Behind America's New Industrial Revolution

Authored by Emel Akan via The Epoch Times (emphasis ours),

The U.S. economy grew faster than many predicted over the past year, outpacing other advanced economies, especially in Europe, where growth has nearly stalled.

The manufacturing facilities of the Independent Can Company in Belcamp, Md., on June 25, 2025. Ryan Collerd/AFP via Getty Images

The manufacturing facilities of the Independent Can Company in Belcamp, Md., on June 25, 2025. Ryan Collerd/AFP via Getty Images

Analysts say President Donald Trump’s pro-growth policies, combined with a surge in investment in artificial intelligence, have further strengthened the country’s economic momentum.

The United States is “at the doorstep of a new industrial revolution,” said Stoyan Panayotov, a financial adviser and founder of Babylon Wealth Management.

He said the country’s strong capital base, skilled workforce, and shareholder-friendly environment make it more attractive to investors than other markets.

Recently, S&P 500 companies have reported earnings that beat market expectations. More than 70 percent of companies recorded positive earnings surprises in the fourth quarter of 2025, according to FactSet data.

On Feb. 6, the Dow Jones Industrial Average surpassed 50,000 for the first time—after the S&P hit 7,000 on Jan. 28.

During his State of the Union address on Feb. 24, Trump credited these milestones to his economic policies, particularly tariffs.

In a Truth Social post on Feb. 6, the president also made a bold prediction: “I am predicting 100,000 on the Dow by the end of my term. Remember, Trump was right about everything!”

Strong corporate earnings, technological innovation, and a positive economic outlook all have contributed to the U.S. stock market’s appeal.

Despite the recent market volatility, entrepreneur and investor Kevin O’Leary believes the United States remains the “most trusted” investment hub for global investors.

Traders work on the floor of the New York Stock Exchange during morning trading in New York City on Feb. 24, 2026. Strong corporate earnings, technological innovation, and a positive economic outlook have contributed to the US stock market’s appeal. Michael M. Santiago/Getty Images

Traders work on the floor of the New York Stock Exchange during morning trading in New York City on Feb. 24, 2026. Strong corporate earnings, technological innovation, and a positive economic outlook have contributed to the US stock market’s appeal. Michael M. Santiago/Getty Images

“You’ve got to realize, 52 cents of every dollar created on earth is invested in the American stock market,” O’Leary told The Epoch Times on Jan. 28 during a summit about “Trump Accounts” for newborns.

“It’s the most liquid and most successful economy on earth,” the “Shark Tank” star said. “It provides consistent returns.”

On Independence Day last year, Trump signed the One Big Beautiful Bill Act into law, which included pro-business measures aimed at boosting capital spending and encouraging the onshoring of factories.

Among its provisions was the permanent restoration of 100 percent bonus depreciation for qualified assets. The policy allows businesses to immediately deduct the full cost of new factories, factory improvements, capital investments such as machinery and equipment, and software, as well as domestic research and development. Many companies are leveraging bonus depreciation to reduce tax liability and reinvest in growth.

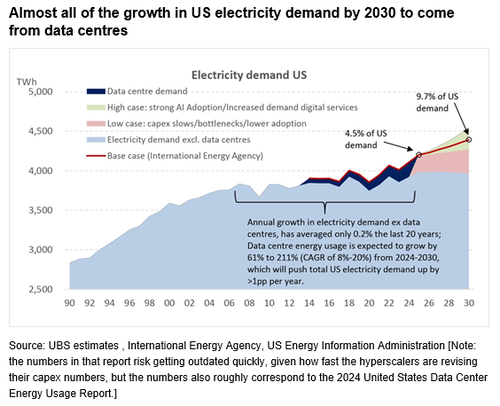

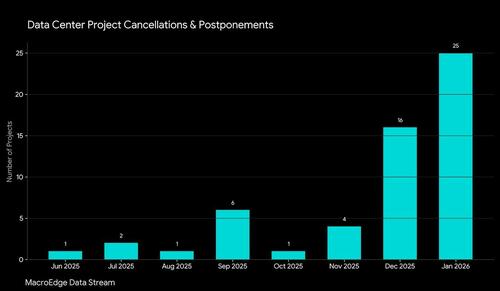

The manufacturing footprint is expanding, and the AI boom is increasing demand for energy, data centers, and commodities. Despite concerns about an AI bubble, U.S. technology giants Alphabet, Amazon, Meta, and Microsoft plan to invest collectively about $650 billion in 2026, mainly to expand their AI infrastructure.

