Michael Collins

President Obama announced the new National Commission on Fiscal Responsibility and Reform on February 18 to address astronomical federal budget deficits. There has been considerable speculation that this commission will target current and future benefits for Social Security recipients to achieve its goals.

Why would this be the case? We need look no further than the treatment of major retirement funds over the past 20 years to get the answer. When the mob needed cash, it looted the Teamsters retirement fund. When large corporations or government entities get in trouble, they effectively borrow from their employee retirement funds by delaying required payments or otherwise gaming the programs. This provides a source of ready cash, a quick vehicle to cover management errors, or jack up their bonuses.

Think of the Social Security Trust Fund (trust fund) as the most lucrative retirement fund in the country, the ultimate pot of gold, and you'll immediately understand why it is that for decades, big business has plundered the trust fund. How does this happen?

The Biggest Retirement Fund Rip Off Ever

Each year, federal taxes fall short of covering government expenditures. At the same time, Social Security payments are more than enough to cover retirement benefit payments. However, in order to keep funding the rest of its programs, the government takes money paid into the trust fund in return for special issue securities from the Federal Government. These securities (IOUs) are a promise to repay the trust fund, which will then pay your benefits.

The Social Security payroll taxes paid by over 90% of US citizens are the premier means of funding the national debt, well ahead of foreign debt holdings. The 2010 Annual Report by the Board of Trustees noted that, "assets held in special issue U.S. Treasury securities grew to $2.5 trillion" (p. 10).

If there were absolutely no anticipated problems honoring the promised payout of the special issue securities, IOUs, this process might be acceptable. But mega deficits have become habitual behavior in the budget process. Year after year, the government spends money it doesn't have through the vehicle set up to tap your social security payroll taxes.

This entire process is presented as sound budgeting. In reality, it's a scam. Sure we'll pay back the trust fund, no problem. But there is a problem and it is not due to Social Security. It's due to excessive spending authorized by Congress that consumes the trust fund annually, spending driven by those big corporations who benefit most and receive payment through your payroll taxes.

Left alone, the Social Security trust fund can meet its obligations. The rest of the government can't. The 2010 $1.3 trillion deficit makes that abundantly clear. The biggest budget busters are the corporate entitlement programs: defense and homeland security contractors; agricultural subsidies for large corporate farms; and the numerous companies who receive large contracts through the federal budget. In addition, the endless wars in Asia now account for $160 billion annually.

The corporate beneficiaries of those programs want money. They behave as though they're entitled to it. Social Security revenues flow in at rates set by the board of trustees. The receipts, sufficient to fund benefits, are then swallowed up by the true entitlement programs that produce no offsetting revenues.

Ironically, as this budget scam comes to a head in the form of astronomical deficits due to corporate entitlement programs, those who created the problem, the cash hungry beneficiaries of government spending, declare a crisis in Social Security. It is a crisis that they created.

Rigged Commission

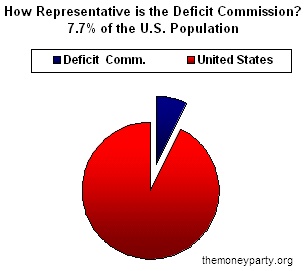

The commission is a rigged panel. The White House selected eighteen members due to report out recommendations for reducing the federal deficit by December 1. Of the eighteen, thirteen are sure votes for higher payroll taxes and lower benefits and the continued reliance on the payroll tax trust fund to keep budget busting programs in place. There are five possible votes against tax increases and lower benefits, although the five lack the cohesion of the thirteen likely to endorse higher payroll taxes and lower benefits.

It takes a majority of fourteen members to report recommendations to Congress. These will be considered by the lame-duck session of the 111th Congress meeting in November and December. Congress will debate the commission recommendations then take an "up-or-down" vote. There will be no amendments allowed, just Yea or Nay on the entire proposal. The all-or-nothing vote makes it easy for Congress to do the dirty work of the Money Party. After the vote, members of Congress will bemoan what a tough decision it was.

The president selected Wall Streeter Erskine Bowles as co-chairman along with former Republican Senator Alan Simpson as the other co-chairman. Simpson has a history of hostility to Social Security. The president hand picked four other members, two Republicans and two Democrats. With the exception of former Service Employee International Union president Andy Stern, this corporate heavy group is a solid vote for ongoing trust fund subsidies for corporate budget items through increased payroll taxes and reduced benefits. Stern may feel some pressure due to a leaked FBI corruption investigation targeting his actions while president of the union. The anti Social Security vote count among these presidential appointees looks like a solid five to one.

