Last week the CBO released their report, The Budget and Economic Outlook: Fiscal Years 2012 to 2022. Deficits everywhere, high unemployment, lackluster economic growth and one very scary year, 2013. Below are the CBO economic forecasts.

| CBO’s Economic Projections for Calendar Years 2012 to 2022 | |||||

| 2011 | 2012 | 2013 | 2014-2017 | 2018-2022 | |

| Q4 to Q4 Percentage Change | |||||

| Real GDP | 1.6 | 2.0 | 1.1 | 4.1 | 2.5 |

| Nominal GDP | 3.8 | 3.3 | 2.6 | 5.8 | 4.5 |

| PCE price index | 2.6 | 1.2 | 1.3 | 1.7 | 2.0 |

| Core PCE price indexa | 1.8 | 1.2 | 1.4 | 1.6 | 2.0 |

| CPI | 3.3 | 1.4 | 1.5 | 1.9 | 2.3 |

| Core consumer price index | 2.2 | 1.4 | 1.6 | 1.9 | 2.2 |

| GDP price index | 2.1 | 1.2 | 1.4 | 1.6 | 2.0 |

| Employment Cost Index | 1.7 | 2.2 | 3.8 | 3.5 | 3.7 |

| Unemployment Rate (Q4) | 8.7 | 8.9 | 9.2 | 5.6 | 5.3 |

| Annual Percentage Change | |||||

| Real GDP | 1.7 | 2.2 | 1.0 | 4.0 | 2.5 |

| Nominal GDP | 3.9 | 3.6 | 2.4 | 5.6 | 4.6 |

Why did the CBO say 2013 is gonna be god awful? Spending constraints by draconian budget cuts that are scheduled. Yes, it's true, reduced government spending decreases economic growth when an economy is operating below it's potential.

That economic forecast reflects the stance of federal fiscal policy as specified by current law. Specifically, the forecast incorporates the expiration at the end of February of the payroll tax cut and emergency unemployment benefits that were extended for two months by the Temporary Payroll Tax Cut Continuation Act of 2011 (Public Law 112-78); the expiration of tax cuts that were extended by the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (P.L. 111-312, referred to here as the 2010 tax act), as well as various other expiring tax provisions; and the constraints on spending imposed by the Budget Control Act of 2011 (P.L. 112-25). Altogether, according to CBO’s forecast, federal fiscal policy under current law will restrain economic growth this year and significantly restrain growth in 2013, but the resulting reduction in budget deficits will boost output and income later in the decade.

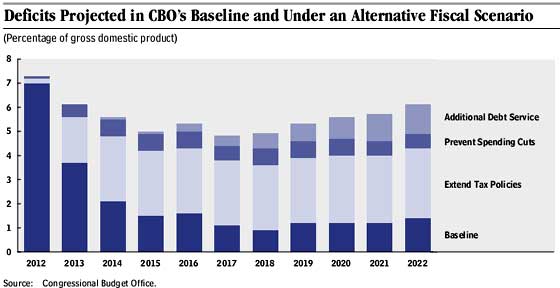

One of the biggest causes of budget deficits are the Bush tax cuts, or should we say Obama's tax cuts since they were extended. From a summary graph below, we can see the deficits balloon if current tax law is extended.

There is one alarming truth to the CBO report. The Bush tax cuts have simply got to go.

Additionally, TARP losses finally showed up.

The Troubled Asset Relief Program will log losses of $23 billion in fiscal 2012, according to the nonpartisan Congressional Budget Office, in a reversal of $37 billion in gains recorded in the prior year.

The net swing of $61 billion in the government's emergency rescue fund that was instituted at the height of the 2008 financial crisis largely reflects declines in share prices of two companies in which the government still holds substantial shares: American International Group Inc. and General Motors Co.

It appears, the GOP in the House of Representatives, seemingly doesn't like the CBO's information, or any semblance of CBO objectivity. They literally passed a bill in the House of Representatives to change the way CBO scores deficits, as an alternate.

On Feb. 3, the House passed H.R. 3582, the Pro-Growth Budgeting Act of 2012. Innocuous on the surface, its long-term purpose is to institutionalize Republican economic policy into the very fabric of budgetary analysis.

The dynamic calculation would be supplementary and not replace the current official scoring methodology, but the obvious long-term goal is to require official revenue estimates to incorporate “Laffer curve” effects in order to make it easier to cut taxes and harder to raise them.

The super rich must love their tax cuts. In response to the CBO report, some Republican congrssional staffers questioned the accuracy and objectivity of the CBO. Others, more practical, point out the CBO often isn't right in projecting deficits, which of course the CBO denies. Unfortunately, corruption in economics, statistics does exist, although we usually assign such immoral ineptitude to private think tanks with agendas, perpetually publishing white paper spin.

