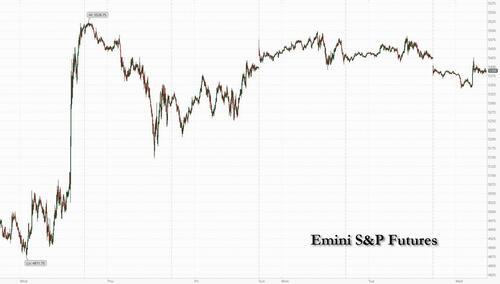

Futures Slide After Nvidia Chip Export Curbs Slam Tech Stocks

US equity futures are lower after NVDA unveiled the US government restricted export of its H2) chips to China, sending the stock -6% lower pre-market and dragging the broader market lower; Europe chip giant ASML Holding NV reported disappointing results further denting the semi space. As of 8:00am, S&P futures are down 0.7%, and Nasdaq futures slide 1.5%, with the balance of Mag7 and Semis, all weaker (AMD -6.2%, AVGO -3.3%). Futures had been even lower overnight but bounced shortly after 4am ET after China said to be open to trade talks with some preconditions, including (i) consistency of message and respectful approach; (ii) one person to negotiate that is not Trump but has his authority; with the goal of having a signable agreement before the leaders meet in person. Bond yields are mixed as the curve twists steeper while USD weakness continues, sending the Bloomberg dollar index to a 6 month low. Commodities are rallying today with all 3 complexes higher; WTI crude oil futures are up about 1%, gold futures more than 2%, extending their recent advance. Precious is standing out to the upside, with gold hitting a new record high above $3300. Today’s macro data focus is on Retail Sales.

In premarket trading, Nvidia was the biggest drag for Magnificent Seven stocks after Trump’s administration banned the chip giant from selling its H20 chip in China (Nvidia -6.3%, Tesla -2%, Meta 1.9%, Apple -0.8%, Amazon -1%, Alphabet -2.1% and Microsoft -0.9%). Semiconductor stocks are weighed down after ASML reported quarterly bookings well below estimates (AMD -6.8%, Broadcom -3.8%, Micron -3.7%, Marvell Technology -3.6%, ASML ADRs -4.5%). United Airlines (UAL) climbs 7% after the carrier Tuesday said it expects an adjusted profit of $11.50 to $13.50 a share if the current environment remains stable; But full-year earnings would drop to as little as $7 a share if the US economy enters a recession (peers rise: Delta Air Lines (DAL) +3.2%, American Airlines (AAL) +2.8%). Here are some other notable movers:

- Interactive Brokers (IBKR) drops 8% after the broker’s first-quarter earnings fell short of expectations, with analysts attributing the EPS miss to a slide in net interest income and higher expenses. Peer Robinhood (HOOD) declines 4%

- JB Hunt (JBHT) falls 6% after the trucker reported revenue in multiple segments that fell short of consensus estimates.

- MP Materials (MP) rises 2.9% and TMC the Metals Co. (TMC) gains 3% after President Trump launched a probe into the need for tariffs on critical minerals, the latest action in an expanding trade war that has targeted key sectors of the global economy.

- Omnicom (OMC) slips 2.4% after the advertising company reported quarterly revenue that came in slightly under expectations.

- REV Group (REVG) falls 3% after Morgan Stanley downgraded the manufacturer of specialty vehicles on tariff risk

- Hertz (HTZ) jumps 21% after Pershing Square Capital Management disclosed a 12.7 million share stake in Hertz. Stake value amounts to about $46.5 million

Markets were setting up for another overnight rout after the US government informed Nvidia on Monday that its H20 chip would require a license to export to China “for the indefinite future.” The new rules address Washington’s concerns that “the covered products may be used in, or diverted to, a supercomputer in China,” the company said in a filing. Nvidia warned it will report about $5.5 billion in writedowns during the current quarter, tied to inventory and commitments for the chip.

“This move is unnerving for two reasons,” said Vishnu Varathan, Singapore-based head of economics and strategy at Mizuho Bank, referring to the Nvidia curbs. “First, it conveys the mercurial nature of Trump tariffs in so far that it has revoked earlier concessions extended to Nvidia. Second, this also suggests that the US-China undercurrents are rather abusive, even as there appears to be some calm on the surface.”

