The Federal Reserve released the August 9th FOMC meeting minutes and now the world of Wall Street is all ablaze, afire with more quantitative easing dreams and desires.

The FOMC meeting minutes paragraph causing the stir is this:

Participants discussed the range of policy tools available to promote a stronger economic recovery should the Committee judge that providing additional monetary accommodation was warranted. Reinforcing the Committee's forward guidance about the likely path of monetary policy was seen as a possible way to reduce interest rates and provide greater support to the economic expansion; a few participants emphasized that guidance focusing solely on the state of the economy would be preferable to guidance that named specific spans of time or calendar dates. Some participants noted that additional asset purchases could be used to provide more accommodation by lowering longer-term interest rates. Others suggested that increasing the average maturity of the System's portfolio--perhaps by selling securities with relatively short remaining maturities and purchasing securities with relatively long remaining maturities--could have a similar effect on longer-term interest rates. Such an approach would not boost the size of the Federal Reserve's balance sheet and the quantity of reserve balances. A few participants noted that a reduction in the interest rate paid on excess reserve balances could also be helpful in easing financial conditions. In contrast, some participants judged that none of the tools available to the Committee would likely do much to promote a faster economic recovery, either because the headwinds that the economy faced would unwind only gradually and that process could not be accelerated with monetary policy or because recent events had significantly lowered the path of potential output. Consequently, these participants thought that providing additional stimulus at this time would risk boosting inflation without providing a significant gain in output or employment. Participants noted that devoting additional time to discussion of the possible costs and benefits of various potential tools would be useful, and they agreed that the September meeting should be extended to two days in order to provide more time.

The question then becomes, who are the some participants proposing more quantitative easing, or QE3, and how many were there? The action from this meeting was the announcement that interest rates would be kept unbelievably low until 2013.

The vote was 7-3 with yeas being Ben Bernanke, William C. Dudley, Elizabeth Duke, Charles L. Evans, Sarah Bloom Raskin, Daniel K. Tarullo, and Janet L. Yellen and nays: Richard W. Fisher, Narayana Kocherlakota, and Charles I. Plosser.

The vote was 7-3 with yeas being Ben Bernanke, William C. Dudley, Elizabeth Duke, Charles L. Evans, Sarah Bloom Raskin, Daniel K. Tarullo, and Janet L. Yellen and nays: Richard W. Fisher, Narayana Kocherlakota, and Charles I. Plosser.

Here are the reasons for the dissenting three:

Messrs. Fisher, Kocherlakota, and Plosser dissented because they would have preferred to continue to describe economic conditions as likely to warrant exceptionally low levels for the federal funds rate for an "extended period," rather than characterizing that period as "at least through mid-2013." Mr. Fisher discussed the fragility of the U.S. economy but felt that it was chiefly nonmonetary factors, such as uncertainty about fiscal and regulatory initiatives, that were restraining domestic capital expenditures, job creation, and economic growth. He was concerned both that the Committee did not have enough information to be specific on the time interval over which it expected low rates to be maintained, and that, were it to do so, the Committee risked appearing overly responsive to the recent financial market volatility.

Mr. Kocherlakota's perspective on the policy decision was shaped by his view that in November 2010, the Committee had chosen a level of accommodation that was well calibrated for the condition of the economy. Since November, inflation had risen and unemployment had fallen, and he did not believe that providing more monetary accommodation was the appropriate response to those changes in the economy.

Mr. Plosser felt that the reference to 2013 might well be misinterpreted as suggesting that monetary policy was no longer contingent on how the economic outlook evolved. Although financial markets had been volatile and incoming information on growth and employment had been weaker than anticipated, he believed the statement conveyed an excessively negative assessment of the economy and that it was premature to undertake, or be perceived to signal, further policy accommodation. He also judged that the policy step would do little to improve near-term growth prospects, given the ongoing structural adjustments and external challenges faced by the U.S. economy.

According to Bloomberg Kocherlakota will probably go along with the next 2013 interest rate pledge, but QE3? It seems not since he is concerned about inflation increasing. Fisher is clearly out on anymore quantitative easing due to his feeling it's Congress and this administration who can only affect the economy at this point. Plosser doesn't seem inclined either since he's implying the monetary actions the Fed has already taken haven't been able to do that much.

