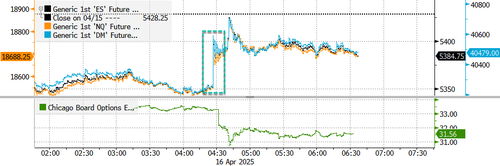

"Markets Have To Choose Between The US And China"

By Michael Every of Rabobank

John Authers at Bloomberg just ran a piece titled ‘This Passover, Everyone Has Questions’. His annual tradition of asking four questions, as in that ancient ceremony, didn’t start with the obvious one: “Why is this market different from all other markets?” But when the 30-year Japanese bond can fall 11bps on the day, most traditional takes on what is going on look, well, ‘unleavened’. In keeping with the Passover theme, it’s also important to stress we have four kinds of analysts’ takes on what’s going via the questions they ask about it: the Wise (“Why is this happening?”); the Wicked (“What has this got to do with me/my view?”); the Simple (“What?”); and the Ones Who Don’t Know How to Ask. Which analyst are you?

To the answer: this market is different from all other markets because in all other markets we assume there is one global economy within which all goods, services, and capital flow, with one single global reserve currency, the US dollar. Now, we might be witnessing an Exodus from it.

President Trump just said: “The ball is in China’s court. China needs to make a deal with us,” thrilling Bloomberg, which interpreted this as a trade-war off-ramp. Not noted by them, because it doesn’t fit that narrative, is he added, “We may want countries to choose between us and China.”

Of course, nobody wants to choose. But that doesn’t mean you don’t then become the chosen people via your inaction. And some are choosing without thinking about the consequences.

As Russia and the US talk about joint energy projects in the Arctic, Greenland says it wants to move closer to China on trade, snubbing both the US and Europe. Ironically, that shows it’s culturally European, not North American, in being bewilderingly out of touch with the realpolitik around it and playing poker with no hand at all.

In the Middle East, it’s clear which way the energy-rich Saudis and UAE lean (to the US), but things are fluid as the Pentagon speeds up munitions deliveries to Israel while stating it will withdraw its troops from Syria, and White House envoy Witkoff offers Obama-esque framing of a proposed new nuclear deal to Iran.

Australia and New Zealand say they don’t have to choose… as following a PLA-Navy cruiser sailing round the Tasman, a Russian request for the use of an Indonesian airbase placing Oz in striking distance was rejected by Jakarta rather than any Antipodean ability to project power in their own backyard. So, who can do it for them, and for what quid pro quo? (Meanwhile, panic over and back to election policies targeting higher house prices for the main parties in Australia.)

US Vice President Vance gave a speech in which he came out as a Gaullist(!), arguing Europe should have helped the US see it was stupid to invade Iraq in 2003, and said it can’t be a ‘permanent security vassal’ of the US. Just an economic one?

Vance also stated he expects a “great” UK trade deal because President Trump loves the place. Yet the UK -- which just bailed out British Steel from a Chinese owner, then heard a minister propose it could be sold to another Chinese firm(!) -- saw PM Starmer agree to mirror EU trading standards which will clash with those the US will insist on in any US-Anglo deal. The British and Greenlanders apparently went to the same card school.

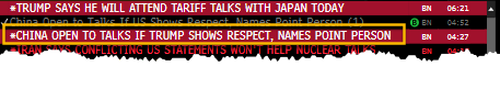

Meanwhile, the EU reportedly expects most US tariffs to stay as trade negotiations make little progress. Perhaps the US is expecting Europe to see things differently after others sign up, with Japan aiming for early results from its US trade talks starting today. That would be a US ace.

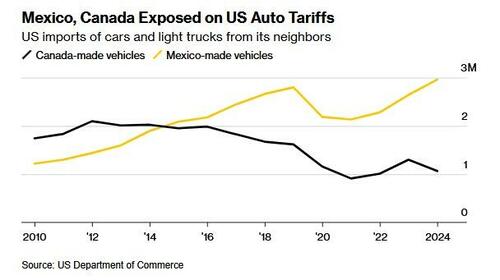

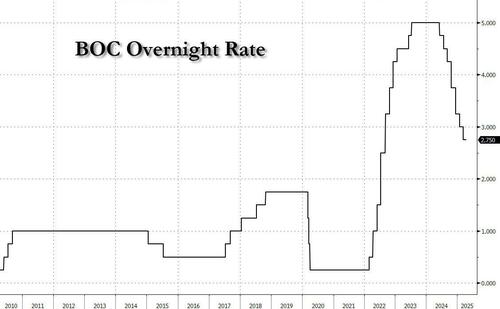

At the same time, Canada will now let automakers import US-assembled cars and trucks tariff-free if they preserve domestic manufacturing. This isn’t being heralded as a Carney “retreat” and “fold”, of course. But in economic statecraft terms, it’s clear Canada had, and has, no real choice.

