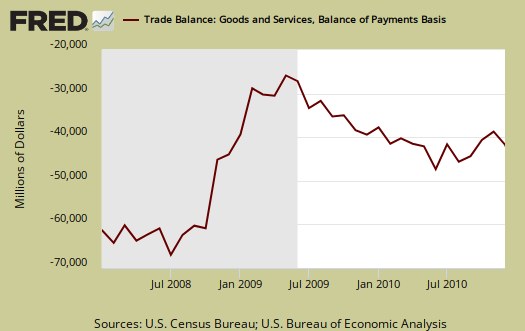

The December 2010 U.S. trade deficit increased $2.3 billion to $40.6 billion. $25.3 billion of this deficit is oil related. For the year, the trade deficit is -$497.8 billion, a trade deficit increase of -$122.9 billion, or 32.8% increase, in comparison to 2009. Oil related trade was -$265 billion of the total yearly 2010 deficit, or 53.2%. Imports increased 1.8 times faster than exports, with monthly increases of $2.8 billion for exports and imports $5.1 billion. The trade deficit with China hit a new record, -$273 billion for the year.

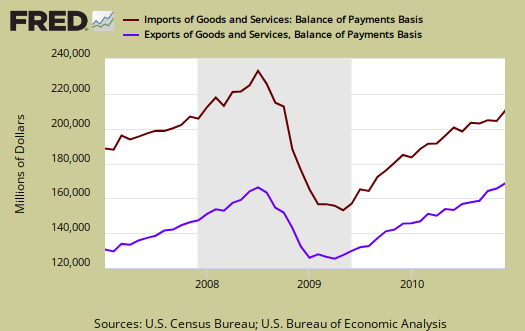

Imports were 1.25 times larger than exports for December.. In other words, for every dollar we export, we import $1.25 worth of stuff. For the year, the ratio is 1.27. This is on a Balance of Payments basis.

The United States basically has two major problems with the trade deficit, Chinese goods and Oil imports.

Below are imports vs. exports of goods and services from January 2007 to November 2010. Notice how much larger imports are than exports, but also notice the growth, or rate of change between months of U.S. exports.

Below is the list of good export increases from November to December. Industrial supplies includes oil and petroleum related products.

- Industrial supplies and materials: $1.1 billion

- Foods, feeds, and beverages: -$0.00 billion

- Automotive vehicles, parts, and engines: $0.6 billion

- Capital goods: $1.5 billion

- Cther goods: $0.2 billion

- Consumer goods: -$0.3 billion

Exhibit 7 gives Census accounting method breakdown for exports. Fuel oil was the biggest drop in exports, under the Industrial supplies category, -$892 million. Foods was basically unchanged with a -$477 million drop in soybeans. This numbers are seasonally adjusted. Capital goods exports the largest contributor was industrial machines and consumer goods had a -$362 million drop in pharmaceutical preparations.

Here are the goods import monthly changes:

- Industrial supplies and materials: $5.2 billion

- Capital goods: -$0.47 billion

- Foods, feeds, and beverages: $0.19 billion

- Automotive vehicles, parts, and engines: $0.15 billion

- Consumer goods: -$0.39 billion

- Other goods: $0.3 billion

The above are seasonally adjusted. Crude oil imports increased $3,269 billion for December, petroleum other, $551 million, fuel oil, $426 million. Clearly rising oil prices caused an increase in the trade deficit. Of interest is imports in pharmaceutical preparations increase $627 million. Do we have another industry being offshore outsourced?

On services, they were essentially unchanged:

Exports of services were virtually unchanged at $46.4 billion, and imports of services were virtually unchanged at $33.4 billion.

Advanced technology products trade deficit improved from

Advanced technology products exports were $26.1 billion in December and imports were $31.6 billion, resulting in a deficit of $5.5 billion. December exports were $3.0 billion more than the $23.1 billion in November, while December

imports were $2.8 billion less than the $34.4 billion in November.

Here is the breakdown with major trading partners, not seasonally adjusted. China is the worst trade deficit, with $20.7 billion, yet a huge drop from last month's $25.6 billion trade deficit with China. Oil, and it seems December is all about oil, has reared it's ugly head with with another OPEC trade deficit increase of $1.3 billion dollars. The unit price for December was $79.78 a barrel. Right now it's $85.64 a barrel, so expect to see more soaring deficits due to Petroleum imports.