That leaves seven. It was clear from Bernanke's Jackson Hole speech he also is saying this Congress and this administration need to enact programs and policies that directly increase jobs and hiring.

We're down to six as potential yea votes of the FOMC voting members for QE3.

Dudley would probably be a yes for more quantitative easing. From an October 1st, 2010 speech as noted:

Mr. Wolf cites New York Federal Reserve chairman William C. Dudley to the effect that Quantitative Easing is primarily an attempt to deal with the mortgage crisis that capped a decade of bad loans and financial gambles. Economic recovery, the banker explained on October 1, 2010, “has been delayed because households have been paying down their debt – a process known as deleveraging.” In his view, the U.S. economy cannot recover without a renewed debt leveraging to re-inflate the housing market.

What about Duke? From this April 2011 speech, we might be able to imply a view that more quantitative easing should increase small business activity. It's quite a complex speech about small business, credit and personal wealth, but in the summary are some hints she might be a yea:

To sum up, the financial conditions that would be necessary for small businesses to start up and thrive would include positive conditions for personal wealth building and a full range of consumer and business credit availability. In the wake of the financial crisis, small business owners and potential small business owners likely experienced a substantial reduction in the personal resources necessary to start or sustain a business. At the same time, small business loans became harder to get, and when they were available, both price and nonprice credit terms were likely quite restrictive. Many small business owners were so convinced that their requests would be denied that they did not even apply for credit.

Charles L. Evans was all for the original quantitative easing and most predict he would be now. Janet Yellen is considered a dove, has spoken publicly on quantitative easing, and therefore a yes vote.

Sarah Bloom Raskin earlier supported quantitative easing and, Daniel K. Tarullo is also a known supporter of quantitative easing:

Mr. Tarullo, a law professor at Georgetown University before joining the Board of Governors in January of 2009, is spearheading the Fed’s efforts to overhaul financial regulation. Yet he is on record as a supporter of accommodative monetary policy, saying in April that the “relatively modest pace of the recovery, the continued high rate of unemployment, subdued inflation trends and well-anchored inflation expectations together suggest that the need for highly accommodative monetary policies will not diminish soon.”

What's the tally? Probably 5 in favor at minimum and that is without Bernanke.

To be fair, there are actually three different actions implied from the August 9th meeting minutes that could happen in the FOMC September 21st meeting:

- Reduction in the interest rate paid on excess reserve balances

- Swapping out short term securities for longer term maturation ones

- QE3

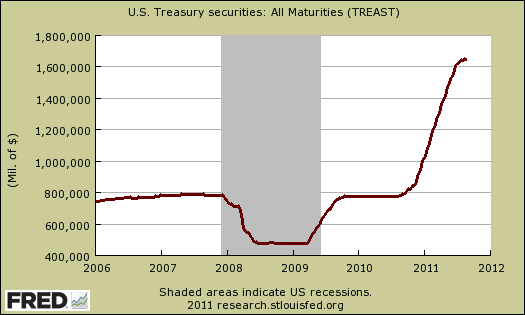

The mechanics of quantitative easing are fairly indirect but many have correlated the increase in the stock market to QE2.

Just what the economy needs right, a bunch of speculators making a killing betting on commodities' futures rising? The real problem with the economy is the malaise on main street, not the uber-rich....

America would be far better served if all the Federal Reserve officials walked out of the marble palace, got dirty and royally chewed out elected officials to get off economic fictional rear ends, stop playing their political power games and pass a direct jobs program and IRS, legislative methods to force multinational corporations to create jobs in America for Americans.

Better yet, hire everyone to go work for the Fed and pay them with the funds used to buy U.S. Treasuries. Let's cut the grass grounds with scissors, hand count all the money, go to a slide rule instead of spreadsheet calculations and let's paint murals on all of the doors while we're at it. Someone could even give Bernanke a facial and a makeover. Let's do their colors! Seriously, we cannot get this Congress to do anything for working America and while all look to the perceived omnipotent Fed, maybe simply hiring every U.S. citizen who needs a jobs is the way to go. After all, how many trillions have been spent or manipulated under the claim to increase economic output and lower the unemployment rate? Let's do 'er, 1 million jobs to count the blades of grass on the Federal Reserve's lawn, whatever, the nation needs jobs, that's the real problem.

