"The Church at the time of Galileo kept much more closely to reason than did Galileo himself, and she took into consideration the ethical and social consequences of Galileo's teaching too. Her verdict against Galileo was rational and just, and the revision of this verdict can be justified only on the grounds of what is politically opportune."

- Cardinal Ratzinger (now Pope Benedict XVI), 1990

You would think in today's world that people would accept that simple math isn't something you debate. You would think that people would accept that 2 + 2 = 4 and then move on.

But that's not how the world works. Galileo failed when he tried to argue physics with theologians. The problem today isn't physics - it is simple addition - and the theologians of today are political.

"How many fingers am I holding up, Winston?""Four."

"And if the party says that it is not four but five -- then how many?"

- George Orwell, 1984

The iron-clad law of economics is supply and demand. It doesn't matter what other factors are involved and what your political agenda might be, if supply exceeds demand (or visa versa) then things get out of balanced and prices collapse (or skyrocket) until supply and demand come back into balance.

This is the framework of how things behave on this planet and it cannot be changed by any political decree. This law has the same moral and political properties as the law of gravity.

It's not a matter of right and wrong. It is simply the way the world works.

Another way that the world works is that people have an uncanny ability to avoid seeing the obvious for extended periods of time if it conflicts with their preconceptions. Governments, and the people who run them, know this to be true and use it against us.

The obvious in this case is government spending.

Trying to make 2 plus 2 equal 5

“The first panacea for a mismanaged nation is inflation of the currency; the second is war. Both bring a temporary prosperity; both bring a permanent ruin. But both are the refuge of political and economic opportunists.”

- Ernest Hemingway, “Notes on the Next War: A Serious Topical Letter” , 1935

All sorts of justifications have been made for the massive federal deficit spending. People with a superficial understanding of Keynesian economics think that all deficit spending in a depression is good.

These people ignore a) Keynes advocated targeted countercyclical deficit spending designed to increase demand, not just any deficit spending, b) Keynes' theories were proven inadequate by the stagflation of the 1970's, and c) deficit spending is what got us into this mess. Is it logical to think that more of the same can be expected to get us out of it?

On the other end of the curve are the opportunists, who look at federal deficit spending as an opportunity to make a profit. These people ignore the damage done to the economy and currency by runaway deficits far outweighs any potential profits.

These discussions ignoring the glaring truth of what we are facing - the sheer size of the deficit spending precludes it from working.

We are failing to see the forest through the trees.

If this was a horror movie we would be guilty of worrying about a relationship problem instead of focusing on the axe murderer in the next room. If this was a car crash we would be guilty of worrying about our auto insurance rather than focusing on surviving the crash.

The Big Picture: 2 plus 2 still equals 4

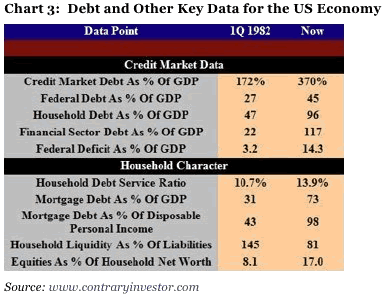

The country was more than 200 years old before America's public debt hit $1 Trillion. It hit $6 Trillion in early 2002, and then $10 Trillion in 2008.

By the end of this year it will climb over $13 Trillion. The CBO estimates nearly $10 Trillion in new debt by 2019. In economics this trend is considered "parabolic", and all things that go parabolic are unsustainable.

It begs the question - where will the money come from?

Sometimes people ask that question, which is a very good question, but stop there.

An even better question to ask is - is there enough money?

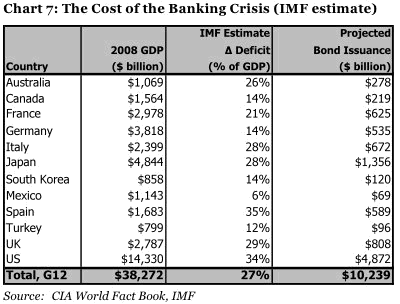

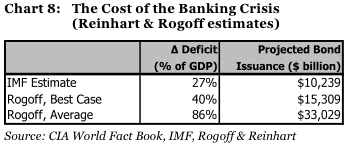

The IMF, which has repeatedly underestimated the economic crisis, has produced some numbers which are scary in and of themselves.

