Peter Schiff: America's Economy Is A House Of Cards

In a recent podcast appearance with Glenn Diesen, Peter makes a compelling case regarding the fragile state of the American economy, highlighting the unsustainable reliance on monetary inflation, trade deficits, and artificially low interest rates. He contrasts the challenging road ahead for America against the comparatively smoother transition other parts of the world might experience by turning their productive capacities inward.

Peter starts by revealing the fundamental imbalance driving the U.S. economy—its dependence on consuming goods it doesn’t produce, paid for by printing dollars:

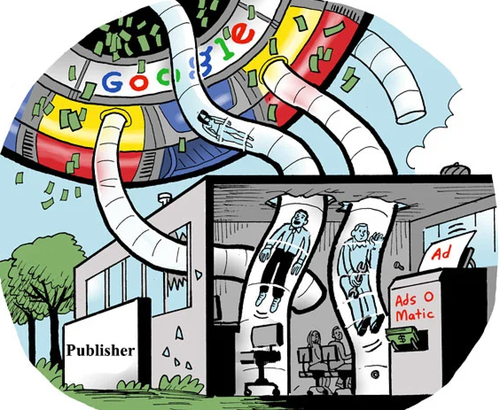

We’re able to consume what we don’t produce, and we pay for it by printing money. And so the world gets our inflation and we get their stuff. So we’ve got the better end of the bargain. Now they use our paper to buy our financial assets, our stocks, our bonds, our real estate. So they are accumulating assets and they’re getting the income from those assets. So what we’re doing is we’re indulging our present and we’re sacrificing our future.

This indulgent behavior is unsustainable, Peter argues. To truly stabilize the U.S. economy, Americans must be prepared for sacrifices and cuts in public spending, reforms that politicians are loath to pursue:

Because in order to free up resources to build factories, we can’t spend all this money and run these huge deficits to crowd out all of our capital. So we need to cut Medicare, Social Security, national defense, and Americans have to stop spending. We need to save our money to build those factories. They’re not going to just grow out of thin air. So there’s a lot of hard work that needs to be done. But of course, nobody has a stomach for that. Our whole economy is a house of cards built on the overvalued dollar and our trade deficits and our excess consumption and artificially low rates. And all that’s about to come toppling down.

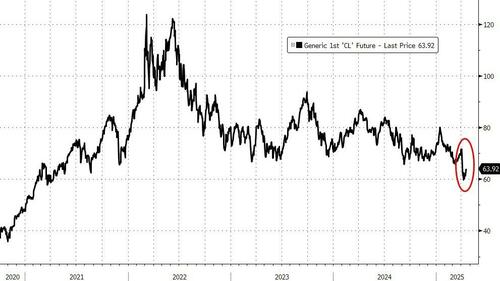

Far from solving the economic woes, Peter warns that the current combination of monetary policy and tariffs will exacerbate existing inflation and economic stagnation, pushing America deeper into recession:

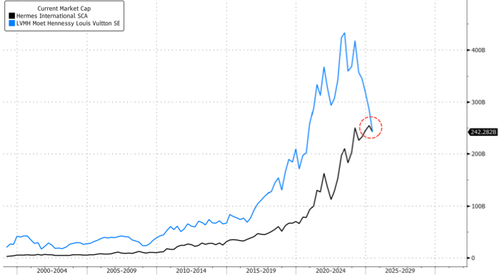

We already have stagflation now. We’re just going to have higher inflation and a weaker economy. We’re going to be in a recession and there’s going to be a lot of inflation. Mainly because the tariffs redirect the inflation out of the financial markets back into the real economy. We’ve benefited from diverting our inflation to the stock market and the bond market. That’s all going to reverse. That’s why if you look at what’s happening today, the foreign stocks are going way up. I own a lot of stocks today that are up 3%, 4%, 5%, 6% that are in Europe, they’re in Asia, they’re in South America. Money is being sucked out of the US right now, the opposite of what Trump wants. Capital is not coming to America, it’s fleeing America.

Given this reality, Peter offers practical advice to investors, encouraging a pivot away from overpriced U.S. assets toward more fundamentally sound investment opportunities abroad, particularly in precious metals:

They should own mining stocks, precious metals mining stocks that will benefit from the rising gold price. Gold is over 3,000. It’s going higher as the world de-dollarizes. Central banks are going to be buying more gold and less treasuries. That’s great for gold mining stocks. That’s not good for the U.S. government, because who’s going to buy those treasuries? The deficits are going to be much bigger in this recession. I think the Fed is going to buy them, and that’s going to be even more inflation. Not only are the tariffs going to be pushing up prices, but so will inflation that the Fed is going to create. The weak dollar is going to add to the pain of the tariffs.

Peter concludes that while America faces daunting structural economic challenges, many international economies have an easier path forward. They can simply redirect their existing productive capacity inward, decoupling themselves from a collapsing dollar:

All the world has to do is turn its productive capacity that already exists and use those factories, use those workers, use those resources and supply chains and infrastructure to make stuff for themselves instead of making stuff for Americans.

…

So the world has an easy task and actually a pleasant task because they get to consume. The hard work is here in America because we got to figure out how to consume without factories, which we can’t do. So we have to build non-existing factories. That takes a lot of resources. That takes a lot of effort. So we have the difficult road ahead, not the world.

Be sure to listen to Peter’s latest podcast, where he analyzes economic news in even more detail.

Tyler Durden Thu, 04/17/2025 - 14:40

A measles advisory on a bulletin board outside the Gaines County Courthouse in Seminole, Texas, on April 9, 2025. Brandon Bell/Getty Images

A measles advisory on a bulletin board outside the Gaines County Courthouse in Seminole, Texas, on April 9, 2025. Brandon Bell/Getty Images

President Donald Trump leaves after a ceremony for the Ohio State Buckeyes, the 2025 college football national champions, on the South Lawn of the White House on April 14, 2025. Madalina Vasiliu/The Epoch Times

President Donald Trump leaves after a ceremony for the Ohio State Buckeyes, the 2025 college football national champions, on the South Lawn of the White House on April 14, 2025. Madalina Vasiliu/The Epoch Times

Attorney General Pam Bondi, accompanied by (L–R) Riley Gaines, Rep. Laurel Libby (R-Maine), and Education Secretary Linda McMahon, speaks during a news conference to announce that the administration it is suing Maine’s education department for not complying with the government's push to ban transgender athletes in girls sports, at the Department of Justice headquarters in Washington on April 16, 2025. Jose Luis Magana/AP Photo

Attorney General Pam Bondi, accompanied by (L–R) Riley Gaines, Rep. Laurel Libby (R-Maine), and Education Secretary Linda McMahon, speaks during a news conference to announce that the administration it is suing Maine’s education department for not complying with the government's push to ban transgender athletes in girls sports, at the Department of Justice headquarters in Washington on April 16, 2025. Jose Luis Magana/AP Photo

Recent comments