Better yet, hire everyone to go work for the Fed and pay them with the funds used to buy U.S. Treasuries. Let's cut the grass grounds with scissors, hand count all the money, go to a slide rule instead of spreadsheet calculations and let's paint murals on all of the doors while we're at it. Someone could even give Bernanke a facial and a makeover. Let's do their colors! Seriously, we cannot get this Congress to do anything for working America and while all look to the perceived omnipotent Fed, maybe simply hiring every U.S. citizen who needs a jobs is the way to go. After all, how many trillions have been spent or manipulated under the claim to increase economic output and lower the unemployment rate? Let's do 'er, 1 million jobs to count the blades of grass on the Federal Reserve's lawn, whatever, the nation needs jobs, that's the real problem.

Of course that will never happen, instead, Wall Street it seems is almost forcing the hand of the Fed by predicting QE3, now expecting it, building their market trades around it and pricing QE3 in. So what if quantitative easing can increase import prices and inflation, after all Wall Street needs to get it's fix.

Comments

Uncle Joe's VC Shack - a thought and proposal

In reading through Duke's speech on financing for small business, I was struck by just how many small businesses are financing themselves through credit cards. Using credit cards, with their pathetic business terms, high interest rates and fees, as a cash flow management tool.

I have an idea. How about setting up some sort of new investment vehicle for investors to buy shares or something in that is akin to asking your Uncle Joe for $10k to invest in that bicycle shop you always wanted to start.

Akin to angel investors, or seed money. Create a host of tools that help small business, such as something to get these banks out of the credit card business for small business and give these people real lines of credit, ultra low interest at least.

Maybe some sort of specialized tax treatment, such as capital gains are tax free, losses can be written out forever and against anything or something to get Wall Street to pour money into the real economy instead of commodities futures and derivatives classes.

Make the funds grants and sell small shares, similar to the VC set ups but this one has conditions. First the business must be in the U.S. and second it must be started by U.S. citizens, at least one and all founders must be U.S. citizens or permanent residents.

That kicks out the glorified BPO industry from taking U.S. funds for labor arbitrage and cuts out the Chinese or Chinese manufacturing from getting funded and so on.

Then, they need incubators, tons of them. Incubators are places which offer resources, from systems to servers, to telecommunications to fax machines, and frankly the biggest thing an incubator can offer is expensive lab equipment, test equipment, prototyping services, manufacturing services and so on....

even a localized team of expertise to start these companies. There are so many experts in the U.S. right now that plain need a job, they could match up skills, experience and strategically hire experts and place them at these incubators as resources or to start forming their own startup.

I'm not kidding, the age discrimination in this country is so bad, you have tons of people, long term unemployed with accounting experience, marketing, engineering, sales, executive, management, manufacturing.....the list goes on and on.

So, they could hire these people and have them also impart their experience with others to formulate new businesses.

Just a thought but there are so many better ways to help Americans and thus the economy than what is always bantered about.

But but but

"Make the funds grants and sell small shares, similar to the VC set ups but this one has conditions. First the business must be in the U.S. and second it must be started by U.S. citizens, at least one and all founders must be U.S. citizens or permanent residents." -- Robert Oak (comment)

But what would the WTO say?

Enabling Communities

Hi,

What you are considering is enabling communities - finance is but one aspect of community support and enablement.

For instance the Internet is a very powerful change agent but the change tends to towards consolidation and globalisation. The reality is that we are all physical - our world is what we touch, who we interact with and where we live geographically. Think of this. Suppose I can leverage my local public bank and trade locally (at non rates of exploitation) I can then recirculate income within my local community. Social websites are never going to do this as their business model is based the individual and exploitative (does not return anything to communities). Imagine if you could use Bitcoin to trade within your community - you would not need commercial banks.

Have been working on something that can do this for 6 to 7 years.

Iain

Enabling a nation?

Just my 2¢, but what about we help communities along by also enabling a nation, enabling sovereignty of a democratic nation, by protectionist barriers such as a VAT (Robert Oak) or even a 15% across-the-board tariff? And how about we eliminate fractional reserve banking?

American Monetary Institute

Fractional Reserve Banking?

Heavens! Did you really mean to suggest that bankers only lend real money, not the stuff the Fed cooks up in its basement? We need to do a remake of "Mr. 880" but have as the protagonist a balding, bearded Princeton economist who brings his plates to work at a government agency where he was told they would let him just add zeroes to the ledger?