Fortunately, Carmen M. Reinhart and Kenneth S. Rogoff have studied dozens of historical examples since 1800 and tried to answer that question by basing it what that history teaches us.

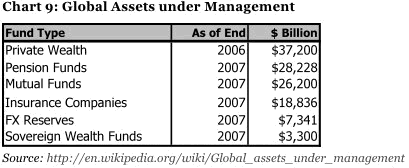

If you are like me, $33 Trillion are so far above my ability to imagine that they may as well be using another language. That's why it is important to put things into perspective by comparing this number to other asset classes.

If you understand the significance of these numbers you have arrived at the "Oh, shit" moment. The amount of money required to bail the world out of the current economic crisis, if this crisis plays out at a historical average, is nearly equal to all the private wealth currently in the world.

To repeat the obvious, this doesn't add up. What about the capital needed to fund the businesses of the world? What about the capital needed for private consumption?

Britain is trying to bail out their economy. The Euro nations are bailing out their economies. So is China and Japan. There isn't enough capital in the world for all these bailouts.

Kyle Bass from the US fund Hayman Advisors said the markets were choking on debt."There isn't enough capital in the world to buy the new sovereign issuance required to finance the giant fiscal deficits that countries are so intent on running. There is simply not enough money out there," he said. "If the US loses control of long rates, they will not be able to arrest asset price declines. If they print too much money, they will debase the dollar and cause stagflation.

"The bottom line is that there is no global 'get out of jail free' card for anyone", he said.

The numbers simply don't add up. Everyone can't do this at the same time. Two plus two are not going to equal five now matter how hard you try to make it happen.

To argue otherwise is to tilt at windmills.

There is no "what if". The odds of all this deficit spending getting financed at an affordable rate is zero. It's simply not going to happen. You can close your eyes and cross your fingers. You can pray to your gods. You can chant "I believe" all you want, but at the end of the day the laws of supply and demand will win as surely as Galileo's physics.

Once you wrap your mind around this horrible fact, you realize that we are in for a world of hurt.

There are only three possible outcomes: 1) interest rates skyrocket to crushing levels, or 2) the central banks print money on a massive scale, or 3) some combination of the first two choices.

What this means

How exactly this crisis plays out is open to debate, but we are starting to see the opening innings.

Government securities declined even as today’s auction of a record-tying $35 billion in five-year notes drew the most demand in three months from a group of investors that includes foreign central banks.

Demand for treasuries was huge today, yet the price of treasuries fell anyway. This pushed the yield curve on treasuries to a new record.

What does that mean? Several things.

Despite massive foreign central bank buying, it still couldn't absorb the even more enormous supply of new debt being issued by the treasury. The law of supply and demand remains.

People holding a 10-year treasury note have lost 10.4% of their value since the beginning of this year. Holders of a 30-year note have lost 27.5% of their value.

“There remains the lurking concern that foreign demand is focusing on the short end, leaving the back end of the curve vulnerable,” Alan Ruskin, a global strategist at RBS Securities Inc. in Greenwich, Connecticut, wrote in a note today.

In other words, our foreign creditors are only buying short-term treasury debt and leaving the long-term treasury debt to the whims of the market. That's why the Federal Reserve has been forced to purchase $130.5 Billion in treasury debt so far this year, about one out of every six dollars of new debt issued.

Why would foreigners not want our long-term debt? Because they don't believe that we will pay it back in dollars of equal value.

Suspicions that Washington is trying to engineer a stealth default by letting the dollar slide could cause patience to snap, even if Asian exporters would themselves suffer if they harmed their chief market.

Even more concerning, the government isn't even half-way through the new debt issues of fiscal year 2009. The longer this goes on the more saturated the credit market of the world will get with dollar-based debt.

