Futures Drop As Iran Tensions Rise, Data Deluge Looms

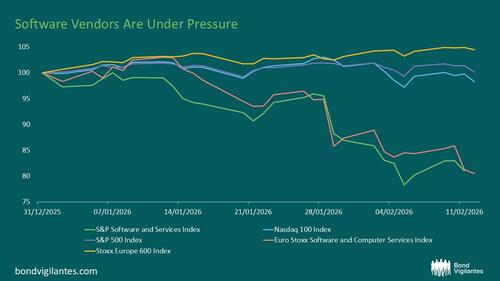

US equity futures are lower, sliding from session highs around the European open to session low just before 8am E as traders assessed the potential market impact of war with Iran, and awaited a firehose of US economic data including GDP and core PCE. As of 8:15am ET, S&P and Nasdaq futures are down 0.1% having traded in the green for much of the overnight session. Pre-market, Mag 7 are mostly red with GOOGL bucking the trend and rising +1.2%. Blue Owl Capital’s shares were set to fall a further 3.5% after its decision to limit withdrawals from a private credit fund. Bond yields have also reversed and are now lower on the session while the USD is flat. Commodities are mixed: base metals are lower while precious metals are rallying, sending gold above $5000 again; Brent crude fell toward $71 a barrel, paring gains since Monday to about 5%. Overnight, a WSJ article rehashed the now familiar story that Trump considers an initial limited strike to force negotiation. Today, key macro focus will be PCE, Flash PMIs and SCOTUS opinion day (markets are waiting for possible decision on IEEPA tariffs).

In premarket trading, magnificent Seven stocks are mixed early Friday (Alphabet (GOOGL) +1.2%, Nvidia (NVDA) -0.3%, Tesla (TSLA) -0.1%, Amazon (AMZN) +0.02%, Meta (META) -0.3%, Microsoft (MSFT) -0.1%, Apple (AAPL) -0.3%)

- Akamai Technologies (AKAM) falls 11% after the software company gave an outlook for adjusted earnings that is weaker than expected for both the first quarter and the full year.

- Ardelyx (ARDX) drops 6% after the drugmaker gave sales forecast for its Ibsrela drug in the first quarter that Jefferies views as softer than expected

- Copart (CPRT) falls 8% after the online vehicle salvage auction company reported operating income for the second quarter that missed the average analyst estimate.

- Floor & Decor (FND) climbs 4% after the flooring and tile retailer reported adjusted earnings per share for the fourth quarter that exceeded the average analyst estimate.

- Grail (GRAL) tumbles 47% after the early cancer detection test maker said Galleri, its multi-cancer screener, failed to meet its primary endpoint of statistically significant reduction in combined Stage III and IV cancer.

- Harmonic (HLIT) rises 9% after the communications equipment’s book-to-bill is seen as strong and reinforcing its growth potential.

- Hudbay Minerals (HBM) declines almost 5% after the miner reported fourth-quarter adjusted earnings per share that missed the average analyst estimate as production fell year-over-year.

- Newmont (NEM) drops 4% after the world’s biggest gold miner said it expects to produce less bullion this year, due to planned upgrades at some of its managed mines and lower output at two joint ventures with Barrick Mining.

- Opendoor Technologies (OPEN) climbs 19% as the online marketplace for residential real estate reported revenue for the fourth quarter that beat the average analyst estimate.

- RingCentral (RNG) rises 10% after the software company’s fourth-quarter results beat expectations on key metrics and it gave a positive forecast for both the first quarter and the full year.

- Texas Roadhouse (TXRH) rises 4% after the restaurant chain said it expects positive comparable restaurant sales growth for the year as it plans to implement a menu price increase in early April.

- Workiva Inc. (WK) gains 12% after the software company reported fourth-quarter results that beat expectations and gave revenue forecasts for both the first quarter and the full year that are seen as positive.

