We've heard it so many times before: Tax reform. When the Democrats say it, it usually means raising taxes (mostly on the rich). When the Republicans say it, it almost always means cutting taxes (mostly for the rich).

The Democrats had a chance for so-called "tax reform" when Obama had both chambers of Congress in 2009/10. Now the GOP controls Congress in 2015, but the Democrats are now proposing tax reform, when they know very well that they don't have a snowball's chance in Hell of ever getting their own version of tax reform passed. Why?

From an article at the New York Times, "Obama Will Seek to Raise Taxes on Wealthy to Finance Cuts for Middle Class":

"President Obama will use his State of the Union address to call on Congress to raise taxes and fees on the wealthiest taxpayers and the largest financial firms to finance an array of tax cuts for the middle class, pressing to reshape the tax code to help working families ... The proposal faces long odds in the Republican-controlled Congress, led by lawmakers who have long opposed raising taxes and who argue that doing so would hamper economic growth at a time the country cannot afford it."

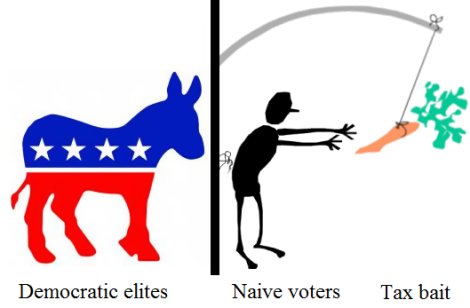

The article goes into detail about Obama's proposed tax reforms, but they are not serious proposals, and are a waste of our time and an insult to our intelligence. Obama and the Democrats are "trolling" their base — maybe to help gamer support for their 2016 Moderate/Third Way/Blue Dog presidential candidate (Hillary).

But it's all poop — plain and simple. After all, Obama and the Democrats also wanted to change the way COLAs were calculated for retirees, Vets and those on disability (paying them a lower monthly benefit.) Some called this a "compromise" with the GOP, while others called it a "sell out" by the Democrats.

Excerpts from an another article at the New York Times, "Driving the Obama Tax Plan: The Great Wage Slowdown":

"The key to understanding President Obama’s new plan to cut taxes for the middle class is the great wage slowdown of the 21st century ... The great wage slowdown has several main causes: globalization, which has forced Americans to compete with hundreds of millions of poorer workers from around the world; technological change, which allows machines to replace human labor in new ways; the slowdown in American educational attainment, even as the rest of the world has continued to become more educated and more highly skilled; and the shifting balance of economic power, away from workers and toward companies and their executives ... No politician, of either party, can quickly alter the basic forces behind the great wage slowdown. That’s why Mr. Obama has begun talking about a tax cut for the middle class, to be financed by a tax increase on the affluent — who have continued to do quite well in recent years. It’s also why several conservatives are talking about a cut in the payroll tax, the largest federal tax for most Americans."

I have no idea why the New York Times linked to that article about a cut in the payroll tax. It's a Tea Party rant about the "error rate" for the Earned Income Tax Credit program and a rant against the IRS. It does mention payroll tax cuts, but those same cuts would mostly benefit employers who must also contribute to Social Security and Medicare — programs the GOP wants to defund. The Republicans want to entice workers to take a payroll tax cut now, and then workers will have to hope that they have adequate Social Security credits to properly retire on later. (Why not just completely eliminate the Social Security "cap"?)

The New York Times also says the payroll tax is "the largest federal tax for most Americans." True, because 95% of all wage earners must pay these taxes (FICA) on 100% of their earnings. Whereas, the most wealthy (whose earnings are primarily from "capital gains") pays no Social Security taxes at all — and the tax rate on capital gains (23.8%) is lower than on regular wages (On $37,451 and over, the tax rate starts at 25% and goes up to 28%, 33%, 35% and 39.6%).

Senator Bernie Sanders became the ranking minority member on the Senate Budget Committee when Congress returned to begin a new session. That will make him a leading voice for Democrats as they clash with Republicans (who now control the chamber) over government spending, entitlement reform and taxes.

G. William Hoagland, a budget hawk who is senior vice president for the Bipartisan Policy Center (founded by Howard Baker, Tom Daschle, Bob Dole and George Mitchell) said “If you are actually setting fiscal policy for the future, it is a very unpleasant thing to talk about either tax increases or spending increases.” Hoagland believes "moderate" Democrats on the Senate Budget Committee will prevent Bernie Sanders from taking too hard a line: “They will definitely pull him back to the left of center, as opposed to the far left of center."