However, stocks pared some of the losses in the morning session on signs China may be open to negotiations with the US, sparking some optimism over the possibility of easing trade tensions. China said it wants a number of steps from President Donald Trump’s administration before it will agree to talks, including showing more respect by reining in disparaging remarks by members of his cabinet, according to a person familiar with the Chinese government’s thinking.

“We’re keeping a defensive stance during this period of uncertainty while being increasingly cautious on tech stocks and industries which have a high share of their value chain exposed to China,” said Francois Antomarchi, a fund manager at Degroof Petercam Asset Management. “There’s the question of knowing when we hit the bottom, geopolitically speaking, of the trade war, and I’m not sure we’re there yet.”

The US government informed Nvidia on Monday that its H20 chip would require a license to export to China “for the indefinite future.” The new rules address Washington’s concerns that “the covered products may be used in, or diverted to, a supercomputer in China,” the company said in a filing. Nvidia warned it will report about $5.5 billion in writedowns during the current quarter, tied to inventory and commitments for the chip.

“This move is unnerving for two reasons,” said Vishnu Varathan, Singapore-based head of economics and strategy at Mizuho Bank, referring to the Nvidia curbs. “First, it conveys the mercurial nature of Trump tariffs in so far that it has revoked earlier concessions extended to Nvidia. Second, this also suggests that the US-China undercurrents are rather abusive, even as there appears to be some calm on the surface.”

Meanwhile, UK bonds rallied after inflation eased more than expected in March, spurring increased bets from traders on Bank of England interest rates.

Federal Reserve Chair Jerome Powell is expected to give a speech later in the day, and investors will be watching March retail sales data for a reading of consumer sentiment before the tariff turmoil.

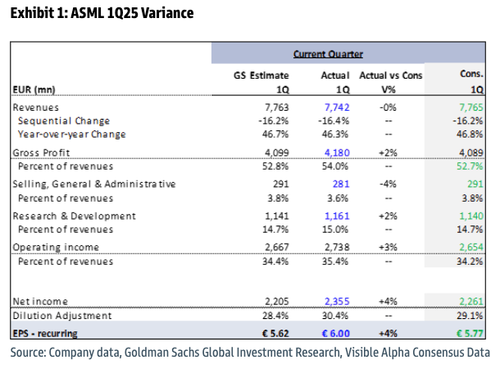

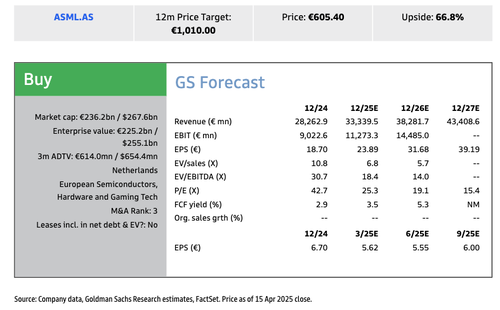

In Europe, the Stoxx 600 pares its drop to 0.9%, technology and financial services shares are the worst-performers, while utilities and telecommunications stocks are the biggest gainers. Tech sentiment was further dented by ASML, whose first-quarter orders missed estimates. Here are the biggest movers Wednesday:

- Sartorius shares rise as much as 9.4% after the German lab equipment maker reported better-than-expected results for the first quarter

- Heineken shares gain as much as 3.5%, the most since April 10, after the Dutch brewer’s earnings. Analysts see a beat on Q1 volumes and sales, solid delivery in key markets, and guidance that helped offset FX concerns

- European oil and gas producers drop as much as 1.4%, snapping a two-day winning streak, as crude prices extend their decline

- Bunzl shares plunge as much as 27%, marking a record drop, after the value-added distributor cut its annual guidance due to challenges in North America and paused its share buyback

- EQT shares slide as much as 8.5% as the Swedish investment firm’s cautious guidance on exits and valuations tempers enthusiasm despite a generally solid first-quarter earnings update

- ASML shares drop as much as 7.6% after the chip-equipment maker reported quarterly bookings well below estimates, a sign of weakness in customer demand

- Straumann shares fall as much as 5.3%, worst performer in the Stoxx 600 Health Care Index on Wednesday, after UBS cut its price target on the stock to a Street-low, citing the recent strengthening of the Swiss franc

- Antofagasta falls as much as 2.7% in London after the miner reported copper production for the first quarter 2025 that was 23% lower versus prior comparable period

