Watch: TDS-Riddled De Niro Sobs In Tears Over Trump

Authored by Steve Watson via Modernity.news,

Robert De Niro, the actor whose unhinged rants against President Trump have become a staple of leftist media, took his Trump Derangement Syndrome to new heights by bursting into tears during an MSNBC appearance.

De Niro sobbed while discussing Trump’s alleged “division,” prompting host Nicolle Wallace to tear up as well in a display of peak propaganda.

De Niro spluttered “You have to lift people up. You can’t divide people… this thing (Trump) they’re destroying, attempting to destroy this country and maybe not even understanding why. It’s up to us to protect the country.”

?? Robert De Niro breaks down crying about Trump:

— Mario Nawfal (@MarioNawfal) February 23, 2026

“You have to lift people up. You can't divide people. This thing [Trump] is destroying the country.”

Peak Hollywood sobfest propaganda. https://t.co/VDoDdXbc75

Wallace responded: “You’re always about lifting up everybody around you,” and added “You weren’t supposed to make me cry.”

De Niro’s tears underscore the desperation among Hollywood elites as Trump’s America First policies continue to reshape the nation, exposing the hypocrisy of those who claim to champion unity while sowing division themselves.

Robert De Niro crying about “lifting people up” & saying “you can’t divide people”, after for years, calling Trump and his supporters racists, Hitler, fascists, Nazis….is BEYOND INSANE!!

— The Conservative Read (@theconread) February 23, 2026

No actor has been more divisive and disparaging to conservative voters than Robert Deniro over the last 10 years so spare me the crocodile tears BS. He is a state propagandists bc that’s what’s required to be a working actor. Especially when you owe millions in taxes.

— Wokeaholics (@wokeaholics) February 23, 2026

A washed up professional actor doing what he does best: acting

— Rising Eagle (@risingeagleusa) February 23, 2026

Top-tier emotional framing here De Niro taps into fear, empathy, and outrage all at once. Classic media play.

— Valchiz | CLONE (?,?) (@radar_dapp) February 23, 2026

Elsewhere in the interview, De Niro again claimed Trump will “never leave” the White House and has to be gotten rid of.

Robert De Niro says Trump will “never leave” office, so people “have to get rid of him” on their own.

— johnny maga (@johnnymaga) February 21, 2026

He then calls on people to obstruct Trump’s election integrity measures at the polls in the midterms.

This absolutely warrants a Secret Service investigation. pic.twitter.com/Y170JAOevm

This latest meltdown comes just months after De Niro’s explosive tirade where he labeled the Trump administration “Nazis” and urged leftists to “fight it out” with them, insisting the President would refuse to leave the White House.

In that earlier outburst, platformed on MSNBC, De Niro blathered, “We see it we see it we see it all the time, he will not want to leave,” adding “He set it up with, I guess he’s the Goebbels of the cabinet, Stephen Miller.”

“He’s a Nazi. Yes, he is, and he’s Jewish and he should be ashamed of himself,” De Niro asserted about Miller.

He continued, “It’s all nonsense. It’s, we know it’s all racist. It’s all, I mean, that’s what he appeals to that’s what Trump is. Everything is what you see is what you get. It’s not going to change with him.”

“Everything, the point is we have to keep fighting and pushing until he is out, period. There’s no other way. He’s not going to want to leave the White House,” De Niro blurted.

“What is he facing? He’s facing certain things no matter what the Supreme Court, they’re going to find a way to go after him for what he’s done, all the awful, monstrous things that he’s done,” he garbled, without specifics.

“You know, I don’t see anyway, he’s not going to want to leave,” De Niro reiterated, adding “We cannot let up on him because he is not going to leave the White House. He does not want to leave the White House. He will not leave the White House.”

“The Republicans, most of all, because they know, but they’re going along with it. It’s a classic bully situation. We see it, and there’s no other way to face a bully. You have to face him and fight it out and back them off and back him down. That’s the only way this is going to work,” De Niro ranted.

He also claimed Americans outside elite metropolitan areas side with Trump because they lack access to truthful media—said on MSNBC, of all places.

De Niro has peddled the “Trump is a Nazi dictator” line for nearly a decade.

He once declared Trump worse than psychopath killers he’s portrayed, and said he’d disown his children if they resembled Trump’s family.

“I don’t want my kids to take this the wrong way, but if my kids did what [Trump’s] kids did, I wouldn’t want to be related to them. I would disown them.” De Niro raged on The View.

“I would have a serious talk with them.” he continued, adding ”if I disagreed with them on things of principle, I would say, and they felt it, and we do now.” he added.