But is Bernie Sanders really all that "far left" on tax policy when compared to Republican President Dwight Eisenhower? Ike's idea of a significant marginal rate cut was to push the top rate down to 91 percent from 92 percent. The IRS reckoned that the "effective" rate of tax in 1954 for top earners was actually 70 percent. A more comprehensive interpretation of income (that also included capital gains) suggests the real effective tax rate for millionaires was 49 percent in 1953 — when corporate taxes hit 50 percent. During that time jobs proliferated, wages rose, and the economy prospered.

Obama’s originally proposed tax plan (aka The Buffett Rule) would have created a 30 percent tax on individuals making more than a million dollars a year — still far less than during Eisenhower's time, and not very much more than the current tax rate of 23.8% on capital gains.

But the whole notion of giving tax cuts to the poor and raising taxes on the rich in 2015 is a total fantasy (especially now that the GOP controls both cambers of Congress). Obama and the Democrats are being very dishonest in their attempt to convince the public that 1) they want tax reform, and 2) that it's even possible with a GOP Congress. As I mention in another post:

Obama and the Democrats are talking stinky-poo. This article at the Nation about "trolling Democrats" (written prior to the Democrat's recent tax proposal) explains why:

"The Democrats are seizing on the opportunity to be progressive at a moment when it’s cheap and easy; being out of power (or in Obama’s case, term-limited) they won’t have to pay the price in campaign dollars or blowback that would come from pursuing these policies in an environment in which they could actually become law. After all, when Democrats controlled all of Congress and the presidency, it’s not like they made a move on paid sick leave or a financial transactions tax or any of a host of other ideas that would have helped out the middle class ... Now they can stoke the fire and garner the goodwill of the left, without having to deal with the downside."

Most American voters (from liberals to conservatives) want a fairer tax code, but neither the trolling Democrats nor the Republicans will ever do anything to change it. Our tax code has been rigged for the very rich ever since the first Gilded Age.

Comments

Compassionate Conservatism

Robert Reich (January 18, 2015) -- The Republican establishment’s leading presidential hopefuls [Jeb Bush and Mitt Romney] know the current upbeat economy isn’t trickling down to most Americans. But they’ve got a whopping credibility problem, starting with trickle-down economics.

The lion’s share of economic gains over the past thirty-five years has gone to the top, regardless of whether Democrats or Republicans inhabit the White House. The most recent recovery has been particularly lopsided.

Since Reagan, Republican policies have nudged [the economy] toward big gains at the top and stagnation for everyone else. The last Republican president to deliver broad-based prosperity was Dwight D. Eisenhower, in the 1950s ... When Eisenhower was president, over a third of all private sector workers were unionized. Ike can’t be credited for this but at least he didn’t try to stop it — or legitimize firing striking workers, as did Ronald Reagan.

Under Reagan, Republican policy lurched in the opposite direction: Lower taxes on top incomes and big wealth, less public investment, and efforts to destroy labor unions. Not surprisingly, that’s when America took its big U-turn toward inequality. These Reaganomic principles are by now so deeply embedded in the modern Republican Party they’ve come to define it.

When Jeb Bush admits that the income gap is real but that “only conservative principles can solve it,” one has to wonder what principles he’s talking about.

http://robertreich.org/post/108489468160

Replace Payroll Taxes

The author may have "no idea" about payroll taxes because he does not appreciate how they destroy jobs and family wealth. The process is complex. On March 13, 2014, Bill Gates told an audience at AEI that he opposed the federal minimum wage and supported a replacement of the combined 15.3 percent payroll taxes as the best way to help workers and create jobs. A 4 percent VAT and elimination of unnecessary business tax expenditures would provide a more secure funding source for Social Security and Medicare.

There is no support for the claim that, "Republicans want to entice workers to take a payroll tax cut now, and then workers will have to hope that they have adequate Social Security credits to properly retire on later." Both Democrats and less conservative Republicans have recognized for decades that low paid workers cannot afford payroll taxes and this has led to generous earned income and child care tax credits. Unfortunately, the credits have simply expanded low wage jobs. Both workers and businesses rely on the credit rather than replace the payroll tax with less regressive funding or follow the author's suggestion to, "completely eliminate the Social Security cap".

The long range problem is wage stagnation that comes with high unemployment. Replacing the payroll taxes encourages full employment and higher salaries in two ways. For business, jobs are less expensive so there is less incentive to outsource and businesses that employ a lot of workers loose the disadvantage they had compared with businesses that have a low worker to sales ratio and profit more from intellectual property monopoly. For workers, there is an immediate 3.65 percent increase in take-home pay and the increased consumer spending grows the economy from the bottom up.