Yet here we are with the tax cut crazy GOP who hate social safety nets and John Maynard Keynes. Bummer Keynesian economics actually works pretty well for economic forecasts. Real bummer social safety nets are about the only thing most Americans have left.

What a sad day for government, objectivity and accuracy. Don't like what a Congressional service group, teaming with economists, statisticians and researchers, has to say about in spite of the Congressional Budget Office being set up to assure they are not subject to political pressure and influence? Why change the law and make the CBO claim what you want!

Wow.

Comments

draconian cuts ? really ?

draconian cuts ? really ? care to list some of those cuts ? Spending has increased over 30% over the last 2 years ... are you saying if spending where to fall back to 2008 levels the economy would collapse ? really ?

the "Bush" tax cuts amount to less than 50 billion per year ... explain how they are casuing 1 trillion plus annual defecits ...

How did 2008 work out? I rest

How did 2008 work out? I rest my case.

clueless wonder

You don't get it, clearly. Budget deficits do not correlate immediately to economic growth, which is why Keynes works and no the Stimulus was not Keynesian. Your comment is spurious, at best. It's only long term economic growth where deficits matter and in the short term, cuts will send the economy a hit. That's why you don't want draconian cuts in the middle of an economic contraction.

Ya know, quit reading your bible or whatever belief you seem to be stuck on, from whatever crackpot spinmeister you're listening to, and crack a few economic texts. You can buy older editions of undergraduate economic texts for a couple of bucks used.

2008 was caused by banks with their derivative laden house of cards implosion and financial trading desk circle jerk, not budget deficits.

Draconian cuts

are the automatic, across the board budget cuts to discretionary spending that were passed earlier when the debt ceiling debacle happened.

The Bush tax cuts reduced revenues from 2001 to 2011 of $3.2 trillion.

Here is the CBO study, which estimates the Bush tax cuts created $3.2 trillion in additional deficits.

That is what the above tax chart for future projections implies. The across the board discretionary spending cuts is why the CBO projects 2013 to have 1% annual GDP ad a ~9% unemployment rate.

Want to join in to repress the CBO because you do not like what they have to say? The first link is to the CBO, but the Bush tax cuts have been analyzed by many different economists as well and they all say the same thing, simply cannot afford them.

This is spot on and mirrors

This is spot on and mirrors Douglas Elmendorf's response to Congressmean Huelskamp.

http://www.youtube.com/watch?v=QudbEGnUrlY

While in the short run, tax increases would have a negative effect on the economy, but in the long run, it would have a positive effect on the economy since the government likes to spend. Therefore, fueling this spending would come from deficit financing, which would crowd out private investment and be a drag on economic growth.

As typical Republicans on get one half of the fiscal conservative equation right: lower taxes. However, they have a history of increasing spending when they lower taxes, then complain about spending when they are not in power. Nonetheless, their mantra of lower taxes and more spending is economic suicide.

reasonable questions in this clip

I'm kind of shocked to see a Republican actually try to understand the CBO's modeling, forecasts in the questioning. Below is the above clip, embedded.

On that calculation on what would be the real unemployment rate.. If all of those not counted who want a job, are not actively participating or in the time window to be counted as part of the civilian labor force, plus all of those forced into part-time jobs who need full-time, is about 17%.

This does NOT count the millions who are underemployed, i.e. working at home depot full-time when they have a PhD in Chemical Engineering or whatever.

That's the bottom line, there is a limit to the trade off between taxes and investment and clearly the current tax scheme went way to far and now we're in trouble.

I should note that the CBO is quoting a classic on Stimulus and Keynes. Stimulus, or government spending, does boost GDP short term, but after it's over, if there isn't longer term real economic growth spawned by the temporary boost, what you have is a lot of debt.

We ripped, criticized, railed against the Stimulus, not because stimulus wasn't needed, we sure did, but because the package was a bunch of tax cuts and then the money just poured into other countries like China, Canada, Germany and so on. Literally foreign guest workers were hired instead of U.S. workers, in an area with 30% unemployment to boot on an Oregon project funded by the stimulus.

Keynesian stimulus, to be effective, if one looks at the equations, must keep that additional government spending in the domestic economy of that government. So, the problem was no requirement (in reality) to buy American products and most importantly use only U.S. citizen, perm resident American workers.

What that did was lower the GDP multipliers of that portion of the Stimulus (the GDP multipliers for tax cuts are a joke, it's simply not worth it), but on the portion of funds that went to projects, all of that pouring U.S. taxpayer money overseas and using foreign workers instead of Americans really lowered any stimulative effects.

So, conservative people, you can be pissed at the Stimulus, but guess what, Keynes does work and the Stimulus was simply in violation of Keynesian economics, so it did waste a hell of a lot of money as a result.

