I discussed much of this in my Q2 2025 RWM client quarterly call on April 5. I am sharing this now because so many questions have poured in.

Best Worst Cases

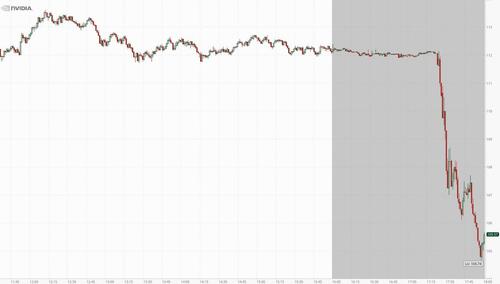

Last Monday, I discussed the consequences of chaos. While the purposes of the new tariff policy were not well explained – some of the goals were muddled and unclear – it seems a large part of the problem was the roll-out. It was ham-fisted, opaque, and amateurish. That amplified the initial market reaction, with a lot of volatility and a significant drawdown.

Consider how the Federal Reserve preps markets in advance for any significant change in policy: They warn that a change is coming several meetings in advance; we see shifts in the dot plot; there are discussions about their favored metrics (PCE vs CPI?). Numerous Fed Presidents fan out to speak in formal, academic environments where they discuss the coming changes. After weeks and weeks, the policy change comes. There is a press conference with the Chairman, and after a month, the meeting minutes come out—a very smooth, well-oiled process.

