Information Asymmetry

A recent news item mentioned that everyone's hero, Joe Lieberman, has proposed new legislation in the US Congress which would allow the president a "kill switch" to control and halt various portions of the Internet in the advent of national emergency.

Regardless of who the president might be, and I have as little faith in President Obama as I had in the previous bunch of presidents, going back to at least Nixon, this would represent the same possible conditions as we've observed in Myanmar, China and Iran; namely the censorship of the Web when they so desire.

This is what economists call "information asymmetry" -- or controlling the flowing information, or a controlled flow of information for selective profit and gain.

As I recently mentioned in a previous post, this administration's treasury department appears to be following the recommendation of avoidance of banning naked swaps, completely at odds of the mood over in the Eurozone!

This should leave everyone rather skeptical, especially given the record of our president when he was a senator; lobbying on behalf of, and attempting to pass legislation to establish a national DNA database for all citizens.

The Military

Many years ago I happened to intern for a brief period with a radical journalist. His oft repeated mantra to me was "..follow the money, always follow the money...politics is the theater to obscure the money."

One career military man who has included that in his armamentarium in the pursuit of truth is Col. Douglas Macgregor, the quintessional military professional, a brilliant scholar and military tactician, and an honorable individual (and I'm sure I'm not in agreement with all of his views).

The originator of one of my favorite descriptions of Afghanistan's government - "the Karzai narco state" - the colonel provides a lucid, cogent and current analysis on political events encompassing economic aspects, no matter how nauseating.

Col. Macgregor recently pointed out that the copper in Afghanistan is being mined by the Chinese who are, of course, being protected by the Americans.

And it is the Chinese who are taking the bulk of the oil in southern Iraq.

To those not following the Big Picture, all those American-based multinationals (and European and Asian transnationals) who relocated their factories and production facilities to China require that oil and copper.

This is reality finance; this is the way it works!

And those Afghan pipelines one hears frequent mention of (to transport oil and gas across Afghanistan) would end in India, where other factories, production facilities and companies have been relocated who also require those resources for the multinationals.

Many, many so-called pundits would have us believe the Chinese are the latest of the bogeymen, but it's all connected; it's all interrelated.

It's not about resources for America (unethical and amoral as that may be) but resources redistributed to benefit the multinationals' profit strategies.

Reality Finance

Recently, JP Morgan Chase announced that this BP oil "spill" (more on that later) might bump up the GDP.

Of course, in the Fantasy Finance world of JP Morgan Chase, this is a good thing.

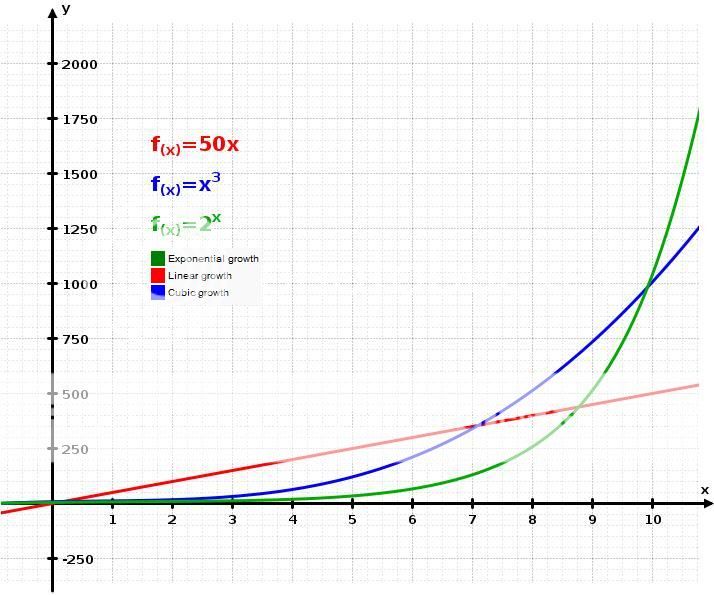

But then, they thrive on exponential growth. This is a mighty important, yet relatively simple mathematical concept, but it is what we've experienced with the rapid concentration of wealth today: exponential growth.

It is what we've observed in the tremendous global debt explosion: exponential growth.

And it is what we've seen in the rapid growth in the number of those debt-financed billionaires: exponential growth.

And it is important to note that pyramid schemes and Ponzi schemes are based upon that mathematical concept: exponential growth!

And to borrow Wikipedia's definition:

Exponential growth (including exponential decay) occurs when the growth rate of a mathematical function is proportional to the function's current value.

A graphic from Wikipedia below illustrates this concept.

It is crucial to fully grasp the connection of all these economic situations which have experienced exponential growth -- it ain't by accident!

Similarly, and concretely connected, has been the exponential growth in the credit derivatives market and the trading of credit default swaps.

And to repeat, it appears the American government is hell bent on not banning naked swaps.

Likewise, when Citigroup publishes a report on the Plutonomy, they are expressing today's reality, companies should be aiming their services and products at the super-rich, for they make up the vast bulk of that 70% of consumer activity in the existing "plutonomy."

Controlling the flow of information, controlling and protecting the flow of resources, and controlling the flow of jobs --- this is how one controls the movement to a neofeudalist state.

Postscript

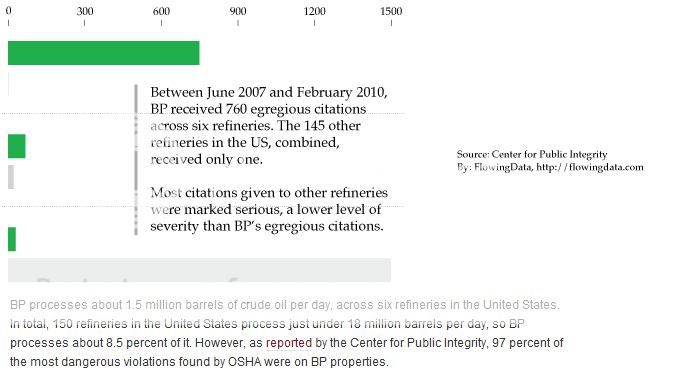

An excellent graph which quickly explains some important history of BP can be found below.

Having read numerous articles regarding the BP undersea gusher(s) over the past several weeks, including a survey of international experts (scientific and technical, not financial), the gist of what I've abstracted appears to be that there is a probability that this gusher will expand, with the possibility of more gushers forming, and as this oil reserve in the gulf may be equal or greater than the Saudi Arabian historic oil reserves, it may continue to spew forth indefinitely.

This is truly alarming and, I hope, incorrect.

And an interesting clip of possible future oil spread can be found at the political math blog site:

Double-Click Image For Larger Display

Recommended Reading

For those who are mystery fiction aficionados, I would like to recommend the superlative Icelandic mystery writer, Yrsa Sigurdardottir, and her two excellent recently published mysteries:

Last Rituals, and

Yrsa has a M.S. in civil engineering and a most engaging writing style.

And for those who can't read Icelandic and are interested in her previously mentioned web page, please go here.

While not pertinent to economic populism, I couldn't help but include the clip below as it happens to be a really neat travelogue of Iceland for anyone interested.

Reminder: when one purchases a book from a local book store, an estimated 45% of the money spent remains locally --- but when one purchases from a chain store, only an estimated 13% of the money spent remains locally.

Please, always try to buy locally --- it's the last hope for those of us trying to exist in the plutonomy!

[Special thanks to the fellow identified as Chumbawamba who comments frequently at the econ site, Zero Hedge for providing the thought behind the exponential growth riff.]

Recent comments