OPEC, where the trade deficit is primarily oil, doesn't even compare to the trade deficit with China. Yet last month the ratio of China to OPEC by trade deficit amounts was 3.66, this month, the ratio dropped to 2.5. These are not seasonally adjusted, but still amazing.

The December figures show surpluses, in billions of dollars, with Hong Kong $2.2 ($1.9 for November), Singapore $1.3 ($0.5), Australia $1.2 ($1.2), and Egypt $0.7 ($0.4). Deficits were recorded, in billions of dollars, with China $20.7($25.6), OPEC $8.3 ($7.0), European Union $6.6 ($7.1), Japan $5.9 ($5.8), Mexico $4.7 ($5.6), Canada $3.9 ($1.7), Germany $3.3 ($3.1), Ireland $2.6 ($2.3), Nigeria $2.5 ($1.7), Venezuela $2.0 ($1.6), Korea $0.7 ($1.6), and Taiwan $0.6 ($0.8).

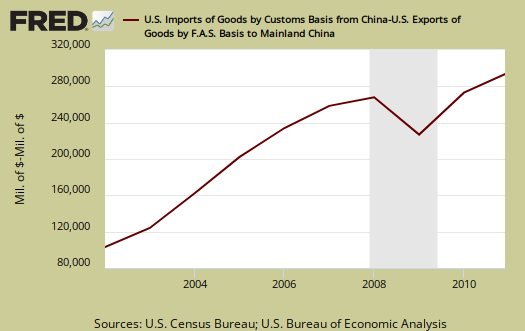

Below is the raw customs basis accounting of the trade deficit with China, not seasonally adjusted. China alone is 41.9% of the goods trade deficit for December. If one takes out not seasonally adjusted petroleum and oil (-$23 billion monthly deficit by NAICS), where only thousands of dollars of oil are imports from China, China becomes a whopping 78% of the total goods trade deficit. Take this calculation as very rough, but it shows, even with soaring oil imports and a drop in the monthly not seasonally adjusted numbers, how much China affects the United States. To accurately estimate this percentage one needs finer granularity of the data than what is available in the trade report, still it gives a good feel for how important China imports levels are to the U.S. trade deficit. Below is the month by month China trade deficit (represented as positive amounts), chart.

Below is a graph of trade deficit with China, per year. This year was a record for a trade deficit with China.

November's trade deficit overall monthly change remained the same but there were minor revision. They are listed in the report. Here is Novembers's report (unrevised, although graphs are updated). Here is the BEA website for additional U.S. trade data.

You might ask what are these Census Basis versus Balance of Payment mentioned all over the place? The above mentions various accounting methods so we're comparing Apples to Apples and not mixing the fruit. The trade report in particular is difficult due to the mixing of these two accounting methods and additionally some data is seasonally adjusted and others are not. One cannot compare values from different accounting methods and have that comparison be valid.

In a nutshell, the Balance of Payments accounting method is where they make a bunch of adjustments to not count imports and exports twice, the military moving stuff around or miss some additions such as freight charges. The Census basis is more plain raw data the U.S. customs people hand over which is just the stuff crosses the border. The 2005 chain weighted stuff means it was overall modified for a price increase/decrease adjustment in order to remove inflation and deflation time variance stuff.

Bottom line, you want just the raw data of what's coming into the country and going out, it's the Census basis and additionally the details are only reported in that accounting format.

accuracy of the import figures

I read recently that the cost of assembling iPhones in China was $6/phone, that all components and software are created outside China, but the value of the import to the US Is booked at the full iPhone import price of $180.

If $174 of the $180 iPhone import price has nothing to do with China, why is China given credit for $180 of exports? How often does this occur and for how many products?

At present energy cost and import volumes, oil and gas imports will total at least $350 billion in 2011. Imagine the employment boost and mulitplier effect increase in GDP if energy production could be repatriated. Imagine the cash flow to the Treasury.

Leave China alone. Drop our own corporate tax rates to Chinese levels, compete successfully and repatriate energy product by allowing drilling for gas and oil to proceed full steam ahead.