- WH Smith shares drop as much as 3.3% after UBS said the retailer is closing far more stores than previously expected this year, while others warned a foreign-exchange headwind could also hit consensus estimates

- XPS Pensions shares fall as much as 5.2%, the most since April 7, after the UK benefits consultaning firm issued a trading update which Shore Capital says slightly beat expectations but leaves little room for upward revisions

Earlier in the session, Asian stocks dropped, driven by technology shares following new restrictions on exports of Nvidia’s H20 chips to China. The MSCI Asia Pacific Index declined as much as 1.4%, with TSMC, Alibaba and Tencent among the major drags. The Hang Seng China Enterprises Index led losses among major regional gauges, falling 2.6% on worries around escalation of US-China tensions. Benchmarks in Taiwan, Japan and South Korea also fell.

The latest Nvidia curbs shook investor confidence again after recent signs of stabilization around President Donald Trump’s tariff war. Sentiment was also hurt by disappointing results from Dutch chip-equipment maker ASML and a US probe into the need for levies on critical minerals. Chinese onshore shares eked out small gains toward the end of the day. Some investors remain optimistic on the nation’s efforts to bolster its economy and tech industry. China earlier reported a set of upbeat economic data. Investors will be also be watching for any signs of a cooling in US-Sino tensions.

“Asian stocks found it hard to muster much in the way of forward progress today with the Nvidia news,” said Tim Waterer, chief market analyst at KCM Trade in Sydney. “There is a reliance on the H20 chip from big name players in the Asian tech space, so any moves which could impact supply will be a drag on the broader sector.”

In FX, the Bloomberg Dollar Spot Index is down 0.5% having earlier fell to a six-month low. The Swiss franc outperforms on haven demand although has pared gains to 0.8% amid the bounce in stocks. The euro also adds 0.8% against the greenback. The pound adds 0.3% to around $1.327.

In rates, treasuries are mixed with outperformance seen in shorter-dated maturities as US two-year yields drop 3 bps to 3.82% and long-dated tenors little changed to cheaper, trailing gains for European bonds after benign UK inflation data. Treasury yields pivot around a little-changed 10-year sector with longer-dated tenors marginally cheaper, steepening 2s10s and 5s30s curves by about 3bp; 10-year is near 4.33% with bunds and gilts in the sector about 3bp richer on the day. Gilts outperform their European peers after UK inflation rose less than forecast in March, with UK 10-year borrowing costs falling nearly 3 bps to 4.62%. Treasury auctions resume with $13 billion 20-year bond second reopening at 1pm New York. WI yield near 4.83% is ~20bp cheaper than last month’s first reopening, which stopped through by 1.4bp. US session includes March retail sales data, a speech by Fed Chair Powell and a 20-year bond auction.

In commodities, oil prices erased an earlier decline after the report that China is potentially open to trade talks with the US. Bullion gained as much as 2.7% to climb above $3,300 an ounce for the first time, surpassing the previous record set on Monday. Bitcoin is steady just below $84,000.

The US economic calendar includes March retail sales and April New York Fed services business activity (8:30am), March industrial production (9:15am), February business inventories and April NAHB housing market index (10am) and February TIC flows (4pm). Fed speaker slate includes Hammack (12pm), Powell (1:30pm) and Schmid, Logan (7pm).

Market Snapshot

- S&P 500 mini -0.6%

- Nasdaq 100 mini -1.2%

- Russell 2000 mini -0.2%

- Stoxx Europe 600 -0.8%

- DAX -0.5%

- CAC 40 -0.6%

- 10-year Treasury yield -1 basis point at 4.32%

- VIX +1.5 points at 31.57

- Bloomberg Dollar Index -0.5% at 1227.95

- euro +0.8% at $1.1374

- WTI crude +1.1% at $62/barrel

Top Overnight News

- NVDA (-6% pre mkt) filed an 8K last night revealing a more stringent set of export rules around its H20 chip. According to the filing, Nvidia will now require an export license from the US gov’t to sell H20 chips to China and D5 countries (this license requirement will stay in effect for the indefinite future). Nvidia warns it will book up to ~$5.5B in charges in FQ1 related to the H20 because of this requirement. FT

- White House plans aggressive campaign to isolate China economically by forcing countries to limit their dealings w/Beijing in exchange for reduced American tariffs. WSJ

- Japan is set to be the first nation to have trade talks with the US, people familiar with the situation said the US had signalled priorities for the talks, including LNG imports, Boosting Market access to Ags and Japanese auto legislation: FT