Long before we get to 2015, let alone 2019, I think the bond markets will have called a halt to $1 trillion deficits. There will be a real crisis. The deficits will not be funded at anywhere close to an interest rate that will not break the budget. Taxes will get raised beyond what they were in the Clinton years.

Watch the bond market. Rates should be going down, not up. The bond market is telling us the deficit simply can't be financed down the road.

Higher interest rates, particularly on the long-end of the curve, will push up mortgage rates. If the Fed is forced to raise interest rates, that will effect the short end of the curve. Rising interest rates on a nation with little savings and high debt levels is deadly.

Higher interest rates aren't the only danger of these massive deficits. The dollar index has fallen 11% since early March when the Federal Reserve announced that it would be monetizing treasury debt.

The last fallacy being pushed that supports the "deficits are good" crowd is that we are suffering from deflation, and deficits are the way to combat it. With deflation we don't need to worry about a falling dollar or rising interest rates.

But the truth is that the deflation scare is already over.

With the S&P up 23% from March 2009 lows, gold up 23% from October 2008 lows, and oil up 42% from December 2008 lows, we bid farewell to the “deflation” that barely was. We’d make the farewell fond but it wasn’t around long enough for us to get intimate.

In fact economists around the world are calling for higher inflation as a way of getting out from under our debt burden. Can the Fed actually do that? Fed Chief Ben Bernanke certainly thinks so.

The conclusion that deflation is always reversible under a fiat money system follows from basic economic reasoning...Like gold, U.S. dollars have value only to the extent that they are strictly limited in supply. But the U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost. By increasing the number of U.S. dollars in circulation, or even by credibly threatening to do so, the U.S. government can also reduce the value of a dollar in terms of goods and services, which is equivalent to raising the prices in dollars of those goods and services.

For those of you who don't understand what Bernanke just said above, he essentially means that the Fed can create such an unlimited supply of dollars that will devalue every other dollar in existence to the point that deflation will never be a problem. It'll make every owner of dollars poorer, but it will stop deflation.

Comments

Keynesian

One thing I appreciate in your post is that this Stimulus is simply not following Keynesian economics. Keynesian was all about domestic income from temporary government expenditures, temporary government spending and also was not applicable when the economy was fully functioning.

What we got was not directly connecting Stimulus to U.S. citizen income by any stretch, i.e. they did not tie jobs to U.S. citizens, keep the expenditures within the U.S. etc.

Erie Canal an example of 2+2=5

I agree with you, Rob. Intelligent decifit spending can grow the economy out of a recession, to be repaid during an expansion.

Intelligent spending on infrastructure is the best way to do that. For example, why did NYC become the premier city on the east coast? Because it was the only city on the ocean that had access to the Great Lakes and midwest without having to go over a mountain range. The building of the Erie Canal, linking the Mohawk River with Lake Erie, meant that goods could be transported at tremendously less cost than going over mountain passes. The tolls charged paid for the outlay in about 5 years, and the rest was, well, history.

It is important to separate temporary countercyclical deficit spending (the "stimulus package") from the financial bailout to financial firms. The former is proper Keynesian stimulus. The latter is simply an inflationary giveaway to the financial class (you may recall, I wrote an essay about Hyman Minksy and how the financial Bailout will harm average Americans even if it works). So I think G is right about the second point.

infrastructure, public works vs. current Stimulus

To clarify, all of the infrastructure spending is dead on, although I question if the best projects are/will be selected. Why I rail against the Stimulus itself is the tax cuts and more importantly how the money is going offshore and assisting in sending jobs offshore. I believe the projected jobs were 25% I.T. and IBM is grabbing those contracts, all the while they are offshore outsourcing them.

Same problem with other aspects of these projects and that defies Keynes for it was supposed to be domestic income exclusively.

That would make yet another nice post, just how wise some of the infrastructure projects which have enabled major commerce have happened throughout U.S. history, esp. in the 1930's etc. I mean right now cities and states are busy selling and leasing these things to foreign nations and private sector.

Well said, sir

So well said, Mr. Oak, so well said. As you mentioned, Keynes was about using government spending to tweak an economy, to rev up its economic engine.

