(editor's note: I was planning on publishing this morning, but some major personal business involving a sick wiener dog to one of those emergency vets had to take precedence. )

Ladies and Gentlemen, welcome to another edition of Manufacturing Monday...er Tuesday! Originally I wanted to post this on Monday morning, but I wanted to include the latest development from the Boeing SPEEA talks. Outside of this we got news from the steel industry, unfortunately not the good kind. Sticking with steel for a moment, there's an op-ed piece I wish to highlight that I thought you should look at. We have news or alarm bells I should say about pensions. Of course we also have some Green news, some ominous, but some good.

But before we get to those, let's take a look at the Numbers!

The Numbers

Today we saw the release of the latest annual auto sales revised for November. For the year, 7.5 million automobiles were sold, below the consensus of 7.81 million. This is also below October's revision of annual sales of 7.7 million. The drop off in sales reflected the current situation facing consumers, as fear creeps in about the nation's economic future. Lending was still tight at many auto dealerships, as many avenues for obtaining cash (despite TARP, thank you Hank Paulson!) became hard to get for many retail end lenders.

U.S. auto makers continued to post sharp sales declines in November as General Motors Corp. reported a 41% plunge and lowered its fourth-quarter production forecast, underscoring why the struggling auto maker and its Detroit rivals are seeking federal assistance to help them through the current environment.

"Every manufacturer is posting awful numbers and we are no exception," said GM North American sales chief Mark LaNeve.

The dour numbers, coming on the back of October's moribund results, also saw Ford Motor Co. post a 31% decline and Toyota Motor Corp. report a 34% decrease. Chrysler LLC, a private company controlled by private-equity group Cerberus Capital Management LP, saw its sales skid 47%.

- excerpt from "Auto Makers Report Continued Sharp U.S. Sales Declines", WSJ, 2008.

On Monday we had the release of one of the "all stars" of manufacturing indicators, the Institute of Supply Management (ISM) Manufacturing Index. For those new to the indicator, the ISM Manufacturing Index is a survey of 300 industrial firms indicating whether they are expanding activity or doing the opposite. A figure above 50 means that things are growing in the sector while below 50 means contraction in manufacturing; 50 itself is a "meh."

Well the latest ISM figure looks bad, in fact, it looks worse than the previous one, and trust me that one was pretty awful! The newest number, for November, came in at a paltry 36.2, which was below 38.4 consensus. The previous month's figure was 38.6, which was itself a downfall from the previous month's activity. Indeed, what we see here is a complete collapse in industrial operation. We are witnessing levels not seen in decades, worse than the last major recession in the early 90s.

The Institute for Supply Management's index of factory activity fell to 36.2 in November from 38.9 in October. It was the weakest since 1982. A reading below 50 shows contraction.

Highlighting the deepening U.S. economic slump, an inflation gauge within the ISM report hit its lowest in nearly six decades, new orders dropped to their lowest level since 1980 and an employment index was at the weakest level since 1991.

- excerpt from "Manufacturing slumps to 1981-82 recession levels", Reuters, 2008.

The fact is, gang, that these numbers aren't just representing America. Well, OK, these figures our, but what I'm saying is that what's happening here is happening all over. All over the world, there are either job cuts or complete plant closures. The reason I'm bringing this up is because what we are facing here is going to take a long time to "heal." We live in a globalized system, whether we like it or not (I'm still kinda iffy on it). For a supposed superpower, we have become highly dependent on the outside world for our growth, not entirely, but a damn good chunk of it. Yet the planet, economically speaking, is winding down and falling, and we're sadly going along for the ride.

Now last week we had two other critical indicators released. The first one is the Durable Goods Orders number, and then the NAPM-Chicago figure. The Durable Goods one reflects new orders being placed with domestic manufacturers for future deliver or immediate delivery. A positive number means that we're seeing an increase in new orders, while a negative one means that less new orders were placed than the previous month. The Durable Goods Order ties in, well sorta, with the National Association of Purchasing Managers (NAPM) number reflects new orders being placed with manufacturers and has been regarded as even a leading indicator to the ISM Manufacturing Index.