I remember a time in the 1960s when you could take dollar bills (silver certificates) to the Treasury and they would give you real silver in exchange (I think the rate was $1.29 per oz.) There were lines at the Treasury around the block -- speculators and numismatists wanting Morgan dollars. LBJ decided enough was enough and slammed that window shut. People wanted real money that, as Mike Mansfield put it, would ring when you tossed it onto the bar. Well, it was too good to last -- we couldn't legally own gold bullion in those days but the French sure could. Oh, the miracle of imagining that money is real! Your local banker can conjure up a boodle of queer without even having to print it, and can charge you for the transaction.

Frank T.

Monetarism and democracy

"Did you really mean to suggest that bankers only lend real money, not the stuff the Fed cooks up in its basement?" --Frank T.

NO. Anyway, not exactly my view of things. The Fed can create currency, but the Fed does a terrible job of managing that monopolistic authority, because the Fed is owned by and for the benefit of fractional-reserve privately-owned banks. See, American Monetary Institute webpage on the Federal Reserve system.

I support the American Monetary Act, which has been proposed in Congress by Rep. Dennis Kucinich (D-Ohio).

Link to download PDF --

http://www.monetary.org/wp-content/uploads/2011/06/hr6550bill.pdf

See also, 'The 1930s Chicago Plan and the American Monetary Act' by Stephen Zarlenga (American Monetary Institute) --

I am a democratic monetarist, meaning that 'printing up' money is just fine, if you are needing a medium of exchange. The thing is that money needs to also be a measure of worth, applicable to planning over a period of time measured in years, not days. It's a matter of maintaining a sane and well-governed monetary system.

There is no need whatsoever for currency to be a lasting store of value, like over centuries. Indeed that idea, except in times such as the period of exploitation of American resources by the Spanish Crown, tends to result in a disincentive for investors who might invest in the real lasting store of value, which is river of life itself. In any event, such systems as the gold standard inevitably become, if they do not always originate as, entrenched systems designed for the exploitation of labor by militaristic imperialists.

Gold standard isn't the answer, never was the answer. For the USA now to adopt a gold standard would accomplish nothing but the resurrection of William Jennings Bryan from his grave. One of the best moves FDR ever made was his EO 6102 (3 April 1933), aka "gold confiscation order" -- but that option was bequeathed to Roosevelt by the populist campaigning of William Jennings Bryan some decades previous.

Having said that, it may be that a return to silver certificates (and coins with silver content) would be a good idea. But I would prefer to see a multi-metallic system than a bimetallic. It could be a good idea for the USA to institute a basket of commodities approach as has been famously proposed by the economist Hayek. (Gaussian copula theory could be put to good use here!) Such a move shouldn't be necessary, since really the basic thing is mutual trust among intelligent citizens believing in themselves, in working and living in a democracy -- and understanding what that means. But as a practical matter, an intelligent citizenry can decide to make use of the basket approach as part of an overall monetary plan based on control of the money supply under a system of democratically enacted law.

Objections to monetarism as the fundamental truth of monetary theory are really, at their core, objections to democracy. For example, the von Mises Institute -- with which the goldbug Rep. Ron Paul (R-Texas) is generally associated -- is openly anti-democracy.

I acknowledge that democracy has its pitfalls. But, from the point of view of individual liberty requiring the avoidance of concentrations of power, is there any honorable way around it?

You take on democracy as a matter of faith, or you don't.

American Monetary Institute

_________

Excerpts from William Jennings Bryan's 'Cross of Gold' speech (1896) --

that's the opposite

of most models today, it's all hyper competitive, global. But that's what we need actually, smaller economic "circles". If you think about some of these technology cities, that's a strange phenomenon. Why do, as an example, tech companies "cluster" in the bay area? They offshore outsource like mad, yet for some reason "cluster" and the same can be said in China, there are "clusters" of manufacturing areas (but part of that was by state design)...

Still, CA esp. it's hyper expensive, it doesn't make a lot of sense to "cluster" but they do and their reasons are something to study.

One of best comments ever

" ... it's hyper expensive, it doesn't make a lot of sense to "cluster" but they do and their reasons are something to study." Robert Oak