Last September Senator Bernie Sanders introduced legislation — The Prescription Drug Affordability Act of 2015 — to stop soaring increases in pharmaceutical prices. He and Hillary Clinton are both running for the Democratic nomination to be President in 2016; and both offer up their own plan for controlling the high cost of rising prescription drug prices on their websites.

However, Hillary has received more campaign cash from drug companies than any other candidate — in either party — even as she proudly declares the industry is one of her biggest enemies. In stark contrast Bernie, received zero contributions from drug companies, and received most of his campaign financing from individual donors and labor unions. So which candidate will launch the most genuine war on Big Pharma?

According to government data released this week, significantly higher drug prices contributed to higher Medicare spending in 2014. At least five drugs covered under Medicare Part D had increases of 100% or more. A report based on a new online database released by the Center for Medicare Services (CMS) this week showed that one of the most egregious examples is the pain reliever Vimovo. Its price increased more than 500 percent after it was sold by AstraZeneca to another company (Pfizer attempted to by out AstraZeneca last year).

The 2014 drug-price information was part of a new online database called the Medicare Drug Spending Dashboard, which details 80 drugs that ranked the highest by total Medicare spending. CMS said the drugs account for 33% of all Medicare Part D spending, and 71% of all spending on prescriptions by Medicare Part B, which covers drugs administered in doctor’s offices and outpatient clinics.

Robert Roach, President of the Alliance for Retired Americans, said "More than 35 million people didn’t fill a prescription last year because they could not afford to." The Alliance is closely tracking what the candidates for President and Congress are pledging to do about prescription drug prices — and are pressing policymakers for change.

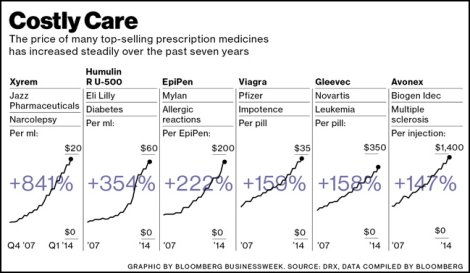

Last year from Bloomberg on May 14, 2014:

As evidenced by Pfizer’s proposed $100 billion-plus [hostile] takeover of AstraZeneca, Big Pharma is in the throes of the greatest period of consolidation in a decade. One reality remains unchanged, however: Drug prices keep defying the law of gravity. Since October 2007 the cost of brand-name medicines has soared, with prices doubling for dozens of established drugs that target everything from multiple sclerosis to cancer, blood pressure, and even erectile dysfunction ... While the consumer price index rose just 12 percent during the period, one diabetes drug quadrupled in price and another rose 160 percent.

Desperation is also propelling the increases, with drugmakers raising prices on products that remain under patent to offset sales declines from blockbusters that have lost such protection. And companies with older drugs boost prices when rivals show up, either to match the price of the newer drug or to make up for prescriptions lost to the competitor. While generic drugs pushed by insurers and the government now make up 86 percent of all medicines used in the U.S., that hasn’t reduced total spending on prescription drugs.

“We have been consistently noticing that as manufacturers near the end of their product’s life cycle, they are seeking larger price hikes than they previously did,” says Sharon Frazee, vice president for research at Express Scripts Holding.

According to a leaked draft copy obtained by Politico last May, the recent TPP trade agreement (that Congress just fast-tracked for Obama) "would give US pharmaceutical firms unprecedented protections against competition from cheaper generic drugs, possibly transcending the patent protections in US law [and additionally] those provisions could also help block copycats from selling cheaper versions of the expensive cutting-edge drugs known as biologics inside the U.S., restricting treatment for American patients while jacking up Medicare and Medicaid costs for American taxpayers."

Robert E. Scott, the director of trade and manufacturing policy research at the Economic Policy Institute, noted: "By extending US copyright and patent protections to consumers in the rest of the TPP, which will dramatically increase the prices of prescription drugs, the treaty will shift billions in profits to big pharmaceutical companies while denying access to life-saving medicines to countless poor consumers."

A year later after Pfizer’s attempted takeover was thwarted by AstraZeneca, in May 2015 the Fiscal Times wrote that the takeover of AstraZeneca would have solved some of Pfizer’s biggest problems:

- Pfizer’s 24 per cent corporate tax rate, which is one of the highest in the pharmaceutical industry — even though the "statutory tax rate for corporations is 35%, but the average "effective" tax rate American corporations were paying was a mere 12.5%. and because AstraZeneca is a British-Swedish multinational corporation, a tax inversion would have been used by Pfizer.