Durable Goods Orders for November were - 6.2% , way below the consensus of - 2.6%. This marks in contrast to a positive order growth of .9% for October. But looking at that chart above, even that anemic positive number simply proved to be another bump on a downward slide.

As just mentioned, the NAPM number has been considered a leading indicator to the ISM Manufacturing number. Now the number I am highlighting here is from the Chicago branch of the National Association of Purchasing Managers. Their index, no surprise here, reflects the "Chicago area" and also include non-manufacturing business concerns. The Chicagoland area still has a manufacturing base, albeit a shrinking one, but a significant one. Now the NAPM has branches in other cities as well, and when their indices are produced, rest assured I will report on them. Now the way they are reported is similar to that of the ISM Manufacturing Index, anything north of 50 is means expansion, south of it means well you get the idea.

Well if the NAPM-Chicago figure is supposed to act like a mirror to what is going on in the nation, I have to tell you, the image ain't pretty. The latest for November now stands at 33.8, significantly below the consensus figure of 36.5.

Boeing and the SPEEA engineer a new flight plan

It's official now, after previous negotiations a new contract has been ratified between Boeing and the Society of Professional Engineering Employees in Aerospace (SPEEA). The union, which represents 14,000 engineers and 7,000 technical staff, voted in two separate elections on the deal. In the end, the engineering faction voted 79% in favor, while the technical workers voted approved by 69%.

The deal was important for both sides. For Boeing, facing a deteriorating global economy, it faced the prospect of further product delays. Some of it's customers were already canceling orders due to the the economic climate (a relative of mine who's a 15 year pilot for a major airline told me when a company uses the word "flexibility" it really means cutting costs). Lastly, the credit situation involved with many financing partners have begun to look dicey, translating into possible complications for customers purchasing planes.

For the union, it had been fostering concern over the company's increasing reliance in outsourcing. It's newest plane, the 787 "Dreamliner" is produced with much of the components from all over, for example the wings come from Japan. In many instances, the components arrived defective or not to spec, causing machinists, engineers and other technical workers to fix the problems caused by these outsourced partners. As delays were extended, this increased pressure on the company which then transferred the stress onto it's workers. For their part, workers from the two largest unions contended that instead of relying on outside sources, that the components should be made in-house to reduce cost and time.

To make matters worse, executives from Boeing had hinted that further outsourcing might be done down the road on other products. Eventually the Machinists went on strike, which went for eight weeks, was settled. The new 4-year contract for the SPEEA is similar in that it guarantees more work being done here instead of handling such responsibility to outside partners. Secondly, it guarantees a 5% year-over-year increase in salaries (with a floor set at 2.5% y/yr) for the term of the contract, plus overtime rates. Pension increases will equal to that what the Machinists Union will get; an increase from $71/mo to $83/mo for each year of service. For those wanting more information on the new contract, feel free to check out this site by the SPEEA. To all you within the Society of Professional Engineering Employees in Aerospace, allow me to say congratulations for fighting to keep the work here!

Job cuts in the steel industry.

ArcelorMittal is announcing that it is going to initiate cost cutting measures. Starting with it's factory in Indiana, it will shun 2400 jobs come January. The company, which is the largest steel company which employs over 320,000 people worldwide, has been shedding jobs left and right. Recently the company let go 6,000 white collar jobs in it's European operations.

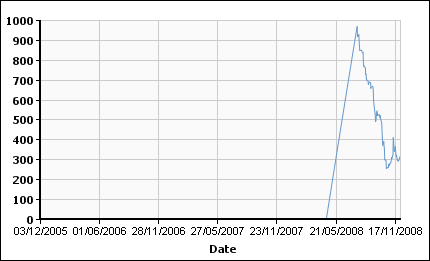

The Luxembourg-based company has been facing cuts in orders due from customers for almost two years. The price of steel has been on the decline. According to the London Metals Exchange, the price for steel for delivery to Asia has fallen from a peak of $955 to a low of $300.

(chart of steel, courtesy of the London Metals Exchange. Editor's note, please ignore that giant angular line, there's a glitch in the data before a certain date, my apologies.)

