Futures Trim Gains From "Big Progress" In Japan Trade Talks After UnitedHealth Plummets

US equity futures have bounced back from yesterday's rout, following positive signals from initial US-Japan trade talks after President Donald Trump said there was “big progress” to strike a deal fueling optimism over trade negotiations. Still, as of 8:00am they are well off their highs after DJIA heavyweight member UnitedHealthcare plunged 20% after slashing outlook on care costs and after President Donald Trump berated Federal Reserve Chair Jerome Powell for being slow to cut interest rates; S&P 500 futures rising 0.4% having earlier risen as much as 1.2%, while Nasdaq futures gained 0.8% with Mag7 names mostly higher as US-listed shares of TSMC rose 3.8% in premarket after forecasting sales for the second quarter that topped estimates. European stock fell and Asian markets rose. Volatility is becoming less extreme as the VIX retreated to around 30, down from last week’s peak of about 52. The dollar edged higher while the yen drops, lagging G-10 currencies. Gold dipped from record highs but was still trading above $3300 while oil rose for a second day after the US vowed to reduce Iran’s energy exports to zero.

In premarket trading, Mag 7 stocks are mostly higher (Nvidia is about flat, Tesla +0.3%, Meta +0.4%, Apple +0.7%, Amazon +0.5%, Alphabet +0.7% and Microsoft +0.2%). TSMC’s US-listed shares rose 3% after the main chipmaker for Nvidia and Apple forecast sales for the second quarter that beat analyst estimates and kept its bullish outlook for growth in 2025, suggesting the world’s biggest chipmaker is confident it can ride out a US-China trade war. Alcoa dropped 1.5% after the the largest US aluminum producer said President Donald Trump’s 25% tariff on metal imports has cost the company $20 million since the duties went into effect. Here are some other notable premarket movers:

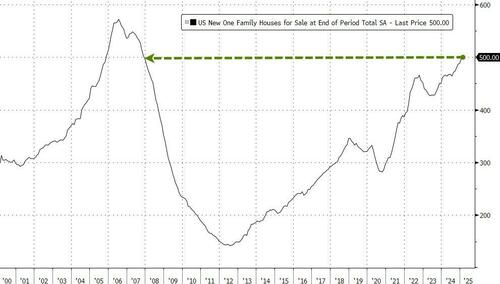

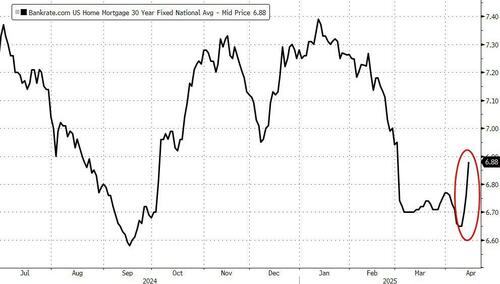

- DR Horton Inc. (DHI) declines 3% as the builder scaled back its expectations for home sales in its full fiscal year as high mortgage rates and growing economic uncertainty pressure buyers.

- Eli Lilly (LLY) soars 11% after the drugmaker said a late-stage trial of its oral GLP-1 drug, orforglipron, met key efficacy goals — showing promise it could become the first approved oral diabetes and weight-loss treatment

- Other obesity drug developers slumped on the news: Viking Therapeutics (VKTX) -5%

- Hertz Global Holdings Inc. (HTZ) shares rise 15%, extending gains from a 56% rally on Wednesday, after CNBC’s Scott Wapner reported on air that Bill Ackman’s Pershing Square holds about a 19.8% stake in the rental-car company, citing a person familiar with the matter.

- UnitedHealth (UNH) slumps 20% after the company cut its earnings outlook for the year and reported first-quarter earnings below estimates, citing heightened care needs in Medicare that were “far above” what it had planned for.

- Health insurers are tumbling after the news from bellwether UnitedHealth: Humana (HUM) -16%, Centene (CNC) -8%, CVS Health Corp. (CVS), which owns insurer Aetna, -6%

Futures had climbed earlier as positive signals from initial US-Japan trade talks stirred optimism agreements can be reached to avoid higher levies on American trading partners. But gains fizzled after the biggest heavyweight in the Dow Jones, UnitedHealth, plunged 20% after the company cut its earnings outlook for the year and reported first-quarter earnings below estimates, citing heightened care needs in Medicare that were “far above” what it had planned for. Sentiment was also dented after Trump said in a TruthSocial post that Powell’s termination from his position can’t come quickly enough, arguing that the US central bank should have lowered interest rates already this year, and in any case should do so now. Powell is “always TOO LATE AND WRONG." Reaction to Trump’s comments in the bond market were muted, with Treasury yields ticking higher across the curve. A gauge of the dollar edged up.