- There is more talk in the media about the White House potentially forcing Chinese firms to delist from American stock exchanges. WSJ

- China is open to talks w/the US but first wants Trump and his administration to show more respect, articulate a consistent position toward Beijing, and appoint a single individual empowered to negotiate. BBG

- China unexpectedly appointed a new int’l trade rep on Wed, installing a fresh person to lead negotiations w/the US (the change could signal that Beijing is hoping to make a breakthrough in talks w/Washington). SCMP

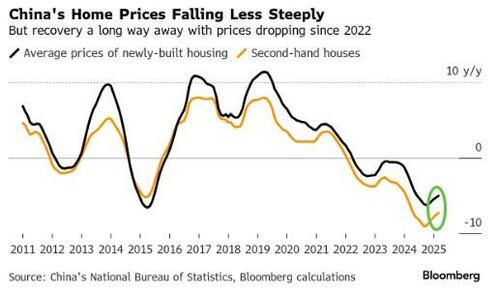

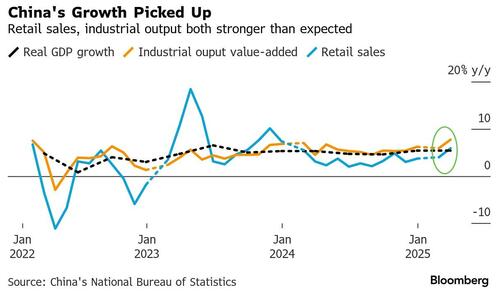

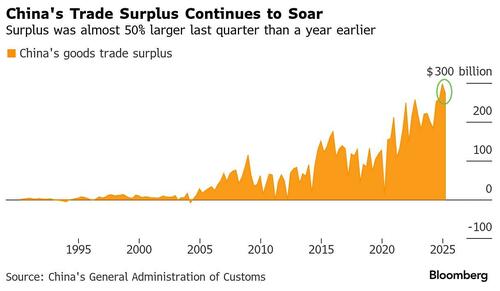

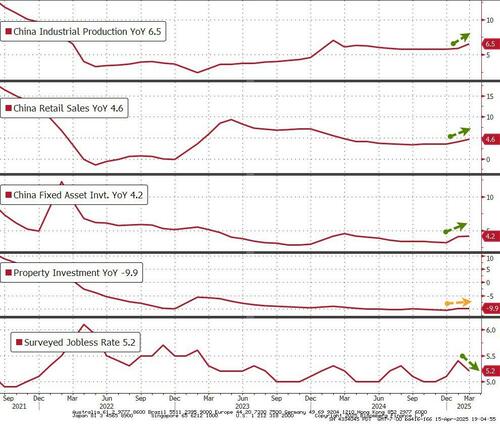

- China’s economic data comes in ahead of expectations, including Q1 GDP (+5.4% vs. the Street +5.2%), Mar retail sales (+5.9% vs. the Street +4.3%), and Mar industrial production (+7.7% vs. the Street +5.9%). RTRS

- BOJ likely to downgrade its growth forecast at the upcoming meeting due to fallout from Trump’s trade war. RTRS

- UAL reported strong Q1 EPS upside at 91c (vs. the Street 74c) w/the beat driven largely by healthy margins (adjusted pre-tax margins rose 360bp Y/Y to 3%) while sales were mostly inline (revenue rose 5.4% w/capacity +4.9% and RASM +0.5%). RTRS

- Donald Trump’s tariffs are forcing private equity groups to pause their dealmaking and focus on managing their existing portfolio companies, in a stark reversal of earlier expectations for a boom in activity under the new administration. FT

Chipmakers

- NVIDIA (NVDA) expects USD 5.5bln in charges in Q1 FY2026 related to H20 products after the US informed the Co. it requires a licence to export those chips to China.

- NVIDIA (NVDA) reportedly did not inform some of its major customers about the new US export restrictions for China-focused H20 chip after the Co. received notice of them, via Reuters citing sources; received around USD 18bln of orders for H20 chips YTD.

- US chip equipment makers calculated that Trump administration tariffs could cost them more than USD 1bln a year, with tariffs estimated to cost Applied Materials (AMAT), Lam Research (LRCX) and KLA Corp (KLAC) USD 350mln each annually, according to Reuters sources.

