Tonight's State Of The Union: Here's What To Watch As Trump Plans Two, Possibly Three Hour Speech

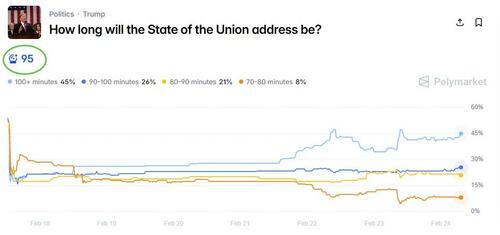

Update (1555ET): Tonight's speech is expected to be over two hours, possibly approaching three, PBS News reports.

He's also expected to call for a new form of personal and corporate tax cuts, Fox News reports, citing comments Trump made at the White House luncheon.

* * *

President Trump is set to deliver his first State of the Union address of his second term on Feb. 24, when he is expected to highlight his administration’s accomplishments and seize the moment to shore up support for Republicans ahead of the critical 2026 elections.

Historically, the president’s party almost always suffers midterm losses, and the House appears especially vulnerable this year.

Trump, eager to reverse the trend, is set to deliver a lengthy speech promoting the policy wins over the past year.

“It’s going to be a long speech, because we have so much to talk about,” the president said during an event at the White House on Feb. 23.

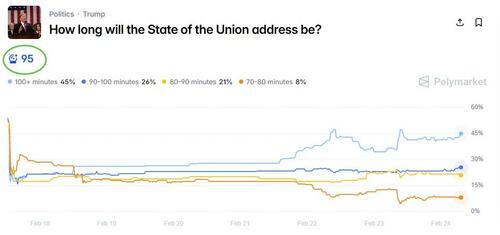

In fact, as Polymarket odds show, his speech is expected to last 95 minutes...

The address is scheduled for 9 p.m. ET and will be Trump’s second to Congress since returning to office. He previously spoke to a joint session of Congress on March 4 last year. While it was not an official State of the Union address, the speech was the longest on record, lasting nearly 1 hour and 40 minutes.

Below, The Epoch Times' Emel Akan lays out five key things to watch at this year’s State of the Union:

Midterms Messaging

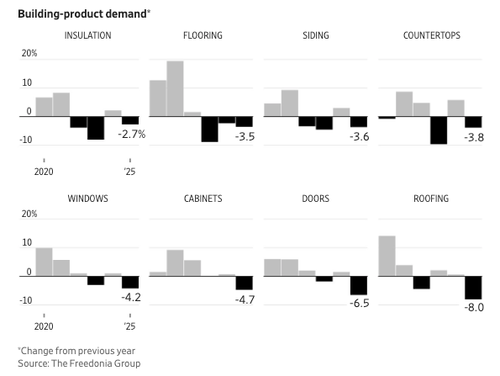

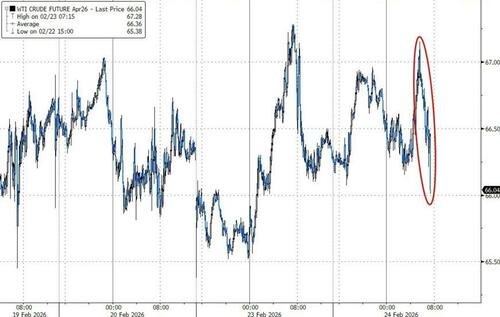

With eight months until the midterms, Republicans are working to win voters, especially independents who backed Trump in 2024. The majority of voters are still anxious about the high cost of living, according to recent polls. Trump is likely to prioritize the economy in his speech and talk about what he has done to lower gas, housing, and health care costs for American families.

Luke Nichter, professor of presidential studies at Chapman University in Orange, California, believes that Trump’s primary message will be about the midterms.

“He wants to make sure those enthusiastic supporters are still enthusiastic, they still support him, and continue to turn out this fall,” Nichter told The Epoch Times.

The speech comes on the heels of the Supreme Court’s decision last week that struck down tariffs imposed under the 1977 International Emergency Economic Powers Act.

President Donald Trump acknowledges the audience before delivering his State of the Union address at the U.S. Capitol in Washington, on Feb. 4, 2020. Mandel Ngan/AFP via Getty Images

Trump sharply criticized the justices who supported the ruling and has since pledged to raise global tariffs to 15 percent using other statutory authorities. During a Feb. 20 press conference, Trump said he was “ashamed of certain members of the court.” Hence, his tone and remarks toward the justices in the room will be closely watched during the address.

Trump is expected to make the case for high tariffs, even as some Republican lawmakers have expressed concerns about their economic impact.

Immigration will also be a key topic, as the Department of Homeland Security (DHS) remains shut down due to ongoing disagreement between the White House and congressional Democrats. Trump is expected to defend his administration’s policies while adopting a more measured tone in light of two recent fatal shootings by immigration agents in Minneapolis.

Aaron Dusso, a political science professor at Indiana University, believes that Trump will try to shift the narrative during his speech, especially given recent criticism of the domestic immigration crackdown and declining approval ratings.

“This is going to be an opportunity for him to command attention across the entire country,” Dusso told The Epoch Times.