The party leaders in the House and Senate picked three members each for a total of twelve members from the 111th Congress. With the exception of Sen. Richard Durbin (D-IL), the Senate contingent represents small, highly conservative, mostly white states.

Appointed by Speaker-to-be John Boehner, the House commission members on the Republican side reflect the Republican Senators in that they're from districts, mostly rural, mostly white highly conservative House districts. The three Democratic House members are from urban, suburban, and rural districts where Social Security is a priority.

The anti Social Security vote from the twelve members of Congress is estimated at eight to four, with the three Democratic House members plus Senator Durbin as opponents of benefit cuts and increased taxes.

On paper, it looks like a thirteen to five deadlock on any increases in payroll taxes and reductions in benefits. In practice, a rigged commission is supposed to look somewhat reasonable but, ultimately, behave like a rigged commission. It is assured that one or more of the five assumed pro Social Security members, for whatever reason, is already in the bag to modify the program by raising taxes and reducing benefits. The vote to report any recommendations on budget deficits and Social Security retirement should be fourteen to four in favor, at least.

There will be little, if any, sentiment expressed by any on the commission against the annual looting of the trust fund to pay the tab for corporate entitlements in the federal budget.

What's This Commission Really Up To?

The commission may very well be a replica of the 1983 Greenspan Commission on Social Security Reform. Greenspan was tasked with producing a plan to shore up trust fund finances. As a result of changes put in place at that time, the trust fund rapidly accumulated a surplus, currently at $2.5 trillion (in IOUs). This sounds like a positive move until you factor in the federal deficits funded by enhanced trust fund revenues. The total federal deficit accumulated between 1983 and 1996 is $2.8 trillion, a sum that could not have been spent without the ready cash taken from world's largest retirement system, Social Security.

We've reached another crisis point in the history of the ruling elite. Their ability to raise money is dwindling. The dot.com bubble burst, now the real estate bubble is down for the count. We have depression level unemployment. What to do? Raise payroll taxes; reduce benefits, and continuing taking every available dollar of citizen payroll taxes in return for IOUs that they can worry about later. Our payroll taxes for Social Security are "interest-bearing securities backed by the full faith and credit of the United States" government. We all know who that is, the Money Party. And we know how good their word is.

END

See: Statement to the Commission on Deficit Reduction - James K. Galbraith, June 30, 2010

This article may be reproduced in whole or part with attribution of authorship and a link to this article.

| Attachment | Size |

|---|---|

| 33 KB |

Comments

Looks like we need a deficit post update

Break down the federal budget and deficit current, future. Last I saw it was Medicare/Medicaid that will eat the nation alive and of course Defense is never mentioned (except by Ron Paul).

It's 1.3 trillion worth of someting

Just start subtracting programs up to 1.3 trillion and stop taking the trust fund. When they hit the wall and have to make serious payments, there will be a crisis of some sort, a major distraction and we'll all have to "sacrifice."

Here's an excellent quote from a very astute observer:

The reports of impendindg doom come from people show shop for convenient assumptions, it would seem. This is congressional behavior similar to a year or so after the Iraq invasion. It was discovered, without doubt, that the intel reports justifying the war had been altered materially and that there was never any real basis for WMD. Congress continued the funding, without missing a beat.

Well, we've known for quite a while about the bait-and-switch with payroll taxes turning them in to questionable IOU's, special securities. Yet the process goes on and on. It's a bipartisan effort, just like the war.

The "full faith" of the governments that we've been subjected to is not a comforting thought.

Michael Collins

Did I miss something?

"Year after year, the government spends money it doesn't have ..."

Is the new Gold-Standard proposed by Robert Zoellick already up and running? Otherwise the above sentence doesn't make any sense. The US government is the monopoly issuer of the currency. From an operational perspective the US government has US$ in the quantity of infinity-1US$ at his disposal.

Thanks for commenting

The government has the money in the same way that the Weimar Republic had the money. I'm referring to money backed by "the full faith and credit of the United States", which I referenced. "Faith based" financing falls short when the cast of characters constantly behave cynically.

Here's the full quote:

Michael Collins

Baby Boomers will recall anyone in Congress who votes to cut SS!

Congress better not try to cut Social Security benefits, increase SS retirement age, or raise SS taxes on the middle class!

France just tried to do the same thing and they are still having riots.

But that's nothing compared to what millions of angry, aging American Baby Boomers can do! We have the experience of the 60's under our belts, and if we have to force Congress to keep their hands off of our Social Security, this time around, we will make the 60's look like the 50's.

