The U.S.-China Economic and Security Review Commission has issued their new, comprehensive annual report on China for 2011. The 414 page report (large pdf), is a comprehensive, with details on trade, economics, currency manipulation, development strategy, military actions and human rights abuses.

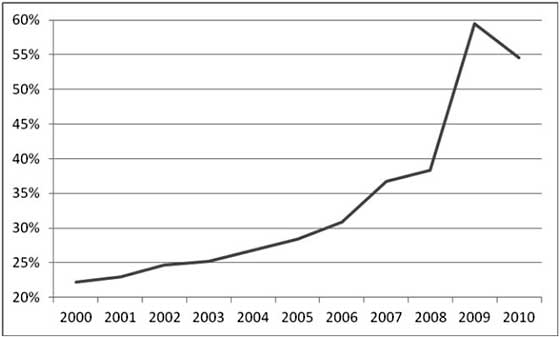

The China PNTR has been in effect for 10 years now and the result is economic disaster for the United States. The monthly trade deficit report backs up these facts. Every month we point out the U.S. has two major problems in trade, China and oil. The graph from the report below shows the percentage China has been of the total U.S. trade deficit since the China trade agreement went into effect.

For the first eight months of 2011, China’s goods exports to the United States were $255.4 billion, while U.S. goods exports to China were $66.1 billion, yielding a U.S. deficit of $189.3 billion. This represents an increase of 9 percent over the same period in 2010 ($119.4 billion). During this period China exported four dollars’ worth of goods to the United States for each dollar in imports China accepted from the United States. In 2010, the United States shipped just 7 percent of its total exports of goods to China; China shipped 23 percent of its total goods exports to the United States. In the ten years since China joined the WTO, the U.S. trade deficit with China has grown by 330 percent.

China doesn't seem to be letting up on dominating trade either. The report lists a series of actions by China within the WTO to be the rule shaper and maker, instead of international rules applying to them. It's so bad, there is a case study detailed of China stubbornly stonewalling the WTO.

Some Facts

The report is loaded with facts, figures, statistics and references on all things China. Here are just a few which stood out:

- China, not the United States, is the world's largest manufacturer

- China maintains policies of forced technology transfer in violation of international trade agreements and requires the creation of joint venture companies as a condition of obtaining access to the Chinese market.

- Counterfeits constitute between 15 and 20 percent of all products made in China and are equivalent to about 8 percent of China’s gross domestic product (GDP).

- Intellectual Property Theft accounts for 2.1 million lost U.S. jobs

- The Chinese currency has only increased 6% for the last year. Current estimates have the Yuan being undervalued by as much as 40%.

- China’s foreign currency reserves currently exceed $3 trillion, three times higher than the next largest holder of foreign currency reserves, Japan.

- Between 2000 and 2010, China’s money supply grew by 434%. China’s money supply is now ten times greater than the U.S. money supply. This has created inflation and a real estate bubble.

- China's continuing currency manipulation removes a key monetary tool to reduce internal inflation.

- China is moving to internationalize the RMB, challenging the U.S. dollar as the world's reserve currency in 5 to 10 years.

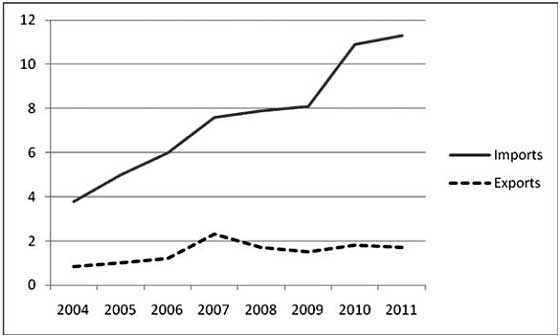

Yet another element of the report is truly bad news. China is moving into advanced technology and manufacturing, with a U.S. trade deficit increase of 17%, so far in 2011. Below is a report graph of the U.S. advanced technology trade imbalance with China.

In the year to date ending August 2011, the United States exported about $13.4 billion in advanced technology products to China, but imported over $81.1 billion in advanced technology products from China, for a deficit of about $67.7 billion. This is a 17 percent increase in the advanced technology products deficit for the same period over the previous year, ending in August 2010.

80% of all computers in China run counterfeit software. That's almost strange considering one can obtain open source Linux which often is superior to Microsoft Windows, still the dominant operating system for PCs. Yet, China's brazen disregard for U.S. patents, trademarks and copyrights is actually a huge drain on the economy. The below report fact box shows just how important intellectual property rights is to the U.S. economy:

Intellectual property plays a key role in creating high-wage jobs and fueling new economic growth. Much of the U.S. economy consists of intellectual assets such as patents, copyrights, and trademarks. These assets compose an estimated 76 percent of the Fortune 100’s total market capitalization and approximately 80 percent of the value of the Standard & Poor’s 500. Within the United States, intellectual property-intensive companies generated nearly $7.7 trillion in gross output in 2008, totaling a third of U.S. total gross output. Intellectual property-intensive industries are particularly critical in the tradable goods sector and accounted for 60 percent of all U.S. exports in 2007, a total of $910 billion. Intellectual property intensive industries also provide high wages. Between 2000 and 2007, the salary of all workers in intellectual property intensive industries was on average about 60 percent higher than their counterparts at nonintellectual property intensive industries. Major copyright industries, including software, contribute nearly 6.5 percent of the total U.S. gross domestic product (GDP), employ over 5.5 million workers, and generate more than $125 billion annually in foreign sales and exports. Solely looking at software, in 2010, ‘‘the direct, commercial value of stolen software tools for personal computers came to $59 billion globally. . . [and] the indirect costs are even greater. Enterprise software theft undercuts legitimate business activity and imperils job creation in every sector of the economy.