- Pfizer's accumulation of roughly $17 billion in overseas cash would attract a hefty penalty if repatriated to the US and taxed — American corporations already have over $2.1 trillion stashed in offshore tax havens. (It should be noted that Senator Bernie Sanders has also purposed legislation that would end the corporate hoarding of offshore profits in tax havens to avoid taxes).

The stock markets have been hitting all-time record highs, as corporate profits have also been hitting all-time record highs — $1.8 trillion after-taxes last year — which was also the best year for mergers and acquisitions since before the financial crisis. The global deal volume topped $3 trillion — a more than 50% increase from 2013. The U.S. M&A market saw the number of deals worth at least $1 billion rise 43% year-over-year. And last year they were poised to spend about 95 percent of their earnings (almost $1 trillion) on stock buybacks (Venture capitalist Nick Hanauer tells us how stock buybacks hurt average working Americans.)

The Fiscal Times goes on to say:

After the Astra rejection, Pfizer CEO Ian Read switched back to his “Plan A” by returning $12 billion to shareholders in share buybacks last year. The $17 billion acquisition of Hospira was welcomed by Pfizer investors, but it will do little to address Pfizer’s three big problems: the higher tax rate, unrepatriated cash profits and patchy pipeline ... Following a US Treasury crackdown on inversions, which allow companies to slash their tax rate by taking over a rival in a lower-tax country and moving its headquarters there, Pfizer’s options are limited. To realize the main benefits of an inversion, its shareholders would have to own no more than 60 per cent of any combined company. That would make AstraZeneca too small, leading some to suggest Pfizer should shift its sights to another, bigger UK group ... One contender could be Ireland-based Actavis. Its effective tax rate was just 4.8 per cent last year, and its limited roots in the Emerald Isle mean there would be no political outcry. Some even suggest that Brent Saunders [not Bernie Sanders] the CEO of Actavis, could take the top job at Pfizer..."

Which brings us to a recent post by Robert Reich:

Of Rotten Apples and Rotten Systems (December 21, 2015) Martin Shkreli [pictured above], the former hedge-fund manager turned pharmaceutical CEO who was arrested last week, has been described as a sociopath and worse. In reality, he’s a brasher and larger version of what others in finance and corporate suites do all the time.

Federal prosecutors are charging him with conning wealthy investors. Lying to investors is illegal, of course, but it’s perfectly normal to use hype to lure rich investors into hedge funds. And the line between the two isn’t always distinct. Hedge funds are lightly regulated on the assumption that investors are sophisticated and can take care of themselves.

Perhaps prosecutors went after Shkreli because they couldn’t nail him for his escapades as a pharmaceutical executive, which were completely legal – although vile. Shkreli took over a company with the rights to a 62-year-old drug used to treat toxoplasmosis, a devastating parasitic infection that can cause brain damage in babies and people with AIDS. He then promptly raised its price from $13.50 to $750 a pill.

When the media and politicians went after him, Shkreli was defiant, saying: "Our shareholders expect us to make as much as money as possible.” He said he wished he had raised the price even higher. That was too much even for the Pharmaceutical Research and Manufacturers of America, Big Pharma’s trade group, which complained indignantly that Shkreli’s company was just "an investment vehicle masquerading as a pharmaceutical company".

Maybe Big Pharma doesn’t want to admit most pharmaceutical companies have become investment vehicles. If they didn’t deliver for their investors they’d be taken over by "activist" investors and private-equity partners who would. The hypocrisy is stunning. Just three years ago, Forbes Magazine praised Shkreli as one of its 30 under 30 in Finance who was "battling billionaires and entrenched drug industry executives."

Last month, Shkreli got control of a company with rights to a cheap drug used for decades to treat Chagas’ disease in Latin America. His aim was to get the drug approved in the United States and charge tens of thousands of dollars for a course of treatment. Investors who backed Shkreli in this venture did well. The company’s share price initially shot up from under $2 to more than $40. While other pharmaceutical companies don’t usually raise their drug prices fifty-fold in one fell swoop, as did Shkreli, they would if they thought it would lead to fat profits.

Most have been increasing their prices more than 10 percent a year – still far faster than inflation – on drugs used on common diseases like cancer, high cholesterol and diabetes. This has imposed a far bigger burden on health spending than Shkreli’s escapades, making it much harder for Americans to pay for drugs they need. Even if they’re insured, most people are paying out big sums in co-payments and deductibles. Not to mention the impact on private insurers, Medicare, State Medicaid programs, our prisons and the Veterans Health Administration.