China

- China is said to be open to talks if US President Trump shows respect, via Bloomberg sources; China wants Trump to rein in cabinet members and show consistency; wants US talks to address concerns on Taiwan and sanctions "The most important precondition for any talks is that Chinese officials need to know such engagement will be conducted with respect" The source said Trump has been relatively dovish when speaking publicly about Chinese President Xi, but other members of his administration have been more hawkish, leaving officials in Beijing unsure of the States' position.

- US President Trump said, when talking on the tariff pause, that they may want countries to choose between the US or China.

- US intends to use tariff negotiations to isolate China with officials planning to use the negotiations of more than 70 nations to ask them to disallow China to ship goods through their countries, according to WSJ.

- White House Press Secretary said President Trump messaged that the ball is in China's court and that they don't have to make a deal with them but Trump is open to a deal with China.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly subdued following the choppy and rangebound performance on Wall St. amid mixed data releases and as trade frictions lingered, while the mostly better-than-expected Chinese GDP and activity data failed to inspire a bid. ASX 200 clawed back losses amid strength in gold miners, consumer staples and financial but with gains limited by weakness in miners including Rio Tinto which reported a drop in quarterly iron production and shipments. Nikkei 225 trickled lower to beneath the 34,000 level amid the ongoing global trade war concerns and despite encouraging Machinery Orders. Hang Seng and Shanghai Comp underperformed amid US-China trade frictions the US said to intend to use tariff negotiations with other countries to isolate China and will also require a licence for NVIDIA to export H20 processors to China, while mostly better-than-expected GDP and activity data from China failed to inspire given that they were from a period before the US-China tariff escalation.

Top Asian News

- BoJ said to cut 2025 growth forecast in its quarterly Report, according to Reuters sources; no consensus within the BoJ on the extent of Trump tariff damage

- China's MOFCOM issued an action plan to promote service consumption which covers areas including catering, tourism and leisure, while it will support the expansion of sectors including catering, accommodation, health, culture, entertainment and tourism. Furthermore, the plan will focus on coordinating domestic and international dual circulation and insist on exerting efforts on both supply and demand, as well as provide strong support for high-quality economic development.

- China's stats bureau deputy commissioner said the unfavourable impact of the international environment on China's economy is deepening, protectionism is rapidly rising globally and the world economic order has been severely damaged. The official said they resolutely oppose US tariffs which are against economic rules and WTO rules, as well as noted that high US tariffs will bring about some pressures on China's trade and economy. However, the deputy commissioner also commented that Q1 data underscores China's strong resilience and potential, while the official added that macroeconomic policies will become more proactive this year and that China has a rich policy toolkit to support the economy.

- BoJ Governor Ueda said they may need a policy response but will decide appropriately in line with changing developments when asked about a BoJ response if US tariff policy puts downward pressure on Japan's economy, while they will scrutinise without any preconception impact of US tariff policy on Japan's economy which is already affecting corporate and household confidence. Furthermore, Ueda said from February onwards, risks surrounding US tariff policy have moved closer towards the bad scenario the BoJ envisioned and noted the BoJ sees both upside and downside risks to the price outlook, according to Sankei.

- Japan's NHK Spring (5991 JT) is to reconsider plans to cut auto parts production in the US, in response to tariffs, according to Nikkei.

European bourses (STOXX 600 -0.9%) opened on the backfoot, continuing the mostly subdued APAC session. A quiet significant pick-up off lows was seen following a Bloomberg report which noted that China is open to talks if US President Trump shows respect – nonetheless, indices still reside in the red. Sentiment today has been hit due to several factors; 1) US President Trump ordering investigations into critical minerals, 2) NVIDIA expecting USD 5.5bln hit amid US export controls, 3) Latest White House Fact Sheet suggested China now faces up to a 245% tariff on imports to the United States as a result of its retaliatory actions. (awaiting clarity), 4) poor ASML results. European sectors hold a defensive bias, in-fitting with the risk tone. Tech is by far the clear underperformer, with downside today driven by losses in post-earning losses in ASML and NVIDIA export control updates. Autos & Parts and Basic Resources are also on the backfoot given the risk tone.

Top European News

- US President Trump signed a healthcare executive order seeking changes to the US Medicare drug price negotiation process and signed an order restoring common sense to federal procurement by simplifying the process, while the order aims to simplify and streamline federal acquisition regulation.