The company has been hit on all fronts of the current economic crises. As demand weakens, it faces overcapacity in it's mills across the globe. This has lead to fears that the company is bleeding more than it is claiming. Forbes (well actually Reuters through Forbes) today ran a piece on how Credit Default Swaps on the company's debt had been on the rise. For the uninitiated, a CDS is essentially insurance on bonds issued by the company, should they default the owners of the Swaps will get a payout.

LONDON, Dec 2 (Reuters) - Debt protection costs on ArcelorMittal, the world's biggest steel group, traded at elevated levels in thin business on Tuesday on concerns about the company's short-term debt maturity.

Five-year credit default swaps (CDS) on ArcelorMittal were bid at around 1,000 basis points and offered at 1,100 basis points, a trader said, about 300 basis points wider on the month but not yet trading upfront.

Trading upfront means the perceived risk of default is so high that most of the cost of buying protection is covered by a down-payment instead of by annual payments. Sellers of protection usually start to demand an upfront payment once a name is quoted wider than 1,000 basis points in CDS.

- excerpt from "ArcelorMittal CDS pressured on short-term debt fears", Forbes.com, 2008.

It's this overcapacity that has everyone wondering how bad things could get for ArcelorMittal. It's clients include everyone from the Detroit automakers to Chinese heavy industrial firms, all suffering heavily right now.

"The measures come in the framework of a 40% drop in production in North America," or slightly more than the average 35% production cut which ArcelorMittal had estimated earlier this month for its factories worldwide.- excerpt from "ArcelorMittal to Cut 2,400 Jobs in U.S.", IndustryWeek, 2008.

The support for green manufacturing gets another member.

The move towards a green manufacturing is growing despite the failing economy. Perhaps companies are seeing this as a way to differentiate from their foreign competitors like in China (who in our next segment is quickly learning!). Or perhaps they are seeing the longer term cost benefits of going green. Either way, the shift towards an enviromental friendly industrial movement is expanding. Embodied by this has been the Alliance for Sustainable Built Environments. IndustryWeek is now reporting that Eaton has now joined the Alliance.

The group is made up various corporations, domestic and international, focusing on environmental impact. It focuses on education consumers and other businesses on the benefits of going green. It's membership includes companies like Owens Corning and Johnson Controls.

So why the hell am I making a big deal about all this? Because Eaton makes lighting systems for a good size of the office and industrial buildings in this country. And while I normally have no hesitation in bashing a company, once in a while I have to give a congrats to one that is trying to make a good move. We all want to see a more greener economy, I do not want (as I'm sure you all don't either) to leave a crappier world for my children. By joining this organization, this company is saying "yes, OK we're gonna do something green for our industry". And by joining, we can hold their feet to the fire or call bullshit on their attempt. The last thing companies, especially in this economy, want is their rep trashed now. It's putting them on notice, well sorta.

We, as liberal-progressives, need to coordinate with these organizations. There is no reason why we can't have our homes built with having a lower carbon footprint in mind. Here we have this gaggle of companies saying they want to do this. I say fantastic, and we should (well actually I'm not fit to give envirnomental advice, though I'm sure there are many on here who could!) be asked to serve on their board. Folks, I know we can do this. Green manufacturing will create more jobs, we can help lead the initiatives and proceed with projects. All I ask, is if we start building green homes or green products, let's make 'em in America, ok?

So yes, I congratulate Eaton for joining the Alliance. I hope we can get them to start building more of their stuff here. If they are truly going the green route, then perhaps we can develop incentives to do such.

Pensions Agency to Detroit: Please Don't die, we can't afford you to!

Last week the Wall Street Journal had a piece about the Pensions Benefits Guaranty Corporation and the Detroit 3. Basically, if the domestic automakers go bust, they are on the hook for those pensions the companies promised the unions. And, when they say they are on the hook, in all honesty they mean we the tax payers are on the hook.

The funding of Detroit's plans in the next year or so is essentially "OK," Mr. Millard said in an interview. But "we see a continued use of the pension plan for other corporate purposes, including restructuring, and we worry that if it continues, the scenario could be much worse." The agency is concerned that with each passing year, the cost of funding buyouts will pose a greater threat to the pension funds.

