Key takeaways

- EPI’s updated Family Budget Calculator shows how much income it takes to afford basic expenses in every metro area and county across the United States in 2025.

- The Family Budget Calculator can be used to assess a living wage level and shows that states like Oklahoma need a higher minimum wage. The state’s minimum wage falls short by over $12 an hour in meeting a one-person budget in the state’s lowest cost county.

- Voters in Oklahoma will have the chance to raise their state’s minimum wage this summer, which will help low-wage workers better achieve a decent standard of living.

- As of 2025, there is no county or metro area in the country where a minimum-wage worker is paid enough to meet the requirements of their local family budget on their wages alone.

Now updated with 2025 data, EPI’s widely cited Family Budget Calculator (FBC) shows what it takes to make ends meet for different family types in all counties and metro areas in the United States. For more than 20 years, we have calculated family budgets for basic expenses like housing, food, health care, child care, transportation, other necessities, and taxes. In doing so, we create a more location-specific and realistic assessment of cost of living than traditional poverty thresholds.

We use government-provided data where possible and stay up to date with changes in policy and data availability. Because of this, and due to related changes in methodology, we don’t recommend comparing budgets over time. For more details on the construction of EPI’s family budgets and all of the datasets we use, see the full methodology. For a video tutorial on how to use the FBC, see here. The full dataset is downloadable here.

Example case: Most and least expensive metro areas in Oklahoma

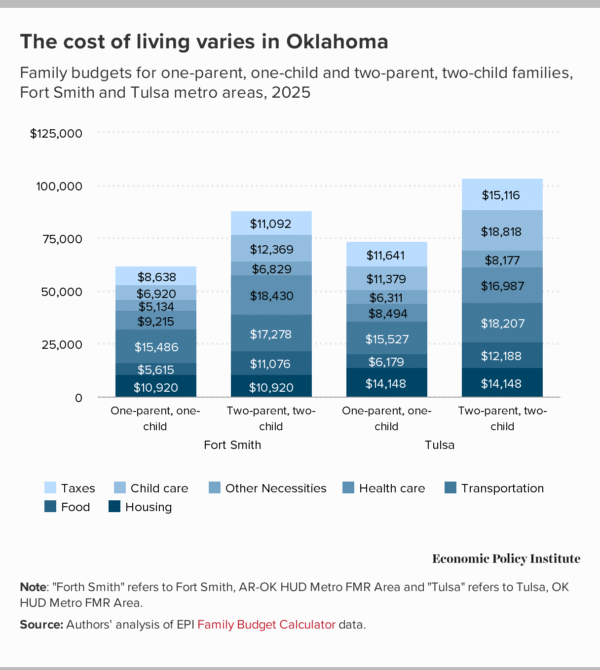

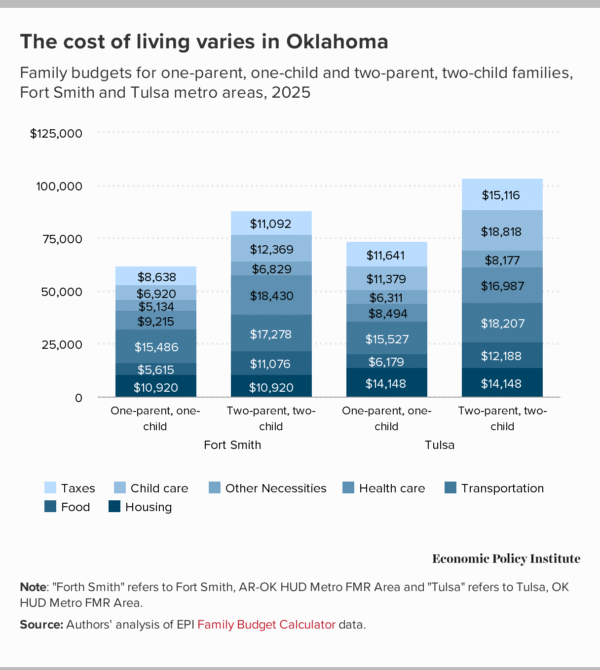

Using family budgets in Oklahoma as an example, Figure A compares each budget component for one-parent, one-child and two-parent, two-child families in the state’s least expensive (Fort Smith) and most expensive (Tulsa) metro areas. Technically, the city of Fort Smith is located in Arkansas, but the metro area crosses into Oklahoma.