- A dozen US House GOP members have said no to big Medicaid cuts, according to Punchbowl News.

FX

- USD is softer across the board after a session of slight gains yesterday with the dollar struggling in the current risk environment. Focus remains on the trade war with the White House stating that over 15 trade deal proposals are being considered and some could be announced soon. In recent trade, the USD was provided a modest boost after a more conciliatory report from Bloomberg that China is said to be open to talks if US President Trump "shows respect". Ahead, US Retail Sales and commentary via Fed Chair Powell. DXY is back below the 100 mark and briefly slipped below Tuesday's low at 99.47.

- EUR is firmer vs. the USD and one of the better performers across G10 FX. Fresh macro drivers for the Eurozone have been lacking during today's session after Tuesday's saw woeful ZEW metrics and reports that there has been little progress in trade negotiations between the EU and US. EUR/USD briefly breached Tuesday's best at 1.1378 but ran out of steam ahead of 1.14, topping out at 1.1392.

- JPY has retreated beneath the 143.00 level with flows into the yen amid the downbeat risk tone and after Machinery Orders topped forecasts. Elsewhere, comments from BoJ Governor Ueda failed to have any material sway on the Yen with the policymaker noting the Bank may need a policy response but will decide appropriately in line with changing developments, adding that the BoJ sees both upside and downside risks to the price outlook. USD/JPY has delved as low as 142.05.

- Antipodeans are both firmer vs. the USD but to a lesser extent than peers considering the current risk tone and after a solid showing during Tuesday's European session. Support from better-than-expected Chinese GDP proved to be temporary given the consensus view that growth is set to slow in the coming months on account of the trade war with the US.

- CAD is firmer vs. the USD but to a lesser degree than peers. Yesterday saw softer-than-expected Canadian inflation data which failed to have a sustained impact on pricing for today's BoC rate decision which sees an unchanged rate at around 60% vs. a 25bps cut at 40%.

- Support from better-than-expected Chinese GDP proved to be fleeting for the Yuan with desks dismissing the data as stale and warning of further headwinds to come. In recent trade, USD/CNH was knocked lower by a report in Bloomberg that China is said to be open to talks if US President Trump "shows respect".

Fixed Income

- USTs incrementally firmer and deriving some haven demand from the NVIDIA & ASML updates. However, USTs are failing to benefit to the same degree as core peers across the pond. Most recently, USTs were knocked by around 10 ticks by a Bloomberg source report that China is open to trade talks with the US, but that they have a number of pre-conditions to this; full details on the feed. Whilst the risk-off mood continues to remain at play, the downside in USTs has continued to extend, and more recently has taken US paper to just above the unchanged mark. Ahead, US Retail Sales, Fed Chair Powell and US supply.

- Bunds began bid, as the risk tone has been chipped away by updates from NVIDIA & ASML. Developments specifically for the bloc have been a little light, final inflation data from Italy subject to a modest revision lower but spurred no reaction. Bunds trimmed roughly 30 ticks following the Bloomberg/China reporting, and extended lower into a 2052 & 2056 Bund auction - but no real move on it.

- Gilts initially firmer start to the session given the risk-off tone after NVIDIA’s update and exacerbated by ASML. Further bullish impetus for Gilts came from UK CPI. Altogether, this caused the benchmark to gap higher by 43 ticks and then extend 25 more to a 92.32 peak. The CPI series was cooler-than-expected overall and will be welcomed by those on Threadneedle St. and has seen the odds of a 25bps cut in May tick up to near-enough fully priced vs a c. 80% chance pre-release. Most recently, as outlined above, the risk tone has seen a marked recovery on the China-trade report. A recovery which weighed on Gilts back to the 92.00 mark though the benchmark remains well into the green and is the clear outperformer across the core space.

- Spread for the new Italian 7yr BTP set at +13bps, 30yr I/L set at +36bps, via Reuters citing leads.

- UK sells GBP 1.5bln 0.125% 2028 Gilt; b/c 3.84x, average yield 3.631%.

Commodities

- Crude spent most of the European session in the red, but those losses have since reversed after Bloomberg reported (citing sources) that China is said to be open to talks if US President Trump shows respect. Elsewhere, the mostly better-than-expected GDP and activity data from China failed to inspire given that they were from a period before the US-China tariff escalation. WTI resides in a USD 60.44-61.55/bbl range while its Brent counterpart trades in a USD 64.90-64.31/bbl parameter.