And the prices of new drugs are sky-high. Pfizer’s new one to treat advanced breast cancer costs $9,850 a month. According to an analysis by the Wall Street Journal, that price isn’t based on manufacturing or research costs. Instead, Pfizer set the price as high as possible without pushing doctors and insurers toward alternative drugs. But don’t all profit-maximizing firms set prices as high as they can without pushing customers toward alternatives?

Unlike most other countries, the United States doesn’t control drug prices. It leaves pricing up to the market. Which enables drug companies to charge as much as the market will bear. So what exactly did Martin Shkreli do wrong — by the standards of today’s capitalism? He played the same game many others are playing on Wall Street and in corporate suites. He was just more audacious about it.

It’s easy to go after bad guys, much harder to go after bad systems. Hedge fund managers, for example, make big gains from trading on insider information. That robs small investors who aren’t privy to the information. But it’s not illegal unless a trader knows the leaker was compensated — a looser standard than in any other advanced country.

Meanwhile, the pharmaceutical industry is making a fortune off average Americans, who are paying more for the drugs they need than the citizens of any other advanced country. That’s largely because Big Pharma has wielded its political influence to avoid cost controls, to ban Medicare from using its bargaining clout to negotiate lower prices, and to allow drug companies to pay the makers of generic drugs to delay their cheaper versions.

Shkreli may be a rotten apple. But hedge funds and the pharmaceutical industry are two rotten systems that are costing Americans a bundle.

On June 25, 2009, as a member of the Senate health committee, Senator Bernie Sanders said that real health care reform must address the billions of dollars in fraud and abuse that comes from the major corporations in the health care industry. The senator said Health and Human Services Department investigators found this year that 80 percent of insurance companies participating in the Medicare prescription drug benefit overcharged subscribers and taxpayers — and that Medicare and Medicaid fraud totals some $60 billion a year.

- PolitiFact (November 2, 2012) Republicans Mitt Romney and Rick Scott both have Medicare fraud in their background (Mostly True)

- PolitiFact: (March 3, 2014) Florida Governor Rick Scott oversaw the largest Medicare fraud in the nation’s history (Mostly True)

- The Fiscal Times (December 2015) Billions in Medicare Fraud Still Rampant, Despite Federal Crackdown

Which bring us back to a newsletter from Bernie Sanders that I received yesterday:

I want to talk with you about one of the very real differences between Secretary Clinton and me that surfaced during last weekend's debate, and that is our approach to health care in this country.

I was, and all progressives should be, deeply disappointed in some of her attacks on a Medicare-for-all, single-payer health care system. The health insurance lobbyists and big pharmaceutical companies try to make "national health care" sound scary. It is not.

In fact, a large single-payer system already exists in the United States. It's called Medicare and the people enrolled give it high marks. More importantly, it has succeeded in providing near-universal coverage to Americans over age 65 in a very cost-effective manner.

So I want to go over some facts with you and ask that you take action on this important issue:

Right now, because of the gains made under the Affordable Care Act, 17 million people have health care who did not before the law was passed. This is a good start, and something we should be proud of. But we can do better.

The truth is, it is a national disgrace that the United States is the only major country that does not guarantee health care to all people as a right. Today, 29 million of our sisters and brothers are without care. Not only are deductibles rising, but the cost of prescription drugs is skyrocketing as well. There is a major crisis in primary health care in the United States.

So I start my approach to health care from two very simple premises:

1) Health care must be recognized as a right, not a privilege -- every man, woman and child in our country should be able to access quality care regardless of their income.

2) We must create a national system to provide care for every single American in the most cost-effective way possible.

I expected to take some heat on these fundamental beliefs during a general election, but since it is already happening in the Democratic primary, I want to address some of the critiques made by Secretary Clinton and Rupert Murdoch's Wall Street Journal directly:

Under my plan, we will lower the cost of health care for the average family making $50,000 a year by nearly $5,000 a year. It is unfair to say simply how much more a program will cost without letting people know we are doing away with the cost of private insurance and that the middle class will be paying substantially less for health care under a single-payer system than Hillary Clinton's program. Attacking the cost of the plan without acknowledging the bottom-line savings is the way Republicans have attacked this idea for decades. Taking that approach in a Democratic Primary undermines the hard work of so many who have fought to guarantee health care as a right in this country, and it hurts our prospects for achieving that goal in the near future. I hope that it stops.

