Disagreements Emerge Over US-China Rare Earth Deal, As US Adds Uranium, Silver To Critical Minerals List

Two days ago, when discussing China's surprising announcement that Trump should not cross four "red lines" (including i)Taiwan, ii) democracy and human rights, iii) China's political system, and iv) development rights) or risk a collapse of the trade truce, we said that "ever since the recent "truce" in the trade war between the US and China was signed in Korea one week ago - the latest of many such ceasefires meant to be broken - skeptics have been patiently counting down until this latest ceasefire is torn up, and tensions between the two superpowers flare up once more."

Needless to say, China telling Trump what the US president can and can not say is one of those things that the generally "sanguine and quite calm" US president tends to not be too excited about, and which leads to occasional bursts of outrage which then restart trade wars.

Then yesterday, we said that it felt like "'the cracks in this latest trade deal are already starting to show, whether it is Beijing ordering Trump what he can't talk about, or quietly ring-fencing its domestic data center by banning US Al chips" and further said that "while China granted Trump a 1 year reprieve on rare earths, it is quietly tightening the export noose on other, just as important minerals. According to the Global Times, China has introduced new export controls on silver, antimony, and tungsten."

We concluded that "the game of export whack-a-mole in the second World Trade War continues: today the US is getting rare earths (at least until Trump has another Truth Social meltdown), but just got stopped out on other, just as important materials. This export control rotation will continue until the day the US is self-sufficient, which however due to the abovementioned environmental limitations, will take a very long time unless somehow the US govt funnels enough money in domestic producers (and allows them to dump the toxic by products anywhere - who knows maybe Elon can blast them off into space) to short circuit the process."

Until then, we told readers, "go long stocks of domestic miners that specialize in extracting and producing anything and everything that China feels like no longer exporting to the US."

We didn't have long to wait for this to manifest itself in practice, because moments ago the Nikkei reported that not only is China making inroads with new export controls, but the question over the old ones still hasn't been accurately resolved. That's because, "discrepancies have emerged over the details of China's agreement with the U.S. to pause rare-earth export restrictions, with Washington saying past controls will also be eliminated, a condition that has not been announced by Beijing."

Here is what we know: Trump and Xi Jinping agreed to lower tariffs and ease export restrictions during talks in South Korea last week, with the Chinese Commerce Ministry saying that rare-earth restrictions that had been announced on Oct. 9 would be postponed for a year, there appeared to be some confusion over what was actually agreed upon.

The restrictions to be paused would have expanded the types of rare-earth elements for which export licenses are required and tightened controls on the export of equipment used for exploration and refining, as well as the technologies necessary for manufacturing rare-earth magnets. They would also require foreign companies making products containing Chinese rare earths to obtain permission from Beijing when exporting to other countries and regions.

And here is where the confusion arises: while China says it will postpone the new regulations for a year, a fact sheet released by the White House on Saturday does not include a time frame, saying "China will suspend the global implementation of the expansive new export controls on rare earths and related measures that it announced on October 9, 2025."

The difference regarding earlier Chinese restrictions implemented on April 4 - which include a requirement for export licenses for seven types of rare earths, including dysprosium, used in high-performance magnets for electric vehicles and fighter jets - is even more pronounced. Following last week's U.S.-China summit, the White House asserted these export licenses would no longer be required, saying China would "effectively eliminate" its current export controls.

But this was contradicted by authorities in the rare-earth industry development zone in Baotou, Inner Mongolia. On Monday, an official social media account stated that the April regulations would remain in effect.

Authorities in Inner Mongolia said on social media that April export controls, which Washington claims will be withdrawn

Authorities in Inner Mongolia said on social media that April export controls, which Washington claims will be withdrawn

The city, located in one of China's most polluted areas (because rare earth mining is one of the most toxic activities known to man) is one of China's leading rare-earth producing regions, and the authorities that made the post are reportedly involved in practical matters such as issuing export permits.

Additionally, Chinese financial news outlet Caixin confirmed the April regulations are still in effect. "As long as the Chinese side deems them valid, the regulations will continue," a Chinese industry insider said.

Some observers say China can continue to pressure the U.S. through customs procedures regardless of whether or not restrictions are in place. Beijing has done this before. In 2010, China halted rare-earth exports to Japan during a dispute over the Tokyo-administered Senkaku Islands, which China claims as the Diaoyu. Although a legal framework for controlling exports was not fully established at that time, Beijing exerted pressure on Japan by claiming procedural delays.

China accounts for 70% of rare-earth production and over 80% of rare-earth magnet manufacturing. It has been leveraging this bargaining chip in negotiations with Washington.

Exports of rare-earth magnets to the U.S. in April were down 59% year-on-year, according to an analysis of trade statistics by Chinese research company FerroAlloyNet. Amid escalating trade friction and the imposition of tariffs over 100% by both sides, exports were drastically cut. They halted almost completely in May, falling 93% on the year.

Global supply chains were thrown into disarray, with Ford Motor temporarily suspending operations at some U.S. plants. In September, the most recent data available, exports of rare-earth magnets to the U.S. were still down 30% year-on-year.

Some rare-earth elements, including the particularly rare dysprosium, are concentrated in China and a few other countries.

"The U.S. will likely accelerate efforts to develop supply chains independent of China, but for the time being, it will not be able to escape its dependence on China," said a source at a non-Japanese company familiar with rare earths.

Which is precisely what we said yesterday, and why the US will have no choice but to invest billions in domestic companies and supply-chains that bypass China.

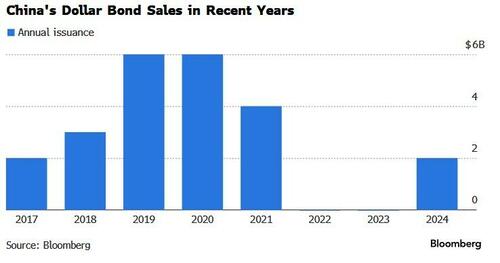

Fully aware that the US has to ramp up its own supply chains, the US added copper, silver and uranium to a government list of critical minerals as the Trump administration broadens its scope of what commodities it deems vital to the American economy and national security.

The updated US Geological Survey list adds 10 minerals to bring the total to 60, including metallurgical coal, potash, rhenium, silicon and lead, according to a US government site. It includes 15 rare earth elements. The list replaces a 2022 version.

Rare earths have become a flashpoint in trade tensions between the US and China, with Trump pushing to encourage domestic mining of the material after President Xi Jinping threatened to curb exports.

The USGS list dictates what commodities are included in the Trump administration’s Section 232 probe into processed critical minerals and derivative products announced mid-April, which could lead to tariffs and trade restrictions. President Donald Trump has made it a priority to bolster domestic supply of these minerals, arguing that an over-reliance on foreign supplies jeopardizes national security, infrastructure development and technological innovation.

The list also informs direct investments in mining and resource recovery from mine waste, stockpiles, tax incentives for US mineral processing as well as streamlined mining permitting.

The resource industry had been pushing for certain metals and minerals, like copper and potash, to be included on the list. Much of the potash used in the US is shipped from Canada, which accounts for roughly 80% of imports of the mineral. Copper imports, meanwhile, comprise almost half of total US consumption and come from countries including Chile, Peru and Canada. The bulk of global copper refining is done in China.

Silver’s inclusion has been a concern for precious metals traders and manufacturers that rely on the material. Any tariffs on silver could wreak havoc on the metals markets because the US relies heavily on imports to meet domestic demand. Silver has wide industrial applications and is used in electronics, solar panels and medical devices.

Tyler Durden Thu, 11/06/2025 - 16:40

Recent comments