These trends are driving renewed investor optimism, according to Panayotov.

A technician works at an Amazon Web Services AI data center in New Carlisle, Ind., on Oct. 2, 2025. The United States has outpaced many advanced economies in growth and productivity over the past year, with some analysts describing the momentum as the start of a new industrial revolution. Noah Berger/Getty Images via Amazon Web Services

A technician works at an Amazon Web Services AI data center in New Carlisle, Ind., on Oct. 2, 2025. The United States has outpaced many advanced economies in growth and productivity over the past year, with some analysts describing the momentum as the start of a new industrial revolution. Noah Berger/Getty Images via Amazon Web Services

Growing Productivity Gap

Recent data show U.S. businesses are also becoming more efficient, with nonfarm productivity jumping by 4.9 percent in the third quarter of last year. Productivity measures how efficiently companies produce goods and services using given input such as labor and capital.

While U.S. productivity has increased rapidly since 2019, productivity growth in the UK and eurozone has remained mostly stagnant, according to data from the Organisation for Economic Co-operation and Development. The growing productivity gap between the United States and Europe is largely explained by the tech sector.

Economists note that most innovation over the past few decades has occurred in the United States, while Europe has lagged behind, primarily because of excessive regulation.

“The EU is weak in the emerging technologies that will drive future growth,” a 2024 report by the European Commission stated. “Only four of the world’s top 50 tech companies are European.”

The outlook also appears favorable for the United States. A recent Financial Times survey found that more than three-quarters of economists expect the United States to keep or increase its productivity lead over other countries. They point to AI, strong capital markets, and lower energy costs as the main reasons.

“Productivity growth is good for everyone and keeps inflation at bay,” Nancy Tengler, CEO of Laffer Tengler Investments, said in a recent note to clients.

European leaders take part in a meeting as they attend the Informal EU Leaders’ Retreat in Alden Biesen, Belgium, on Feb. 12, 2026. While US productivity has increased rapidly since 2019, productivity growth in the UK and eurozone has remained mostly stagnant, recent data shows. Ludovic Marin/AFP via Getty Images

European leaders take part in a meeting as they attend the Informal EU Leaders’ Retreat in Alden Biesen, Belgium, on Feb. 12, 2026. While US productivity has increased rapidly since 2019, productivity growth in the UK and eurozone has remained mostly stagnant, recent data shows. Ludovic Marin/AFP via Getty Images

Cutting Red Tape

Reducing regulatory barriers is central to the Trump administration’s economic agenda. The administration aims to lower business compliance costs, thus allowing companies to reinvest capital, increase productivity, and create more jobs.

According to economist Daniel Lacalle, a contributor to The Epoch Times, deregulation has been a key driver of the U.S. economy’s strong performance in recent quarters relative to other advanced economies.

In his view, deregulation alongside lower taxes has delivered an “immediate boost to production, economic growth, and private investment.”

U.S. manufacturing activity expanded in January for the first time in 12 months. Typically, developed countries experience growth in services while manufacturing remains stagnant, Lacalle told The Epoch Times.

The United States is the only major economy implementing reforms, such as deregulation, tax cuts, and tariffs, to encourage manufacturing and investment, he said.

US Vice President JD Vance (3rd L) tours Hatch Stamping in Howell, Mich., on Sept. 17, 2025. US manufacturing activity expanded in January for the first time in 12 months. Jeff Kowalsky/AFP via Getty Images

US Vice President JD Vance (3rd L) tours Hatch Stamping in Howell, Mich., on Sept. 17, 2025. US manufacturing activity expanded in January for the first time in 12 months. Jeff Kowalsky/AFP via Getty Images

Since returning to office, Trump has rolled back regulations across sectors including finance, energy, and technology.

In December 2025, the White House Office of Management and Budget announced that federal agencies eliminated 646 regulations while introducing only five new ones in fiscal year 2025. That amounts to 129 regulations removed for every new one issued, far exceeding the 10-to-one goal set by the president. The White House estimates that these efforts have generated $212 billion in savings, or more than $600 per American.