[Editor's Note: Hillary Clinton said she won't raise taxes on the middle-class (To her, that means anyone making up to $250,000 a year) to pay for such as program as Bernie proposes. First of all, $250,000 a year is not a "middle-class" wage — per Social Security wage data, that's in the top 1%. Secondly, Bernie proposes a 2.2% across-the-board tax increase for EVERYONE, and it pays for "Medicare for All" — and therefore, eliminates the mandate to purchase an Obamcare healthcare plan. Upper income earners will pay proportionately higher taxes, but lower income earners will get the same quality healthcare. Besides just healthcare and lower prescription drug prices, workers will also get paid family and medical leave — which is not automatically included in Obamacare. (Now back to Bernie's newsletter...)

Let me also be clear that a Medicare-for-all, single-payer health care system will expand employment by lifting a major financial weight off of the businesses burdened by employee health expenses. And for the millions of Americans who are currently in jobs they don't like but must stay put because of health care access, they would be free to explore more productive opportunities as they desire.

So, what is stopping us from guaranteeing free, quality health care as a basic fundamental right for all Americans? I believe the answer ties into campaign finance reform. The truth is, the insurance companies and the drug companies are bribing the United States Congress.

I want to make health care a right for every American. The health care industry doesn't like that very much, so they're flooding my opponents with cash. Fight back against those who want to stop a Medicare-for-all, single-payer system with a $3 contribution to our campaign.

Now, I don't go around asking millionaires and billionaires for money. You know that. I don't think I'm going to get a whole lot of contributions from the health care and pharmaceutical industries. I don't like to kick a man when he is down, but when some bad actors have tried to contribute to our campaign, like the pharmaceutical CEO Martin Shkreli who jacked up the price of a life saving drug for AIDS patients, I donated his contribution to an AIDS clinic in Washington, D.C.

Secretary Clinton, on the other hand, has received millions of dollars from the health care and pharmaceutical industries, a number that is sure to rise as time goes on. Since 1998, there are no industries that have spent more money to influence legislators than these two. Billions of dollars! An absolutely obscene amount of money. And in this election cycle alone, Secretary Clinton has raised more money from the health care industry than did the top 3 Republicans -- combined.

Now, and let's not be naive about this, maybe they are dumb and don't know what they are going to get? But I don't think that's the case, and I don't believe you do either.

So, what can we do about it?

Changing the health care laws in this country in such a way that guarantees health care as a right and not a privilege will require nothing short of a political revolution. That's what this campaign is about and it is work we must continue long after I am elected the next President of the United States.

And because of the success we have enjoyed so far, I am more convinced today than ever before that universal quality health care as a right for all Americans will eventually become the law of the land.

It is the only way forward.

Make a $3 contribution to our campaign as a way of saying you have had ENOUGH of the health care and pharmaceutical lobby buying our candidates and elected officials.

Thank you for standing with me on this important issue.

In solidarity,

Bernie

Comments

we need the war on consolidation of health care services 2

Love these organizations who simply wipe out all competition in providing health care services in an area. Then, they play God and try to link credit/billing to obtaining health care. Haven't even gotten to insurance yet.

Those drug prices are outrageous and the day they ban big pharma ads on TV is the day American society 100% improves immediately.

Dean Baker asks a good question...

Dean Baker, Center for Economic Research and Policy (December 28, 2015) If Patent Monopolies Bias Cancer Research, Why Not Have Publicly Funded Trials?

http://cepr.net/blogs/beat-the-press/if-patent-monopolies-bias-cancer-re...

If I were in charge...

Something I've thought about, and while I realize it isn't likely to happen I would be interested to hear other views about is this:

What if we treated pharmaceutical companies as public utilities? That means in exchange for allowing them to own the rights to, and sell, medicines to the US population, they would have to accept a specific rate of return on their investment in research, production, etc. This would be a bit tricky to implement, but it would encourage research into new drugs, as the return would be guaranteed. At the same time, prices would be effectively moderated. Obviously there are some logistical issues, and it would require oversight of the research end of the business, but I think it could be made to work. The price for any drug would be the production cost, plus an amount that covers the development costs the company has for their entire portfolio of drugs.

just a random thought. I don't think I understand enough about the pharmaceutical industry to understand the implications.

More M&As

Shire PLC. is a New Jersey-registered Irish-headquartered global specialty biopharmaceutical company that originated in the United Kingdom with a large operational base in the United States. Recently Shire PLC. announced an agreement to acquire U.S.-based biopharmaceutical company Baxalta Inc. for about $32.0 billion.

Thermo Fisher Scientific, an American multinational biotechnology product development company, recently announced an agreement to acquire cellular and genetic analysis product provider Affymetrix Inc. for about $1.3 billion.