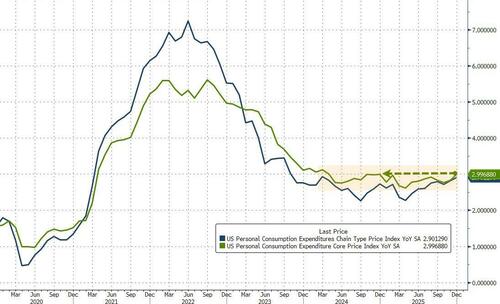

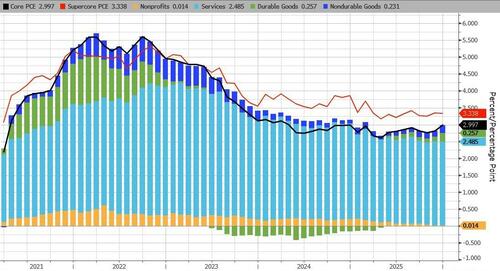

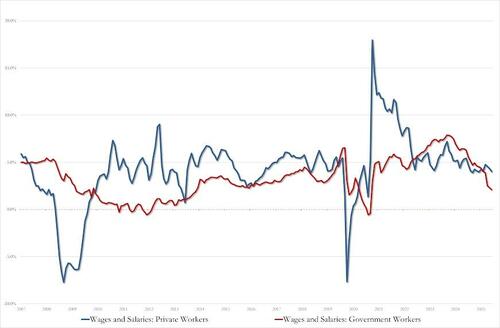

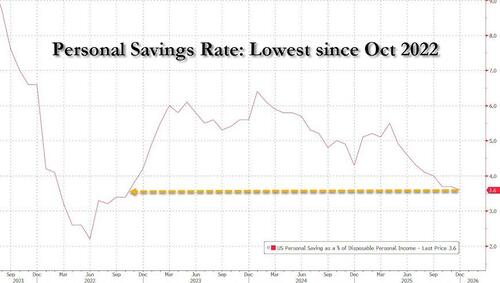

Friday morning brings long-delayed readings of core personal consumption expenditure — a measure of price changes in consumer goods and services that excludes volatile food and energy costs. The data may prove important not only in deciphering the next move in interest rates, but also the outlook for the great rotation trade out of tech names into materials, energy and other cyclicals linked to a stronger economy. Bloomberg Economics expects core inflation to have accelerated into the year end. Prices of services including recreation, accommodation and video streaming are likely to have contributed to a month-on-month increase of 0.32% in the core PCE deflator for December and a tick-up in the annual rate to 2.9% from 2.8%.

Wider inflation is set to be stoked by oil near a six-month high as Trump oversees the biggest US military buildup in the Middle East since 2003 and warns Iran that it has 10 to 15 days at most to strike a deal over its nuclear program — or else.

Speaking of "or else", the US military is deploying a vast array of forces in the Middle East as President Donald Trump ramps up pressure on Tehran to strike a deal over its nuclear program. While the move in oil seeped into risk assets, traders note that recent geopolitical flare-ups have had only a limited impact on markets.

“Geopolitical stories are really notoriously difficult to price,” Marija Veitmane, head of equity research at State Street Global Markets, told Bloomberg TV. “Right now it’s almost impossible to assign probabilities to any outcome, given how quickly those narratives change.”

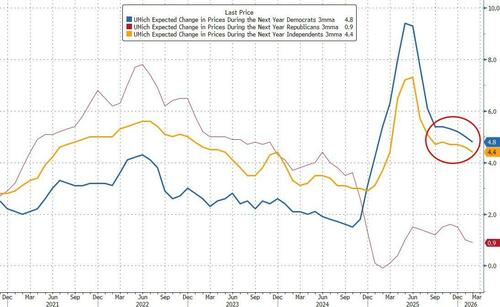

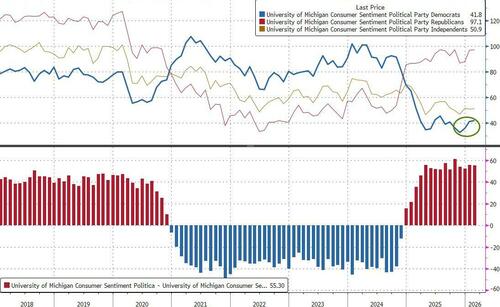

Elsewhere, as Trump looks to soothe concerns among rich and poor alike ahead of the midterms, he declared victory in the fight over cost-of-living concerns. It signals a new approach from the president that denies problems with his economic agenda while touting stock market gains to insist that his tariff plans have been a success. The White House is ratcheting up pressure on Congress to enact Trump’s proposed ban on investors buying homes, laying out for the first time what sort of investment firms he plans to target, The Wall Street Journal reports.

Turning to earnings, Of the 425 S&P 500 companies to have reported so far this earnings season, more than 74% have beaten analysts’ estimates, while nearly 21% have missed. No major companies are due to report today, but the earnings season picks up pace again next week, with companies representing a further 13% of the S&P’s market value on deck.

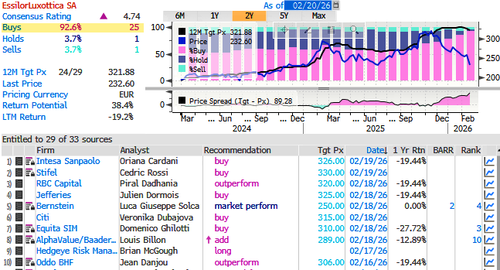

European stocks rebound after a halt to their rally in the prior session. Stoxx 600 up by 0.5%, with consumer, construction and chemicals outperforming. Moncler leads luxury stocks to outperform, while the energy and utilities sectors lag. Here are some of the biggest movers on Friday:

- Moncler shares gain as much as 13%, the most since September 2024, after the maker of high-end puffer jackets reported results that Barclays said were significantly ahead of estimates.

- Air Liquide shares rise as much as 3.9%, trading at a three-month high, after the French industrial-gas producer posted second-half earnings that beat expectations and raised its dividend more than anticipated, according to a Jefferies analyst.

- Kingspan shares climb as much as 9.4%, touching their highest level since 2024, after the construction firm generated record revenue and said the part of its business that builds infrastructure for data centers has an “extraordinary pipeline.”

- Unipol shares rise as much as 6.6%, their biggest gain in over 10 months, after the Italian insurer topped expectations in the latest quarter, with Barclays noting a higher dividend, stronger capital returns and better margins.

- Dis-Chem shares rally as much as 4.6% in Johannesburg, touching its highest intraday level in over a year, after the pharmacy stores chain reported a loyalty program-driven increase in revenue.

