CAAT CEO Derek Dobson Resigns, New Leadership Team Announced

James Bradshaw of the Globe and Mail reports CAAT CEO Derek Dobson resigns, agrees to repay $1.6-million vacation payout:

The CAAT Pension Plan is parting ways with chief executive officer Derek Dobson, who has agreed to repay a controversial $1.6-million vacation payout he received last year as he ends his nearly 17-year tenure at the helm of the plan.

CAAT said in a statement on Friday that “Mr. Dobson has tendered his resignation and will leave CAAT effective immediately” as part of a settlement agreement that “brings closure to his employment at the plan.”

Mr. Dobson was placed on administrative leave last month after concerns about his leadership and the board’s oversight of his actions caused upheaval in the senior ranks of the $23-billion fund, ultimately leading to a governance crisis that has prompted an overhaul of the plan’s management.

The terms of the settlement agreement were not disclosed.

“Both Mr. Dobson and the CAAT board of trustees acknowledge the importance of moving forward in a manner that supports the long-term health of the plan and the beneficiaries it serves,” CAAT’s statement said.

Mr. Dobson said in an e-mail that he is leaving “with deep pride in what we accomplished together,” and remains “passionate about strengthening retirement income security for Canadians.”

“There is more important life-changing work to be done,” he added.

CAAT is a multiemployer pension plan that expanded rapidly during Mr. Dobson’s tenure, from $4-billion of assets to more than $23-billion today. It serves Ontario’s colleges and more than 800 public- and private-sector employers, with about 125,000 members. The plan is also in a surplus position, with $1.24 for every dollar of expected pension obligations in the future.

Ana Pereira of the Toronto Star also reports CAAT pension plan CEO resigns, will repay $1.6-million vacation payout:

The CEO of CAAT pension plan has resigned and will repay a $1.6-million vacation payout he received in 2025.

On Friday morning, CAAT (Colleges of Applied Arts and Technology) pension plan announced in a news release that Derek Dobson reached a settlement agreement with the company after being put on administrative leave by the board of trustees last month.

“Both Mr. Dobson and the CAAT board of trustees acknowledge the importance of moving forward in a manner that supports the long-term health of the plan and the beneficiaries it serves,” CAAT said in the release.

The $1.6-million vacation payout was among concerns cited by three senior executives who abruptly left the organization in January, leading to a governance upheaval at the plan and several other leadership changes. Another concern was related to the CEO’s sanctioned relationship with a co-worker.

Corporate governance experts told the Star that the sheer amount Dobson received in lieu of taking vacation is “exceptional” and a “red flag,” and that secrecy surrounding his compensation threatens to erode trust in the company.

The non-profit pension plan, which manages the retirement dollars for 125,000 members (including Toronto Star employees), has launched a governance review, which is still underway.

“The independent governance review is progressing well,” said CAAT spokesperson Stephen Hewitt. “The board will provide an update following its conclusion.”

Dobson had been the head of CAAT since 2009, when the plan held $4 billion in assets. Today, the organization manages $23 billion.

“After nearly 17 years as CEO and plan manager of the CAAT pension plan, I am concluding my tenure with deep pride in what we accomplished together,” Dobson wrote in an emailed statement to the Star.

“I have been privileged to work alongside extraordinary people who shared a similar purpose of improving retirement income security for Canadians.”

In light of the three senior executive departures, the Ontario Public Service Employees Union (OPSEU), which appoints five trustees to the board, suspended former board chair Don Smith in January.

The union alleged that Smith and former vice-chair, Kareen Stangherlin, acted outside the policies and procedures of the plan and made decisions about the CEO’s compensation without informing the other members of the board.

Smith was subsequently fired and Stangherlin resigned. She previously told the Star that the accusations against her are not true.

Smith and Stangherlin did not immediately reply to the Star’s request for comment regarding Dobson’s resignation.

Also Friday, CAAT announced a new leadership team as part of the plan’s effort to restore trust. The plan is well-funded, with $1.24 in assets for every dollar of promised benefits.