Earlier, Trump said there was “big progress” in talks to strike a deal for Japan. The yen weakened after the country’s chief trade negotiator said currencies weren’t discussed, allaying concerns the US would push for a stronger exchange rate. Treasury yields climbed after Federal Reserve Chair Jerome Powell reiterated his commitment to keeping inflation in check. A gauge of the dollar climbed.

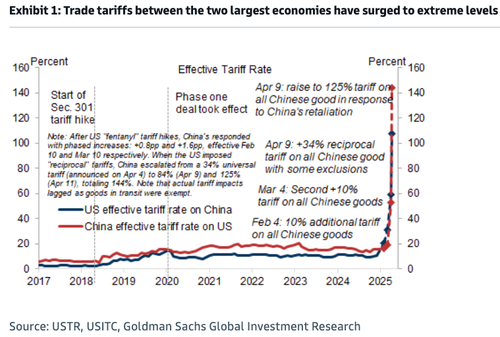

Following the turmoil triggered by the announcement of broad US levies earlier this month, investors are focusing more on developments in country-specific trade negotiations. Key questions surround China, after Beijing indicated Wednesday it has several conditions for agreeing to talks with the Trump administration.

“Hopes for good trade talks between the US and other countries after initial progress with Japan is one of the main drivers for US equity futures turning to green territory,” said Mathieu Racheter, Julius Baer head of equity strategy. “But that comes after quite a drop yesterday, so I wouldn’t read too much into the daily price action. The path of least resistance still remains to the downside.”

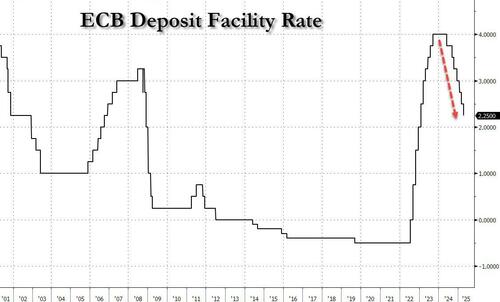

The ECB is expected to cut rates for the seventh time later Thursday, after Trump’s tariffs darkened the economic outlook. With trade negotiations still in flux, President Christine Lagarde is unlikely offer clear indications on where rates will go next.

Meanwhile, Powell on Wednesday signaled a wait-and-see approach to tariffs, pushing back on hopes the central bank would act quickly to soothe investor fears. His comments, along with concerns over the impact of tariffs on the tech sector, helped end a two-day consolidation in stocks.

“The only ‘Fed put’ that the Fed could envisage is if there was a risk of market dislocation, which is not the case at the moment,” said Enguerrand Artaz, a fund manager at La Financière de l’Echiquier. “When you look at the data, there is no need to intervene. Markets going down is not a reason in itself to intervene, especially not at these levels of valuation.”

Europe's Stoxx 600 falls 0.5%. Construction, health care and telecommunication shares underperform, while energy leads peers after solid results from Siemens Energy. Here are the biggest movers Thursday:

- Siemens Energy shares surge as much as 14%, touching a record high, after the German firm significantly lifted its full-year revenue, margin and free cash flow guidance

- ABB shares rise as much as 5.1% after the company said it is planning to spin off its robotics unit and confirmed its full-year guidance. Analysts welcome the firm’s move to become a pure electrification and automation player

- J Sainsbury shares rise as much as 4.3%, hitting a one-month high, after the UK’s second-largest supermarket chain posted annual adjusted profits ahead of expectations

- Hermes falls as much as 4.2%, after its first-quarter sales slightly undershot analyst estimates, stoking worries that even companies exposed to the wealthiest clients could be susceptible to a slowdown in demand for high-end items

- Biomerieux shares fall as much as 7.5%, after French biotech firm reported earnings. Morgan Stanley and RBC flagged FX headwinds and patchy division performance, though noted strong growth in the molecular business