Right, right, it works just

Right, right, it works just like socialism works--we just didn't do it right...*rolls eyes*.

"Keynesian stimulus, to be effective, if one looks at the equations..."

Your argument is Keynes works because "equations" say it works?? Huh? How about some real-world examples of Keynesian economics working? (I'm reasonably sure this is a complete impossibility because, like most economics, the numbers can be tortured into saying whatever you want them to say, but we kept all that cash in America in the 30s, per Keynes, and we sat in a Depression for a decade-plus, before the destruction of the entire, industrialized world set us on a glide path for decades of prosperity.)

Philosophy vs. Fact, evidence

This site is not a philosophy site, it's heavily laden with data, statistics, graphs.

You want an example of Keynesian economics working? WPA, CCC, WWII.

We have a blazing example right before us on how well austerity works in Europe and Greece, where their GDP declined, output declined, as Keynesian economics would predict when overall demand is weak.

But I'm not getting into a pissing match, we rely on historical time series for that effort.

Stimulus bad in long term - really?

Robert, doesn't your point about the effect of stimulus (being dependent on how much is invested domestically) also apply to investment by the private sector?

"Keynesian stimulus, to be effective, if one looks at the equations, must keep that additional government spending in the domestic economy of that government."

Why would we assume that all private sector investment is restricted to the domestic economy? That bears no resemblance to reality. I think this logically calls into question the CBO assumption that government spending inevitably crowds out private sector spending to the economy's long term detriment. If the private sector prefers to invest overseas, then higher taxation to fund domestic spending would have a positive economic effect long-term also, no?

miasmo.com

stimulus vs. private investment

Stimulus is simply to give the domestic economy a boost, artificially increase demand in the economy due to the economy not operating at full potential.

Stimulus is good in the long term if it more than pays for itself. That's why things like the WPA, CCC and direct jobs, putting wages in the hands of workers was good. We got some awesome infrastructure, bridges, damns, electrical grid, which pave the way for private economic activity later.

i.e. without the highway system one wouldn't have this massive intra-state trade, they are glorified shipping lanes by trucks and enable faster deliveries across the nation, just one example.

No electrical grid, no businesses can start in the region who need electricity to do their business, another example.

The "I" in GDP (see equations, links on GDP, left hand column) is only domestic investment and the private sector. "G" is government. Government spending can crowd out private investment in the local economy, but depending on other factors. Did the CBO say that as a general rule? I didn't get that, but it's a massive document.

I think higher taxation on those who offshore outsource their profits instead of investing in the U.S. would greater spur domestic investment and hiring.

The entire "corporate tax rate is 35%" is kind of bogus since most large corporations pay zero taxes and some have literally gotten refunds, but that said, for the small business, without legions of CPAs and tax attorneys, an overall lower domestic tax rate could spur investment and hiring, depending on how the incentives are crafted. i.e. get "zero" tax rate if one hires X% percentage of workers, doing > 20 hrs a week, who are U.S. citizens...

So, overall private sector investment is not limited to the domestic economy, but U.S. GDP represents only domestic economic activity.

Stimulus, goes into the "G" equation of GDP. Think that comments on what you're trying to say, maybe not, but suspect go check the GDP report and check out that basic GDP equation I always put at the top. This is why imports subtract from GDP, that's economic activity from outside the U.S....

so all foreign investment, economic activity isn't in the U.S. GDP report (as a rule).

Economic Suicide - phrase of the day

Great catch phrase! That's Congress generally. They do not listen or even have a national manufacturing policy, a long term economic strategy or a long term trade strategy (that isn't written by multinational corporate lobbyists, et. al).

I'll take a very hot topic that is guaranteed to whip out the name calling in 2 seconds, immigration. Immigration directly affects labor markets, supply and demand. Right now, we cannot even get accurate data on what's going on with labor arbitrage, foreign guest workers and illegal workers. Literally you have even people in Academia whipping out economic fictional spin and other labor economists, who do know their mathematics and assumptions, getting name called as "racists". It's 100% full of special interests, the U.S. Chamber of Commerce and their cheap labor agenda, the offshore outsourcers, globalists and those corporations who want unlimited, unfettered corporate controlled global migration. You cannot get a sane, factual labor economic statistic out there on this topic. Literally, I've watched Senate Judiciary Committee members do mark-up on C-SPAN, and they cannot even add up how many foreign guest worker Visas they are increasing or authorizing, never mind even contemplate how that affects U.S. citizens, permanent resident workers.

Same is true with budgets, deficits and the mother of all political tools, the tax code. Never a fact shall enter the debate that is genuine.

If one looks at the ramping up Presidential election, we have, once again, a lot of political rhetoric, where the policy as implies would actually be economic suicide.

