Last April the Bush Administration changed the rules so that the Federal Home Loan Banks could take a more active part in propping up the housing bubble.

The looming financial difficulties have not prevented the Bush administration from expanding the F.H.A.’s role to help ease the nation’s foreclosure crisis. Since September, more than 150,000 homeowners have refinanced through F.H.A. and officials hope that the number will increase to 400,000 by the end of the year.

In doing so, the FHLB dramatically increased their share of the overall mortgage market right when the market was collapsing.

"[It's] ongoing and expensive venture into irresponsible lending and speculation - all at the taxpayer’s expense.”

- Barry Ritholtz

It also increased their losses.

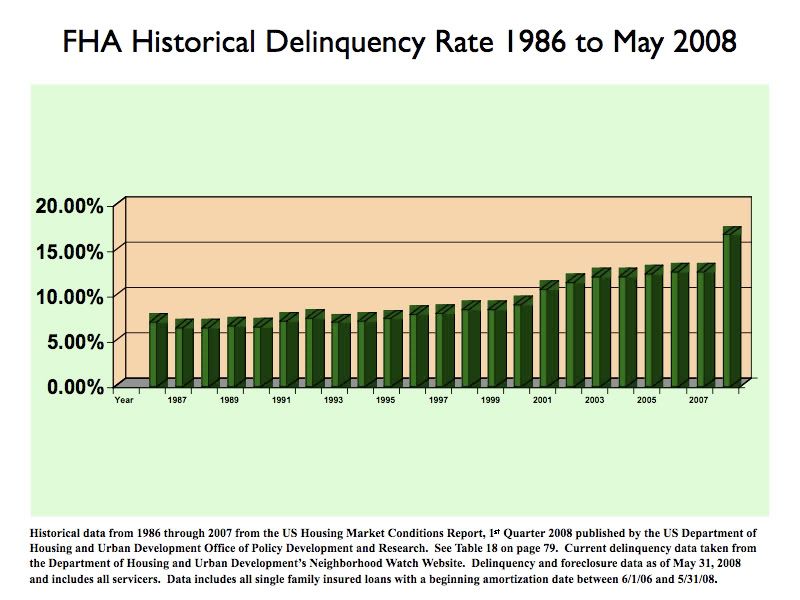

He said the mortgages had foreclosure rates three times those of traditional loans and would push the F.H.A. to the brink of insolvency."Let me repeat: F.H.A. is solvent," Mr. Montgomery said on Monday in a speech at the National Press Club. "However, no insurance company can sustain that amount of additional costs year after year and still survive. Unless we take action to mitigate these losses, F.H.A. will soon either have to shut down or rely on appropriations to operate."

“The government was using the Federal Home Loan Banks as a way to bail out the banking system early on.”

- James Bianco

Late September of last year the FHLB of Atlanta loaned Countrywide Financial $51 Billion in exchange for questionable mortgages as collateral.

Countrywide went under shortly afterward.

Well, the Day of Reckoning has arrived.

The Federal Home Loan Bank (FHLB) of Seattle said it didn't meet a regulatory capital requirement at the end of last month because of the declining value of mortgage-backed securities.The FHLB of Seattle, a government-chartered cooperative, said in a statement Monday that because of the capital deficiency it is disallowed from paying a dividend or repurchasing capital stock.

The Seattle bank in January became the second FHLB, after San Francisco, to warn of a potential capital shortage and take steps to guard reserves. As many as eight of the 12 banks may fall short of capital requirements after writing down holdings of so-called nonagency mortgage securities, Moody's Investors Service predicted.

The federal home-loan banks of Atlanta, Pittsburgh and Indianapolis have delayed or suspended dividend payments, and the Chicago bank said last month that it would report a fourth-quarter charge for the impairment of mortgage securities.

In order to keep the whole system from crashing down, the Federal Reserve is busy monetizing FHLB debt.

On the good side, the FHLB's will no longer be available for reinflation of the housing bubble. On the bad side, the taxpayer will be bailing them out soon. Without a taxpayer bailout liquidity in the mortgage market would dry up, and that would threaten the banking system (...again).

“They’ve got a real problem on their hands,” said James Bianco, president of Bianco Research in Chicago, a leading analyst and market commentator, in reference to the Federal Home Loan Bank system. “And it’s helping to drag down larger banks as well.”

...

Some think the Atlanta FHLB could be taken over by the Federal Reserve, that the San Francisco bank could be merged with other banks, and that the New York bank has lost a significant amount of money, Bianco said.

...

“They could be sitting on big losses,” Bianco said. “We don’t know how many bad loans they have, and their accounting is so bad investors don’t have any confidence in their numbers.”The same regulators of the savings and loans that collapsed were hired on with the Federal Housing Finance Board, which meant real reform never happened.

“When you fail in Washington,” Bianco said, “you get a promotion.”

What is amazing is how some good

government programs, such as FHA, that promoted home ownership were completely abused all in the interest of creating more profits for the mortgage industry and financial conglomerates.

RebelCapitalist.com - Financial Information for the Rest of Us.

Remember this little scandal?

From September 30, 2008. The FHLB of Atlanta decided to loan Countrywide Financial $51 Billion in exchange for mortgage securities of questionable value. A couple months later Countrywide was finished.

consider adding that

to the post. $51 billion ain't chump change. I uprated this to go to the front page. Just needs 1 more promote vote. First I even heard of it. Do you know what is the percentage, the overall impact on the financial sector as a whole, the amount of money we're talking about if they fail?

Diary updated

I added several links, data and quotes. I still don't have any numbers on how large this bailout will become. I'm not sure that anyone knows for certain.

side note, we do posts, DK does diaries

I don't like the term diaries because it implies personal notes. I'd claim many of us are writing citizen journalism types of posts, really articles, many researched from first principles so to me, the term diary really diminishes the effort.

Good

I never understood the "diary" term anyway. Post or Article makes more sense to me.

Already Insolvent...Bye, Bye Miss American Pie;-)

http://www.brookings.edu/events/2009/0309_lessons.aspx

All hands on deck!

"Bazooka" Paulson was throwing everybody and everything into propping up the banks. Here are the GSE's being directed to take on more leverage last May (before takeover):

"The lowering of the prudential cushion was appropriate in line with the company’s progress and with the need to maintain safe and sound operations": OFHEO Director James Lockhart

I wonder if 1) he said that with a straight face, and 2) if anyone in the audience listened with a straight face.

The Sander Solution

Not directly a comment, but you might be interetested in this:

As the crisis gets bigger - it's not just the banks now, all countries are staring bankruptcy in the face - the solution needs to get bigger, too. Nationalising western banks - if it happens - won't help Mexico or the Ukraine. And if they fall, the domino effect could be catastrophic. So how about this suggestion (The Sander Solution):

- x% of all bank and savings deposits in the OECD above, say $1000, are requisitioned as forced loans and placed in a special IMF fund.

- This fund can be used to bail out countries ...

- ... and to buy up insolvent banks. Because it isn't national government doing it but the IMF, this might be politically acceptable.

How easy this would be depends on the value of x%. If only 2% of deposits were to be "borrowed", people would probably leave their money where it is rather than moving it out of the OECD. Much more, and there would have to be a swift and secret agreement and possibly even a 24-hour closedown of the banking system. possible, but unrealistic.

The programme would ideally generate a few trillion dollars - enough to make it absolutely clear that the IMF and national governments have the funds to achieve turnaround.

I'm afraid I can't find numbers for this suggestion I don't have access to the appropriate figures in order to enable to do the maths. Maybe you do?