In our current interconnected global economy nothing happens in a vacuum.

Spooked investors worldwide were fleeing risky assets like stocks. And from Shanghai to Sao Paulo, people were awakening to the reality that what is happening in these European minnow states has vast implications for the fate of the fragile global economic recovery.

*snip*

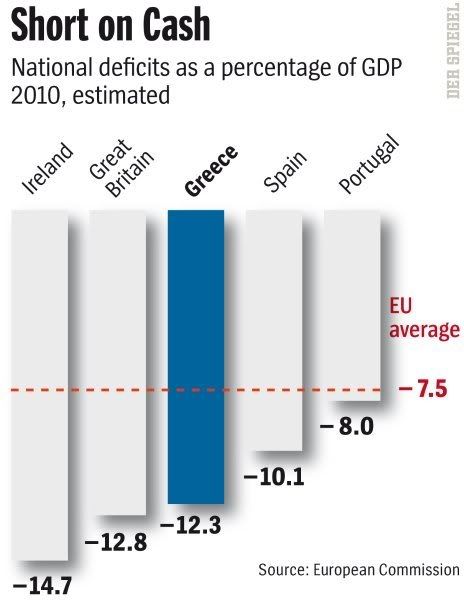

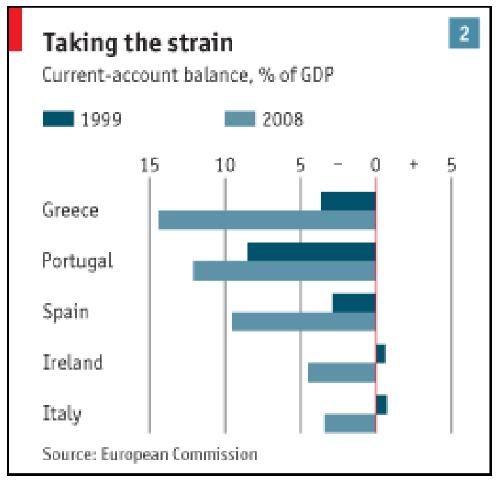

Markets fear Greece may default or require a costly bailout from already strapped European governments, and those concerns are spreading to other financially troubled governments such as Portugal and Spain.

Euro "in danger of becoming unstable" "In my view the most important (challenge for Europe) is stabilizing the currency," Oettinger was quoted saying. "The euro is in danger of becoming unstable -- look at Greece, Ireland or possibly soon Spain, Portugal, Latvia and Italy." ~ Guenther Oettinger, a conservative leader in Germany and designated European Union energy commissioner

Sovereign default was a hot topic for the G7 this weekend. G7 talk on Greece will not soothe global investors

TORONTO (Reuters) - Investors are skeptical of assurances European finance ministers gave to their Group of Seven counterparts this weekend that the euro zone's debt crisis is under control.

The 16-country currency bloc is facing its biggest ever test after concerns about Greece's huge public debt and deficits spread to several other euro zone countries, pushing the euro to a near nine-month low against the dollar.

A sell-off of Greek, Portuguese and Spanish debt last week, which hurt global stock markets, pushed Greece's debt woes onto the agenda of the meeting of Group of Seven rich nations' finance ministers and central bankers in Canada's remote north.

Can the crisis be contained in Greece? Portugal, Ireland and Spain are also quickly losing ground.

In order to maintain "Austerity" (budget) plans, social services and government spending will be slashed. Protests are underway in Greece as social unrest escalates.

Stay tuned for more on Economies Run Amok.

I guess we'll know this week

There are all sorts of in depth analysis showing that the current crisis was just kicked down the road and a host of analysis expecting sovereign defaults to kick in and start "phase 2".

Actually,

I have seen some articles that point to Greece as the catalyst for a global depression and others point to Japan.

Eventually the can is no longer able to be kicked.

Oh yes

I know but I was more thinking in a week we should know if this is going to happen.

The news is happening fast and furious with a lot of misinformation happening too.

I'm betting the EU bails them out to avoid contagion.

From the Horse's Mouth

On MEET THE PRESS today:

MR. GREGORY: A disturbing report on Wednesday in The New York Times talked about people underwater in their mortgages. "The number of Americans," the paper reported, "who owed more than their homes were worth was virtually nil when the real estate collapse began in mid-2006, but by the third quarter '09 an estimated 4.5 million homeowners had reached the critical threshold, with their home's value dropping below 75 percent of the mortgage balance. ...according to Sam Khater, senior economist with First American CoreLogic, "People's emotional attachment to their property is melting into the air.'"

Q. Secretary Paulson, what happens if housing prices go down again?

MR. PAULSON: It clearly wouldn't be good. It's very difficult for governments to design a program that is effective and fair to taxpayers...historically, everyone would do whatever it took to make the mortgage payment and avoid default...And when the home is worth less than the mortgage, behaviors tend to change."

MR. GREENSPAN: "Well, I am very much concerned if home prices decline. The reason I am is that during 2005 and 2006, there were eight million home purchases with so-called conventional conforming mortgages with the 20 percent down payment. That down payment is gone, and we have this very large block of homeowners who are right on the edge of tilting down into that underwater category. Fortunately, the evidence suggests that the vast majority of these homeowners--that is, those with standard, conventional mortgages--continue to pay on their mortgages...even if the value in the homes is below the market price. Or rather, what worries me particularly is that there is a very large block that will be thrown on the market, I mean people starting to foreclose, if prices go down significantly from here."

Frank T.

Frank T.

What surprised me about that interview

Not one question was asked about the G7 meeting? The topic was not touched upon.

Greece default doesn't matter yet then it does ...

That's a nice concise wrap-up. In and of itself a Greek bankruptcy or bond default should -in theory- not affect the Euro as such very much, Greece being maybe 3% of the total. However, just as a Californian bankruptcy (probably inevitable, large US cities at least are already contemplating insolvency, ten idividual states may well follow) would reflect badly on the "state of the Union" as a whole so would the default of on EU country, coupled with the rising interest rates and thus further destabilisation of the remaining over-leveraged member states, make investors wonder when sovereign default across the board is likely. Thus they wouldn't commit themseves to bonds of longer maturity and that's the beginning of the end.