- Man Group shares fall as much as 4.2%, as the UK money manager’s assets under management were dragged down by $5.6 billion in the first half of April due to market turmoil caused by President Donald Trump’s tariff plans

- Sartorius AG shares fall as much as 5.6%, the most since April 9, after the German health-care group was flagged by JPMorgan as potentially vulnerable to US federal funding cuts

- Moncler’s shares slipped as much as 3.4% after the top-performing luxury stock’s muted growth in the first quarter, with analysts noting the Italian maker of high-end puffer jackets faces a tough backdrop

- Pernod Ricard shares fall as much as 1.6% after the spirits maker’s third-quarter sales fell short of estimates amid sluggish demand in China

- VAT Group falls as much as 4.5%, with analysts disappointed by the results and outlook despite the company saying it expects another year of growth

Earlier in the session, Asian stocks rose, amid optimism surrounding the progress of trade negotiations between the US and its trading partners. The MSCI Asia Pacific Index climbed as much as 0.9%, with Tencent, Alibaba and Sony among the biggest contributors. Benchmarks in Hong Kong and India led gains, with notable advances also in Japan and South Korea. After the recent turbulence sparked by President Donald Trump’s tariffs, investor focus is shifting to potential US deals with a flood of nations looking to avoid hefty duties. Trump said there was “big progress” in talks with Japan’s lead tariff negotiator, while China has signaled an openness for discussions. Meanwhile, the Bank of Korea kept its benchmark interest rate steady while citing a significant increase in downside risks to growth. Many Asian markets will be closed for holidays on Friday, including Hong Kong, Australia and India.

In FX, the euro drops 0.3% versus the dollar ahead of the ECB decision where policymakers are widely expected to lower the deposit rate 25 bps to 2.25%.EUR/USD down 0.2% to 1.1379, versus 1.1344 day’s low; one-week risk reversals at 121bps, calls over puts There is some profit taking on dollar shorts ahead of the long weekend, a Europe-based trader says. The ECB is about to cut interest rates for the seventh time, and overnight volatility is elevated yet that reflects cycle highs in realized vol more than positioning for a surprise from the central bank. The yen slumped after it emerged that the currency was not a topic in the ongoing trade talks.

In rates, Treasuries are flat, erasing an earlier decline, with US 10-year yields trading 2 bps to 4.30%, down from 4.32% earlier. With yields higher by 2bp-3bp across maturities, curve spreads are little changed, however a slight flattening move briefly faded after President Trump said Fed Chair Powell’s termination “cannot come fast enough.” ECB policymakers are expected to cut interest rates for the seventh time in policy decision at 8:15am New York time. German and UK bonds are also down across the curve.

In commodities, oil prices rise for a second day, with WTI up 1% at $63.10 a barrel. Spot gold drops $20 to $3,323/oz. Bitcoin is steady above $84,000.

US economic calendar includes March housing starts/building permits, weekly jobless claims and April Philadelphia Fed business outlook (8:30am). Fed speaker slate includes Barr at 11:45am

Market Snapshot

- S&P 500 mini +0.5

- Nasdaq 100 mini +0.8%

- Russell 2000 mini +0.4%

- Stoxx Europe 600 -0.5%

- DAX -0.2%

- CAC 40 -0.5%

- 10-year Treasury yield +4 basis points at 4.32%

- VIX -2 points at 30.62

- Bloomberg Dollar Index +0.1% at 1227.01

- euro -0.2% at $1.1378

- WTI crude +0.9% at $63.06/barrel

Top Overnight news

- Trump again criticized Jerome Powell, saying the Fed chair should also lower rates and adding, “Powell’s termination cannot come fast enough!” BBG

- Trump made bullish remarks about Japanese trade talks (“Big Progress!”) after meeting w/officials from Tokyo at the White House on Wed, although there was very little detail, and it doesn’t appear that an agreement is imminent. Nikkei

- US House Energy and Commerce Committee is targeting May 7th, for a markup of its portion of the Republican reconciliation package: Punchbowl

- The Internal Revenue Service is making plans to rescind the tax-exempt status of Harvard University. CNN

- White House seeks to cut USD 40bln in funding for the Department of Health and Human Services: WaPo

- Fed's Schmid (2025 voter) said there is a lot of nervousness in the agricultural sector from tariffs but noted he's an optimist and they need to be patient to see how it plays out, while he said they will react to disruptions that might affect mandates.