- Firm price action across spot gold and silver amid the risk aversion caused by the aforementioned factors - namely the worsening trade landscape. Spot gold mounted USD 3,300/oz for the first time ever, with momentum continuing - with today's range currently USD 3,230.68-3,317.92/oz.

- Base metals are softer across the board amid the overall downbeat sentiment across the markets amid the aforementioned reasons. 3M LME copper resides in a USD 9,030.00-9,125.15/t range.

- US Private Inventory Data (bbls): Crude +2.4mln (exp. +0.5mln), Distillate -3.2mln (exp. -1.2mln), Gasoline -3.0mln (exp. -1.6mln), Cushing -0.3mln.

- OPEC states that Russia has to compensate for 691k BPD of overproduction.

Geopolitics

- Israel's army said it bombed Hezbollah infrastructure in southern Lebanon, according to Sky News Arabia.

- US President Trump held a meeting on Tuesday morning in the White House situation room about the ongoing nuclear deal negotiations with Iran, according to two sources with direct knowledge cited by Axios.

US event calendar

- 7:00 am: Apr 11 MBA Mortgage Applications -8.5%, prior 20%

- 8:30 am: Mar Retail Sales Advance MoM, est. 1.35%, prior 0.2%

- 8:30 am: Mar Retail Sales Ex Auto MoM, est. 0.4%, prior 0.3%

- 9:15 am: Mar Industrial Production MoM, est. -0.2%, prior 0.7%

- 9:15 am: Mar Capacity Utilization, est. 77.9%, prior 78.2%

- 10:00 am: Feb Business Inventories, est. 0.2%, prior 0.3%

- 10:00 am: Apr NAHB Housing Market Index, est. 37.5, prior 39

- 4:00 pm: Feb Net Long-term TIC Flows, prior -45.2b

- 4:00 pm: Feb Total Net TIC Flows, prior -48.8b

Central Banks

- 12:00 pm: Fed’s Hammack Speaks in Moderated Q&A

- 1:30 pm: Fed’s Powell Speaks to Economic Club of Chicago

- 7:00 pm: Fed’s Schmid Chats With Fed’s Logan on Economy, Banking

DB's Jim Reid concludes the overnight wrap

After a strong start to the week, the market mood turned more negative again yesterday, as tensions between the US and China showed signs of further escalation. That meant the S&P 500 (-0.17%) posted a modest decline, and futures on the index are down another -0.90% this morning, which follows the news that the US had imposed restrictions on Nvidia’s chip exports to China. On top of that, Trump also launched a probe into whether critical minerals should face tariffs, so that added to fears that further tariffs were on the horizon. So after a brief period of greater stability in markets, that reminded investors about the ongoing risks of escalation, raising fears that the trade war could still get worse from here.

Those concerns about further trade restrictions came on several fronts yesterday. In terms of the Nvidia story, the administration placed new restrictions on the export of Nvidia’s H20 chips to China, which had actually been designed to comply with earlier US export restrictions. As a result, Nvidia said it will report $5.5bn in write downs due to the new rules. Meanwhile, in another sign that the US-China trade war moving beyond tariffs, Bloomberg reported earlier yesterday that China ordered its airlines to halt any deliveries of Boeing jets and purchases of US aircraft equipment. So while there had been optimism after the weekend news on tariff exemptions for electronics, there’s been no sign since of either the US or China backing down and yesterday the White House commented that “The ball is in China’s court. China needs to make a deal with us. We don’t have to make a deal with them”.

Elsewhere, there was also little sign of the US coming to an agreement with the EU, as Bloomberg reported that the EU-US trade negotiations made little progress. The article said that Maroš Šefčovič, the EU’s trade chief, left the talks struggling to determine what the US was aiming for, and also that US officials indicated the tariffs would not be removed outright. So again, this pushed back on the more positive narrative around the weekend, which was generally in the direction of more exemptions on the tariffs (e.g. smartphones) and lots of discussions with trading partners.

With the overnight news, that’s meant Asian markets are struggling this morning, with losses for the Nikkei (-0.86%), the Hang Seng (-2.53%), the CSI 300 (-0.93%), and the KOSPI (-0.66%). Tech stocks have been particularly impacted, and the Hang Seng Tech index is down -4.53%, whilst futures on the NASDAQ 100 are down -1.54%. But it’s not just equities that have been impacted, as fears of an escalation have spread to other asset classes once again. For instance, the dollar index has fallen -0.48% this morning, and gold prices (+1.35%) have surged to another record high of $3,274/oz. Long-end Treasury yields have also crept up a bit, with the 30yr yield (+0.8bps) posting a most gain to 4.79%.