- excerpt from "Pension Agency Sounds Alarm on Big Three", WSJ, 2008.

The director of the PBGC, Charles E.F. Millard, sent out letters to all three automakers proclaiming it's concern. The Pension Benefit Guaranty Corporation takes over the retirement plans of companies after they go bust. But Millard has stated that to carry on all three of the automakers would bring the corporation on the brink. Questions have also been raised about the solvency of the PBGC itself. A few weeks back, Millard was on CNBC and was grilled by hosts of the show Fast Money. In the end he finally divulged that the bulk of the assets of the company track those of the S&P 500.

Given that that index has fallen 40%, this does not bode well. I really wish Congress would haul in Millard and others of the Pension agency and find out what's going on. The situation with the Detroit automakers is too big for the Pension Benefits Guaranty Corporation. Union members were promised pension packages (which have already been under attack) that the PBGC cannot afford. Bankruptcy would land those UAW pension packages onto the cutting floor, where members would end up with a fraction of what they were promised.

The PBGC is an insurance company created by Congress to protect workers. It was established after the 1963 closing of a Studebaker plant in South Bend, Ind., which left 4,000 workers with only 15% of their promised pensions and another 2,900 with zero. The PBGC is funded by premiums paid by corporations that offer defined-benefit plans -- traditional pensions whose sponsors pledge to pay the participants a fixed amount each month after they retire -- rather than 401(k) plans, whose sponsors simply contribute a certain amount each month before the participants retire.

Pension Benefit Guaranty insurance isn't a good deal for every employee. Generally, when the PBGC ends up with a company's pension plan, only about 80% of the workers are fully covered, because of limits on the maximum annual pension obligations that are covered. That's why the PBGC fights pension transfers, says director Charles E.F. Millard.

Last year, the PBGC succeeded in having auto-parts giants Dana Corp., with 53,000 plan participants, and Federal Mogul, with 33,000, keep their plans intact through bankruptcy reorganization and beyond.

- excerpt from "The Truth About Auto Pensions", Barrons, 2008.

The PBGC, by Millard's past statements has claimed that they are underfunded. The agency has been making moves to force the Detroit 3 to keep those pensions on their books, something that could force them from a Chapter 11 into Chapter 7 (total liquidation).

Will the 21st Century be the rise of the Jade Dragon?

For all you conservative skeptics out there who think going green is a bunch of bunk, let me give you one reason why it ain't. China! You really want to allow the Peoples Republic of China to take the lead in green manufacturing and cleaner technology? Do you conservatives really want to allow China to establish what is essentially Silicon Valley 2.0? Because I have to tell you, I don't.

I know where this will lead. Development in one field will have a butterfly effect and lead to other industries and technological advancement, especially in military technology. Don't think so? If you can build a sustainable residential housing unit, you can build a sustainable military bunker without having to go topside. I know to many fellow liberal-progressives, this sounds like paranoia talk. But conservatives say they are "the security people" well Ok, if investing in green technology and a more sustainable low-carbon footprint economy, time for the righties to put their money where their mouth is. I have no problem having the Pentagon and their kind investing in green manufacturing and cleaner technology (oh I'm gonna take heat on this one from you good folks, I just know it!). If DARPA can help give us the Internet, then why not this?

CNN is reporting that China is attempting to take the lead. They are investing at the moment on the consumer side. A greener way to make things. More fuel efficient automobiles. Hell, if you go to the site, you'll see a picture of a solar powered stop light!

Chinese engineer Xu spent a decade developing electric vehicle systems for Ford Motor Co. in America. In 2002, he decided to return to China to develop electric vehicle systems of his own.

"There are many guys like me," said Xu, founder of Shanghai Kinway Technologies, a small start-up specializing in motors for electric cars and manufacturing equipment.

"China offers a very good platform and environment for us to do innovation."

Xu represents a growing group of clean technology entrepreneurs in China who are forming a new part of the country's massive engine of economic growth -- a part that, like the motors Xu develops, is becoming increasingly energy efficient and environmentally savvy.