- Nvidia CEO Jensen Huang arrived in Beijing days after the US barred the company from selling H20 AI chips to China. Huang held talks with Vice-Premier He Lifeng and met with DeepSeek founder. FT

- TSMC’s US-listed shares gained premarket after it reaffirmed 2025 revenue and spending forecasts and issued a stronger-than-expected second-quarter sales guidance. BBG

- Japan’s fin min expressed “deep concern” over the economic fallout from Trump’s trade policies. RTRS

- The ECB is expected to cut its key rate for a seventh time today — to 2.25% from 2.5% — as the trade war darkens the economic outlook. Investors see at least two more reductions by year-end. BBG

- Israel had planned to strike Iran’s nuclear facilities as soon as May, but was dissuaded from doing so by the White House as Washington holds negotiations w/Tehran about a deal. NYT

- The Chamber of Commerce has decided not to file a lawsuit against the Trump tariffs and will instead lobby the White House directly to dial back the duties. Politico

- BofA Week-April 12th Total Card Spending +2.3% Y/Y (vs +1.1% on avg. in March); notes that the increase could be due to a dual boost from the upcoming easter and front-loading due to tariff uncertainty.

Tariffs/Trade

- US President Trump posted on Truth Social "A Great Honor to have just met with the Japanese Delegation on Trade. Big Progress!".

- Japanese Economy Minister Akazawa said he told US negotiation counterparts that Japan wants the best solution as soon as possible for both nations and strongly requested the revocation of tariffs on Japan. Akazawa said they agreed to hold a second meeting this month and he believes the US wants a deal within the 90-day window but added that he has no idea how talks will progress going forward.

- Japanese PM Ishiba said the Economy Minister reported to him that constructive talks were held with the US, while Ishiba added that of course talks will not be easy going forward and he will visit the US at an appropriate time to meet with US President Trump.

- Intel (INTC) told Chinese clients last week that chips would require a licence for exporting to China if the chips met certain requirements, according to FT.

- UK officials are said to be tightening security when handling sensitive trade documents to shield them from the US amid the tariff war, according to Guardian sources.

- White House officials believe a trade deal with Britain can be finalised within three weeks, according to Telegraph sources.

- China's MOFCOM says it is willing to expand a mutual opening up with Europe, maintaining normal communication with US counterparts, China is open to negotiations with the US in economic and trade areas.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks shrugged off the negative handover from Wall St. but with gains capped amid a lack of bullish drivers and as trade uncertainty lingered. ASX 200 was led higher by strength in energy and mining stocks following recent gains in underlying commodity prices and as participants digest quarterly updates from the likes of BHP, South32 and Santos. Nikkei 225 reclaimed the 34,000 status amid favourable currency moves and with US President Trump suggesting big progress was made in US-Japan trade talks. Hang Seng and Shanghai Comp conformed to the positive mood but with the gains in the mainland limited by the ongoing US-China trade frictions, while officials from MOFCOM, MIIT and the PBoC are set to hold a briefing on Monday where China will announce an expansion plan for its service sector.

Top Asian News

- China is to announce an expansion plan for its service sector at a briefing on Monday with officials from MOFCOM, MIIT and the PBoC to attend the briefing, while the Finance Ministry held a meeting with experts on international economic conditions.

- US House panel is probing whether DeepSeek used restricted NVIDIA (NVDA) chips, according to FT

- BoJ Governor Ueda said Japan's economy is recovering moderately albeit with some weak signs, while he added that Japan's economy and prices moving roughly in line with their forecasts but they must be vigilant to heightening uncertainty including from each country's trade policy. Ueda also stated that Japan's real interest rates remain very low and the BoJ is expected to keep raising interest rates if the economy and prices move in line with projections made in the quarterly report. Furthermore, he said when the BoJ raised rates in January, the US economy was in solid shape and markets had been stable but added that uncertainty surrounding US policy, particularly on tariffs, has heightened sharply recently, as well as noted that US tariffs could exert downward pressure on the economy and reiterated that keeping low rates even when underlying inflation is accelerating could result in a situation where we would be forced to hike rapidly.

- BoJ's Nakagawa said US tariff policy, as well as overseas economic and market developments, are among risks to Japan's economic outlook, while uncertainty over US tariffs could affect household and corporate sentiment, and Japan's economy and prices.