Of course, the "economic engine" of the USA has been, insanely, financialization, also known as financial "engineering."

One of the factors (it's important to emphasize "one of") leading up to the Great Depression (c. 1930) was over-production - that is, over production of real goods.

Today's over production is the "over production" of nonreal goods -- debt-based securities and other quasi-financial instruments -- formerly known as JUNK PAPER, JUNK BONDS, and so on.

Obviously to us thinking people, such over production enriches a select few, while scamming the rest of us.

When the Group of Thirty began promoting the adoption of credit derivatives back in the early '90s, either they were all financial geniuses or crooks - and given the obvious results -- and how they enriched themselves and their cronies to the detriment of the rest of us -- they were, and still are, crooks.

With the bailouts going to that select few, to further offshoring American jobs, further commodities speculation and lobbying against anything constructive to the American worker, they are continuing to disassemble the American economy -- as those stats clearly prove.

well said midtowng too

One of the hopes for EP is we can zero in on the details and point out things like this Stimulus is not real Keynesian economics. We get into these broad based rallying cry philosophies that in terms of effectiveness...well, aren't.

i.e. "that's socialism", "that's the government controlling your health care", "that's conservatism", etc.

and one of the very good call outs, besides the incredible, raging, no oversight really, beyond belief debt going on...

is how keyword Stimulus is painted as Keynesian, but it's not actually.

It's kind of like "free trade". U.S. trade policies simply do not follow the theory and the means of production, i.e. people are not supposed to be mobile in the actual equations. Yet you'll hear "free trade" and "free trade is bad" and all of this rhetoric yet few have sat down and tried to read a trade agreement or understand the basic theory.

I hope we has open minded thinking lay people (and our economists and economic tourists) can discuss, point out, in reasonable discourse, on this site.

The Nation

Has a pretty scathing article on the financial crisis "government response". The Greatest Swindle Ever Told.

A Black Zil At 2:00 AM, Perhaps?

"For those of you who don't understand what Bernanke just said above, he essentially means that the Fed can create such an unlimited supply of dollars that will devalue every other dollar in existence to the point that deflation will never be a problem. It'll make every owner of dollars poorer, but it will stop deflation."

Yeah, but that's only before the Revolution.

Bernacke's arrogance is absolutely stupifying. What is frequently forgotten by bacteria of his variety is the eternal verity that life is what happens to you while you're making plans. This man has been wrong about almost everything important he's had to confront over the last few years and here we find him pontificating? Better a show trial, a confession and quick sentencing.

As to Pope Benedict's evaluation of the Galileo verdict some centuries ago, the presuppositional overreach of both sides, while at the time perhaps "rational", must today be accepted as demonstrably untrue, which was the point of his remark when it was made. Had the Church then recognized moral reasoning as more properly the context for science and not its substitute and science the fact that its very underpinnings are derivative and not unsituated, much harm could have been avoided. Only among the emotionally underdeveloped and starkly uninformed are these truths largely ignored today.

Lavrenti Beria read this

I notice you are leaving comments a lot. So can I suggest going to the left hand corner, creating an account and joining us?

The CAPTCHA is bypassed and you can then track your comments and see who has replied to you. Makes it much easier to have a conversation and discuss.

Michael Hudson's prediction

Interesting how Michael Hudson, quite some time ago, exactly predicted what Bernanke would both say and do.

Using physics to argue politics through theology

Was Galileo's error. He wasn't jailed for saying that the earth goes around the sun. He was jailed for calling the Pope an idiot.

I fear we as economists- whether strictly amateur like me or professional, like Paul Krugman- are in a similar boat. We're arguing math and reality against politics and faith- and calling our opponents idiots, while absolutely true, is getting us nowhere.

What we need, is to start coming up with some solutions that work within the system, instead of trying to change it. This is hard- because the system has been designed, whether on purpose or by accident, to utterly deny us the ability to come up with solutions.

-------------------------------------

Executive compensation is inversely proportional to morality and ethics.

-------------------------------------

Maximum jobs, not maximum profits.

it's fun to call people idiots

not so fun to toil away at some policy, craft a solution to then be called an idiot.