- excerpt from "Can cleantech China teach the West how to be green?", CNN, 2008.

Nothing personal against the Chinese, but as Dr. Xu is concerned for his country, I am of mine. We gave up the consumer electronics industry to the Japanese (Ok, I grant you, they do make some cool stuff, but still!). Our...well take your pick, to China! We are now outsourcing our engineering and software work to Eastern Europe and India. C'mon!

8 years....we had 8 years to take the lead. Yet nothing was done, because that Bastard-in-Chief wouldn't know technological initiative even if the Bible told him so! Right now, I feel as if we've been given a second chance, but that window is closing very fast.

Look at Brazil, look at Germany, and I'm sure others I can't think of right now. The former said no more to regular petrol. The latter has friggin' skyscrapers laddered with solar panels plus area renovation projects. And where are we? Years from now, I don't want to see that the electric car that we've been demanding is some Chinese model from Chery.

It's time for something different. It's time we start looking after ourselves. I'm not talking about isolation or shunning the world. But when it comes to our economy, our workers, our children, our communities, us first (note, I would have said "America first" but I've been told that has a racist connotation now)! We can not only take the lead in making our country greener, but taking what we develop and taking it to the next step. Today it's solar panels and low-carbon foot print autos, tomorrow it's bringing back now-dead fisheries like off of New England or farmlands in the Sahara (hey...you never know!).

Comments

comment on China

When they promote their nation, it's simply loyalty. When we try to stand up for America's economy and working America, we simply hate brown people or those people need our jobs.

I seriously have heard this stated many times in certain blogs and it's so absurd it's one of my pet peeves to make sure that sort of mentality isn't pulled over here.

You have a pooch! Hope the wiener is aok! I have a 6lb dog who is attached to me like something in the movie Alien.

You know, I was at a Borders

You know, I was at a Borders Books the other day (I was buying John Adams the book for a friend for Xmas), and I was in their lousy cafe. Anyways, I ended up talking to this guy next to me, and well the economy came up. I said we need to make America first when it comes to jobs, and he goes and says that's racist because we started wars and ruined "local indiginous" economies with our trade deals. I was like "fine, forget the trade deals" then he goes on about economic justice and karma. Fucking karma!? You got to be kidding me. So I asked him, what he did...asshole worked at the Apple Store across the street at the big mall.

Yep, I got a pooch! Oscar's doing well, unfortunately the guy's an eating machine, not good for a wiener dog. He's a good dog with a big heart, stupid, but a good dog none the less. He apparantly found a sock that fell out of the dryer (A dryer I may add made in America and running well for at least 15 years!). Well you know the rest, and I don't think (I hope) he'll try eating another sock. Like a I said, a good dog, just stupid, but a lovable dog.

exactly

Unfortunately these people are going off of propaganda, some sales snow job, do not understand how the world is a series of nation-states and probably have never been outside of the United States at all.

Very cute pooch. Bones, lots, lots, lots, tons of bones, chews. Training: Kimborn liver treats. My dog learned how to fly for them. ;)

EP has an awesome responsibility...

...to be, well, economically populist. I don't know if by that you mean nationalist, economic nationalism not being a dirty word, in my book. I consider myself quite far out on the Left, and I named my dissertation after a quote by maybe the all-time great economic nationalist, Friedrich List: "The power to create wealth". I can't find the full quote right now, but the idea is that the knowledge and capability to create wealth is much more important than owning wealth, and that nations, like individuals, must encourage and protect this knowledge and capability.

I can rant on some other time about the absurdity of Ricardo's "Comparative Advantage" idea, but suffice it to say that the world economy would obviously function a lot better if every region of the globe was wealthy and had an independent capacity to "create wealth". How else can they trade with each other if they don't all make things that the other wants, and if they can't buy things that the other makes? And yet, in the wonderful world of neoclassical economics, this simple fact seems to be ignored...and thus you get to absurdities like making America "post-industrial" (pre-industrial, really).

So anyway, here's to economic populism.

JR on Grist

Jon Rynn