- Bank of Korea kept its base rate unchanged at 2.75%, as expected, with the rate decision not unanimous as board member Shin Sung-Hwan dissented and saw a need to respond to the worsening economic outlook. BoK said uncertainties to the growth path are higher and headwinds to economic growth are seen bigger than previously expected, while it will determine the timing and pace of any further base rate cuts and noted that monetary easing policy stance is to continue. BoK Governor Rhee said most board members saw lower interest rates in the three months ahead and they will factor in the interest rate differential with the US for the next rate decision. Furthermore, Rhee said they will assess in May whether the policy rate needs to go below 2.25% by year-end.

European bourses (STOXX 600 -0.5%) opened mixed, but have gradually succumbed to selling pressure to display a negative picture in Europe. Positive updates related to US-Japan trade and strong TSMC results have failed to lift sentiment. European sectors hold a negative bias, in-fitting with the broader risk tone. Consumer Products is towards the top of the pile, as traders digest the latest Luxury updates. There have been earnings releases from three high-fashion brands today; Moncler (-1.8%, Q1 topped expectations amid strong Asia demand), Brunello Cucinelli (U/C, in-line figures and maintained guidance), Hermes (-1.9%, Q1 beat but said will implement price hikes in US to offset tariffs).

Top European News

- TSMC (2330 TT / TSM) Q1 (TWD) Net Profit 361.6bln (exp. 354.6bln), Op. Profit 407.1bln (prev. 249bln Y/Y), Revenue 839.3bln (prev. 592.6bln Y/Y). Forecasts Q2 revenue between USD 28.4-29.2bln (exp. 26.4bln); sees Q2 gross margin 57-59% (prev. 58.8% in Q1); sees Q2 operating margin 47-49% (prev. 48.5% in Q1); says overseas fabs will impact TSMC margins. Not seen any change in customer behaviour because of US tariffs. FY Guidance maintained. Notes of very strong AI demand from US customers like Apple (AAPL), need to expand capacity in the US.

- NVIDIA (NVDA) CEO Huang says China is a very important market for NVIDIA, hope to continue to cooperate with China, via CCTV. Elsewhere, CEO Huang reportedly met clients in Beijing, including DeepSeek founder, to discuss new chip designs for Chinese customers, according to FT sources; he then held separate talks with Chinese Vice Premier Li. CEO says US tightening of chip export controls has a significant impact on the company's business, via Chinese State media; will resolutely provide services to the Chinese market.

- LVMH (MC FP) CEO says 2025 started well but worsened from March amid economic turmoil linked to tariffs

FX

- DXY is attempting to claw back some of Wednesday's lost ground. Markets continue to digest Wednesday's remarks by Fed Chair Powell who noted that the Fed wishes to wait for greater clarity before considering any change to its policy stance. For today's docket, weekly claims data will be eyed for signs of labour market weakening. DXY sits towards the bottom-end of Wednesday's 99.17-100.104 range.

- EUR softer vs. the USD in the run-up to the ECB policy announcement which is widely expected to see policymakers pull the trigger on a 25bps reduction in the Deposit Rate to the upper end of its neutral rate at 2.25%. EUR/USD sits towards the top end of yesterday's 1.1281-1.1412 range.

- USD/JPY has re-emerged from beneath the 142.00 level after dipping to a fresh seven-month low overnight at 141.62 with the rebound supported by the positive APAC risk appetite and after weaker-than-expected Japanese exports and imports data. Overnight, BoJ Governor Ueda stated that Japan's real interest rates remain very low and the BoJ is expected to keep raising interest rates if the economy and prices move in line with projections made in the quarterly report.

- GBP is flat vs. the USD and more resilient than peers. Fresh macro drivers for the UK are on the light side asides from a report in The Telegraph that UK PM Starmer is reportedly closing in on a new partnership with the EU that could put a trade deal with the White House at risk. GBP/USD is currently steady on a 1.32 handle and in a 1.3204-56 range.

- Antipodeans are both softer vs. the broadly stronger USD after a solid showing yesterday. AUD saw little follow-through from a mixed Australian labour market report in which employment change fell short of expectations and the unemployment rate came in below consensus.

- PBoC set USD/CNY mid-point at 7.2085 vs exp. 7.3083 (Prev. 7.2133).