Costs for a one-parent, one-child family budget vary from $61,928 in Fort Smith to $73,678 in Tulsa, with housing and transportation being two of the largest costs. In areas with limited access to public transit, the costs of buying, maintaining, and driving a car can be a large burden.

Food, health care, and child care are considerably more expensive for larger families. For a two-parent, two-child family, the total cost of affording a basic standard of living ranges from $87,994 in Fort Smith to $103,642 in Tulsa. The largest difference between Fort Smith and Tulsa is the cost of child care, which is 50% more expensive in Tulsa.

Figure A

The Family Budget Calculator can be used to calculate living wages

The Family Budget Calculator can be used to calculate living wages

The FBC has been cited by living-wage advocates, private employers, academics, and policymakers who are looking for comprehensive measures of economic security. EPI’s family budget tool is also frequently used to gauge the adequacy of labor earnings, and we are often asked how to construct a living-wage standard from our family budget numbers. Doing so requires making choices and assumptions about how a family’s needs could or should be met that will result in different “living wage” values. For instance, health care expenses could be covered primarily by families, employers, or public programs (such as Medicare or through premium subsidies in the health insurance marketplace). We provide a user’s guide to translate our FBC data into living wages.

The FBC can be used to roughly calculate the hourly wage necessary to meet a family budget through labor market income alone. For a full-time, year-round worker providing for themselves and their family, we simply divide the required budget by 2,080 (40 hours a week multiplied by 52 weeks a year) to get an hourly wage equivalent. The full dataset of living wage options is downloadable here.

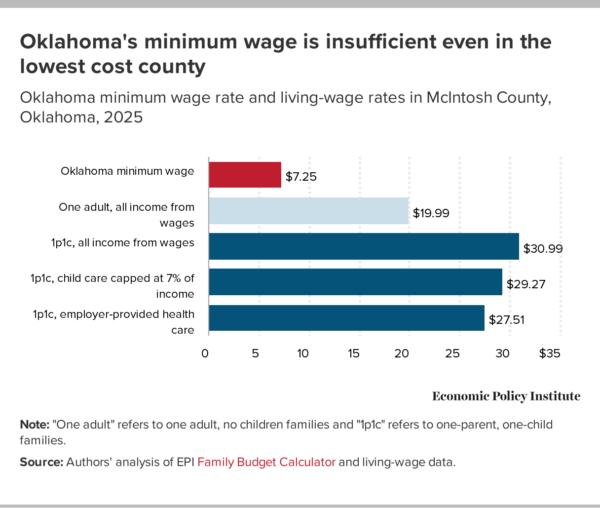

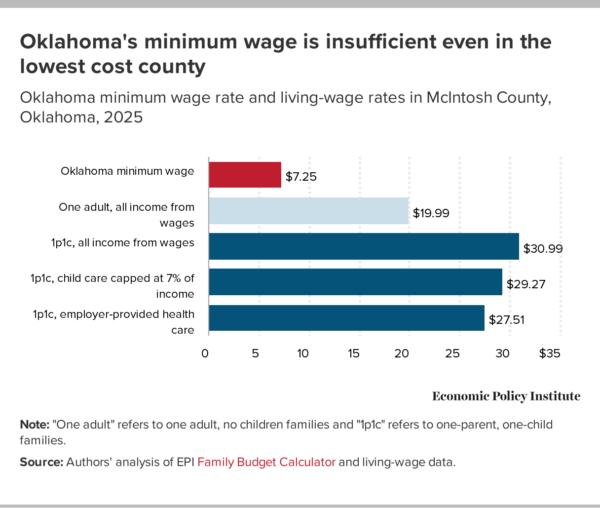

Example case: McIntosh County

McIntosh County—located in Muscogee (Creek) Tribal Jurisdiction—is the lowest cost county in Oklahoma for single adult households. Figure B shows that a full-time, year-round adult worker without children would need to be paid $19.99 per hour to meet the requirements of their $41,577 budget to attain a modest yet adequate standard of living. The current minimum wage in Oklahoma—$7.25 an hour—falls short by $12.74 per hour, or $26,500 annually. In other words, minimum wage workers are paid less than 40% of what they need to afford to live, even in the least expensive county in Oklahoma.