Earlier today, the CAAT Board of Trustees announced departure of CEO and new leadership team:

- Derek Dobson to leave CAAT effective immediately and repay 2025 vacation payout

- New senior leadership team comprised of internal CAAT executives appointed

Toronto, March 6, 2026 — The CAAT Pension Plan (“CAAT” or “the Plan”) today announced the departure of CEO and Plan Manager Derek Dobson and unveiled a new senior leadership team to lead the organization.

Derek Dobson departureCAAT has reached a settlement agreement with Mr. Dobson that brings closure to his employment at the Plan. As part of this agreement, Mr. Dobson has tendered his resignation and will leave CAAT effective immediately, and repay his 2025 vacation payout to CAAT.

Both Mr. Dobson and the CAAT Board of Trustees acknowledge the importance of moving forward in a manner that supports the long-term health of the Plan and the beneficiaries it serves.

CAAT also thanks the Financial Services Regulatory Authority of Ontario for its constructive engagement as the Plan continues to strengthen its governance and oversight.

New leadership teamCAAT also announced a new leadership team to execute on the Plan’s strategy, restore stakeholder trust and continue to deliver on CAAT’s pension promise to its members and sponsors.

“While the Plan has recently undergone a period of significant change, I am proud that these five senior leaders are all existing CAAT employees who will drive stability and institutional continuity while leveraging their strong internal relationships to engage and inspire our teams as they serve our member constituents every day,” said acting CAAT CEO and Plan Manager Kevin Fahey.

The following five leaders will report directly to Mr. Fahey:

- Laura Foster, appointed interim Chief Financial Officer

- Jillian Kennedy, appointed Chief Operating Officer

- James Fera, appointed Chief Legal Officer & General Counsel

- John Baiocco, appointed Senior Vice President, Funding & Sustainability

- Stephen Hewitt, appointed Senior Director of Communications

Mr. Fahey will also continue to serve as the Plan’s Chief Investment Officer. A search for a Chief Human Resources Officer remains ongoing.

“On behalf of the Board, I’d like to thank Kevin for his strong leadership since his appointment as the Plan’s acting CEO and the impressive progress he has made in a very short period of time,” said CAAT Board of Trustees Chair Audrey Wubbenhorst. “The Board continues to focus on its work in the best interests of members and I would also like to express our gratitude to all of our stakeholders for their ongoing trust and confidence in the Plan.”

CAAT remains one of Canada’s most sustainable and well-funded pension plans. Its most recent independent valuations show the Plan at a 124% funded status, meaning that for every $1 of pension benefits CAAT has promised to members, the Plan has $1.24 in assets. With more than $23 billion in assets and over $6 billion in funding reserves, the Plan is well positioned to withstand market volatility, demographic change, and other risks.

About CAATEstablished in 1967, the CAAT Pension Plan is an independent, jointly governed plan that offers highly desirable modern defined benefit pensions. Originally created to support the Ontario college system, the CAAT Plan now proudly serves more than 800 participating employers in 20 industries, including the for-profit, non-profit, and broader public sectors. It currently has more than 125,000 members. The CAAT Plan is respected for its pension and investment management expertise and focus on stability and benefit security. On January 1, 2025, the Plan was 124% funded on a going-concern basis.

Learn more at: www.caatpension.ca.

For his part, Derek Dobson posted this message on LinkedIn which he also emailed to me and others earlier today:

After nearly seventeen years as CEO and Plan Manager of the CAAT Pension Plan, I am concluding my tenure with deep pride in what we accomplished together. When I joined CAAT in 2009, the Plan served 33,000 members and held $4 billion in assets and was in a funding deficit.

Today, CAAT supports more than 125,000 members across 800 employers in 20 industries nationwide, with assets exceeding $25 billion and over $6 billion in funding reserves to keep the pension plan secure indefinitely.