Paul Ryan will Gut Social Security

Martin Feldstein, the President Emeritus of the NBER, promoted the idea of gradually raising the eligibility age for full Social Security benefits to as high as 70. [He claimed] that would it increase the labor-force participation rate among people older than 65 (and expand the economy). But raising the retirement age would also add to the strain on the disability fund, which has had to cover more workers longer, ever since the retirement age was raised from 65 to 67.

And then there's the new rule change regarding the transfer of funds from the regular Social Security trust fund to the disability fund to keep it solvent. An analysis by Social Security’s chief actuary, Stephen Goss, suggests there’s less to the new House rule than meets the eye. That’s because the point of order is triggered only if lawmakers exceed a “0.01 percent” threshold, which equates to a $38.6 billion cap on what any one Congress can move from the retirement fund. That leaves too little room for some long-term, multi-year reallocation of payroll tax revenues but it is enough to get past 2016.

Gross says, “We’re projecting disability trust funds will be depleted in December of 2016. The shortfall for the ensuing 12 months would come to about $29 billion. What that means is that we could have a tax rate reallocation that could apply in 2016 — or 2016 and 2017 that would generate up to $30 billion, or even $35 billion, transferred to the disability trust fund, which would at least extend its reserve depletion date for one more year.”

Rep. Sam Johnson (R-Texas), who promoted the rule change as chairman of the Social Security panel on the House Ways and Means Committee, will relinquish his role to the new Ways and Means Committee Chairman, Paul Ryan (R-Wis.), who has already installed his own staff on the committee. Now, Ryan (who wanted vouchers for Medicare) would like to be the architect for "reforms" in the social safety net. (He'll probably outlaw all hammocks too.)

http:/www.politico.com/story/2015/01/republicans-target-social-security-114382...

LA Times: Capital gains preference is pure gold

The capital gains preference is uncapped. The larger the gain one reports, the greater the tax break — that differential between the 23.8% top cap gains rate and the 39.6% top marginal rate is gold, pure gold.

There's another aspect that makes the capital gains preference entirely too profitable. Taxpayers can defer it indefinitely simply by deferring the sale of taxable assets [and] put off your capital gains liability for your entire life.

Then comes the biggest loophole of all, the so-called trust fund loophole. This allows capital assets to be passed on to one's heirs at their appreciated value [and] the accumulated capital gains tax liability is utterly extinguished. Hundreds of billions of dollars escape capital gains taxation each year because of the 'stepped-up' basis loophole that lets the wealthy pass appreciated assets onto [job creators, such as Paris Hilton and Kim kardashian.]

Sen. Orrin Hatch (R-Utah) claimed eliminating these all tax loopholes would hurt small businesses.

But the Treasury estimates that 99% of the revenue raised by boosting the capital gains tax rate and closing the inheritance loophole would be paid by the top 1% — and four-fifths of it would come from the richest tenth of 1%.

http://www.latimes.com/business/hiltzik/la-fi-mh-capital-gains-20150119-...

long gone are the days

where the stock market indicated real health and investment.

What does the Meek Inherit?

Huffington Post: House and Senate Republicans rejected President Obama’s suggestion to reform a tax code that allows heirs to inherit extreme amounts of wealth largely tax-free.

Rep. Jason Chaffetz,(R-Utah), angrily responding to Obama's tax proposal: “That’s a non-starter. The audacity, that he thinks the government has a right to people’s money? He wants to transfer wealth. It’s one of the most immoral things you can do, is try to steal somebody’s inheritance, to steal it away from their family.”

(* Even though our grandma is taxed on every single dollar of tips she earns at her minimum-wage job as a waitress at the local diner.)

Senator Marco Rubio (R-Fla.) said there was no need to punish the children of the rich. “My preference is to have as much money available for people to reinvest back into the economy. I think we can succeed at helping the middle class without having to go after anybody, or make an example of anybody, or punish anyone.”

* Yes, no one wants to punish innocent children, especially those such as Paris Hilton and Kim Kardashian.

Paul Krugman recently asked, "So who, exactly, has been waging class warfare?"

So I told him in a comment:

Warren Buffett (2006) “There’s class warfare all right, but it’s my class, the rich class, that’s making war --- and we’re winning."

Warren Buffett (2011) "Actually, there’s been class warfare going on for the last 20 years, and my class has won."