We’re going to start by reviewing OPEC's December Oil Market Report (covering November OPEC & global oil data), which was released on Wednesday of last week, and which is now available as a free download. The first table from this report that we'll look at is from page 64 of that OPEC pdf, and it shows oil production in thousands of barrels per day for each of the current OPEC members over the recent years, quarters and months, as the column headings indicate. For all their official production measurements, OPEC uses an average of estimates from six "secondary sources", namely the International Energy Agency (IEA), the oil-pricing agencies Platts and Argus, the U.S. Energy Information Administration (EIA), the oil consultancy Cambridge Energy Research Associates (CERA) and the industry newsletter Petroleum Intelligence Weekly, as an impartial adjudicator as to whether their output quotas and production cuts are being met, to resolve any potential disputes that could arise if each member reported their own figures.

As we can see from this table of official oil production data, OPEC oil output decreased by 133,500 barrels per day in November, to a six month low of 32,448,000 barrels per day, from an October production total of 32,581,000 barrels per day, a figure that was originally reported as 32,589,000 barrels per day (for your reference, here is the table of the official October OPEC output figures as reported a month ago, before this month's revisions). As you'll note in the far right column above, the reasons that OPEC's output fell by 133,500 barrels per day in November was that the decrease of 108,700 barrels per day in output from Angola more than offset the 95,800 barrel per day increase in output from Nigeria, and that the Saudis, the Emirates and Venezuela all also saw sizable reductions in their oil output. The cutback in Angolan production now lowers their output to below their agreed to quota, leaving Iraq as the only OPEC member whose production is well in excess what their pact calls for, as can be seen in the table below:

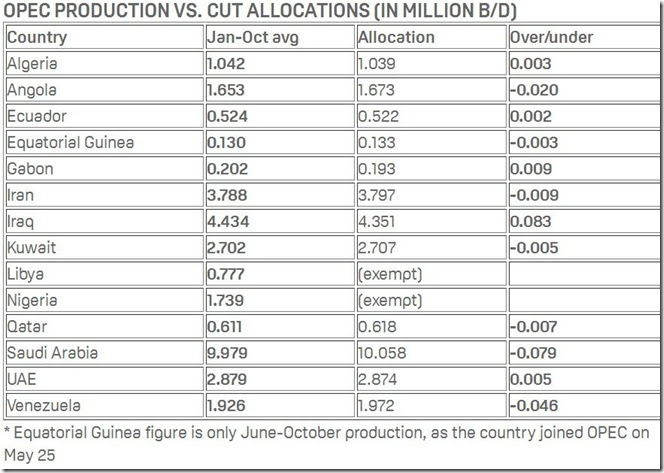

The above table is from the "OPEC guide" page at S&P Global Platts: the first column of numbers shows average daily production in millions of barrels of oil per day for each of the OPEC members over the first eleven months of this year, and the 2nd column shows the allocated daily production in millions of barrels of oil per day for each OPEC member, as they agreed to at their November 2016 meeting, and the 3rd column shows how much each has averaged over or under their quotas for the eleven months of this year that the OPEC pact to curtail production has been in effect. One minor clarification to this Platt's table would be that Nigeria and Libya are no longer exempt from the pact, in that they have agreed to a combined output cap of 2.8 million barrels per day at the November 30th OPEC meeting two weeks ago.. With a combined output of 2,983,000 barrels per day in November, they were obviously in excess of that new quota for that one month, possibly as they over-pumped in anticipation of having to throttle back in December. But as you can see from the above, most OPEC members are pretty close to meeting their commitment to cutting their production back 4%, except for Iraq, whose production has averaged nearly 2% higher than what they committed to. However, cuts in excess of what was agreed to by the Saudis, Venezuela, and other OPEC countries have more than made up for the 83,000 barrels per day that Iraq has been overproducing, so the organization as a whole has kept their commitment to reduce supply.

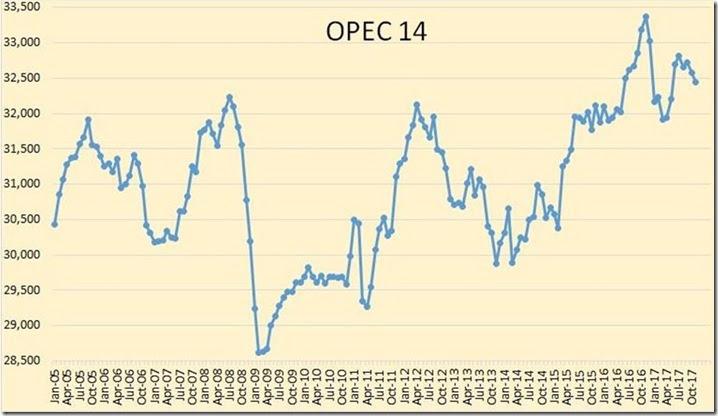

For a visualization of how OPEC's cuts have progressed, we'll next include a longer term historical graph of their monthly oil output:

The above graph, taken from the "OPEC November Oil Production" post at the Peak Oil Barrel blog, shows total oil production, in thousands of barrels per day, for the current 14 members of OPEC, for the period from January 2005 to November 2017, using the history of the same official data from secondary sources that we saw in the first table above. Here we can obviously see that OPEC's November production of 32,448,000 barrels per day is lower than their production of the past five months, but up from earlier this year. But we can also see how their production spiked to a record last November, just before they announced their output cuts, giving them quite a bit of leeway to "reduce" production from those elevated levels, without ever having to fully cut back to the level they were producing at in late 2015 and early 2016...