Whatever the final tariff situation, the White House can clearly learn from the communication strategies the Federal Reserve has perfected.

~~~

We are not privy to the discussions inside the Oval Office. We are left looking at the many false starts and feints, the on-again, off-again nature. We can only observe that the players appear to be mercurial and unpredictable. Whatever comes next seems random and driven by individual whims—or the bond market vigilantes.

Rather than try to guess the impact, I prefer to wargame various scenarios to discern potential outcomes, each with a varying likelihood of occurrence. While there are many gradations, let’s work with three: Best-, Worst-, and Middle-case scenarios.

These map out not merely a variety of outcomes but the paths taken to get there—via the impact on consumer spending, corporate CapEx, hiring, etc. Think of this as the discounting function of the markets, assessing a range of corporate revenues and profits over the next four quarters.

The market volatility has been a real-time attempt to assess those probabilities. A sudden 10% drop in the price of U.S. equities implies a significantly lowered set of revenues and profits the following year.

Let’s consider those three potential outcomes:

Best Case Scenario

We have been told to “Take the president seriously, but not literally.”

Let’s do just that, starting with the unknowns: Is this temporary or permanent? Was this an opening salvo, a negotiating tactic, or an attempt at a complete realignment of global trade? Will there be lots and lots of one-on-one side deals with individual countries? Can we reach a “reasonable set of accommodations globally?” Are we halfway or two-thirds of the way through any adjustments, or is this merely the start?

I imagine a best-case scenario as some more downside to come, but all of this turns out to be a savvy negotiating tactic, and a wide range of deals get cut.

The old regime of Pax Americana remains (mostly) in place, and some of the worst offenses of China – protectionism, theft of intellectual property, hacking corporate America, and the unfair treatment of overseas investors – get modified.

The US remains the global economic, military, and political leader. Many countries are unhappy, but it’s in their (and our) best interest to work these things out.

Everybody saves face, the markets eventually find their footing, and we avoid a recession. Later in the year, encouraged by improving CPI data and minimal economic disruption, the FOMC resumes its rate-cutting regime.

Let’s put a 10-20% likelihood this occurs.

Middle Scenario

This gets worse before it gets better.

Numerous regional alliances form – we see that already in the Pacific Rim countries. Despite their long history of animosity and regional conflicts going back millennia, Japan, China, and South Korea band together. They recognize that this upending of prior relationships threatens all of them. They negotiate a trade alliance to protect themselves against the US. Similar things happen in Europe and elsewhere (South America + Mexico?). These regional alliances develop, giving them the heft to negotiate regional deals with the U.S.

Some damage gets done to the US economy and trade relations. We’ve already seen consumers begin to freeze travel and spending plans in place. The backlash includes boycotts of the US and its goods. Travel from Canada to the US has fallen off 75% already.

On the corporate side, companies hold off on big CapEx spending, building new plants, investments, and hiring. “Hey, we don’t have any clarity as to what the new rules are gonna look like, so we will just sit tight to avoid making any big mistakes.”

Before 2025 ends, a mild recession begins. New Treasury issuance does not go great, and the cost of financing the United States’ deficits soars. Lots of good will, accumulated over the 8 decades since World War Two, is dissipated.

It’s a painful self-own, not quite as bad as the 1930 Smoot-Hawley Tariff Act or even Brexit, but still an unforced error, recession, and loss of positive momentum caused by a risky undertaking with poorly defined goals amateurishly implemented.

It’s bad, but we have survived worse: The Great Depression, WW2, Watergate, the 1970s Oil Embargo, September 11, the Great Financial Crisis, and the Covid-19 pandemic.

Our middle case is painful, but not as disruptive as that laundry list of annus horribilis.

Perhaps Congress finally reclaims its tariff authority. Maybe the next president, POTUS 48, can repair some of the worst of this. A lot of global ass-kissing, rewinds, and generosity, and we restore our prior advantageous trade relations and standing.

The middle scenario is a 40-60% likelihood.

Worst Case Scenario

The end of Pax Americana and the global world order have been in place since the beginning of WW2.

The consumer and corporate freeze that led to a mild recession this year turns into a deeper Stagflationary recession. Parts and materials become hard to find. Key components are missing, in many ways, it becomes reminiscent of the pandemic supply chain woes.

As the Economist magazine observed, this is the biggest economic self-error in a century, it leads to an international realignment. Europe looks inwards and towards itself and decouples from the United States as best as it can. The dollar loses its status as the world’s reserve currency. Financing our deficits becomes absurdly expensive.

Inflation soars, standards of livings collapse. This leads to a global recession. Employment falling, unemployment rising spending, and wages fall. We have sticky, stubborn stagflation, a very unpleasant economic scenario. Global GDP drops, as do standards of living around the world fall.

We were the military, economic and political leader around the world, only we no longer are. Think United Kingdom after the fall of British Empire – still around, but poorer and much less respected/feared than before.

We’ve frittered away so much good will: We helped stop disease around the world. We’ve. raised literacy levels everywhere, reduced poverty in so many places. We fought HIV in Africa, and Malaria all around the world. That leadership is now gone, and ultimately so much good from it simply dissipates and goes off the rails.

Bad. Things. Happen.

This is the worst case scenario, and honestly, I personally have a hard time imagining its worst repercussions. Ben Hunt is better able to go dark like that, and his take last week – Crashing the Car of Pax Americana – fleshed out the worst-case scenario better than I can.

The worst scenario is a 10-20% likelihood.

To give you an idea of how reckless this is, that’s about a single spin of a six-shooter in Russian Roulette with the entire United States $28 trillion economy…

~~~

I hate ending on such a down note, so let me share one of my favorite charts, via Batnick. The first one up top shows all of the reasons to sell the

Go back a century to 1926: There is always something to feel awful about. The worst-case scenario I laid out sounds terrible, but look at the past a hundred years there, and there has always been something God-awful going around.

Hopefully, cooler heads prevail…

See Also:

Crashing the Car of Pax Americana (Epsilon Theory, April 7, 2025)

Previously:

The Consequences of Chaos (April 7, 2025)

7 Increasing Probabilities of Error (February 24, 2025)

Tune Out the Noise (February 20, 2025)

The post What Are the Best & Worst-Case Tariff Scenarios? appeared first on The Big Picture.

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios.

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios.

Click pic, add to cart, use code THANKYOU10 for 10% off...

Click pic, add to cart, use code THANKYOU10 for 10% off... President Donald Trump prepares to sign an executive order in the Oval Office at the White House on March 31, 2025. Leah Millis/Reuters

President Donald Trump prepares to sign an executive order in the Oval Office at the White House on March 31, 2025. Leah Millis/Reuters

Buy two for free shipping! (over $50)

Buy two for free shipping! (over $50)

Recent comments