“Deregulation is unleashing innovation in every sector,” Cathie Wood, founder and CEO of Ark Invest, said in her 2026 outlook report.

More recently, Trump announced the repeal of an Obama-era rule that imposed greenhouse gas emissions restrictions on U.S. industries. The White House described the move as “the largest deregulatory action in American history,” estimating that it will save the American people $1.3 trillion.

The change is expected to benefit the fossil fuel and automotive sectors as well as energy-intensive manufacturers and power plants.

Read the rest here...

Tyler Durden

Tue, 03/03/2026 - 17:40

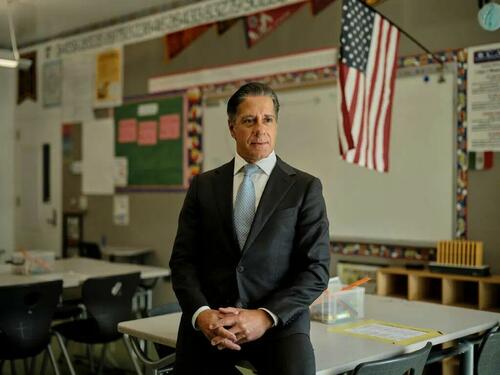

The F.B.I. raided the home of Alberto M. Carvalho, superintendent of the Los Angeles Unified School District, and the district offices on Wednesday. Credit...Philip Cheung for The New York Times

The F.B.I. raided the home of Alberto M. Carvalho, superintendent of the Los Angeles Unified School District, and the district offices on Wednesday. Credit...Philip Cheung for The New York Times

The manufacturing facilities of the Independent Can Company in Belcamp, Md., on June 25, 2025. Ryan Collerd/AFP via Getty Images

The manufacturing facilities of the Independent Can Company in Belcamp, Md., on June 25, 2025. Ryan Collerd/AFP via Getty Images Traders work on the floor of the New York Stock Exchange during morning trading in New York City on Feb. 24, 2026. Strong corporate earnings, technological innovation, and a positive economic outlook have contributed to the US stock market’s appeal. Michael M. Santiago/Getty Images

Traders work on the floor of the New York Stock Exchange during morning trading in New York City on Feb. 24, 2026. Strong corporate earnings, technological innovation, and a positive economic outlook have contributed to the US stock market’s appeal. Michael M. Santiago/Getty Images A technician works at an Amazon Web Services AI data center in New Carlisle, Ind., on Oct. 2, 2025. The United States has outpaced many advanced economies in growth and productivity over the past year, with some analysts describing the momentum as the start of a new industrial revolution. Noah Berger/Getty Images via Amazon Web Services

A technician works at an Amazon Web Services AI data center in New Carlisle, Ind., on Oct. 2, 2025. The United States has outpaced many advanced economies in growth and productivity over the past year, with some analysts describing the momentum as the start of a new industrial revolution. Noah Berger/Getty Images via Amazon Web Services European leaders take part in a meeting as they attend the Informal EU Leaders’ Retreat in Alden Biesen, Belgium, on Feb. 12, 2026. While US productivity has increased rapidly since 2019, productivity growth in the UK and eurozone has remained mostly stagnant, recent data shows. Ludovic Marin/AFP via Getty Images

European leaders take part in a meeting as they attend the Informal EU Leaders’ Retreat in Alden Biesen, Belgium, on Feb. 12, 2026. While US productivity has increased rapidly since 2019, productivity growth in the UK and eurozone has remained mostly stagnant, recent data shows. Ludovic Marin/AFP via Getty Images US Vice President JD Vance (3rd L) tours Hatch Stamping in Howell, Mich., on Sept. 17, 2025. US manufacturing activity expanded in January for the first time in 12 months. Jeff Kowalsky/AFP via Getty Images

US Vice President JD Vance (3rd L) tours Hatch Stamping in Howell, Mich., on Sept. 17, 2025. US manufacturing activity expanded in January for the first time in 12 months. Jeff Kowalsky/AFP via Getty Images

Cue death squads. Illustrative Fallujah fighting, via EPA

Cue death squads. Illustrative Fallujah fighting, via EPA

Recent comments