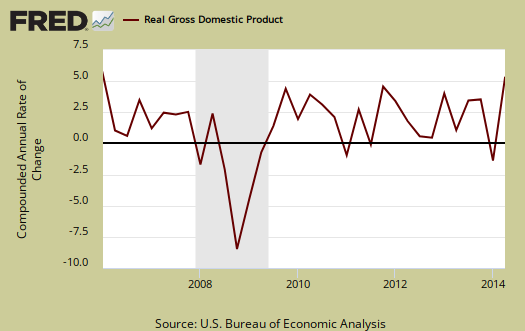

Q2 2014 real GDP was revised to 4.6%, a strong showing not seen since Q4 2011. Q2 Gross Domestic Product also cancels out the dismal Q1 -2.1% real GDP contraction for the year. Growth was across the board. Investment showed large growth. Personal consumption expenditures increased and were a large component of GDP. Changes in private inventories was a large GDP contribution, but so were exports. Overall Q2 GDP was a big bounce back from Q1.

As a reminder, GDP is made up of: where Y=GDP, C=Consumption, I=Investment, G=Government Spending, (X-M)=Net Exports, X=Exports, M=Imports*. GDP in this overview, unless explicitly stated otherwise, refers to real GDP. Real GDP is in chained 2009 dollars.

This below table shows the percentage point spread breakdown of Q1 from Q2 2014 GDP major components and their spread.

| Comparison of Q1 2014 and Q2 2014 GDP Components | |||

|---|---|---|---|

|

Component |

Q1 2014 |

Q2 2014 |

Spread |

| GDP | -–2.1 | +4.6 | +6.7 |

| C | +0.83 | +1.75 | +0.92 |

| I | -1.13 | +2.87 | +4.00 |

| G | -0.15 | +0.31 | +0.46 |

| X | -1.30 | +1.43 | +2.73 |

| M | –0.36 | –1.77 | -1.41 |

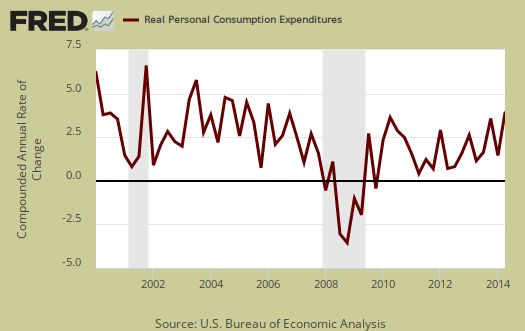

Consumer spending, C in our GDP equation was 38% of GDP. Durable goods were almost an entire GDP percentage point and Motor vehicles & parts was 0.45 percentage points of GDP. Below is a percentage change graph in real consumer spending going back to 2000.

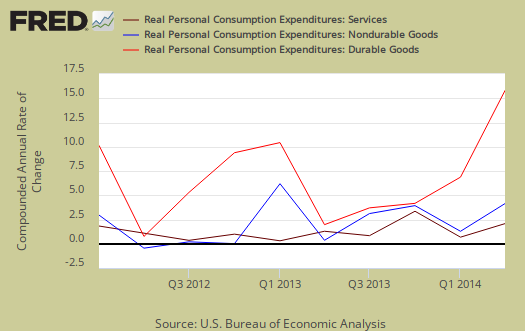

Graphed below is PCE with the quarterly annualized percentage change breakdown of durable goods (red or bright red), nondurable goods (blue) versus services (maroon).

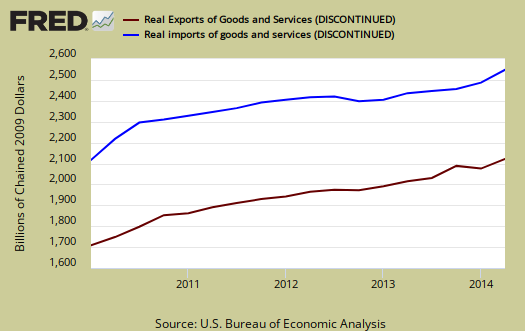

Imports and Exports, M & X subtracted -0.34 percentage points from Q2 GDP as exports grew yet imports grew more. This is a huge improvement from Q1 as shown in the below graph.

Government spending, G was all state and local spending increases. Below is the graph of government spending showing the drag on economic growth is over.

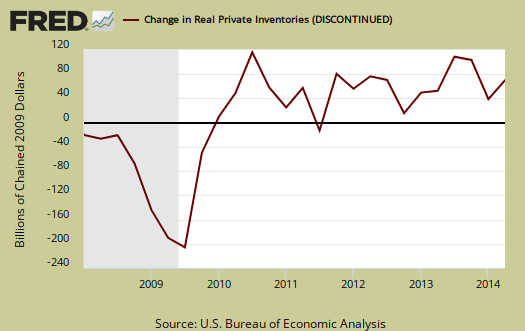

Investment, I is made up of fixed investment and changes to private inventories. Investment was the big factor for Q2 GDP, contributing 2.87 percentage points or 63.4% of GDP. The change in private inventories alone gave a 1.42 percentage point contribution to Q2 GDP after a contraction in Q1. Changes in private inventories alone was 30.9% of Q2 GDP. Below are the change in real private inventories and the next graph is the change in that value from the previous quarter.