- ALK-Abello shares rise as much as 4.7%, hitting their highest level in over a month, after the pharmaceutical company with a focus on allergies said it will pay its first dividend since 2017 and topped expectations in the final quarter, according to analysts at Jefferies.

- Siegfried shares fall as much as 6.7%, the most since August, after weaker-than-expected 2026 guidance from the the Swiss pharma firm.

- Umicore shares decline as much as 7.1% in Brussels, hitting its lowest intraday level since December after the specialty chemicals company reported net income for 2H 2026 that missed the average analyst estimate.

- Danone shares drop 2.1% after a like-for-like sales beat was offset by a miss in volumes and misses in certain units in China and the US, according to Jefferies.

- Aston Martin shares slip as much as 4.4% after the British carmaker posted another profit warning.

- Chemring shares slide as much as 5.5% after the defense firm said it has made a slower start to the year than anticipated.

Earlier, Asian stocks fell in the last session of a holiday-thinned trading week, as renewed fears of conflict between the US and Iran weighed on risk sentiment. The MSCI Asia Pacific Index dipped as much as 0.4%. Alibaba and Tencent were the biggest drags, with investors rotating into smaller tech names in Hong Kong as the market reopened following the Lunar New Year break. Benchmarks fell more than 1% in Japan and New Zealand. Stocks gained in South Korea and India. Investors turned cautious after US President Donald Trump warned that Iran had 10 to 15 days to come up with a deal over its nuclear program. While equities broadly fell, sectors related to energy and defense gained on the escalating tensions. Mainland China and Taiwan markets will reopen next week. Traders will also be focused on monetary policy decisions from South Korea and Thailand, as well as gross domestic product data from Hong Kong and India. Companies due to report results from the region include HSBC and Baidu, while Nvidia headlines overseas earnings.

In FX, the Bloomberg Dollar Spot Index up 0.1% and in a narrow range for the day. Sterling outperforming, yen and the kiwi falling.

In rates, treasuries are little changed.Gilt curve flattening after slew of data, including strong retail sales, a record budget surplus and solid PMIs. Euro-area business activity improved thanks to a boost from German factories. Bund yields edging lower,

In commodities, oil fluctuates with concerns about US-Iran tensions at the forefront. Brent now down for the session and getting closer to $71/barrel, having jumped the day before. Gold prices higher and holding above $5,000/oz.

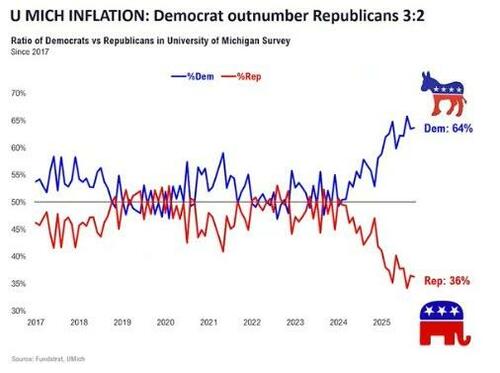

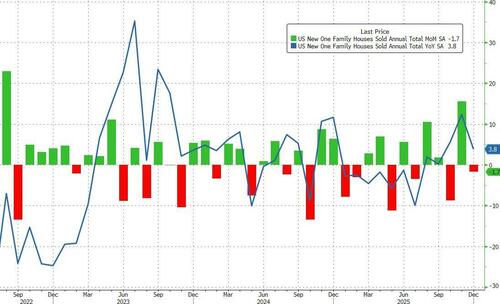

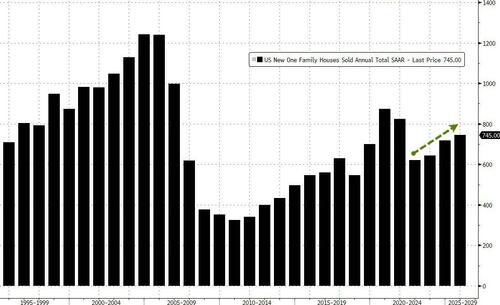

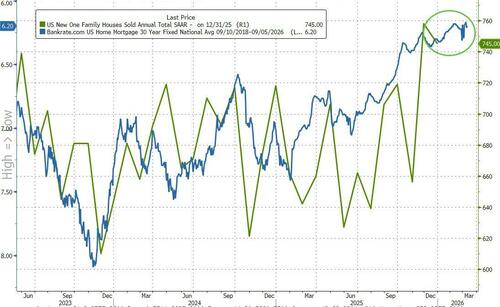

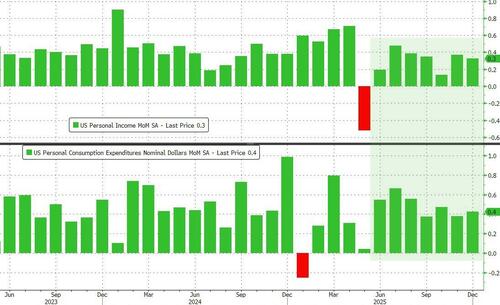

Today's econ calendar consists of readings of personal income and spending in December are due at 8:30 a.m. ET, alongside core PCE indexes for the same month and 4Q GDP data. They are followed at 9:45 a.m. by S&P Global’s provisional manufacturing, services and composite purchasing managers’ indexes for February. At 10 a.m., readings of new homes sales in December and the University of Michigan’s final index of consumer sentiment in February are due. Fed speaker slate includes Bostic (9:45am), Logan (12:45pm) and Musalem (3:30pm)