I have been privileged to work alongside extraordinary people who shared a similar purpose of improving retirement income security for Canadians.

I have deep appreciation for those who transformed CAAT into one of Canada’s most respected and innovative pension plans. Together, we launched internationally award‑winning programs such as DBplus and GROWTHplus, strengthened the Plan’s funded status, and most importantly helped members and employers across Canada meet their goals. I am grateful for the trust placed in me over the years and the many milestones we achieved together.

I want to thank the many colleagues, partners, and stakeholders who have made this journey so meaningful.

As I look ahead, I am excited to continue contributing to making Canada better for today and tomorrow. I remain passionate about strengthening retirement income security for Canadians. There is more important life-changing work to be done.

Alright, it's Friday, my week off went nowhere because there were important items to cover in the pension world (there always are).

My thoughts on the latest developments at CAAT Pension Plan.

Well, to be frank, I'm not surprised.

The writing was on the wall. I knew Derek Dobson's days were numbered, and he was asked to resign, which he did and they put the Plan first by agreeing to terms.

The headlines say he also agreed to repay his $1.6 million vacation pay that was wrongfully awarded to him by the former chair and vice-chair.

But the terms of the settlement were not disclosed, and I wouldn't be surprised if Derek Dobson negotiated a nice settlement upwards of $2-3 million to walk away cleanly.

That's fine. He spent 17 years leading the CAAT Pension Plan, accomplished a lot during that period, and deserves a fair settlement (in my opinion, all settlements should be made public).

To be brutally honest, for 17 years, Derek Dobson was CAAT Pension Plan, and that in itself was a problem because he was involved in every aspect of the Plan and was the public figurehead for it (there wasn't much succession planning there).

Members trusted him implicitly and it's a shame he's leaving the organization under these circumstances, but he also has a lot to be proud of and did leave it in great financial shape.

Now it's time for CAAT Pension Plan to turn the page under a new board of directors and a new leadership team.

I've said it before, Kevin Fahey is going to make an outstanding CIO, and I'm confident in his ability to assume a larger responsibility and also act as CEO and Plan Manager at this critical juncture.

More importantly, CAAT's Board has full confidence in him to assume this huge responsibility.

Of course, it goes without saying that Kevin Fahey a lot on his plate. He really needs to manage his time and objectives properly if he wants to continue growing CAAT's membership and delivering solid long-term returns.

That means the people who now report to him on the investment, finance, and other key areas need to also step up to the plate and support him, now more than ever.

His first job is stability and focus on riding out this turbulent time at CAAT and the markets.

Once the dust settles, he can focus on other objectives like growing the membership.

But first focus on stability, stability, and stability; the rest will fall into place.

What happens to the three senior execs who departed the organization after informing the Board of their concerns?

Unfortunately, they're gone, not coming back. They are probably negotiating their own settlements or have already done so (again, details are not disclosed).

The same goes for the employee who was in a relationship with Derek Dobson, she was placed on administrative leave and she's probably also negotiating her settlement.

And what about the independent governance study that CAAT's Board commissioned?

That will eventually be made public and I'm looking forward to reading the findings.

Whatever the findings, however, it's time to put this governance crisis behind CAAT and focus on the future.

This is an important pension plan in Canada, and it has a very bright future.

On that note, wish everyone a great weekend and I will leave you with some market clips.

Below, the CNBC Investment Committee debate how to play the volatile markets and whether investors should buy the dip or not (from March 5th)>

Next, Dan Niles, Niles Investment Management founder, joins 'Power Lunch' to discuss the broader market sell-off, recent software stock performance and much more (March 5th).

Third, the CNBC Investment Committee debate what $90 Oil means to the market and how you should navigate it (March 6th).

Fourth, Jan Hatzius, chief economist at Goldman Sachs, joins 'Squawk on the Street' to discuss the latest jobs report, market themes, and more.