A definite point but....

...at this point it's hard to argue that the Congre$$ is composed of anything other than fools and knaves, been reading my Mark Twain, and they may have to pay the ultimate price for their stupidity. Obama is certainly a goner if any part of SS is privatized.

But this may very well happen after the damage is done as the populace seems very, very clueless at the moment.

I do think it will be a big story and I do think far more folks know this is a scam than did so even as recently as a year ago. Let's hope they are numerous and vicious enough to...

...kick some butt.

'When you see a rattlesnake poised to strike, you do not wait until he has struck to crush him.'

It's time

Clean house. They're all in on this operation, have been for years.

The very people who say that 'the money will never be there' are the people making that abundantly clear. The shameless rhetoric will succumb to the bright light of public rage. This is the ultimate populist issue - the very few exploiting the many for purely financial gains. There's no victim group here, it's the 90% who pay into the system. The the bailout reaction will be nothing compared to this.

Michael Collins

David "We never had the numbers." Stockman

Talks sense about the Defense Budget and Social Security.

Isn't that something

I remember Stockman from way back. What a reasoned outline of the issues. The Empire project is going nowhere, unless alienating every potential customer for US exports is the goal. It returns nothing. Homeland security needs to justify itself, in a serious way (and who started this "homeland" business?).

And here's an idea. The income basis for payroll taxes might be addressed without raising taxes across the board in a regressive way. Raising the income cap mindlessly would be a terrible idea since those right at it would get hammered. But having a gap and then raising it at a income point where the impact would be a much smaller percent of income should be considered.

Thanks for this. It's amazing the consensus you can achieve across the political spectrum when the commentators are intellectually honest.

Michael Collins

Michael Collins dissection of the CatFood commisssion

Hwere is where it gets difficult: 6.2% from the employee and the company to pay for SSI, Medicfunds to a ceiling. If income is taxed above that ceiling at the 6.2% rate regardless of source (earned or non-wage income) and that is matched AND that surplus is used to guarantee the funds viability to pay full benefits (what is at risk in 2035),balance to pay down the debt......we are heading somewhere.

Look for the billionaires and Fortune 500 to absolutely oppose this. America was a way stop in the global awsomeness and reach for heaven. We are no longer significant excepet as just another market and a source of cannon fodder. So it is Catfood now, Catfood forever, ecxcept when our masters introduce Soylent Green TM as a cheaper alternative.

War is on the way, with blood in the streets and in legislatures over these proposals. You will be starving people to hold the line on rich and poor.

Taxes Cuts in the Cat Food Commission

Love how they lowered taxes on corps to 23% and income taxes to the same amount, but Social Security will have major cuts and the index fudged with even more. Its not like most people that rely on Social Security alone is living the high life on their Social Security. Funny how Social Security is self funding and money is not taking out of the general fund to pay for it, but we must take cuts in benefits to pay for even lower taxes on companies that off shore jobs. Yeah, that is a brilliant move. More robbing the lower class to subsidies the rich, god knows all we ever hear is free market. Let them take the hit when they play the game on wall street. Most of us are tired of being the suckers and being on the hook for these people that get the bail outs. Its getting to the let them eat cake moment in this country.

And there will be no cake to eat soon;) Excellent points!

Those in charge are reaching new levels of arrogance in their looting of the system. They think nobody notices. But that's not the case. A good deal of the voting by 42% of those eligible was out of anger, punishment votes. The majority, however, were those who think it's not worth voting. That is a vote and a telling one. Let them pursue the Social Security cuts for real after Dec 1 and we'll see how the public delivers the message.

Michael Collins

OMG, Newt Gingrich made sense on the budget deficit!

I had on FAUX news, Greta show and Newt Gingrich slammed this report saying these people just recycle old, very bad ideas. He also says there was a study by IBM (who loves to offshore jobs) so, I haven't seen/read this study, but it concluded it could shave off $1 trillion from the budget just by updating the methods and ways government does daily business. I can believe that, it's still stuck in the 1970's in the way it processes and so does the U.S. legal system. If anyone has that report, let me know for I'll look it over.

But yes, shocking but true, Gingrich said the catfood commission report was absurd, simply recycling old worn out ideas that just harm the American people instead of really analyzing it from a 2010 view. I think I dropped a plate and broke it so surprising.

IBM $1 Trillion Dollar Report

Here's the link:

http://www.techceocouncil.org/storage/documents/TCC_One_Trillion_Reasons...

It's actually by the Technology CEO Council (IBM is a member along with some other tech companies).

http://www.techceocouncil.org