Market Snapshot

- S&P 500 mini +0.2%

- Nasdaq 100 mini +0.3%

- Russell 2000 mini +0.1%

- Stoxx Europe 600 +0.5%

- DAX +0.3%, CAC 40 +0.9%

- 10-year Treasury yield little changed at 4.07%

- VIX -0.1 points at 20.09

- Bloomberg Dollar Index little changed at 1191.49

- euro -0.1% at $1.1759

- WTI crude -0.6% at $66.06/barrel

Top Overnight News

- US President Trump is weighing an initial limited military strike on Iran to force it to meet his demands for a nuclear deal, a first step that would be designed to pressure Tehran into an agreement but fall short of a full-scale attack that could inspire a major retaliation. WSJ

- Trump said regarding affordability "we've solved it" and will talk about inflation in the State of the Union next week.

- The White House is ratcheting up pressure on Congress to enact President Trump’s proposed ban on investors buying homes, laying out for the first time what sort of investment firms he plans to target. In a memo sent Thursday to House and Senate committee leaders, the White House proposed banning investors with more than 100 single-family homes from purchasing additional homes. WSJ

- The US is planning a Peace Corps initiative that would send thousands of science and math graduates abroad to boost foreign nations’ reliance on American tech over Chinese alternatives. BBG

- Oil traded near a six-month high as tensions with Iran intensified, with the US amassing forces in the Middle East in its biggest deployment since 2003. Donald Trump said Iran has no more than two weeks to reach a deal over its nuclear program. BBG

- Blue Owl sold $1.4 billion of private loans to three of North America’s biggest pension funds and its own insurer to help pay out investors, people familiar said. The move underscores the risks facing retail investors as they move into the fast-expanding private credit market. BBG

- Nvidia is close to finalizing a $30 billion investment in OpenAI that will replace the long-term $100 billion commitment agreed last year. FT

- Japanese PM Takaichi told fellow lawmakers on Friday that a severe lack of domestic investment is holding back the country’s potential growth rate compared to other major advanced economies as she pledged to take “thorough and decisive measures” in the form of government backed, large scale and long term strategic investments. Nikkei

- Japan’s consumer prices rose at a slower pace in the first month of 2026, giving the central bank more breathing room to consider its next step. Consumer inflation, excluding volatile fresh food prices, climbed 2.0% in January from a year earlier, compared with December’s 2.4% rise, government data showed Friday. WSJ

- Britain recorded its biggest budget surplus on record in January, augmented by a surge in inflows of capital gains tax and lower debt payments. Separate data showed retail sales surged 1.8%, the fastest growth in 20 months. The pound erased losses. BBG

Trade/Tariffs

- India's Trade Minister said they expect the US to issue a notice on lowering the import tariff to 18% during February.

- India's Trade Minister said they expect the trade deal with the UK to come into effect by April.

- Indonesian Government said they will get 19% tariffs on most goods, with 0% on coffee, chocolate and rubber in the US trade deal. Deal also will not involve any third country when asked about China trans-shipment concerns.

- Japan's Trade Minister Akazawa said not set the timing on the second set of US investment projects, adds want to make sure PM Takaichi's US trip in March is fruitful.

- White House releases fact sheet on Trump administration finalising the trade deal with Indonesia that will provide Americans with unprecedented market access and unlock major breakthroughs for America’s manufacturing, agriculture, and digital sectors.

- US President Trump accused China of flooding US market with subsidised goods.

- US President Trump said steel tariffs have been a game-changer.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks followed suit to the predominantly negative mood on Wall Street, where risk appetite was subdued amid private credit fund concerns and geopolitical risks related to the US and Iran following Trump's latest threat and 10-15 day ultimatum. ASX 200 was lacklustre amid underperformance in the tech, telecoms and consumer sectors, while participants continued to digest a slew of earnings, although downside was stemmed by resilience in utilities and the top-weighted financial industry. Nikkei 225 stumbled back beneath the 57,000 level with the index pressured despite recent currency weakness and the softer inflation data, which essentially provides the BoJ with more policy space, while tech and autos were among the industries notably represented in the list of worst-performing stocks. Hang Seng retreated upon returning from the Lunar New Year holidays with the big tech names leading the declines in the index, while mainland markets and the Stock Connect remained shut and won't open until next Tuesday.

Top Asian News

- Japanese PM Takaichi said there is a dearth of domestic investment in Japan and will stop trend of austerity and lack of investment. She pledges to drive a significant investment via multi-year budgets and long-term funding strategies and affirms that essential expenditures will be maximised through the initial budget allocation. Affirms commitment to prudent fiscal policies to maintain market confidence. Aims for swift approval of crucial legislation, including tax reform, by the end of FY26/27. Government will unveil an investment roadmap for 17 strategic sectors beginning next month. Announced acceleration of nuclear reactor restarts.

- Japan PM Takaichi to promote measures to spur private spending and outline plans for increased strategic investment, active but responsible fiscal policy, and more assertive diplomacy in parliamentary address, according to Bloomberg.

