Welcome to the weekly roundup of great articles, facts and figures. These are the weekly finds that made our eyes pop.

Welcome to the weekly roundup of great articles, facts and figures. These are the weekly finds that made our eyes pop.

Lie Whopper Call Out

Naked Capitalism has a great call out on the never ending Wall Street drum to destroy social security.

People who write for right wing outlets live in an alternative reality. The piece that Michael Thomas pointed out to me from the New Criterion, “Future tense, V: Everybody gets rich,” by Kevin D. Williamson, belongs in a special category of its own in terms of the degree of disconnect it exhibits.

As much as I enjoy shredding articles, this piece has so much wrongheadedness in a compressed space so as to make a full bore exercise of unpacking it a a major exercise. Let’s deal with just this part, which is a neat one-two effort to tell us no one need safety nets like Social Security because even people making minimum wage can be rich.

Hedge Funds Hold Europe Hostage

Rely on ZeroHedge to dig out the obscure, ignoring the attitude. While the facts in their posts are undeniable, trying to imply hedge funds holding an entire global sector hostage is a good thing, well, what have you been smokin' people?

Hedge funds are taking on the powerful International Monetary Fund over its plan to slash Greece's towering debt burden as time runs out on the talks that could sway the future of Europe's single currency. The funds have built up such a powerful positions in Greek bonds that they could derail Europe's tactic of getting banks and other bondholders to share the burden of reducing the country's debt on a voluntary basis.

GAO Says TARP Profits Misstated by Treasury

Ya know that line which claims TARP, the great bank bail out, was profitable? Seems the GAO says Treasury isn't quite being honest.

Treasury and CBO project that TARP costs will be much lower than the amount authorized when the program was initially announced. Treasury’s fiscal year 2011 financial statement, audited by GAO, estimated that the lifetime cost of TARP would be about $70 billion—with CPP expected to generate the most lifetime income, or net income in excess of costs. OFS also reported that from inception through September 30, 2011, the incurred cost of TARP transactions was $28 billion.

Although Treasury regularly reports on the cost of TARP programs and has enhanced such reporting over time, GAO’s analysis of Treasury press releases about specific programs indicate that information about estimated lifetime costs and income are included only when programs are expected to result in lifetime income.

For example, Treasury issued a press release for its bank investment programs, including CPP, and noted that the programs would result in lifetime income, or profit. However, press releases for investments in AIG, a program that is anticipated to result in a lifetime cost to Treasury, did not include program-specific cost information. Although press releases for programs expected to result in a cost to Treasury provide useful transaction information, they exclude lifetime, program-specific cost estimates.

There are many examples by the GAO where costs are not included, but guess which name is among them. Why AIG of course!

Bernanke to Double Down

Bloomberg details how Bernanke is doubling down on the buying up of MBS, despite the fact it hasn't worked too well to prop up the housing market.

Since the Fed started buying $1.25 trillion of mortgage bonds in January 2009, the value of U.S. housing has fallen 4.1 percent, and is down 32 percent from its 2006 peak, according to an S&P/Case-Shiller index. The central bank is poised to buy about $200 billion this year, or more than 20 percent of new loans, as it reinvests debt that’s being paid off. Some Fed officials have said they may support additional purchases that Barclays Capital estimates could total as much as $750 billion

What's the lie here boys? Here comes $750 billion more in QE3, all to supposedly help....the economy. Right. We forgot, investors and banks are the econmy, oh yeah.

Dudley’s comments and the Fed study signal a greater likelihood of QE3, according to Ajay Rajadhyaksha, a Barclays analyst in New York, who has estimated it could involve $500 billion to $750 billion of mortgage-bond purchases over a year.

Costs of Unemployment

This is a must read post simply because it's showing when unemployment is high and sustained, the costs are greater than social, it all negatively impacts economic growth. Yes Virginia, workers are more than something to dispose of for those corporate cost reduction quarterlies.

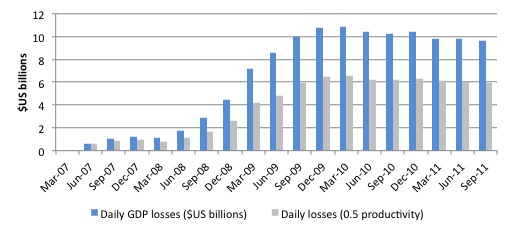

The daily GDP losses that the US economy is enduring as a result of the decline in economy activity below it previous peak are shown in the following graph. You can see that in the September-quarter 2011 these stood at $US9.7 billion per day.

Just say it to yourself – every day the US government is allowing $US9.7 billion to go down the drain in lost income just because they are too stupid to implement sensible direct job creation strategies.

Cutting Corporate Tax Rates Does Nothing

David Cay Johnston is quoting a Bush study to show lowering the U.S. corporate tax rate isn't going to do much.

Consider what President George W. Bush‘s Treasury Department said in a report in 2007: big countries, such as the United States, receive far less economic benefit from lower corporate tax rates than smaller countries do. For large countries, cutting corporate tax rates “would result partly in increased capital inflow and partly in lower world interest rates.”

While other large countries have cut their corporate tax rates since then, lowering the U.S. rate would just encourage other countries to go even lower. Since we are cutting spending in the very areas that build wealth – education, infrastructure and research – a corporate tax rate cut would increase the pressure for further cuts in those areas, making us poorer.

Callin' Out the Wall Street Journal

The latest conservative spin du jour is somehow claiming Federal worker jobs are just some sort of glorified welfare bloatware program. We beg to differ and so does Jeffrey Sachs:

Today's lead editorial, with its graph of "Obama's Growing Payroll," is a perfect example of how the WSJ misleads rather than informs. The gist of the editorial is that Obama is presiding over a massive increase of government, exemplified by the surge of civilian employees. The graph shows a striking rise of federal employment from around 1.875 million in 2008 to 2.1 million in 2011. (I reproduce this as Figure 1 below).

The Journal neglects the fact that today's 2.1 million workers is actually identical to the number of Federal employees in 1981 at the start of the Reagan Administration, 1989 at the end of the Reagan Administration, and 1993 at the end of the Bush Sr. Administration. The numbers went down slightly after that (by around 200,000-300,000 workers as of the late 1990s) with a decline in Defense Department civilian employees, a decline that was probably offset by the rise of private defense contractors (not included in the OMB tables). There is no long-term trend at all.

What economic fiction call out did you find this week? Plenty to choose from!

Comments

what happens if there is an Iran oil embargo?

Economist James Hamilton has a detailed post on what happens if there is an Iran oil embargo. We've pointed out oil shortages are highly correlated to recessions here too and Hamilton goes into some deep analysis.