Fixed Income

- USTs are softer, with benchmarks coming under pressure early doors as the general risk tone improved after strong TSMC numbers. Prior to this, a bearish bias was already in-play as APAC shrugged off the Wall St. lead and climbed, with focus on Trump’s positive commentary on trade with Japan. The US-Japan progress weighed on JGBs, resulting in them briefly underperforming overnight alongside a long-dated JGB liquidity auction. Currently at a 111-02+ low and around 15 ticks from the overnight high. Ahead, Weekly Claims, Philly Fed, Building Permits/Housing Starts & Baker Hughes.

- Bunds are directionally in-fitting with the above. EGBs await the ECB where a 25bps cut is expected and entirely priced. Focus for the meeting will be on how Lagarde and Co. approach the tariff uncertainty, and the two-way impulses on growth and inflation. Bunds are at a 130.91 base, around 30 ticks from overnight highs and just below Wednesday’s 131.02 low. To the downside, support factors at 130.75, 130.24 and 129.92 from the three sessions prior.

- Gilts are tracking the above, UK specifics and the docket ahead on the lighter side as markets focus on events within Europe and the US. On the trade front, the only update for the UK has been a piece in The Telegraph whose sources report that the White House believes a trade deal with Britain can be finalised within around three weeks.

- France sells EUR 12bln vs exp. EUR 10-12bln 2.40% 2028, 2.70% 2031, 2.00% 2032 OAT

Crude

- Crude is firmer with prices extending on Wednesday's gains after the US issued fresh Iran-related sanctions targeting oil tankers, while Treasury Secretary Bessent noted that the Trump administration has made it clear that they will apply maximum pressure on Iran and disrupt the regime’s oil supply chain and exports. WTI resides in a USD 62.61-63.51/bbl range while Brent sits in a USD 65.95-66.77/bbl parameter.

- Softer price action across precious metals following yesterday's run higher. Spot gold mildly pulled back after recently printing a fresh record high with the precious metal above the USD 3,300/oz level in a current 3,314.30-3,357.77/oz range - the top end being another record high.

- Copper futures are choppy but ultimately faded some of the recent gains as risk sentiment in its largest buyer lagged overnight. 3M LME copper resides in a 9,134.00-9,237.85/t range.

Geopolitics

- "Lebanese media: Low flight of Israeli drones in the airspace of the capital Beirut and the southern suburbs", according to Sky News Arabia.

- "Iranian media: Saudi defense minister arrives today in Tehran for talks with senior Iranian officials", according to Sky News Arabia.

- "The response to the Israeli proposal will confirm the rejection of any partial agreement to stop the war", via Asharq News.

- US President Trump waved off a planned Israeli strike on Iranian nuclear sites in favour of negotiating a deal with Iran to limit its nuclear program, according to the New York Times.