I propose the above while we with all reasonable haste improve gas mileage in our fleets, employ cost efficient alternative non carbon energy sources and become more efficient users of energy in all our civil and industrial capacities.

so, how are you going to repatriate oil fields?

Firstly, there are many methods for counting imports, you are referring to the Census method, which is the at the border assessment.

There are others, Balance of payments method, which removes some intermediate inputs plus price adjusters, import/export price adjustments for the national accounts. Check out the links, it's "grad class advanced accounting and statistics" be warned.

Of course the iphone should be an import because it's labor and the economic activity it generated in making it, that's plant, people, capital, energy uses, all are China economic growth and activity, not the United States. Apple is not the United States, and China is getting the benefit of making iphones.

Secondly, most multinationals already pay close to zero corporate taxes, it's small corporations who are not multinational who risk paying 35%, not corporations like Apple, Google and Goldman Sachs.

Thirdly, currency pegs distort markets as we can see and there is more than one Economist who estimates if the Yuan was floated and thus raised a good 40%, literally the trade deficit would disappear. China would no longer be able to capture the U.S. manufacturing sector through currency manipulation.

Also, the reality is the U.S. has improved it's energy consumption, by volume, it's a flat line on petroleum, it's prices that have increased. This is with an increasing population each year, which shows energy has decreased.

You simply will not reduce the trade deficit by energy. That said it's important, but it's clear China is the real problem and it's a man made one, one that is pure policy and arbitrage and could be corrected in a reasonable period too. Energy, while needs to be worked on, is highly important, has elements of innovation that have not occurred yet, cost effective production...

and here we are, offshore outsourcing manufacturing, the very sector where the R&D spawned by it...could provide some of those very break throughs required.

Whereas, China is pure policy, bad trade deals, multinational corporations and FIRE pulling the policy strings and could be easily fixed with the will of the American people.

See the scale in the above numbers? How goods trade dwarfs services? See that breakdown of the goods trade deficit? How petroleum was about half, but the rest, with out Petroleum is China?

You cannot dig up Saudi oil fields and plunk 'em down in the corn fields of Indiana.

Trade Deficit for December 2010 - $40.6 Billion

Time for a trade and exchange rate war

New World Trade Organization data showed the trade gap between the United States and China rose to a record level last year. It hit a record $273 billion in 2010.

The small steps the Chinese government has taken will never allow the yuan to appreciate to its real level. China's central bank controls the exchange rate by actively buying or selling renminbi increasing supply or demand as needed. Administration strategy to press China for better market access is no more relevant. China is waging an economic war with the US. It uses its economic power as weapon, especially its foreign exchange reserves. State-owned Chinese company have a monopoly over electronic payment processing. China systematically imposed duties on certain types of U.S. steel. The procedures and decision-making employed by China in its trade remedy investigations, always led to serious restrictions on exports of American goods. Negotiations time on trade tensions between the two countries was teen years ago. Washington should do more than combat currency manipulation. Obama administration should impose duties on China’s goods ASAP. There is damage done that should be repair by China.

China’s strategy do not only target the United States. That country is also rising by oppressing its neighbours. Countries like Japan, India, Vietnam, Australia, the Philippines, Indonesia, and Korea now suffer China aggressive behaviour. China's neighbouring countries should not have to support this. They should not be bullied to bend to China’s interest. An increasingly assertive Chinese military had push many of them to sought closer military alliances with the U.S. The United States should give them the freedom to defend themselves. Each time India tried to cooperate with China it got conned in one way or the other. Obama should do more than support India for a permanent membership in the United Nations Security Council. The U.S. should be highly interested in forming a very strong anti-China alliance. It should send a strong message about its relationship with India and permit transfer of strategic technology. India has become as a market for the American defence industry. It is now time for an exchange rate war and a trade war.

new Chinese currency manipulation bill introduced today

I agree with you and Congress needs to pass legislation to label China a currency manipulator as well as introduced corresponding tariffs.

I think it was Webb & Kyl who introduced the bill in the Senate, but they are both not running in 2012, and as usual Senate leadership never meta demand by corporate lobbyists they didn't like....