On the other hand, China halted planned deliveries of Boeing planes and Hong Kong Post has stopped sending mail to the US… as the US launched a trade probe on critical minerals and placed export controls on Nvidia selling chips to China (how will they stop them getting there via transshipment?) while flagging a 21% tariff on Mexican tomatoes. That sounds like a salsa significant trade conflict ahead.

On the planes front, China can of course buy from Airbus – and increase US-EU trade tensions with it. Or Beijing can push forward the roll-out of its domestic COMAC planes – which may then mysteriously ‘struggle’ to get safety certification for flights to the US/West (**cough** non-tariff barriers **cough**)… and the skies will, like the Red Sea past and present, be parted.

Liberalising trade, yet still hitting markets, President Trump also signed an executive order directing the FDA to allow more states to import medicines directly from countries that sell them at lower prices, following the lead set by Florida buying from Canada in January 2024. With the US paying around 3 times more for branded medicines than other OECD members, this could bring down prices significantly. Of course, looming 25% tariffs run in the other direction while aimed at incentivizing the build-out of domestic production… presumably alongside other economic statecraft measures to explain to firms that “because markets” and three-times multiples are no longer how this will work ahead.

Moreover, underlining that what starts with tariffs and trade spreads to capital and other areas, Congressional Republicans are proposing legislation that would penalize holders of US financial assets for anyone from a country that imposes a “discriminatory” tax, like the Canadian —and proposed EU— digital services tax. A withholding tax of 5% would be imposed, rising by 5 percentage points for next three years to a maximum of 20%.

Overarching this all, a recently released White House statement from the ‘Endless Frontiers Retreat’ notes:

“American progress in critical technologies will make us the global partner of choice… [but] we must safeguard US intellectual property… [and] prevent rival nations from infiltrating our infrastructure and supply chains, as well as from embedding themselves in the infrastructure of our allies… [and] enforce export controls and other measures that keep American frontier technologies out of competitors’ hands… The Golden Age of American innovation is on our horizon, if we choose it… the task ahead of us is to adapt to new realities without destroying the American way of life or disinheriting the American worker. We seek, in the most basic terms, to secure our economy, restore our middle class, and uphold America as the planet’s best home for innovators.”

Can the US keep innovating and deregulating its way out of its current problems?

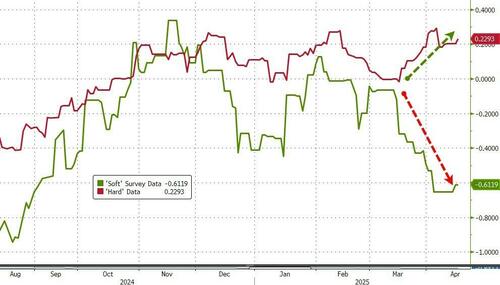

On the other hand, Chinese data showed Q1 GDP +5.4% y-o-y vs. 5.2% expected despite the q-o-q figure only being 1.2% vs. 1.4%, with retail sales 5.9% vs. 4.3% expected (even as imports were sharply lower!), industrial production 7.7% vs. 5.9% consensus, and property investment -9.9%. Of course, markets rallied despite this picture of a mercantilist policy that doesn’t add to global growth.

There are a lot of bitter herbs, and pills, for countries, industries, firms, individuals, and markets to swallow in having to choose between the US and China; and in getting economic statecraft, not ‘free markets’ policy, telling us what we ‘matzah’ do.

Regardless, it may be choose or be chosen, people.

Tyler Durden

Wed, 04/16/2025 - 11:40

Li Chenggang, a former assistant commerce minister and WTO ambassador

Li Chenggang, a former assistant commerce minister and WTO ambassador

House Speaker Mike Johnson (R-La.) speaks during a news conference after the House Republican Conference meeting at the U.S. Capitol Building in Washington on April 1, 2025. Anna Moneymaker/Getty Images

House Speaker Mike Johnson (R-La.) speaks during a news conference after the House Republican Conference meeting at the U.S. Capitol Building in Washington on April 1, 2025. Anna Moneymaker/Getty Images Click pic... buy seeds... take food supply into your own hands...

Click pic... buy seeds... take food supply into your own hands...

Recent comments