US Event Calendar

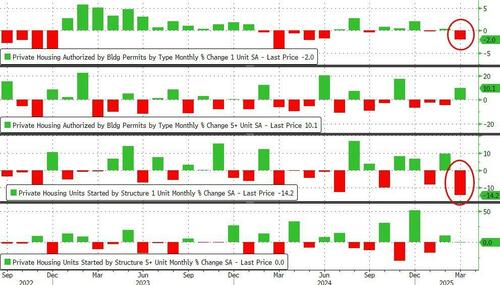

- 8:30 am: Mar Housing Starts, est. 1420k, prior 1501k

- 8:30 am: Mar P Building Permits, est. 1450k, prior 1459k

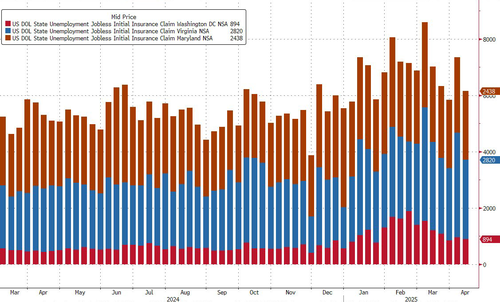

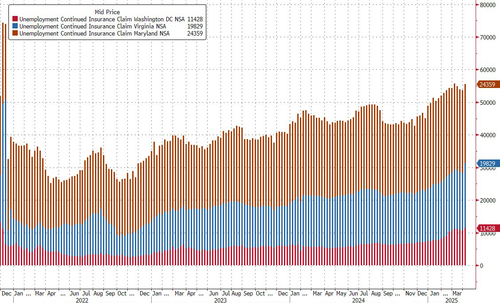

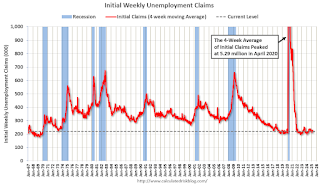

- 8:30 am: Apr 12 Initial Jobless Claims, est. 225k, prior 223k

- 8:30 am: Apr 5 Continuing Claims, est. 1870k, prior 1850k

- 8:30 am: Apr Philadelphia Fed Business Outlook, est. 2.2, prior 12.5

Central Banks

- 11:45 am: Fed’s Barr Speaks in Fireside Chat

DB's Jim Reid concludes the overnight wrap

Here in the UK, we’re about to have two public holidays, so the EMR will be taking a break as well until Tuesday. Wishing a Happy Easter to you and your families, and many thanks for all your interactions over recent months.

Ahead of the Easter weekend, risk assets sold off again, as ongoing trade tensions and hawkish comments from Fed Chair Powell led to growing concern about the near-term outlook, particularly if the Fed would be reluctant to ease policy. That led to a widespread selloff, with the S&P 500 (-2.24%) slumping back, whilst the dollar index (-0.83%) fell to another three-year low, and this morning S&P 500 futures (+0.74%) have only seen a partial recovery from that decline. To be fair, we did get some decent US data, but given the tariffs, any data before this month is being discounted as old news, so that offered little relief for investors. And with the risk-off move spreading, gold prices (+3.48%) saw their biggest daily jump in two years, reaching another all-time high of $3,343/oz.

In terms of the latest on the trade front, investors were most concerned about chipmakers yesterday, which followed the new restrictions from the Trump administration on semiconductor exports to China. Moreover, that concern mounted after AMD said they could face up to $800m of charges because of the new export controls, which followed Nvidia’s announcement the previous day that it’d report $5.5bn in write downs. So that led to a major slump in chipmakers, with the Philadelphia semiconductor index down -4.10%, whilst Nvidia (-6.87%) and AMD (-7.35%) posted even bigger declines. Meanwhile in Europe, ASML (-5.19%) also lost ground after its earnings announcement, with Q1 orders coming in beneath expectations. For more on this theme, Marion Laboure has published a note this morning on the latest export restrictions.

Later in the session, risk assets then came under further pressure after Fed Chair Powell’s speech, which suggested that any ‘Fed put’ remains well out of the money. Powell stressed the need to “keep longer-term inflation expectations well anchored and to make certain” that a one-time price increase “does not become an ongoing inflation problem”. He also noted that the US labour market was still "in a really good place". His comments added to the sense that the Fed wouldn’t be in a rush to react to the weaker surveys of recent weeks, with Powell noting that “we are well positioned to wait for greater clarity before considering any adjustments to our policy stance”. Moreover, he downplayed the need for any Fed market intervention, noting that markets remained orderly even if they were “struggling with a lot of uncertainty”.

Earlier in the day, equity futures had actually moved higher after a Bloomberg report suggested that China was open to trade talks, if the US met various conditions, including showing more respect and holding a more consistent position. There were also some more positive noises around the US-Japan trade discussions, as President Trump posted that he would be attending the meeting, along with Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick. After the meeting, Trump claimed that there was “Big Progress!” with the Japanese delegation. But despite these headlines, investors were ultimately sceptical given the lack of concrete results for now, especially between the US and China.

All-in-all, the trade news and Powell’s comments provided a tough backdrop for markets, which pushed the S&P 500 (-2.24%) to a large decline. Indeed, the index managed to avoid an even worse day after recovering by 1% in the final 30 minutes of trading. The decline was led by tech stocks, with the Magnificent 7 (-3.95%) posting a sharp loss led by a -6.87% slump for Nvidia. But even away from that group, there were broad losses, with the equal-weighted S&P 500 down -1.35%. And in further evidence of ongoing market stress, the VIX index (+2.52pts) ticked up again to 32.64pts. So it’s now closed above the 30 mark for 10 consecutive sessions, which is the first time that’s happened since October 2022, back when the S&P 500 hit its low-point in that year’s bear market.