Foreign Policy Questions

Foreign policy is typically not a major focus in the State of the Union addresses, as presidents usually prioritize domestic issues. Trump’s address may be an exception, Nichter said.

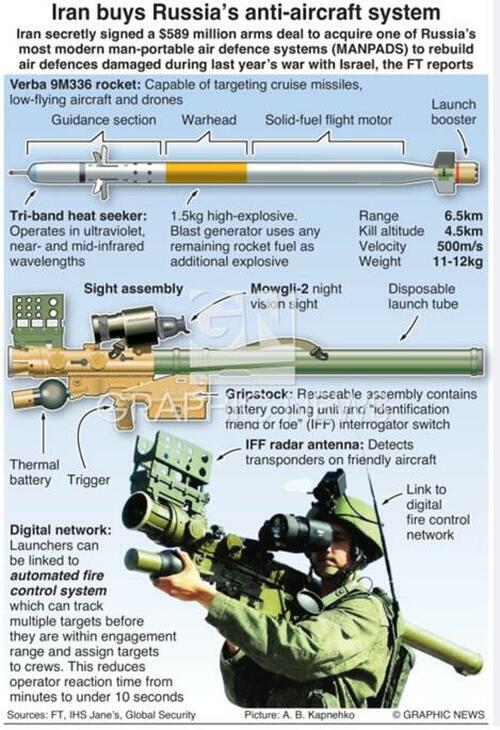

In recent weeks, the administration has stepped up the U.S. military presence in the Middle East to exert pressure on Iran to curb its nuclear program. The Pentagon has dispatched another large aircraft carrier to the region. Amid tensions, another round of talks with Tehran is set for Feb. 26 in Geneva. Lawmakers will be closely watching for any new announcements regarding Iran.

Mexican soldiers patrol in armored vehicles in Acapulco in the aftermath of a military operation in which Mexican drug lord Nemesio Oseguera, known as "El Mencho," was killed in Jalisco state, in Acapulco, Mexico, on Feb. 22, 2026. Henry Romero/Reuters

In Mexico, a U.S.-aided operation killed Nemesio “El Mencho” Oseguera Cervantes, a powerful drug cartel leader, on Feb. 22. Lawmakers and foreign policy analysts will be listening for clarity on the extent of the U.S. involvement in the Mexican military’s operation.

Trump is also expected to highlight his broader efforts to broker peace around the world, crediting himself for ending eight wars.

According to Nichter, Trump may also address unresolved foreign policy issues, including Greenland, Cuba, Venezuela, and the golden dome missile defense system.

Guests in the Gallery

The White House and lawmakers will invite special guests to the State of the Union to highlight their political messages.

Over the weekend, Trump invited the U.S. Men’s and Women’s Olympic Hockey teams following their gold medal victories over Canada.

The women’s team declined the invitation, citing scheduling issues. The men’s team is expected to attend.

Jake Guentzel #59, Tage Thompson #72, Jaccob Slavin #74, Kyle Connor #81 and Jake Sanderson #85 of Team United States listen to the national anthem during the medal ceremony for Men's Ice Hockey following their gold-medal win over Canada at the 2026 Winter Olympic games at Milano Santagiulia Ice Hockey Arena in Milan, Italy, on Feb. 22, 2026. Bruce Bennett/Getty Images

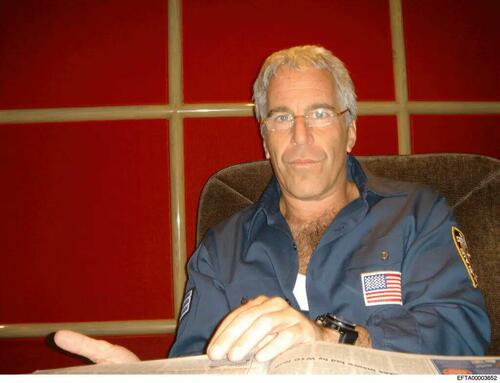

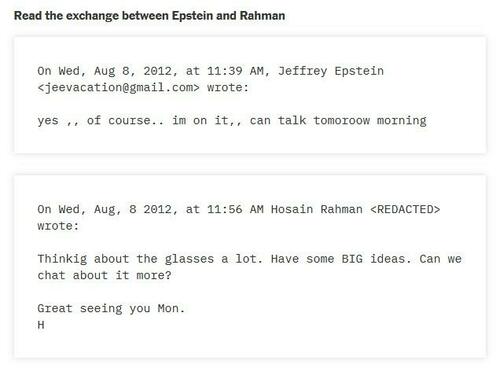

Democratic lawmakers have invited several people who say they were victims of sex offender Jeffrey Epstein, including Jess Michaels and the family of the late Virginia Roberts Giuffre, to demand legal consequences for those named in the files.

Some Democrats, including Senate Minority Leader Chuck Schumer (D-N.Y.), will bring constituents to raise concerns about the impact of rising tariffs and health care costs.

Some Republicans are focusing on human rights issues in China. House Speaker Mike Johnson (R-La.) will host the daughter of Gulshan Abbas, a Uyghur doctor detained in China since 2018. Rep. Chris Smith (R-N.J.) will host Claire Lai, daughter of Hong Kong media tycoon Jimmy Lai, who is serving a 20-year prison sentence.