It's clear China is moving up the manufacturing value chain. Anyone thinking China is interested in manufacturing low cost, low value goods, think again. Cheap plastic goods were simply a stepping stone:

On a monthly basis, the United States now imports roughly 560 percent more advanced technology products from China than it exports to China. Exports of low-cost, labor-intensive manufactured goods as a share of China’s total exports decreased from 37 percent in 2000 to 14 percent in 2010.

Evidence of Multinationals in China

There is enormous evidence U.S. multinationals keep their profits abroad, reinvest in China and thus do not invest, hire, in the United States.

In 2010, the amount of foreign direct investment (FDI) flowing into China jumped to $105.7 billion, up from $90 billion in 2009. Foreign-invested enterprises were responsible for 55 percent of China’s exports and 68 percent of its trade surplus in 2010.

On the other hand, China's U.S. investments have increased 100% from 2009 to 2010. Yet many are saying China is acquiring U.S. manufacturing and brands....to simply technology transfer these businesses back....into China. China is repeatedly acquiring companies and technology that is either highly sensitive for defense, or key critical technologies for manufacturing. China is simply not just buying up legacy PC makers here.

U.S. direct investment in China is more than 12 times greater than Chinese direct investment in the United States.

Why would this happen? It seems foreign investors are forced into joint business ventures with China, or native intellectual property R&D and other technology-sharing arrangements. Literally foreign companies are forced to set up R&D centers in China. All of this, required by China for these companies to simply gain access to the China market. It's all about selling multinationals' autos, goods, for less than cost, to the mythical 1.4 billion people consumer market of China. China's consumer market is now larger than the United States.

Currency Manipulation

China of course continues with their manipulation of their currency, the Yuan, also known as the renminbi, or RMB. Few understand the underlying mechanics of currency manipulation. Folks wrongly assume the buying of U.S. Treasuries gives China power over the United States or is a diplomatic act. Nope, the reason China buys record amounts of U.S. bonds is more about currency manipulation. The below report excerpt explains how the ruse is run:

Chinese merchants who export to foreign parties are still left with little choice other than to relinquish their foreign currency earnings to the state-owned banks in exchange for renminbi. Thus, when China runs a trade surplus, the supply of RMB in circulation grows. To counteract the inflation that would naturally spring from a rapidly expanding money sup-ply, the Chinese government issues special bonds in an attempt to attract investors and thereby soak up the extra money. Thus, the government is left holding both foreign currency and RMB, and the Chinese public is left holding sterilization bonds denominated in RMB. The Chinese government must then reinvest the foreign currency if it is to avoid losing value to inflation. The Chinese government could pursue any investment strategy, but in order to satisfy the second of its two primary monetary policies, namely, a managed exchange rate, it chooses to invest its foreign currency in bonds, primarily U.S. Treasury bonds.

This activity helps maintain the price of dollars relative to the RMB. To avoid a black market in foreign currency, the government requires that most Chinese businesses and citizens exchange their dollars at a bank, the large majority of which are state owned. Each day the central bank declares the price at which the state-owned banks will exchange dollars for RMB. Finally, in order to keep this maneuver affordable, the government must maintain an abnormally low domestic rate of interest. For if the prevailing interest rate at Chinese banks were to increase, then the government would be forced to increase the interest rate on sterilization bonds in order to maintain their attractiveness in the market, which would significantly increase the cost associated with the exchange rate policy.

Indigenous Innovation Policy

Did you know China has a requirement that patents, intellectual property be developed in or transferred to China to be recognized as valid? Check out what China does to companies wanting to do business with the government.

Foreign-invested enterprises seeking to be considered for government procurement contracts or public works projects are expected to file for patents and copyrights within China in order to qualify for preferential treatment in government contracting. Foreign affiliates risk the unintended transfer of their technology to Chinese firms if they do so, because of the nature of the Chinese intellectual property system and the lax enforcement of intellectual property laws and regulations in China.

Even worse, China's state owned businesses receive favorable treatment, subsidizes and in some cases, no private enterprise is allowed at all. Below is a video report, subtitled, on China owned state enterprises and favorable treatment by China.

In 2010, of 42 mainland Chinese companies listed in the Fortune Global 500, all but three were state owned. By revenues, three Chinese state-owned companies ranked among the top ten in the Fortune Global 500, compared to just two American companies. China’s own list of the 500 biggest Chinese companies showed that among the top 100 firms traded on the stock exchange, the government controlled the majority of the stock in 75.