Fifth, Rick Rieder, CIO of global fixed income at BlackRock, says “the economy and employment are quite different conditions,” as he reacts to the February jobs report and explains why he still sees 2.5% - 3% US economic growth in the first quarter.

Lastly, concerns have been bubbling up over the $1.8 trillion private credit market in recent weeks, with investors spooked in part by the risk of artificial intelligence on some borrowers and worries about valuations. Last month, a Blue Owl Capital Inc. fund opted to halt quarterly redemptions and started selling assets to return money to investors.

This week, Blackstone Inc.’s flagship private credit fund allowed investors to redeem a record 7.9% of shares. Worries have mounted more broadly in credit markets following a spate of high-profile corporate collapses, most recently of UK-based Market Financial Solutions Ltd. Banco Santander SA Executive Chair Ana Botin likened hits from bad loans to jellyfish stings, after her bank was reported to be exposed to the mortgage finance firm. JPMorgan Chase & Co. CEO Jamie Dimon has spoken of failed corporate borrowers as “cockroaches,” suggesting there could be more.

Bloomberg News Chief Correspondent for Private Capital Davide Scigliuzzo joins Bloomberg Businessweek Daily to discuss. He speaks with Carol Massar and Tim Stenovec. With record fundraising after the 2008 financial crisis, direct-lending vehicles have loosened their underwriting standards and are due for a stress test, according to a Pacific Investment Management Co. analysis of private-credit risks.

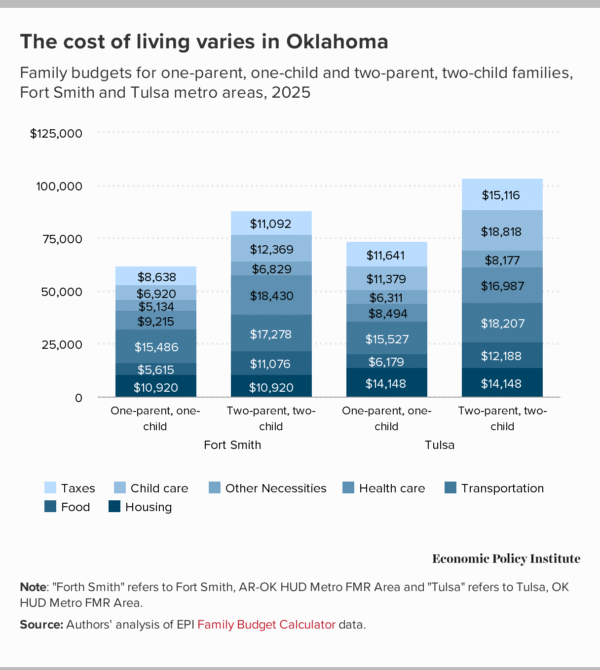

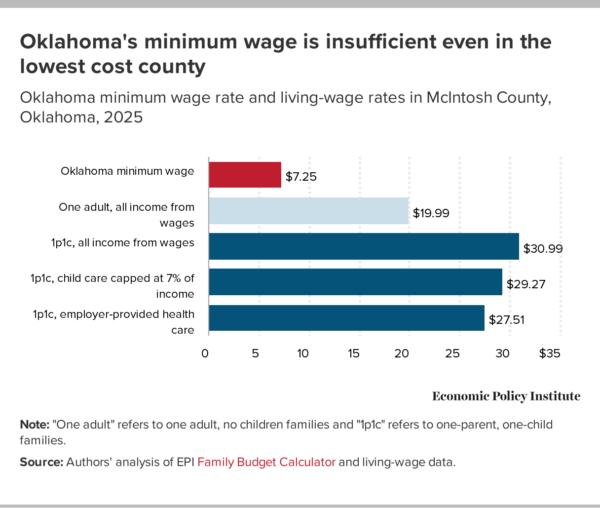

The Family Budget Calculator can be used to calculate living wages

The Family Budget Calculator can be used to calculate living wages

Oklahoma needs a higher minimum wage

Oklahoma needs a higher minimum wage

Recent comments