European bourses (STOXX 600 +0.5%) have rebounded from Thursday's selloff, with the FTSE MIB (+1.0%) and CAC 40 (+0.7%) leading gains. The FTSE 100 (+0.7%) is also in the green, supported by strong January retail sales and a PSNB surplus figure, beating estimates by a large margin. European sectors hold a positive bias; Consumer Products and Services (+1.7%) lead the standings, closely followed by Chemicals (+1.4%). On the other hand, the pullback in oil prices is weighing on the Energy sector (-0.6%). Moncler (+11.9%) announced a positive set of FY earnings, comfortably beating revenue and net income estimates. This is lifting other luxury companies such as LVMH (+3.0%) and Kering (+1.2%).

Top European News

- UK S&P Global Services PMI Flash (Feb) 53.9 vs. Exp. 53.5 (Prev. 54.0, Low. 52.8, High. 54.2).

- UK S&P Global Manufacturing PMI Flash (Feb) 52.0 vs. Exp. 51.5 (Prev. 51.8, Low. 51, High. 52.5).

- UK S&P Global Composite PMI Flash (Feb) 53.9 vs. Exp. 53.3 (Prev. 53.7, Low. 52.8, High. 53.9).

- UK Retail Sales MoM (Jan) M/M 1.8% vs. Exp. 0.2% (Prev. 0.4%, Low. -0.6%, High. 1.0%).

- UK Retail Sales ex Fuel MoM (Jan) M/M 2.0% vs. Exp. 0.2% (Prev. 0.3%, Low. -0.1%, High. 0.9%).

- UK Retail Sales YoY (Jan) Y/Y 4.5% vs. Exp. 2.8% (Prev. 1.9%, Rev. From 2.5%, Low. 2.4%, High. 3.6%).

FX

- DXY is incrementally firmer this morning and trades at the mid-point of a 97.84 to 98.07 range, with the peak of the day matching the WTD’s best; currently holding around its 50 DMA at 97.96. Focus remains firmly on the geopolitical situation between US and Iran. To recap, President Trump said 15 days is the maximum deadline to reach an agreement with Iran, other it will be “unfortunate” for them. Recent reports in the WSJ suggest that Trump is weighing a “limited” strike, to force Iran into a deal. Attention for the time being will be on US data, which includes US GDP and PCE.

- GBP is incrementally firmer/flat. Retail Sales was an exceptionally strong report, with the upside attributed to strong “artwork and antiques sales, alongside continued strong sales from online jewellers”. But other components suggest that the pick-up was also seen in more conventional figures such as household goods store sales, with clothing sales also rising. Elsewhere, the PSNB was in a surplus in January and topped expectations – though the figure is subject to the usual caveats for the period (tax filings). GBP moved higher in an initial reaction, but then pared that move; thereafter, a strong set of PMI metrics took Cable to a session high of 1.3478. Despite the strong metrics, the inner report suggested that “ongoing worrying labour market weakness will likely result in a growing call for further rate cuts”. Market pricing for the BoE meeting was little moved, with the chance of a March cut priced in at 88% whilst April is fully priced.

- JPY slightly weaker this morning, succumbing to the broader USD strength and following the region’s inflation report, which held a dovish skew. In brief, National CPI printed at 1.5% (exp. 1.6%), core was in-line whilst the supercore metric was a touch below the consensus. Elsewhere, PMIs printed better-than-expectations – benefiting from increased optimism following Takaichi’s landslide victory. Following the inflation data, Pantheon Macro wrote that the inflation report “justifies” the BoJ taking time on a rate hike. USD/JPY in a 154.87-155.64 range.

- Other G10s are broadly lower against the USD. Aussie manages to stay afloat, whilst the EUR moves a touch lower. More ECB-related newsflow, this time via the WSJ, which suggested that ECB's Lagarde said her baseline is finishing the ECB term, while she added that she has accomplished a lot but needs to make sure it is solid. On the data front, EZ PMIs continue to confirm the modest recovery picture in the EZ. The strong German report spurred fleeting EUR strength.

Central Banks

- Fed's Daly (2027 voter) said policy is in a good place and labour market is in a better position after 75bps of cuts, adds inflation continues to decline outside goods sector. said:We have more work to do to get inflation down, but don't want to get behind, or over our skis.

- ECB's Lagarde said her baseline is finishing the ECB term, according to WSJ.

- ECB President Lagarde called for cooperation to 'save global order' in award acceptance speech in New York.

- RBNZ Governor Breman noted that although central bank remains forward focus, monetary policy will adapt based on new information instead of following a predetermined path. The path back to 2% inflation has been bumpy, but expects inflation to be within the target range in Q1. Central bank is confident inflation will return to 2% midpoint over the next 12 months. NZD is not too far from fair value right now.

Fixed Income

- USTs are near enough flat in thin 112-29+ to 113-02 parameters. Specifics for the space are somewhat light thus far as we count down to a packed 13:30GMT data docket and await any further insight on US-Iran tensions before potential SCOTUS opinion(s) at 15:00GMT.