Those overnight losses happened despite a strong Q1 GDP print out of China. However, like a lot of economic data right now, the Q1 numbers aren’t too much of a focus for markets, as they don’t take into account the reciprocal tariff impact, so we’ll have to wait a few weeks before we get concrete numbers on that. Nevertheless, Q1 GDP was up +5.4% year-on-year (vs. +5.2% expected), the same pace as Q4. Moreover, the March activity data was also above consensus, with retail sales up +5.9% year-on-year (vs. +4.3% expected), and industrial production up +7.7% year-on-year (vs. +5.9% expected).

Ahead of the latest trade news, the S&P 500 (-0.17%) was fairly stable, although the index gave up much stronger gains at the open, when it had peaked at +0.82% intraday. The initial optimism was supported by decent earnings releases and the lack of further trade news, which added to growing hopes that the US could still avoid a recession this year. So most assets kept unwinding their tariff-related moves, and by the close, US HY spreads were still -4bps tighter, whilst the 10yr Treasury yield fell back -4.1bps to 4.33%. Even the dollar index (+0.53%) recovered some ground, ending a run of 5 consecutive declines.

In terms of the session, there was a reasonable amount of sectoral divergence. Financials outperformed, with Bank of America (+3.60%) and Citigroup (+1.76%) both seeing strong advances after their earnings results. However, the Magnificent 7 (-0.55%) continued to drag on the rest of the S&P, falling back for a second day running, while Boeing fell by -2.36% following the reporting on China’s pullback. By contrast, European equities put in a much stronger performance, and the STOXX 600 (+1.63%) just about managed to move back into positive YTD territory, now up +0.09% since the start of the year. We even saw the VIX index (-0.77pts) fall back for a third day running to 30.12, although it picked up towards the end of the session, having fallen beneath the 30 mark on an intraday basis at one point.

Meanwhile on the rates side, the Treasury rally saw the 10yr yield (-4.0bps) fall back to 4.34%, with the 30yr yield (-3.1bps) down to 4.78%. Moreover, US Treasuries outperformed their European counterparts, where yields on 10yr bunds (+2.3bps), OATs (+2.2bps) and BTPs (+3.8bps) all moved higher. So again, that unwound one of last week’s big moves, which was a huge widening in the 10yr UST-bund spread, but that tightened again for a second day running. The outperformance of Treasuries was supported by comments from Deputy Treasury Secretary Michael Faulkender that officials were investigating potential changes to the Supplementary Leverage Ratio regulation, which could allow banks to buy more Treasuries. In the meantime, US credit spreads also tightened, with HY spreads down -4bps to 405bps, whilst IG spreads came down -1bp to 111bps.

Finally, looking at yesterday’s data, there was a huge slump in the German ZEW survey’s expectations measure. The component fell back to -14.0 (vs. +10.0 expected), which was a big reversal after its surge the previous month, and also brings it down to its lowest since July 2023. Separately in Canada, the latest CPI reading surprised on the downside, with headline CPI falling to +2.3% (vs +2.7% expected). And in the UK, the number of payrolled employees fell by -78k in March (vs. -15k expected).

To the day ahead now, and US data releases include retail sales, industrial production and capacity utilisation for March, along with the NAHB’s housing market index for April. In the UK, we’ll also get the March CPI reading. From central banks, we’ll hear from Fed Chair Powell, as well as the Fed’s Hammack and Schmid. There’s also a policy decision from the Bank of Canada.

Tyler Durden Wed, 04/16/2025 - 08:34

Via Associated Press

Via Associated Press

People walk past Princeton University's Woodrow Wilson School of Public and International Affairs in Princeton, N.J., on Nov. 20, 2015. Dominick Reuter/Reuters

People walk past Princeton University's Woodrow Wilson School of Public and International Affairs in Princeton, N.J., on Nov. 20, 2015. Dominick Reuter/Reuters

Hang up when anything seems fishy. BestForBest/Shutterstock

Hang up when anything seems fishy. BestForBest/Shutterstock Associated Press/Getty Images

Associated Press/Getty Images

Recent comments