VW's 20% Cost-Cutting Plan Exposes Germany's Industrial Crisis

Submitted by Thomas Kolbe

For too long, Germany’s economy has watched political developments from the sidelines – perhaps far too long. The cost pressures triggered by the energy transition and Brussels’ extensive regulatory policies are now reflected in business results.

Following Stellantis and Opel, Volkswagen on Monday announced sweeping measures to confront the existential economic crisis. CEO Oliver Blume presented a cost-saving program that, according to Manager Magazin, is expected to reduce global company costs by one-fifth by the end of 2028.

The internal overhaul was presented in mid-January by Blume and CFO Arno Antlitz. A concrete statement from the company on its strategy has not yet been issued. Plant closures in Germany are reportedly also under discussion.

Pressure to act is immense. The final results for last year are not yet available, but after three quarters, an operating profit (EBIT) drop of roughly 48 percent year-on-year to around €9.9 billion is emerging. The EBIT margin, a key measure of profitability, fell to 3.05 percent from 5.87 percent.

Revenue stagnated at around €324 billion, with vehicle sales of roughly nine million units, down 0.5 percent. The fourth quarter in particular saw a 4.9 percent decline, with China and North America suffering the largest losses. European sales remained relatively stable with modest gains, though the negative trend accelerated toward year-end. This may have been the trigger prompting management to implement drastic cost-saving measures.

Free cash flow also collapsed by 90 percent to €514 million, further limiting the company’s ability to invest in R&D and plant development. Fundamentally, cost consolidation remains the only lever to create breathing room amid fierce global competition – particularly with China and increasingly with the United States.

Germany’s Industrial Base BleedsBy 2030, 35,000 jobs are set to be cut in Germany alone. VW’s core brand currently employs around 130,000 workers. The reduction will be carried out without layoffs, using severance packages and partial retirement plans. Fewer young specialists, less dynamism, fewer jobs – the visible consequence of Germany’s energy-policy isolation and the EU’s climate-policy path.

The plants in Wolfsburg and Zwickau are under particular efficiency pressure. Structural production relocations to cheaper locations such as Hungary, as well as further consolidation in China and possibly the U.S., are underway. Germany’s aggressive climate regulations are forcing companies like Volkswagen to recalibrate their global strategy.

Most investments now flow to China, followed by Mexico, Brazil, and the U.S. In Chattanooga, Tennessee, the plant currently produces SUVs like the Atlas and Passat, as well as the electric ID.4. Significant production expansion in Germany is no longer on the agenda.

Volkswagen is also pushing suppliers to cut costs, heavily affecting Germany’s SME sector. The VW crisis is thus also a crisis for the German Mittelstand, where a large portion of pre-production value is generated for the country’s industrial core.

Structural WeaknessVolkswagen’s efficiency program is not a routine cost-cutting measure but a visible expression of structural weakness. Years of the diesel scandal, a largely failed transition to e-mobility, and intense pressure from Chinese competitors are culminating in a large-scale company overhaul.

Volkswagen, partly owned by the state of Niedersachsen, has become a global symbol of the decline of the “Made in Germany” label. It is astonishing that Germany allowed its technological edge and energy security to be sacrificed to a destructive political ideology – only to hastily relocate value creation to cheaper sites like China.

Thousands of suppliers and municipal treasurers must watch the decline unfold, as the traditional automotive regions around Stuttgart and Wolfsburg face fiscal challenges that can only be temporarily mitigated with special funds. Entire industrial ecosystems risk disappearing, with knowledge and capital following the companies abroad.