Reaction

There have been dramatic moments at past State of the Union addresses, most notably in February 2020, when then-House Speaker Nancy Pelosi tore up a copy of Trump’s speech after he finished speaking.

This time, the setting will be different. Seated behind Trump will be Johnson and Vice President JD Vance.

Reactions from Democrats in the chamber will be closely watched. As with previous years, some lawmakers are expected to stage symbolic protests, wearing coordinated colors or displaying signs.

Vice President Mike Pence claps as Speaker of the House of Representatives Nancy Pelosi rips a copy of President Donald Trump's speech after he delivers the State of the Union address at the Capitol in Washington on Feb. 4, 2020. Mandel Ngan/AFP via Getty Images

The official response from the Democratic Party will be delivered by Virginia Gov. Abigail Spanberger, who won a landslide victory last November and became the state’s first female governor. Her response will air immediately after Trump’s speech.

Yemisi Egbewole, a Democratic strategist and former Biden White House adviser, said that Spanberger’s selection shows the party is changing its strategy by focusing on affordability and moving away from identity issues.

The response is expected to be measured and aimed at voters who are uneasy about Trump as president, even if they sometimes support Republicans, Egbewole told The Epoch Times.

“That is really where Democrats need to hit,” she said.

Virginia Gov. Abigail Spanberger signs executive orders after being sworn into office at the Virginia State Capitol in Richmond, Va., on Jan. 17, 2026. Win McNamee/Getty Images

More than a dozen Democrats plan to skip the speech and attend an alternative event, the “People’s State of the Union” rally at the National Mall in Washington.

Sens. Adam Schiff (D-Calif.), Ed Markey (D-Mass.), Jeff Merkley (D-Ore.), Chris Murphy (D-Conn.), Tina Smith (D-Minn.), and Chris Van Hollen (D-Md.), as well as Reps. Yassamin Ansari (D-Ariz.), Becca Balint (D-Vt.), Greg Casar (D-Texas), Veronica Escobar (D-Texas), Pramila Jayapal (D-Wash.), Delia Ramirez (D-Ill.), and Bonnie Watson Coleman (D-N.J.) are expected to skip the address.

Defending the Record

Trump is expected to defend his record and outline his legislative goals in another lengthy address.

He will tout economic milestones, including the Dow Jones Industrial Average surpassing 50,000 points. He will argue that crime is falling nationwide.

He will also likely highlight reductions in immigration flows at the southern border with Mexico. Trump has previously said that illegal immigration along that border has reached near-zero levels.

A banner showing President Donald Trump at the Department of Justice in Washington on Feb. 21, 2026. Madalina Kilroy/The Epoch Times

The address is also considered a prime opportunity for the president to lay out his legislative proposals. This year, Trump is expected to encourage the passage of the Safeguarding American Voter Eligibility (SAVE) America Act, a bill that would require proof of citizenship to vote.

He will also tout his other policies, such as banning male athletes with gender dysphoria from competing in women’s sports.

According to David Schultz, a political science professor at Hamline University in Minnesota, Trump will have to keep his base energized while deciding whether to adjust his tone and message to win back the independent voters who helped elect him in 2024.

Republicans’ chances of holding Congress depend on retaining those swing voters, he told The Epoch Times.

“His base is still mostly with him,” Schultz said. “The question becomes, does he only pitch to the base, or does he try to alter his language and approach to appeal to the swing voters?”

Tyler Durden

Tue, 02/24/2026 - 13:35

The DeepSeek app on an iPhone screen in San Anselmo, Calif., on Jan. 27, 2025. Justin Sullivan/Getty Images

The DeepSeek app on an iPhone screen in San Anselmo, Calif., on Jan. 27, 2025. Justin Sullivan/Getty Images

Work progresses on a new migrant detention facility dubbed "Alligator Alcatraz" at Dade-Collier Training and Transition facility in the Florida Everglades on July 4, 2025. Rebecca Blackwell/AP Photo

Work progresses on a new migrant detention facility dubbed "Alligator Alcatraz" at Dade-Collier Training and Transition facility in the Florida Everglades on July 4, 2025. Rebecca Blackwell/AP Photo

via Reuters

via Reuters Graphic News: the Verba 9K336 MANPADS

Graphic News: the Verba 9K336 MANPADS

Jeffrey Epstein, right, became a personal confidant and key business adviser to Ariane de Rothschild, left, for six years from 2013 © FT montage/Bloomberg/Alamy/Getty Images

Jeffrey Epstein, right, became a personal confidant and key business adviser to Ariane de Rothschild, left, for six years from 2013 © FT montage/Bloomberg/Alamy/Getty Images Epstein with Sheikh Jabor Bin Yousef Bin Jassim Bin Jabor al Thani. Pic: @OversightDems

Epstein with Sheikh Jabor Bin Yousef Bin Jassim Bin Jabor al Thani. Pic: @OversightDems

Source: AFP

Source: AFP via ABC News

via ABC News via AFP

via AFP

Recent comments