- Gilts had two leads to digest at the open. Stronger-than-expected retail sales, though with caveats, were a bearish driver as the data doesn't push BoE's Bailey (or any of the hawks, particularly focused on Mann) towards voting for a cut in March vs April; however, ultimately, the data will have little impact on that discussion. Separately, a larger-than-expected government PSNB surplus in January served as a bullish driver. Gilts came off best levels alongside EGBs into the morning's UK PMIs, a series that printed above consensus across the board. Within the series, S&P's Williamson wrote that "relatively modest price pressures being signalled and ongoing worrying labour market weakness will likely result in a growing call for further rate cuts".

- Bunds spent the morning firmer, with gains of 20 ticks at best, notching a 129.45 peak, strength that seemed to just be a continuation of recent gains. Thereafter, the benchmark fell from best and moved to near-enough unchanged on the session at a 129.28 trough following the morning's PMIs, which were generally strong and particularly so for manufacturing, which unexpectedly returned to expansionary territory for Germany for the first time in over 3.5 years.

- Australia sold AUD 800mln 3.25% April 2029 bonds, b/c 3.89, avg. yield 4.3014%.

Commodities

- Crude benchmarks are taking a breather, with both WTI and Brent trading subdued, though still near highs for the week, due to the heightening geopolitical tension between the US and Iran. US President Trump yesterday reiterated that Iran has 10-15 days to strike a deal, or else something bad will happen. However, during a report by the WSJ, which stated that Trump is reportedly weighing a limited strike to force Iran into a nuclear deal. WTI and Brent are trading at the lower end of USD 65.86-67.03/bbl and 71.10-72.34/bbl, respectively.

- In the precious metal space, spot gold was aided by the ongoing geopolitical tension, with the yellow metal crossing the USD 5,000/oz mark to the upside overnight. The dollar has waned from its best levels throughout the European session after finding resistance at Thursday's high, thus underpinning gold prices. XAU and XAG are trading at the upper range of USD 4,981.58-5,042.37/oz and USD 77.47-81.20/oz, respectively.

- Copper prices are also firmer, tracking broader risk sentiment in the European session. Otherwise, a fresh macro catalyst has been lacking for the red metal, especially with the Chinese market on holiday. 3M LME copper trades at the upper range of USD 12.781-12.895k/t.

- Iranian Oil Minister said cooperation with the US on oil is possible.

- Hungarian government to release 250k tonnes of crude oil from its strategic reserves after Druzhba oil flow stopped.

- US ambassador to India said active negotiations are underway with India's Energy Ministry on the import of Venezuelan oil.

- Goldman Sachs sees significant upside to gold price forecasts on further private sector diversification when expressed through call option structures.

- US President Trump said 50mln bbls of Venezuelan oil are on the way to Houston and US-Venezuela energy cooperation is going well.

Geopolitics: Ukraine

- Russia's Kremlin reiterates that there's no confirmed date set for a new round of talks with Ukraine.

- Ukraine's President Zelensky said he's ready to discuss with the US about compromises.

- Next round of Russia-Ukraine talks is reportedly possible next week, via TASS.

Geopolitics: Middle East

- US President Trump reportedly weighs limited strike to force Iran into nuclear deal, according to WSJ; President considers a range of military options but said he still prefers diplomacy. Trump is considering an initial limited military strike on Iran to force it to meet his demands for a nuclear deal, in an attempt to pressure Tehran into an agreement but fall short of a full-scale attack that could see a major retaliation. Sources add, the opening fire, which if authorized, could come within days, would target a few military or government sites. If Iran still refused to comply with Trump’s directive to end its nuclear enrichment, the US would respond with a broad campaign against regime facilities.

- Semafor, on US President Trump reviewing his options regarding Iran, writes "He hasn’t made a decision yet, though people close to the president see an attack as growing more likely by the day."

- Iran said in letter to UN Secretary General and members of the Security Council that if they are attacked, all bases, facilities and assets of hostile force in the region will constitute legitimate targets within the framework of Iran's defensive response.

- Palestinian media reported Israeli warplanes launched a raid on the Al Tufar neighbourhood in Gaza City, according to Sky News Arabia.

Geopolitics: Others

- Russia's Foreign Minister Lavrov discusses Iranian nuclear program with Iranian counterpart, TASS reported.

- China is monitoring US military aircraft movements over Yellow Sea, according to Global Times.

- NORAD said it detected and tracked two Tu-95s and two Su-35s and one A-50 operating Alaskan ADIZ on February 19th, while it launched several aircraft to intercept and positively identify, and escort the aircraft until they departed the Alaskan ADIZ.

- New Zealand provides a Russia sanctions update which includes a designation of 23 individuals, 13 entities, and 100 vessels, while it lowered the oil price cap on Russian oil from USD 47.60/bbl to USD 44.10/bbl.

