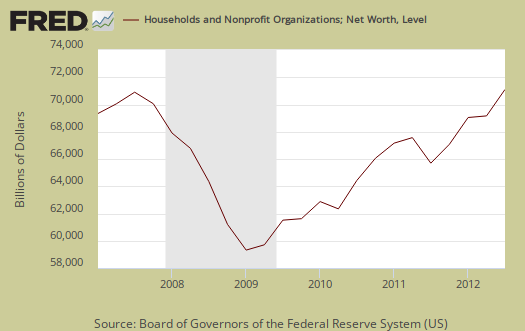

The Q3 2012 Federal Reserve's flow of funds report shows a select few gained handsomely in wealth. Household wealth increased $1.7 trillion to $62.67 trillion in Q2 2012. The gains were in stocks, $524.4 billion worth, mutual funds by $282 billion and real estate values increased. This isn't average or median household wealth as only about 54% of Americans own any stock at all, 44% mutual funds and the homeownership rate was 65.5% for Q3. Below is a graph of annual household net worth and notice the Great Recession wealth wipe out in the below graph.

Household net worth—the difference between the value of households’ assets and liabilities—was about $64.8 trillion at the end of the third quarter of 2012, $1.7 trillion more than at the end of the second quarter. In the third quarter, the value of corporate equities and mutual funds owned by households expanded $800 billion and the value of real estate owned by households increased about $370 billion.

Home equity was $7.714 trillion, an increase of $386.9 billion from Q2. Owner's equity as a percentage of real estate increased from 43.4% to 44.8% in Q3. Below is the graph of homeowner's equity (from table B.100, line 49).

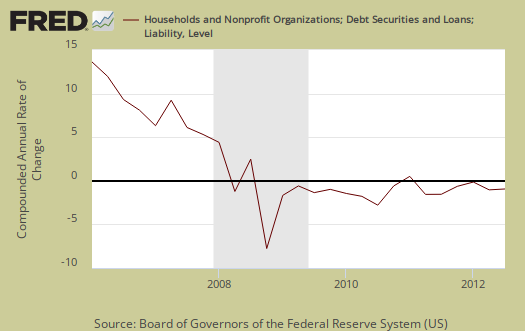

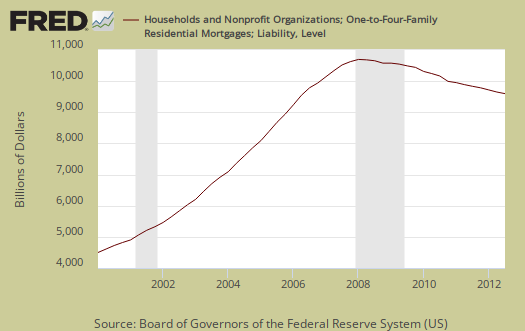

Household debt decreased at a -2.05% annualized rate and was $12.868 trillion at the end of Q3. Consumer credit increased $29.3 billion or 4.4% at an annualized rate. Home mortgages declined by another annualized -3.0% or -$72.9 billion. Household debt has been declining since Q2 2008. Believe this or not, increases in household debt are taken as a positive economic sign we we little people are then spending more, except for those of us who have to make the payments.

Below are home mortgages. Less mortgage debt doesn't mean people paid off their loans, it means people lost their homes in foreclosure or sold them, short. It can mean people nowadays potentially cannot afford a mortgage. It also can mean people are waiting to buy a home.

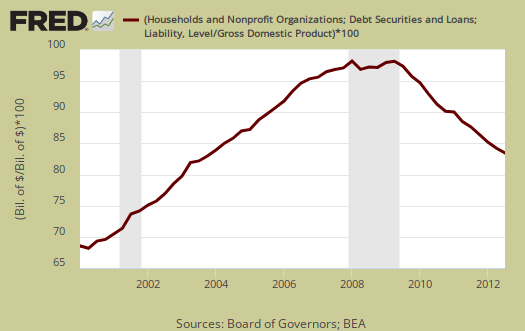

Below is overall Household debt to GDP, as ratios typically used by the IMF. While we see a healthy decline, it's still an astounding overall percentage of 81.5%.

Nonfinancial business debt increased 4.46% on corporate bonds outstanding and this is because interest rates are free money. This is actually a good sign as shown in the below graph of the annualized percent change of business debt against the gray bars, which mark recessions. Businesses do not take on more debt in recessions.

Federal Debt rose 6.36% for Q21 and the flow of funds says that's half the average rate of the past four quarters. Below is a scary graph showing Federal debt as a percentage of GDP over time.

Total domestic debt, which is household, government and business increased 2.46% from Q2 and is 100 times larger than U.S. GDP ($15.8 trillion annualized, quarterly debt also annualized to create ratio figures from Table D.3).

The below summary figures are heavily rounded and not annualized. The flow of funds is a very messy report, with some figures annualized, others rounded previously and some percentages concatenated to the nearly quarterly percentage point. Additionally some figures are seasonally adjusted while others are not.

At the end of the third quarter of 2012, the level of domestic nonfinancial debt outstanding was $39.3 trillion, of which household debt was $12.9 trillion, nonfinancial business debt was $12.1 trillion, and total government debt was $14.3 trillion.

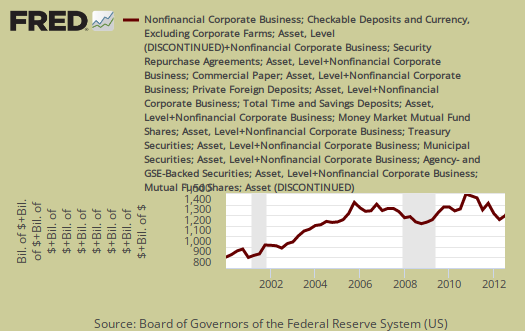

Corporate cash is now $1.737 trillion, an increase from Q2 of $43.9 billion. That's a 10.8% annualized increase in corporations just sitting on money they could be using to hire and invest. Corporations are still sitting on a boatload of cash, at record highs, as shown in the below chart which adds up the flow of funds elements which comprise corporate cash.

The flow of funds is impossible to read and over 100 pages. The tables to zero in on are the balance sheets, B.100 - Households and Nonprofit Organizations and B.102 - Nonfinancial Corporate Business.

You might also be interested to know exactly what is meant by businesses are sitting on a buttload of cash that the press reports but does not explain.

The report from which corporate cash comes from is incorporated businesses which are not financial or farms. That excludes insurance companies too. Then, liquid assets are also referred to as cash. Why? Because this stuff is easily turned into currency or directly represents currency, such as time deposits. What does the Fed classify nonfarm, nonfinancial businesses' assets as liquid? The list is: municipal securities and loans, commercial paper, checkable deposits and currency, total time and savings deposits, money market mutual fund shares, total U.S. government securities, private foreign deposits, federal funds security repurchase agreements, and mutual fund shares.

In the flow of funds report, you can find total liquid assets on line 41, L.102 Nonfarm Nonfinancial Corporate Business table.

The flow of funds is different from the Census report on households.

Here is last quarter's overview, only some graphs revised.

Recent comments