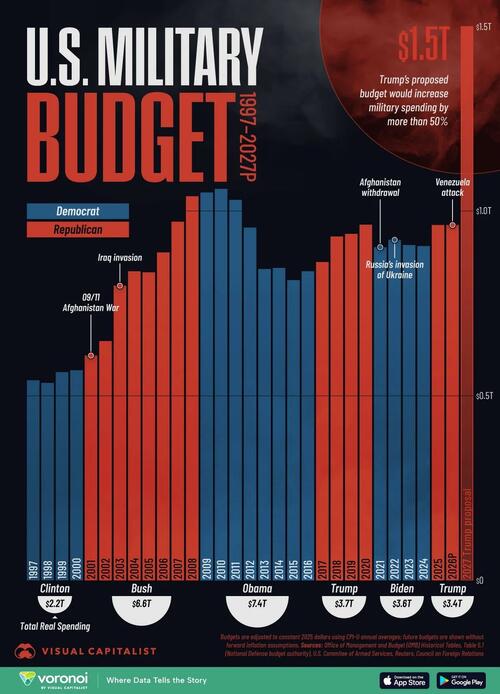

The government’s idea of replacing lost industrial capacity with military production is both reckless and unworkable. Civilian automotive output cannot be simply converted into tank manufacturing, regardless of subsidies or state intervention. The loss of high-value civilian production cannot be offset in this way.

Volkswagen’s decline should make clear the full extent of the political missteps in Germany and Europe. Within the current ideological framework, reforms are insufficient. A thorough reassessment of Agenda 2030 and the Green Deal is required to mitigate the economic and social fallout facing Germany.

* * *

About the author: Thomas Kolbe, a German graduate economist, has worked for over 25 years as a journalist and media producer for clients from various industries and business associations. As a publicist, he focuses on economic processes and observes geopolitical events from the perspective of the capital markets. His publications follow a philosophy that focuses on the individual and their right to self-determination.

Tyler Durden Fri, 02/20/2026 - 07:20

AFP via Getty Images

AFP via Getty Images

Dr. Jay Bhattacharya, director of the National Institutes of Health, in Washington, on Feb. 8, 2026. Irene Luo/The Epoch Times

Dr. Jay Bhattacharya, director of the National Institutes of Health, in Washington, on Feb. 8, 2026. Irene Luo/The Epoch Times The National Institutes of Health Gateway Center in Bethesda, Md., on June 8, 2025. During President Donald Trump’s second term, National Institutes of Health Director Dr. Jay Bhattacharya said the agency “is focused on actually addressing the chronic health problems of this country.” Elizabeth Frantz/Reuters/File Photo

The National Institutes of Health Gateway Center in Bethesda, Md., on June 8, 2025. During President Donald Trump’s second term, National Institutes of Health Director Dr. Jay Bhattacharya said the agency “is focused on actually addressing the chronic health problems of this country.” Elizabeth Frantz/Reuters/File Photo President Donald Trump (C) speaks as National Institutes of Health Director Dr. Jay Bhattacharya (2nd L) looks on during a press conference at the White House on May 12, 2025. The NIH redirected its funding priorities after Trump began his second term. Andrew Harnik/Getty Images

President Donald Trump (C) speaks as National Institutes of Health Director Dr. Jay Bhattacharya (2nd L) looks on during a press conference at the White House on May 12, 2025. The NIH redirected its funding priorities after Trump began his second term. Andrew Harnik/Getty Images A researcher studies skin wound healing in a lab at the University of Illinois Chicago in Chicago on March 5, 2025. On Jan. 5, a federal appeals court ruled that the Trump administration could not limit the percentage amount the National Institutes of Health pays grant recipients for indirect costs, including administrative expenses and facility maintenance. Scott Olson/Getty Images

A researcher studies skin wound healing in a lab at the University of Illinois Chicago in Chicago on March 5, 2025. On Jan. 5, a federal appeals court ruled that the Trump administration could not limit the percentage amount the National Institutes of Health pays grant recipients for indirect costs, including administrative expenses and facility maintenance. Scott Olson/Getty Images

The Federal Trade Commission (FTC) in Washington on Aug. 6, 2024. Madalina Vasiliu/The Epoch Times

The Federal Trade Commission (FTC) in Washington on Aug. 6, 2024. Madalina Vasiliu/The Epoch Times

Recent comments