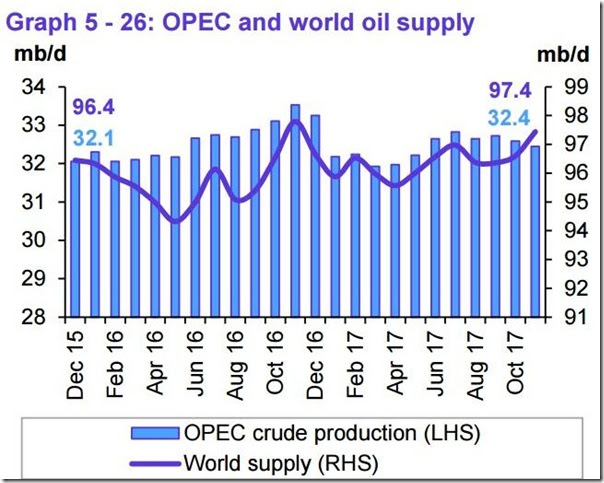

The next graphic we'll include shows us both OPEC and world oil production monthly on the same graph, over the period from December 2015 to November 2017, and it comes from page 65 of the December OPEC Monthly Oil Market Report. The cerulean blue bars represent OPEC oil production in millions of barrels per day as shown on the left scale, while the purple graph represents global oil production in millions of barrels per day, with the metrics for global output shown on the right scale...

OPEC's preliminary data indicates that total global oil production rose to a 12 month high of 97.44 million barrels per day in November, up by .84 million barrels per day from a October total of 96.60 million barrels per day, which was revised .11 million barrels per day lower from the 96.71 million barrels per day global oil output for October that was reported a month ago. Global oil output for November was also 0.60 million barrels per day higher than the 96.84 million barrels of oil per day that was being produced globally in November a year ago (see last December's OPEC report online (pdf) for the year ago data). OPEC's November production of 32,448,000 barrels per day thus represented 33.3% of what was produced globally, down from their 33.7% share of October global output, as oil output increases by the US, Canada, Norway, the UK and Brazil more than made up for OPEC's decrease. OPEC's November 2016 production, excluding ex-member Indonesia, was at 33,131,000 barrels per day, so even after their production cuts, the 13 OPEC members who were part of OPEC last year, excluding new member Equatorial Guinea, are only producing 2.5% less oil than they were producing a year ago, at a time when they were producing at a record level...

However, even after the increase in global oil output that we can see on the above graph, there was again a deficit in the amount of oil being produced globally, as the next table from the OPEC report will show us..

The table above comes from page 38 of the December OPEC Monthly Oil Market Report, and it shows regional and total oil demand in millions of barrels per day for 2016 in the first column, and OPEC's estimate of oil demand by region and globally quarterly over 2017 over the rest of the table. On the "Total world" line of the fifth column, we've circled in blue the figure that's relevant for November, which is their estimate of global oil demand for the fourth quarter of 2017...

OPEC's estimate is that over the 4th quarter of this year, all oil consuming areas of the globe will be using 98.08 million barrels of oil per day.. At the same time, as OPEC showed us in the oil supply section of this report and the summary supply graph above, after the OPEC and non-OPEC production cuts, the world's oil producers were only producing 97.44 million barrels per day during November, which means that there has been a shortfall of around 640,000 barrels per day in global oil production vis-a vis demand during the month...

Global oil production estimates for October were also revised lower with this report, to 96.60 million barrels per day, so that now means there was also a deficit of 1,480,000 barrels per day in October global output, which we had previously figured to be a global oil deficit of around 1,370,000 barrels per day. Meanwhile, since there were no revisions to oil production or demand estimates for the prior months, that means the figures we computed for the previous months of this year remain as they were. Those include a shortfall of 1,540,000 barrels per day in September global output, and a global shortfall of 1,630,000 barrels per day in August, when global oil production was even lower...

Prior to that, we estimated a global oil deficit of 560,000 barrels per day in July, a global oil surplus of 850,000 barrels per day in June, a global oil deficit of 360,000 barrels per day in May, a global oil deficit of 670,000 barrels per day in April, a global surplus of 390,000 barrels per day in March, and an average surplus over January and February of around 610,000 barrels per day. Taken together, the data from these monthly OPEC reports means that after eleven months of OPEC production cuts, the global oil glut has been reduced by roughly 95.27 million barrels of oil since the 1st of the year, with most of that reduction coming over the past four months. More than 30.9 million barrels of that drawdown from global oil supplies came out of US oil inventories; as we reported last week, US crude inventories had fallen to 448,103,000 barrels as of December 1st; that was down from the 479,012,000 barrels we had in storage on December 30th 2016, in the last EIA report for last year. As we'll see, that ongoing drawdown from of US oil supplies also continued into early December, according to the latest EIA report...

note: the above was excerpted from my weekly synopsis at Focus on Fracking

Recent comments