The risk-off mood also saw Treasuries gain ground for a third consecutive session, with 10yr yields (-5.6bps) down to 4.28% and the 2yr yield (-7.5bps) down to 3.77%. And with yields moving lower, the dollar index (-0.83%) fell to a new three-year low. However, in the very near-term, Powell’s hawkish comments saw markets marginally dial back the probability of a Fed cut by the June meeting from 83% to 80%, and this morning that’s continued, falling back to 73%.

In energy markets, Brent crude oil rose +1.82% to $65.85/bbl, its highest level since April 3, and this morning it’s up another +0.91% to $66.45/bbl. The rise was initially supported by the news on China’s openness to talks and then was further boosted by news of additional US sanctions on Iranian oil, with Treasury Secretary Bessent posting that “we will apply maximum pressure on Iran and disrupt the regime’s oil supply chain and exports”.

Earlier in the day, we had actually got a decent set of US economic data, although given it covered March, it’s all being heavily discounted as old news by markets. Nevertheless, the period did include higher tariffs on China, and also coincided with a slump in various confidence measures, so it was interesting that the hard data was still resilient in spite of that, echoing the March payrolls number, which was still at +209k. In terms of yesterday’s releases, retail sales were up +1.4% as expected, and industrial production fell -0.3% (vs. -0.2% expected), so there wasn’t a huge alarm in those numbers.

But even as the hard data held up for now, the surveys continued to look a lot more negative. Yesterday we got the New York Fed’s Business Leaders Survey of service firms, where the expectations component fell back to -26.6 in April, the lowest since April 2020 at the height of the pandemic. One thing to look out for today will also be the weekly initial jobless claims, as those will cover the week ending April 12, entirely after the reciprocal tariff announcement.

Overnight in Asia, equity markets have put in a decent performance, with gains for the Nikkei (+0.8%), the Hang Seng (+1.62%) and the KOSPI (+0.69%). There’s been a bit more weakness in mainland China however, where the Shanghai Comp is only up +0.21%, whilst the CSI 300 is down -0.02%. Otherwise, the Japanese Yen has weakened overnight (-0.52% vs. USD), which comes after Japan’s trade negotiator said there wasn’t a discussion on currencies in the trade talks, so investors felt it was less likely that a stronger exchange rate would result.

Looking forward, attention will turn to the ECB’s latest policy decision today, which is at 13:15 London time. This is their first decision since the reciprocal tariff announcement, and it’s widely expected that they’ll cut their deposit rate by another 25bps, taking it down to 2.25%. Our economists have a full preview (link here), and their view is that the hit to growth from reciprocal tariffs, uncertainty and financial conditions likely exceeds what the ECB was expecting.

Ahead of that decision, European equities put in a better performance than their US counterparts, with the STOXX 600 (-0.19%) outpacing the S&P 500 for a third consecutive session. Meanwhile on the rates side, yields on 10yr bunds (-2.6bps), OATs (-2.4bps) and BTPs (-2.0bps) all moved lower. The biggest outperformance came from 10yr gilts (-4.9bps), which moved lower after the UK inflation data was softer than expected in March. It showed headline CPI falling to +2.6% (vs. +2.7% expected), whilst core CPI was in line with expectations at +3.4%. The release helped to cement investor conviction that the Bank of England would cut again at the May meeting, with a rate cut now fully priced in.

To the day ahead, and the ECB’s policy decision will be the most watched event. In terms of US data releases, there’s March housing starts and building permits, as well as the weekly initial jobless claims. We’ll also get Germany’s PPI reading for March. Finally, earnings announcements include UnitedHealth, Netflix, American Express, Blackstone, Charles Schwab and Truist Financial.

Tyler Durden

Thu, 04/17/2025 - 08:11

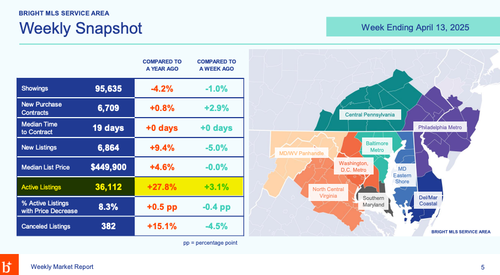

Total starts were up 1.9% in March compared to March 2024. Year-to-date (YTD) starts are down 1.5% compared to the same period in 2024. Single family starts are down 5.6% YTD and multi-family up 9.0% YTD.

Recent comments