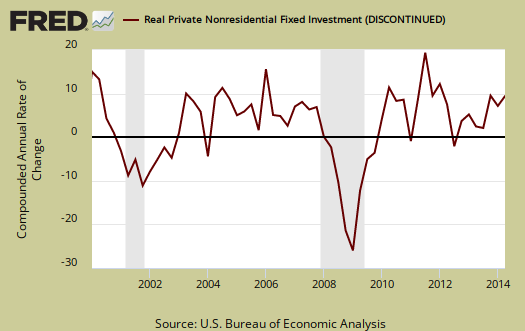

Fixed investment is residential and nonresidential and added 1.45 percentage points to GDP. Nonresidential was 1.18 percentage points of GDP, with equipment being 0.63 percentage points. Nonresidential structures by themselves added 0.35 percentage points.

Part of fixed investment is Residential fixed investment. Residential added 0.27 percentage points to Q2 GDP. One can see the housing bubble collapse in the below graph and also how there is no meteoric recovery in terms of economic growth.

Nominal GDP: In current dollars, not adjusted for prices, of the U.S. output,was $17,328.2 billion, a 6.8% annualized increase from Q1. In Q1, current dollar GDP contracted -0.8%.

Real final sales of domestic product is GDP - inventories change. This figures gives a feel for real demand in the economy. This is because while private inventories represent economic activity, the stuff is sitting on the shelf, it's not demanded or sold . Real final sales increased 3.2%. Q1 real final sales were -1.0%.

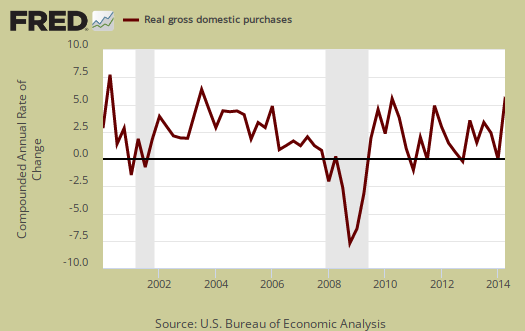

Gross domestic purchases are what U.S. consumers bought no matter whether it was made in Ohio or China.   ; It's defined as GDP plus imports and minus exports or using our above equation: where P = Real gross domestic purchases. Real gross domestic purchases increased 4.8%. Q1 was -0.4%. Exports are subtracted off because they are outta here, not available for purchase by Americans, but imports, as well a know all too well, are available for purchase at your local Walmart. When gross domestic purchases exceed GDP, that's actually bad news, it means America is buying imports instead of goods made domestically.

Below are the revised percentage changes of Q2 2014 GDP components, from Q1. There is a difference between percentage change and percentage point change. Point change adds up to the total GDP percentage change and is reported above. The below is the individual quarterly percentage change, against themselves, of each component which makes up overall GDP. Additionally these changes are seasonally adjusted and reported by the BEA in annualized format.

|

Q2 2014 GDP Component Percentage Change (annualized) |

|||

|---|---|---|---|

| Component | Percentage Change from Q2 | ||

| GDP | +4.6% | ||

| C | +2.5% | ||

| I | +19.1% | ||

| G | +1.7% | ||

| X | +11.1% | ||

| M | +11.3% | ||

Other overviews on gross domestic product can be found here,

4.6% will be hard to match...

a lot of the 2nd quarter gains were just rebounds from the winter depressed 1st quarter...the 14.1% annualized rate of increase in durables goods consumption, which accounted for .99% of the GDP increase, will be particularly hard to match...almost half of that was an increase in consumption of motor vehicles and parts, which grew at a 19.1% annual rate and added .45% to GDP all by itself; in addition, real outlays for durable household equipment and furniture grew at a 12.9% rate, while real consumption of recreational goods and vehicles rose at a 13.3% rate, as all durables consumption benefited from a negative 1.9% deflator...

investment in equipment was also growing at an unsustainable rate of 11.2%, which added .63% to 2nd quarter growth.. investment in industrial equipment grew at a 27.3% rate and investment in information processing equipment grew at a 26.6% rate...blips in growth like that cannot be sustained...

rjs

not sustained GDP

I just started back with our analysis,but since jobs are nowhere, wages flat, the same lies about "worker shortage" as the middle class has disappeared, I doubt any of this can be sustained.

Thanks for the additional detail figures. I saw autos & parts and wondered who exactly is buying up these cars? Wages are flat, rents are high....

I believe I saw a host of downgrades yesterday on Q3 estimates.