It's pretty clear to me from other data why there is no U.S. job growth and the above rocket chart of China imports is one place to look at where the jobs really are.

So, the only way this bill is going to pass is if regular people realize how bad the China trade deficit is plus the other issues and demand the bill is passed.

Help with math

Oil was -$265 billion of the total yearly 2010 and China was -$273 billion for the year. 273 plus 265 is 538. If the US had a -$497.8 billion trade deficit, am I correct in seeing -$497.8 billion as a net and the US is running a 538-498 = $40 billion dollar trade surplus with the rest of the world?

Gold was pushing against $1000 in 2008, then it moved up and pushed against $1200 in 2009. 2010 saw gold pushing $1400.

Is the US Fed is devaluing the dollar working against the rest of the world, but failing against China because of their currency peg?

This seems to be dangerous game in which the US is running up food prices throughout the rest of the world but losing its manufacturing.

trade accounting

The total is on a balance of payments accounting method and is seasonally adjusted.

China annuals are on a Census basis and not seasonally adjusted.

Petroleum is reported on an end use category and is seasonally adjusted.

So, these are three different accounting methods and why they will not total together and why you see the difference of -$40B between them. They are still valid.

The bottom of the above post shows the difference between the two main methods of Census vs. balance of payments and the Census explains it on their trade website.

So, you cannot add up the three for they are from different accounting methods. Also, end use means the China numbers has some of the Petroleum numbers in it.

Some work with negative numbers:

-538 - (-498) = -538 + 498 = -40

or -1 * -1 = +1

So, there is a $40 billion dollar deficit difference between the total trade deficit and trying to add the China annual trade deficit and petroleum end use category for components with in the trade deficit.

The reason the numbers for China, Oil do not add up to the reported total trade deficit is the above. But the ratios, the percentages to the total, that are calculated above are reasonable.

It's an apples to apples thing. If they are both seasonally adjusted and of the same accounting method, it works. For example, the China ratios were done using the non-seasonally adjusted Census basis method trade totals from the report. Oil was actually retrieved by NAICS category, separate database of trade data, not seasonally adjusted, so one could have a valid ratio of how bad the China non=oil trade deficit is.

more trade accounting math

So, firstly that -$40 billion is just the difference between one method to report the trade deficit and the invalidity of adding the China deficit to the Petroleum deficit numbers together.

From the trade report, table 9, this is the not seasonally adjusted, by BOP (balance of payments) basis, trade deficit: -$646.541 billion. The by Census accounting method, not seasonally adjusted: -$633.938 billion.

So, China, for 2010, by Census basis and not seasonally adjusted was -$273.066 billion.

-273.066/-633.938 = 0.4307 = 43.1% for the year.

By end use, for the year, SITC, seasonally adjusted, the deficit is -$646.541 billion. End use is more of a "trade by commodity" accounting method. So, they bunch up everything that has to do with petroleum in one number. This is called SITC and has to do with yet another international accounting standard, this one to compare via the U.N. This is table 9 in the report.

So, the Petroleum is SITC standard. Therefore, the ratio, of Petroleum must be compared against the total amount via the SITC std. Therefore one can only take the ratio of the yearly Petroleum number against the SITC seasonally adjusted total for 2010. or -$265,117/$646.541 = 41% of the total trade deficit.

and they wonder why regular people believe they are just plain lying with confusion like this. :) That said, imagine trying to add up every single little thing that goes in and out of the country and how many times, it's value and what it's being used for. That's why this is so complicated.

There are actually international standards bodies who work on accounting methods, sampling errors, accuracy on this all of the time as well as a slew of Economists and Statistics people inside the various government agencies responsible for these reports.

So, the Petroleum, or "Oil" number is by SITC, which is a completely different accounting method, trying to track the economic functions of products versus their physical totals....

i.e. you import oil, now did you use that import for making gas, or did you use that for making products or worse, did you use that for making chemicals?

The SITC is a "make that", whereas the other system is "brought in what".

Maybe next time I can dig out the "Petroleum" which is partially dug out in the China in comparison to the "oil" deficit number, by the HTS system, seasonally adjusted though.

For more definitions on these various accounting methods, probably a good idea to start with this Census trade FAQ page.