US Event Calendar

- 8:30 am: United States Dec Personal Income, est. 0.3%, prior 0.3%

- 8:30 am: United States Dec Personal Spending, est. 0.3%, prior 0.5%

- 8:30 am: United States Dec PCE Price Index YoY, est. 2.8%, prior 2.77%

- 8:30 am: United States Dec Core PCE Price Index MoM, est. 0.3%, prior 0.2%

- 8:30 am: United States Dec Core PCE Price Index YoY, est. 2.9%, prior 2.79%

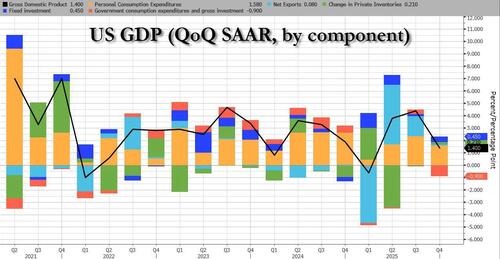

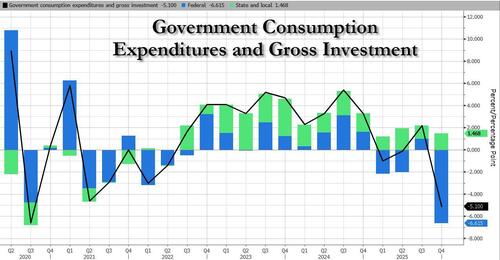

- 8:30 am: United States 4Q A GDP Annualized QoQ, est. 2.8%, prior 4.4%

- 8:30 am: United States 4Q A Personal Consumption, est. 2.42%, prior 3.5%

- 8:30 am: United States 4Q A GDP Price Index, est. 2.8%, prior 3.8%

- 8:30 am: United States 4Q A Core PCE Price Index QoQ, est. 2.6%, prior 2.9%

- 9:45 am: United States Feb P S&P Global US Manufacturing PMI, est. 52.35, prior 52.4

- 9:45 am: United States Feb P S&P Global US Services PMI, est. 53, prior 52.7

- 9:45 am: United States Feb P S&P Global US Composite PMI, est. 53.1, prior 53

- 9:45 am: United States Fed’s Bostic in Moderated Conversation

- 10:00 am: United States Dec New Home Sales, est. 730k

- 10:00 am: United States Feb F U. of Mich. Sentiment, est. 57.25, prior 57.3

- 12:45 pm: United States Fed’s Logan Speaks at Bank Regulation Conference

- 3:30 pm: United States Fed’s Musalem Appears on Fox Business

DB's Jim Reid concludes the overnight wrap

I'm supposed to be on hols today playing golf off the junior tees, for the first time since early October, with three-quarter power swings accompanying my twins on the last day of half-term. However, as it's a holiday week I'm heroically holding the fort until this has been sent out. It's now just over 4 months since back fusion surgery and I'm starting to return to light golf. Sadly the nerve symptoms in the leg are no different but I'm told it could take a year to tell if the surgery has made a difference and the nerve repairs itself. I've done my rehab every day for well over 2 months now so this reflects my obsession with golf more than anything else. My wife shakes her head as I twist myself into all sorts of shapes most evenings in front of the TV.

As I leave to do my two hour warm-up to limber up muscles I haven't used for 4 months, markets on both sides of the Atlantic reversed their gains yesterday as geopolitical tensions between Iran and the US took center stage. The S&P 500 (-0.28%) and STOXX 600 (-0.53%) both fell, while the price of Brent crude registered its largest two-day jump since October 2025, back when the US announced sanctions against Russia’s two largest oil companies. It was up +2.20% yesterday to its highest level since July and this morning is +0.49% at $72.01/bbl, having traded as low as $66.85 just before Europe closed on Tuesday.

The latest developments saw President Trump seemingly issue an ultimatum to Iran, suggesting that 10 to 15 days was the maximum he would allow for talks to continue and that Iran must make a “meaningful deal” or else “bad things would happen”. Those comments came as the US has deployed aircraft and naval ships to the Middle East ahead of a possible strike on Iran. Later in the day, the Wall Street Journal reported that while President Trump had not yet decided on military action, he could authorise a limited strike within days, and this would then be followed by a broader US campaign against the regime if Iran failed to comply.

So that led to a sell-off in markets, with 60% of the S&P 500 down on the day, as investors pulled back over fears of geopolitical conflict. The Nasdaq (-0.31%) and Magnificent 7 (-0.21%) also declined. Bonds were caught between the inflationary consequences and the risk-off mood, with 2yr (-0.3bps) and 10yr (-1.6bps) Treasury yields moving slightly lower. Against this risk-off backdrop, gold (+0.37%) poked back up above $5k before closing at $4,999/oz while silver (+1.69%) also outperformed. The VIX volatility index (+0.61pts) crept back above 20 to close at 20.23. This morning, US and European equity futures are back up a couple of tenths and Gold and 10yr USTs are largely unchanged.

Adding to the cautious mood in markets were a couple of stories that rekindled lingering concerns over the US economy. One was a resurfacing of private credit worries that we saw last autumn, after Blue Owl Capital announced it wouldn’t re-open withdrawals from one of its retail-focused private credit funds. The company’s shares tumbled -5.93% after the news, also weighing on other listed private equity companies, such as Blackstone (-5.37%), Apollo (-5.21%) and KKR (-1.89%). Another was a cautious outlook from Walmart (-1.38%) as its full-year earnings forecast missed expectations, with the company’s CFO saying “it’s prudent to be somewhat measured with the outlook right now” amid the uneven US economy.

