"Find the trend whose premise is false, and bet against it."

- George Soros

It didn't used to be this way. Back in the days of Bretton Woods, and a gold-backed currency, the financial markets were relatively stable. If you wanted to make money you had to do it over a long period of time.

In the post-Bretton Woods era, and especially in the last decade, market bubbles and crashes happen every few years. An investor with a keen eye and an open mind can spot golden investment opportunities, or at least avoid the fallout from the bubble bust.

We are about to see the bursting of the next bubble...and its going to be a doozy.

With President-elect Barack Obama and congressional Democrats considering a massive spending package aimed at pulling the nation out of recession, the national debt is projected to jump by as much as $2 trillion this year, an unprecedented increase that could test the world's appetite for financing U.S. government spending.

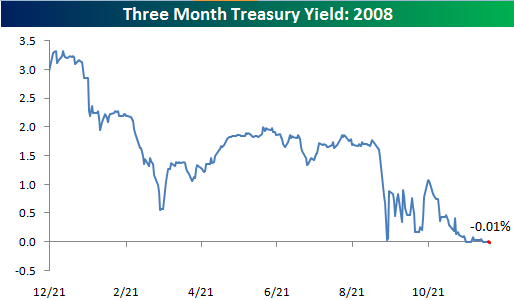

For now, investors are frantically stuffing money into the relative safety of the U.S. Treasury, which has come to serve as the world's mattress in troubled times. Interest rates on Treasury bills have plummeted to historic lows, with some short-term investors literally giving the government money for free.

But about 40 percent of the debt held by private investors will mature in a year or less, according to Treasury officials. When those loans come due, the Treasury will have to borrow more money to repay them, even as it launches perhaps the most aggressive expansion of U.S. debt in modern history.

You can always spot a bubble by the irrationality of the investment near the top. For instance, in 2005 people were offering tens of thousands of dollars above asking price for homes because they were "afraid they would be priced out of the market" and never be able to afford a home.

In other words, it was panic buying - paying premium prices for an asset irregardless of its long-term investment value. A sure sign of a bubble.

We are seeing this same dynamic today in treasury bonds.

It isn't just short-term treasuries. The 30 year treasury bond yields just 2.83%. Does anyone really think that inflation in the next 30 years will never surpass 2.83%?

The flight to U.S. Treasuries is an Armageddon trade. It reflects investors’ panicked attempts to seek safety amid plummeting stock markets, collapsing property values and more than $1 trillion in losses and write-offs by banks worldwide.

There never was, and never will be, justification for yields on any bond to be negative. What it means is that people are paying the government to lend it money.

It makes no economic sense at all. Shoving your cash into your mattress is a better investment than that. Like the housing bubble and the Dot-Com bubble, this illogical panic buying will end poorly as well.

The treasury bubble isn't just a bad investment because the investor knowingly looses money. It's a bad investment because the fundamentals of the asset are deteriorating.

Note the Washington Post article above. The federal government isn't just adding $2 Trillion in new treasuries to the market this year, but another $6 Trillion is maturing this year. That $6 Trillion in existing debt will need to be rolled over (because we have no intention of ever paying it down). Thus we need to borrow $8 Trillion just this year, almost all of that from foreigners (because we don't save money in America. We spend it on imports from those same foreigners).

So then the question is: how likely are foreigners to loan us the money? Let's look at the trend of their recent appetite for our debt.

Net purchases of the U.S. long-term securities declined from $65.4 billion (revised down from $66.2 billion) in September to 1.5 billion in October. That’s quite a disastrous result, considering the foreign purchases barely cover the domestic sale, while the markets expected a value close to $40 billion for October net purchases.

It's important to note that the treasury and the dollar are joined at the hip. Any blow to confidence in one, hits the other just as hard. Here's a quick list of items to look for in the coming year:

1) The global recession is forcing nations to sell their currency reserves (which are usually dollars) to protect their own currency. India and Russia have already been doing this.

2) Selling treasuries are the equivalent of promises to print money. More dollars being printed means a weaker dollar in the future.

3) Foreign sovereign-wealth funds took a beating in late 2007 and early 2008 when they bought into Wall Street banks. They will be much more cautious buying dollar assets in the future.

4) The bailouts aren't over. The states are asking for a $1 Trillion bailout. The Pension Benefit Guaranty Corporation will need a bailout this year of tens of billions. The bailouts of AIG, Fannie Mae and Freddie Mac keep getting more costly. The automakers will need more money as well.

5) The economy could be even worse than expected, thus causing a shortage of tax revenue.

America's GDP is only about $13 Trillion. Does it sound even remotely logical and sustainable for a nation that produces $13 Trillion a year to be borrowing $8 Trillion in a single year?

So what does it mean for the treasury bubble to pop?

For starters, because it is a bubble, millions of investors would lose money, which might cause a selling panic (bursting bubbles are always messy).

Second, it might threaten Treasuries’ status as the global “risk-free asset” and would damage the international stature of the U.S. Foreigners, who own about half of all Treasuries, might stop funding the country’s growing trade and budget deficits without an increase in U.S. interest rates.Finally, a busted Treasury-market bubble could undermine the dollar’s global reserve-currency status, which in turn would spell higher U.S. interest rates, undercutting economic growth.

Basically what I am saying is sell your treasuries now if you have any. They are overvalued and have nowhere to go but down, and when it goes down it will take the dollar with it.

Comments

end 2009

I made a terrible mistake of not realizing the lag with the incredible impossible deficit, thinking it would have an immediately effort.

From treasuries to .....?

Stuffed a good portion of my 401(k) in TIPS because of inflation worries, which in hindsight limited my damage from the collapse of stocks....but where to put it now? Cash is no good if the currency collapses, which is now looking inevitable.....Perhaps it is just not going to be possible to protect savings from what's coming, my 401(k) does not offer gold as an investment choice.....

Putting 401K in gold

Couldn't you buy GLD on the NYSE?

Oh, and what is TIPS?

Finding an interest-free protected currency

Is harder than it sounds. Given that four major religions ban usury, you'd think there'd be at least ONE country out there that didn't buy into the modern scandal of the banking industry, but I've yet to find it.

-------------------------------------

Maximum jobs, not maximum profits.

Buy land

The safest investment in messy longterms is buying land that eventually can be seed (good for catastrophic times).