Not only are scores of industry sectors 100% China state owned enterprises, it seems China Communist Party leaders and these enterprises are intertwined.

Five Year Plans

China, unlike the United States, plans. In fact they issue 5 year plans and then execute upon them. Guess what the new 2011 five year plan is targeting? These industries: new generation information technology, high-end equipment manufacturing, advanced materials, alternative fuel cars, energy conservation and environ-mental protection, alternative energy, and biotechnology.

See anything like that in the United States? See the United States join forces, even to rebuild critical infrastructure upon which these industries rely? Nope.

Myths Dispelled

A common myth to justify why America needs to export her jobs and middle class to China, is somehow a stronger middle class will create democracy instead of the authoritarian regime currently in place. The report states the opposite is true, the more economic prosperity comes to some in China, the more the current regime is strengthened. Even worse, there is denial of health care to internal regional migrants and a host of techniques and policies to enact thought and mind control of the Chinese people.

Cyber Attacks

By now it's well known most cyber attacks, hacks into networks are coming from China.

In 2011, as in previous years, the U.S. government, foreign governments, defense contractors, commercial entities, and various nongovernmental organizations experienced a substantial volume of actual and attempted network intrusions that appear to originate in China. Of concern to U.S. military operations, China has identified the U.S. military’s reliance on information systems as a significant vulnerability and seeks to use Chinese cyber capabilities to achieve strategic objectives and significantly degrade U.S. forces’ ability to operate.

Without coming out and calling a spade a spade, the report implies China is literally interfering with U.S. Satellites. Military defense, media, all sorts of systems rely on Satellites. This is a huge threat to the United States.

This USCC 2011 China report is one scary horror show and is a must read. It's impossible to cover all of the report exposures and shocking nightmares here, but if you need one reference document on China, this report is it.

While this overview focuses on economics, the report also covers China's military exercises in the China South Sea, increases in their military build up and desire to control shipping routes (implied).

One has to wonder if our Congress, government is simply made in China. Their policy responses cannot seem to process facts, are cheap, plastic and broken. While the Congress fails on budget deficits, one of the things never mentioned is China. The not so super supercommittee was tasked with budget cuts $1.2 to $1.5 trillion over 10 years. This year's trade deficit with China alone is on target for $300 billion. That's just one year. Reducing the China trade deficit increases U.S. GDP, jobs and thus tax revenues. Yet, while the Senate passed a currency manipulation bill, it's not brought up for a vote in the House.

Comments

Actions of Speaker Boehner

"While the Senate passed a currency manipulation bill, it's not brought up for a vote in the House."

It's worse than that -- it hasn't been allowed to go to a vote even though a bipartisan majority sufficient to pass the bill were on record as co-sponsers of an identical House bill. See, APNews story (4 October 2011) via Townhall.com

Boehner is clearly abusing his power as Speaker, and there should be a demand for his resignation. (Some would say Boehner should be prosecuted for treason, but that would not be conforming with the elements required for an indictment under current statutory law for treason.) But what's Boehner's side of the story? We go to Xinhua news service for that --

Here's from Boehner-friendly China news service (Xinhua) story via webpage of the embassy of the People's Republic of China to the USA) --

Record on currency manipulation bill

What Robert Oak refers to as the "currency manipulation bill." The bill is titled "Currency Exchange Rate Oversight Reform Act of 2011" and is officially identified as "S. 1619" (Senate bill Number 1619).

Here's the bottom four lines from Thomas (Library of Congress) webpage for S. 1619, 'All Congressional Actions", (emphasis added) --

thanks 2OLD4OKEYDOKE

You always add some useful references which I might have missed. Watching how Boehner has shelved the China currency manipulation bill, when I believe in the House the majority have co-sponsored the bill (which is significant, it means it will pass with flying colors), says it all about Boehner's refusal to listen to even his own party, never mind the will of the people.

Boehner and Obama - two sides of same coin

Boehner and Obama are bedfellows on trade issues!

The action by Boehner to prevent a vote on currency exchange rate legislation puts the lie to the GOP claim that the agenda is all about defeating Obama in 2012. Since Obama will not be forced to take an unambiguous stand on currency regulation, it's a gift to his campaign. (I am not saying that President Obama necessarily would or would not veto the Act -- just that if he would sign it, so that it would be enacted into law, that would make international corporations less likely to contribute to his campaign fund. And, thanks to Senate GOP opposition to the DISCLOSE Act in 2010, we would never even know about those contributions!)

From APNews report (4 October 2011), via Townhall Magazine --

More from the APNews story (emphasis added) --

From later (11 October 2011) APNews story, via Newser.com --

A job in China

My son applied for a job as a pilot in China. They were very clear that he was to train Chinese who would replace him in his job. That kind of job protection in the US would be appreciated.

Act Like We Are in A Trade War and He will Be Fine

Have your son do the kinds of nice things to the Chinese they have been doing to us for years now. FTA now stands for Free Trade Asshole. I would never tell anyone to refuse work in these times. I did that in 2008 and really suffered.

Withhold, sabotage, and gather info. Explain that we are at war.

Burton Leed