I disagree, but not in a way that makes the task any easier.

The current system is the problem. But entrenched systems are not changed by intellectual critique, they are changed by knitting together a progressive change coalition that is able to grab enough power to change the system.

And coming up with policies that are improvements that can serve as some of the threads binding the coalition together is even harder than coming up with some idealized notion of "the best" policies. Compromising in the interests of a "large enough" coalition without compromising so much that nothing is accomplished ... there is no optimum there. Its a balancing act consisting of a series of strategic choices.

b) Keynes' theories were

I had always understood that the primary causes of the 70's stagflation were the Vietnam war debt, and the rapid spikes in energy costs resulting from the oil embargos.

The increase in the M3 money supply when Nixon removed the final vestiges of the gold standard played a role as well.

Is this not entirely correct? or oversimplification?

Cause versus theory

You are correct about the causes of the stagflation. That is separate from Keynesian theory. The problem with Keynsianism is that his theories didn't account for stagflation at all.

In a Keynsian world stagflation didn't exist. His theories said that inflation and growth went hand in hand. Deflation and recession went hand in hand.

But recession and inflation were mutually exclusive in Keynsianism.

That's a simplified version of it. Hopefully someone else can expand on it.

Good post

Now if only a major portion of the USA could understand what the government is doing to us (oops better stay Orwellian) What the government is doing for us.

There are just so many, many, many people that will just tip their hat to the elected whiz kids and allow them to do what ever they want to do.

I am in a blue mood for our economic health in the near term. In this case near term equates to years. This current Congress has created more debt than the total of all of the previous Congresses since the beginning of the Republic. How long can they keep these plates spinning?

Keynes' theories were not in use in the 1970's.

What was in use was the oversimplified hydraulic "Keynesian" economics of Samuelson ... the part that survived the ultimately failed effort to place bit and pieces of the General Theory on neoclassical economic foundations, despite the fact that the General Theory indicated that neoclassical economics is radically incomplete.

But Samuelsonian theories were no more "Keynesian" by virtue of their trademark than Fox News is "Fair and Balanced" by virtue of its trademark. Treating the General Theory as debunked by policies that ignored the majority of the General Theory is like treating "Fairness" as debunked by actions of Fox News.

Indeed, all of the parts of the General Theory that would have guided policy to prevent the financial collapse we just experienced had to be left out when the General Theory was neutered to make it less incompatible with neoclassical economics, because the General Theory was founded upon the observation that there is fundamental, intrinsic uncertainty in the world, and fundamental, intrinsic uncertainty simply cannot be included within the type of model pursued in mainstream economic theory.

Government deficit spending is quite patently not what got us into this mess, since part of the time we were creating this mess, we had budget surpluses. It was far more our tolerance of national deficit spending in the guise of the unsustainable current account deficit of Clinton/Bush that got us into this mess.

People that believe in simple minded theories that all budget deficit spending is good in a recession are like those that believe in simple minded theories that the expansion of less than 5% of the money supply in the face of a decline in the other 95% is going to automatically translate into inflation ... simple minded theories are never reliable. Sometimes something happens that fits the theory, which is taken as confirmation, saved and pointed to time and time again, and events that do not fit the simple minded theory are simply ignored.

The most important part of Keynes was

according to Indian economist Prabhat Patnaik,

It is a great quote, but it is a United Nations pdf file that will not allow me to copy and paste, The Present Crisis and the Way Forward. Which is just as well, because I urge anyone interested to go and read at least the first nine or ten paragraphs. Patnaik explains that what Keynes wanted was not really a stimulus in times of depression, but

Which of course reminds me of what Stirling Newberry wrote a week or two ago in The Depression that Hayek Built in which he writes that over the past three decades:

Dictatorship of the propertariat ! Newberry sure can bang the nail squarely on its head !

FT op-ed on debt, pretty astounding numbers

Exploding debt threatens America John Taylor.

He is saying the deficit is a much larger threat to the U.S. as well as global economy than the actual financial crisis.