Ironically, one of De Niro’s sons declared himself transgender, citing influence from Black women: “I think a big part of [my transition] is also the influence Black women have had on me… I think stepping into this new identity, while also being more proud of my Blackness, makes me feel closer to them in some way.”

Your support is crucial in helping us defeat mass censorship. Please consider donating via Locals or check out our unique merch. Follow us on X @ModernityNews.

Tyler Durden Tue, 02/24/2026 - 18:25

Work progresses on a new migrant detention facility dubbed "Alligator Alcatraz" at Dade-Collier Training and Transition facility in the Florida Everglades on July 4, 2025. Rebecca Blackwell/AP Photo

Work progresses on a new migrant detention facility dubbed "Alligator Alcatraz" at Dade-Collier Training and Transition facility in the Florida Everglades on July 4, 2025. Rebecca Blackwell/AP Photo

via Reuters

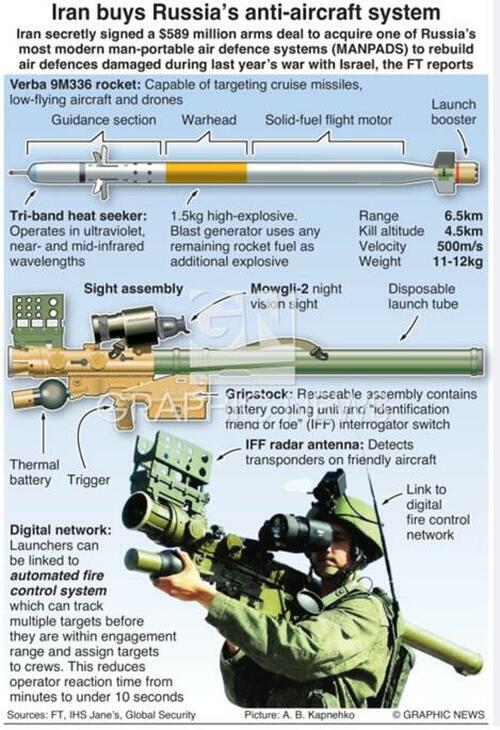

via Reuters Graphic News: the Verba 9K336 MANPADS

Graphic News: the Verba 9K336 MANPADS

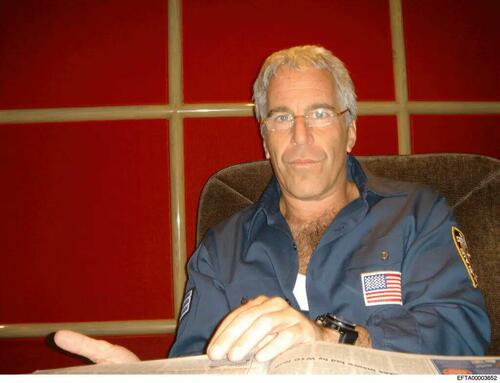

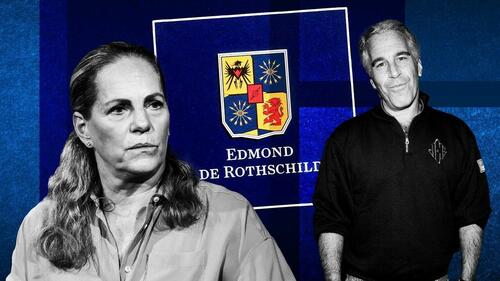

Jeffrey Epstein, right, became a personal confidant and key business adviser to Ariane de Rothschild, left, for six years from 2013 © FT montage/Bloomberg/Alamy/Getty Images

Jeffrey Epstein, right, became a personal confidant and key business adviser to Ariane de Rothschild, left, for six years from 2013 © FT montage/Bloomberg/Alamy/Getty Images Epstein with Sheikh Jabor Bin Yousef Bin Jassim Bin Jabor al Thani. Pic: @OversightDems

Epstein with Sheikh Jabor Bin Yousef Bin Jassim Bin Jabor al Thani. Pic: @OversightDems

Source: AFP

Source: AFP via ABC News

via ABC News via AFP

via AFP

Zelensky awarding a medal to a Ukrainian soldier on February 23, 2026 Source: Office of the President of Ukraine.

Zelensky awarding a medal to a Ukrainian soldier on February 23, 2026 Source: Office of the President of Ukraine. Thorbjorn Jagland, a former prime minister of Norway, in Oslo February 12th.

Thorbjorn Jagland, a former prime minister of Norway, in Oslo February 12th.

Recent comments