominance and enforce compliance, building the tokenized, borgified system of digital serfdom

To pull off this nightmare, elites and tech oligarchs are racing to build AI data centers at breakneck speed devouring massive amounts of fresh water and energy just to hoard every scrap of our tokenized data. They can’t build them fast enough, but that desperation is our opening. People are waking up to their plan as their electric bills go sky high and their fresh water is drained by the data centers. People are starting to speak out.

Could their pride be their downfall?

How supremely arrogant of these self-anointed digital overlords to imagine they hold proprietary title over nature itself and over human beings, treating both as resources to be patented, monetized, and managed. How breathtakingly hubristic for them to insist that scientists, engineers, and technocratic elites are better suited to govern than the democratic process, elected representatives, and the will of the people.

Proverbs 16:18 – Pride goes before destruction, a haughty spirit before a fall.

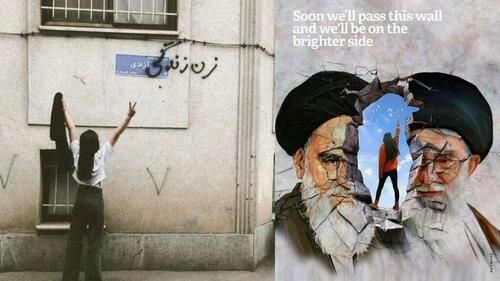

Expose their plan before it’s too late.

Don’t let them Borgify us and turn free humans into obedient, trackable nodes in their machine. Don’t let them steal nature and turn it into a commodity for the elite. Get active locally. Resist immediately. Slow their rollout to a crawl. The future isn’t theirs yet. We claim it by saying NO!

Resistance is NOT futile.

We will NOT comply.

* * *

Views expressed in this article are opinions of the author and do not necessarily reflect the views of ZeroHedge.

Tyler Durden

Sat, 02/21/2026 - 23:20

A truck drives through the Port of Oakland in Oakland, Calif., on Nov. 14, 2025. Justin Sullivan/Getty Images

A truck drives through the Port of Oakland in Oakland, Calif., on Nov. 14, 2025. Justin Sullivan/Getty Images

via Iranian state media

via Iranian state media

Source: qantara.de

Source: qantara.de

Recent comments