The ongoing worries over Iran meant that less attention was given to a handful of notable US data releases that trickled in. Initial jobless claims were better than expected in the week ending February 14, declining from 227k to only 206k (vs 225k expected). That meant claims more than reversed their spike two weeks earlier, which may have been affected by the extreme winter weather across the US. The release also corresponds to the survey week for payrolls so an encouraging sign for that print in a couple of weeks’ time. There was less comforting data released later in the day that showed January pending home sales at -0.8% vs +2.0% m/m expected (-1.2% vs +2.3% expected y/y).

Meanwhile, US goods trade data showed a larger-than-expected deficit for December (-$98.5bn vs -$86.0bn expected), as imports rose +3.6% m/m, while exports fell -1.7% m/m. This puts the latest monthly deficit largely in line with levels of around $100bn seen in the final few months before President Trump’s election in late 2024, after what had been a very volatile 2025 as initial import front-running was followed by a sharp fall after Liberation Day. However, while the aggregate trade position of the US has not changed much, we’ve seen some big redirection of trade. Notably, the latest data highlights the extent that US-China decoupling, with China now accounting for only 7% of US imports, down from 13% in 2024 and above 20% prior to President Trump’s first China tariffs in 2018.

Looking ahead to today, attention will focus on December core PCE and Q4 US GDP. For the former, DB is at +0.4% vs. +0.2% in November, with consensus a tenth lower. Although core CPI was better than expected last week, the read-through for January core PCE wasn't quite so benign. Our economists expect Q4 real GDP growth to slow to +2.5% annualized (+2.8% consensus), a step down after Q3’s +4.4% pace. A sizable portion of that deceleration—roughly 70bps—reflects the drag from the record long shutdown.

Back in Europe, equities reversed course amidst fears of a US attack on Iran, with a few countries potentially taking a stance or action. For instance, the Times reported yesterday that the UK has blocked the Trump administration from using its joint bases for strikes on Iran, whilst Poland’s Prime Minister urged its citizens in the country to leave Iran, saying that the possibility of a conflict is “very real”, according to Politico. Against this backdrop, the STOXX 600 (-0.53%), CAC 40 (-0.36%), DAX (-0.93%), and FTSE 100 (-0.55%) all fell. Industrials were amongst the worst hit, largely due to a steep fall in Airbus (-6.75%) shares after the company missed expectations in its forecast for commercial aircraft deliveries in 2026. In fixed income, yields on 10yr bunds (+0.4bps), OAT (+0.4bps), and BTP (+0.4bps) all moved marginally higher.

In Asia, Mainland China is still closed for the holidays but the Hang Seng (-0.60%) has reopened for the first time this week. The Nikkei (-1.17%) is following the global risk off move from yesterday but the Kospi is continuing its tag as one of the best markets in 2026 with a +2.21% increase. It's now up over +37% in the 7 weeks of 2026 so far.

Overnight we have also received Japan’s CPI for January, which came in a touch below consensus for the headline (+1.5% vs +1.6% est) and core-core (+2.6% vs +2.7%) measures, although the latter still comfortably sits above 2%. Core CPI came in as expected (+2.0% y/y). The easing in core measures over the last few months will validate the BoJ and PM Takaichi’s views from last year that a good portion of the early 2025 price pressures was temporary, with the question now being where those underlying price pressures will settle, especially with a stimulus package from the incoming new administration high on the agenda. Separately, Japan Feb PMIs rose, most notably in manufacturing (52.8 vs 51.5 prior). So that was an encouraging sign, given capital investment is a big priority of Takaichi’s.

To the day ahead now, we’ll get the US, UK, Germany, France and the Eurozone February PMIs, US December PCE, personal income, personal spending, Q4 GDP, December new home sales, UK January public finances, retail sales, Germany January PPI, Eurozone Q4 negotiated wages, Canada December retail sales, January industrial product price index, raw materials price index, Denmark Q4 GDP. Central bank events include Fed’s Logan and Bostic speak.

Tyler Durden

Fri, 02/20/2026 - 08:29

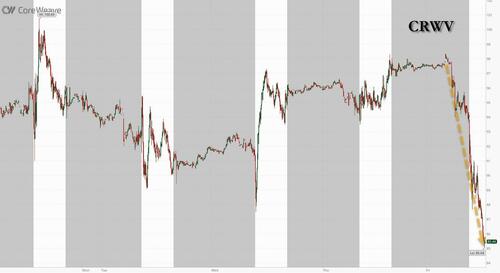

CoreWeave's Lancater data center: Photo: Bloomberg/Getty Images

CoreWeave's Lancater data center: Photo: Bloomberg/Getty Images

Chosun Daily: The South Korean and U.S. Air Forces conduct a joint formation flight, escorting a US Air Force B-1B 'Lancer' strategic bomber with fighter jets, following North Korea's ICBM provocation in February 2023.

Chosun Daily: The South Korean and U.S. Air Forces conduct a joint formation flight, escorting a US Air Force B-1B 'Lancer' strategic bomber with fighter jets, following North Korea's ICBM provocation in February 2023.

FBI Director Kash Patel speaks during a news conference at the Department of Justice in Washington on Dec. 4, 2025. Daniel Heuer/AFP via Getty Images

FBI Director Kash Patel speaks during a news conference at the Department of Justice in Washington on Dec. 4, 2025. Daniel Heuer/AFP via Getty Images

Recent comments