Bottom line here is you cannot subtract and add numbers from different accounting methods and different adjustments.

And you also know, when I run these numbers and write up that our latest trade report shows the U.S. is in huge trouble, almost all of it from China and foreign oil...

you now know I am checking a lot of numbers behind the scenes in an effort to make this English and visual translation credible.

After all, who can read the actual trade report itself, which is a simplified version of what is available publicly on trade data....which is a very simplified version of what kinds of accounting is really being used?

So, that's what I try to do, put some real numbers behind this and some corresponding graphs, with numbers that are valid, by the Census/BEA methods, yet boil it down to English too.

Next time I write one of these up, I think I'll make a point to not put China numbers or SITC Petroleum numbers next to BOP monthly trade deficit numbers for less chance of confusion.

Huge mistake, yet at the same time, the numbers by themselves imply "horrificness" for the U.S. economy and really jobs. Deficits like this imply products are being made offshore instead of domestically, a LOT of products.

effect on Q4 GDP

WSJ and others are reporting that the 12/10 trade estimates used to calculate GDP were slightly higher, 0.3% than what December came in at, therefore Q4 GDP revision should be higher or the same.

We'll see. To date I have yet to get numbers to jive when trying to go from the Census data to the NIPA methods using the price indexes, so I'll just take their word on this one.

We Can Fix Our Economy by Buying American

The average adult consumes $700 per month in imported goods. If we could reduce that to $517 per person per month, we would have no trade deficit at all. With no trade deficit, we would likely have 3-4% unemployment. All we need to do is reduce our consumption of imported goods 25% to have jobs again in this country. That will secure our long-term economic future (a.k.a. our children’s future). Start buying American before we lose our country.

Take the Buy American Challenge today: http://www.BuyAmericanChallenge.com

Randy

Reduce the trade deficit; increase GDP & median wage

R.O., your response to me within the trade forum’s discussion of “Reduce the trade deficit; increase GDP & median wage” was:

. . . . “Firstly, it's rude to put someone's name over and over again in a comment, when the comment authors are listed. This is why user's names are listed and there is a reply button. There are over 1300 people on this site who are registered, active users and we also have many anonymous comments.

Secondly, I linked to the posts, written by me, on Phantom GDP in the comments already. I'll link to it again, Productivity, Phantom GDP, Jobs & Outsourcing.

Thirdly, this original post is very weak in content, continually promoting one concept, with little analysis, and is quite old. Therefore comments will be locked on this thread.

If you wish to participate, please comment appropriately on some of many posts on trade, GDP, offshore outsourcing, globalization, insourcing, labor arbitrage...there are over 4500 posts on this site”.

//////////////////////////////////////////////////////////////////////////

I regret that you perceive my addressing you by your name as rudeness. I don’t know or believe that I should be concerned if the name is actually your “legal” or a “pen” name. I thought it was an act of common courtesy and respect to address you by your published name. I had no reason to believe you did not want to be mentioned. I did not seek any advantage or intended to insult anything or anyone by addressing you by name. I only meant to be respectful.

I wasn’t aware that the title of your message, “See Phantom GDP link” was itself a link. I now tried to use it as a link but it didn’t work for me. Possibly the fault is due to my poor knowledge or skill as an internet user?

I left clicked upon the title and nothing happened. When I right clicked on the title, a menu appeared. Using the menu I clicked upon “open”; then upon “open in new tab” and finally upon “open in new widow”; in each of these cases couldn’t reach the site you’re referring too.

Would you credit me with Googling and I believe finding reading and fully considering the site based upon the phrase you provided?

My topic of course concerns a single concept. Why would we wish to complicate the discussion of a single concept by introducing other unrelated concepts?

The only response to your opinion that a posted topic is very weak and contains little analysis should come from others than posts’ authors themselves.

The age of a concept is not germane to its validity.

You have determined to lock out further comments to a thread because you do not approve of the concept or although the discussion is civil, the manner or style of its discussion does not meet your standards? Within a free market of ideas, do not concepts eventually flourish or perish dependent upon their own merits? If a concept or the discussion is unworthy of consideration, wouldn’t it die naturally?

Respectfully, Supposn