That's our problem here. We don't have elected officials who will subscribe to unbiased, accurate, objective analysis and even worse, we do have some economists (which is frankly immoral to me they should be stripped of their PhDs for this), busy spinning up fiction by manipulating underlining equations, literally in some cases, setting key variables to zero or claiming some variable has no overlap to another and on and on.

So, our nation's leaders are busy committing economic suicide and they get away with it because 99.5% of Americans do not have the first clue on how Macro economics or how all of these factors really effect each other.

Glad to see the site so busy

Glad to see the site so busy recently.

Did you see the amazing statistics about jobs and Hispanics?

According to the Atlantic, “Although Latinos make up only a seventh of the population, they have “racked up half the employment gains posted since the economy began adding jobs in early 2010″, the Los Angeles Times reported this morning. In 2011, the trend accelerated. Of the 2.3 million jobs added in 2011 according to the Household Survey of the Bureau of Labor Statistics, 1.4 million, or 60 percent, were won by Latinos.

http://www.theatlantic.com/business/archive/2012/02/how-latinos-won-the-...

http://www.latimes.com/business/la-fi-latino-jobs-20120205,0,3008802.story

How can 15% of the workforce get 50% of the jobs created since 2010 — and 60% of the new jobs created in 2011?

What a country.

The Atlantic story goes on to say:

"One true story of the recession is that employment gains have been biased toward the highly educated. More than half of the jobs added in 2011 went to Americans with a college education. Another true story of the recession is that most of the other jobs have been low-paid and went to the less-educated."

So let me get this straight: If over half of the jobs in 2011 went to college graduates and 60% to Hispanics, doesn't that mean that almost no jobs in 2011 went to non-college graduates and non-Hispanics?

Obviously many of the jobs didn't go to Americans at all, if we throw in the jobs that went to temporary work visas holders.

It makes my head spin. Are we unemployed, native American non-Hispanics doomed to eternal unemployment?

immigration affects domestic workers

The labor economics terms is actually "native" which is a poor choice, but people who are born here are called "natives" vs. the "foreign born". The Atlantic has their own agenda. They love to claim there is a STEM labor shortage and nothing is further from the truth. The BLS does NOT differentiate workers based on immigration status. In other words, all of those H-1B workers and even L-1 are being counted in the unemployment statistics. So, in occupational areas where we know many U.S. citizens have been displaced by H-1B (train your replacement and then get fired)...this biases the occupational employment statistics.

But bottom line, it's true (last time I looked) that employment by the broad area "Hispanic", which includes Cubans, Puetro Ricans (who are U.S. citizens), native born U.S. citizens of Hispanic ethnicity and....drum roll...illegal immigrants (from Mexico, the largest population of illegals)....had amazing employment gains vs. native born.

You can only get to "native born, foreign born" and then by nation, you can't get to the data. "Asian" means from Vietnam, China, India, basically tne entire region, while we know the India BPO (offshore outsourcing industry) is the biggest user of H-1B Visas plus is something like 12% of India's GDP now.

But the main point, immigration does negatively impact U.S. workers is true and unfortunately corporate lobbyists don't like that reality so their hire hordes of front men to go on pundit shows, write bogus articles and spin labor economics equations in labor economics fictional white papers.

This actually pisses me off. We need this raw data. You cannot craft solutions to U.S. domestic labor markets, assuming anyone gives a rats ass about the U.S. labor force, without accurate raw data, statistics.

labor and trade

Wouldn't it be nice if labor and trade policies were written by laborers rather than corporate lobbyists.

miasmo.com

or even credible economists

Most economists who have bothered to read the actual agreements know that sure isn't "free trade" by the theory. I'd be happy with a consensus of experts even than this.

I hear ya!

The Historical Record of FDR and Keynes on Stimulus

I am always fascinated and astounded by those who claim that Stimulus as professed by Keynes is Socialism. Keynes and FDR had a dialog in letters lasting months. In that dialog, both of them professed a real desire to save the capitalist system. Russia was communist and Germany was fascist. Three U.S. states had avowedly socialst governors. The money they borrowed for the deficit was 7 percent of GDP in 1933-34. Sizeable. FDR wanted to do less stimulus and Keynes wanted more. FDR repeatedly said he had no use for the Huey Longs and Bob Lafallettes.

Bob alludes to the CCC WWII and projects like the grid (REA). The South in 1933 had hardly andy electric power in the rural areas. FDR extended the Grid to the region, and also paid to buy the crops of farmers who were dumping the food they produced. That saved food was trucked in to cities to feed many who were literally starving.

Yeah, that part sounds to be socialist but would anybody today dare call it Christian?. Few who lived south of the Mason-Dixon opposed these moves and FDR had a entire region of friends.