On Friday we saw some pretty awful economic news. Unemployment spiked to over 6%, and the word is out that the taxpayers will be bailing out the massive mortgage giants of Fannie Mae and Freddie Mac.

With news like that it would be pretty easy to miss a much smaller item with huge political implications for the presidential race.

The news I speak of is that regulators have seized Silver State Bank.

"When the casinos treat you poorly, let Silver State treat you like a valued customer."

- the Silver State Bank motto (I kid you not)

The lender, the 11th bank to fail in the U.S. this year, was overexposed to risky real-estate loans, a problem that's vexing many banks amid the worst financial crisis in a generation. Silver State had nearly $2 billion in assets and 17 branches in Arizona and Nevada.

Silver State's failure will be costly to the FDIC's already-strained deposit insurance fund. The FDIC estimated it will incur a $450 million to $550 million hit.

So why does this have anything to do with the presidential campaign? Because just five weeks ago, Andrew McCain, John McCain's son, stepped down from the Silver State Bank's board of directors.

Until recently, the son of Republican nominee Sen. John McCain sat on Silver State's board and was a member of its three-person audit committee, which was responsible for overseeing the company's financial condition.Andrew McCain left the Henderson, Nev., bank July 26 after five months on the board, citing "personal reasons." He is Sen. McCain's adopted son from his first marriage.

Spokespeople for the McCain campaign didn't return calls seeking comment. Efforts to reach Andrew McCain Friday night at Hensley & Co., the family-owned beer distributor where he is chief financial officer, were unsuccessful.

Deja Vu

Now for some of the younger readers here, this might not sound like a big deal. But for anyone old enough to remember the 1980's, this should sound extremely familiar to you.

I speak, of course, of the Relatively Charmed Life of Neil Bush.

Neil Bush became a director of Silverado Savings at the age of 30, despite not having any real business experience.

The basic actions of Neil Bush in the S&L scandal are as follows:Neil received a $100,000 "loan" from Ken Good, of Good International, with no obligation to pay any of the money back.

Good was a large shareholder in JNB Explorations, Neil Bush's oil-exploration company.

Neil failed to disclose this conflict-of-interest when loans were given to Good from Silverado, because the money was to be used in joint venture with his own JNB. This was in essence giving himself a loan from Silverado through a third party.

Neil then helped Silverado S&L approve Good International for a $900,000 line of credit.

Good defaulted on a total $32 million in loans from Silverado.

During this time Neil Bush did not disclose that $3 million of the $32 million that Good was defaulting on was actually for investment in JNB, his own company.

Good subsequently raised Bush's JNB salary from $75,000 to $125,000 and granted him a $22,500 bonus.

Neil Bush maintained that he did not see how this constituted a conflict of interest.

Neil approved $106 million in Silverado loans to another JNB investor, Bill Walters.

Neil also never formally disclosed his relationship with Walters and Walters also defaulted on his loans, all $106 million of them.

Neil Bush was charged with criminal wrongdoing in the case and ended up paying $50,000 to settle out of court. The chief of Silverado S&L was sentenced to 3.5 years in jail for pleading guilty to $8.7 million in theft. (Keep in mind that you can get more jail time for holding up a gas station for $50.)

Silverado Savings went belly up in 1988 at a cost to the American taxpayer of $1.6 Billion.

Of course it doesn't end there. You see, when you are Neil Bush everything just comes easy. Like making money from insider trading, for instance.

In July 1999, Bush made at least $798,000 on three stock trades in a single day of a company where he had been employed as a consultant. The company, Kopin Corporation of Taunton, Massachusetts, announced good news about a new Asian client that sent its stock value soaring. Bush stated that he had no inside knowledge and that his financial advisor had recommended the trades. He said, "any increase in the price of the stock on that day was purely coincidental, meaning that I did not have any improper information."

Now not everything has come so easily for Neil. In 2003 his marriage collapse in a messy divorce. Why did it collapse? What could possible go wrong for the golden boy, you ask? Allow me to enlighten you.

Asked by his wife's attorney whether he'd had any extramarital affairs, Bush told the story of his Asian hotel room escapades."Mr. Bush," said the attorney, Marshall Davis Brown, "you have to admit that it's a pretty remarkable thing for a man just to go to a hotel room door and open it and have a woman standing there and have sex with her."

"It was very unusual," Bush replied.