One common benchmark for setting living wages is that an adult working full time should be able to support themselves and one child. In McIntosh County, a worker with one child would need to be paid $30.99 per hour to afford an annual budget of $64,456. This means that Oklahoma’s current minimum wage is $23.74 per hour lower than a living wage, or almost $49,400 annually.

These basic calculations assume that all income comes from wages, but wages are not the only resource available to families. If an employer offers health insurance or the state subsidizes child care, the wage needed to meet a basic family budget would be reduced, as shown in Figure B. Conversely, if reasonable savings for retirement, college, or emergencies are considered critical budget items, then the living wage required would be even greater.

Figure B

Oklahoma needs a higher minimum wage

Oklahoma needs a higher minimum wage

Our Family Budget Calculator highlights the need for a higher minimum wage in Oklahoma. The state still follows the dismally low federal minimum wage, which Congress has not updated since 2009 despite 44.1% cumulative inflation since then. At $7.25 per hour, the federal minimum wage is not high enough to keep workers out of poverty, much less provide a modest yet adequate standard of living.

It’s time for Oklahoma to pass a minimum wage increase that can support workers and their families across the state, and residents are ready for the change. In 2024, more than 157,000 Oklahomans signed a petition to request a statewide election to vote on whether to raise the state’s minimum wage. Although organizers collected enough signatures well before the deadline to be placed on the November 2024 ballot, a lengthy certification process delayed State Question (SQ) 832’s approval. In September 2024, Oklahoma Governor Kevin Stitt delayed the vote by nearly two years and scheduled it for June 2026.

If voters pass the measure this summer, SQ 832 will increase the minimum wage to $15 per hour by 2029, starting with an increase to $12 per hour in 2027. The legislation also mandates annual inflation adjustments starting in 2030 and extends the wage floor to historically excluded categories of workers such as tipped workers, farmworkers, part-time employees, domestic workers, and feed store employees.

According to EPI’s 2024 estimates, this higher minimum wage would benefit 320,000 Oklahoman workers (directly benefiting the more than 200,000 Oklahomans who are paid less than $15 per hour and indirectly boosting wages for another 119,000 workers.) Low-wage workers are not just teenagers working fast-food jobs on the weekends; nearly 82% of affected workers are age 20 or older and more than half (51.3%) are working full time. Women in particular are more likely to work at or near the minimum wage, making up almost two-thirds (62.9%) of affected workers.

Workers of color are also disproportionately more likely than white workers to work low-wage jobs: while they make up about one-third (34.8%) of the Oklahoma workforce, they are nearly half of the affected workforce (48.7%). This disparity is the outcome of decades of violence and discrimination. For example, the destruction of Tulsa’s Black Wall Street brought an end to a vital center for Black economic advancement. Higher wages, alongside strong nondiscrimination laws, are necessary to rectify this inequality.

Oklahoma is one of the country’s poorest states, with one in seven residents (14.9%) living in poverty and nearly one in five (18.9%) children living at or below the federal poverty line. Passing SQ 832 and raising the minimum wage would alleviate poverty, help workers and their families, and boost Oklahoma’s economy. Without it, many Oklahomans will continue to struggle to afford basic necessities as costs of living grow.

But it’s not just Oklahoma—the Family Budget Calculator shows that nowhere in the country can a minimum-wage worker meet the requirements of their local family budget on their wages alone. Raising wages is a critical, but often overlooked, component of solving the affordability crisis. EPI’s Family Budget Calculator is a vital tool for understanding the wages and resources that are needed for families to afford the true cost of living across the United States.

The Family Budget Calculator can be used to calculate living wages

The Family Budget Calculator can be used to calculate living wages

Oklahoma needs a higher minimum wage

Oklahoma needs a higher minimum wage

Recent comments