Actually, it wasn't that unusual. It happened at least three or four times during Bush's business trips to Asia, he said: "I don't remember the exact number."

"Were they prostitutes?" asked Brown.

"I don't -- I don't know," Neil replied.

"Did you pay them?"

"No."

Ah, it must be nice to be Neil Bush.

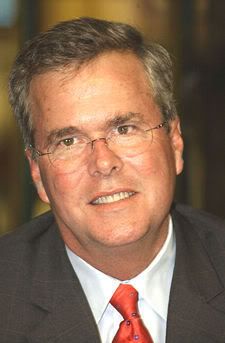

There are more financial shenanigans like these in these links, but after a while it gets a little redundant. So instead of continuing on about Neil, I would like to address another one of the Bush clan - Jeb Bush.

Deja Vu All Over Again

Jeb Bush was an early supporter of John McCain's campaign. It seems that he likes McCain's family values.

And what better family values can there be than a little legal banking fraud.

Shortly after arriving in Miami, Jeb was hired by Cuban-American developer Armando Codina to work at his Miami development company as an agent leasing office space. A couple of years later, Jeb and Codina became business partners, and in 1985 they purchased an office building in a deal partly financed by a savings and loan that later failed.The $4.56 million loan, from Broward Federal Savings in Sunrise, Florida, was granted in such a way that neither Codina's nor Bush's name appeared on the loan papers as the borrowers. A third man, J. Edward Houston, borrowed the $4.56 million from Broward and then re-lent it to the Bush partnership. When federal regulators closed Broward Savings in 1988, they found the loan, which had been secured by the Bush partnership, in default.

As Jeb's father was finishing his second term as vice-president and running for the presidency, federal regulators had two options: to get Jeb Bush and his partner to repay the loan, or to foreclose on their office building. But regulators came up with a third solution. After reappraising the building, regulators decided it wasn't worth as much as was owed for it. The regulators reduced the amount owed by Bush and his partner from $4.56 million to just $500,000. The pair paid that amount and were allowed to keep their office building. Taxpayers picked up the tab for the unpaid $4 million.

After the Broward Savings deal was revealed, Jeb described himself and his partner as "victims of circumstances."

Now if the taxpayer picked up $4 million for me, I wouldn't describe myself as a "victim", but then I'm not part of the Bush or McCain family. They have different family values than I do.

Like Neil, there's all sorts of stuff about Jeb's business partners being involved in fraud and embezzlement, but after a while you kind of get tired reading the same things over and over again.

The important thing to take away from all this is that it must be nice being part of a rich Republican family.

Comments

to be fair

You need to cover some of the insider trading games over in the Democratic land. Pick a few, any few, there are so many there too.

(Oh I wish it weren't so).

McCain isn't Bush so hold on a minute

I think it's important to be deadly accurate on these sorts of things so quoting the

article with more details:

So before we go making unfounded accusations or even worse, the infamous unsubstantiated rumor mill machine of the blogs, the article also says:

It could be more simply our classic super rich executive class who hire incompetent CEOs because they are their friends pay them absurd amounts of money to run corporations and companies into the ground or mediocrity, get fired, get a golden parachute and then moveon to another CEO or executive position to do the same thing all over again.

History doesn't repeat, it rhymes

First of all, we don't know how much of this failure can be attributed to incompetence, and how much to fraud yet. That sort of information won't come out for many months.

Fraud in large quantities always happens during bubbles. The real estate bubble will not be an exception.

Now did Andrew engage in fraud? Probably not. Did Neil Bush engage in fraud? Yes. Did Neil Bush knowingly engage in fraud? It's hard to say. Neil Bush doesn't strike me as being all that smart.

Let's say you were a crook. Or better yet, part of a gang of crooks. The best partner you could have would be the brother or son of a powerful politician.

Not only would having him as a partner allow you easy access to rich people, but when you finally got caught you know they wouldn't throw the book at you because it would come back on the brother or son.

It also helps if the brother or son isn't very bright, for obvious reasons.

Birds of a feather

Great comment title. In the dot con era and seemingly they got completely away with it, power point slides might not have even existed for a buddy of a pal to give another one of his friends millions in Venture Capital.

There is assuredly a good ole boys network, or the executive class where I think it's safe to say they are not getting these executive jobs based on meritocracy.

My caution comment is just we don't want to turn into the financial and economic version of "babies of whose babies of who had what baby and not her baby" type of things we cannot substantiate yet.

Not that it isn't possible.