Oil prices, and prices for everything that is refined from oil, continued to head up last week, something you don’t need me to tell you if you've bought gasoline lately. There has been no fundamental change in the global oversupply situation that would account for higher prices, however, but rather a change in the betting positions of oil speculators. Just as oil prices were forced down to nearly $26 a barrel in mid-February as oil traders were selling contracts to deliver oil they did not own, oil prices are now being forced up by traders who are buying contracts for oil they have no intention to take delivery of. And as we've explained previously, with daily electronic trading in oil contracts accounting for more than 100 times the amount of actual oil produced and shipped weekly, the gamblers in oil contracts have much more to say about the short term direction of prices than do the producers or users of that oil..

After falling to close at $42.62 a barrel on Monday on news that the Saudis were boosting production to meet Chinese demand, June contract prices for WTI oil spiked to over $44.50 a barrel on Tuesday after an American Petroleum Institute report that inventories of crude, gasoline and distillates were all down, settling to close the day at $43.72 a barrel. However, even after the EIA report showed that the crude oil glut had actually continued to build, traders drove prices up to close at a 2016 high of $45.33 a barrel on Wednesday, preferring to focus on a small drop in field production of crude, believing that would suggest supply-and-demand conditions would soon come back into balance. Thus convincing themselves that the oil price rout was over, buying by speculators continued on Thursday, as the current contract price rose to a 5 month high and closed at $46.03. Oil prices then fell below $45.40 on Friday morning as the rally ran out of steam, but then recovered after the rig count report showed the largest decrease in oil rigs 6 weeks, and closed the week at $45.92 a barrel, up nearly 20% for the month of April. We'll include an oil price graph here so you can all see how this rally has been playing out.

The above graph now shows the daily closing contract price per barrel for June delivery of the US benchmark oil, West Texas Intermediate (WTI), as traded on the New York Mercantile Exchange over the last 3 months. The last time we showed an oil price graph it was for the May contract, trading for which expired at $41.08 last Tuesday. This June contract closed at $42.47 on that same day, after which it became the widely quoted "price of oil". Also note that although the March contract for oil fell as low as $26.02 a barrel in mid-February, this contract price for June delivery never got much lower than $32. Although futures price quotes are commonly available out to 2024, i don't know of anyone who charts any of those non-current futures. Hence. each time the current contract expires, its chart is replaced by all such charting services with the new current contract month’s prices, which then shows A different price history than what had been quoted in the media just days earlier.

Prices at this level have the potential to draw some of the more overconfident frackers back out into the field. Continental Resources and Whiting Petroleum, two big operators in the Bakken, have previously said that they may begin fracking their large inventory of drilled but uncompleted wells if oil prices rise above $40 a barrel . To be sure, they wont be making money at that price, but it should be enough to cover the cost of fracking, given that all the other drilling expenses are already water over the dam. And this week, Pioneer, a large Dallas based fracker, announced they will add more rigs as soon as oil hits $50. In reporting earnings this week, they reported they'd already produced more oil than forecast, citing $45 a barrel as a breakeven price in some plays. So although the rig count was down to a new record low this week, if oil prices continue to rise, we would not be surprised to see an increase in drilling shortly thereafter.

The Latest Oil Stats from the EIA

While our imports of crude oil fell significantly from the elevated levels of last week, our refineries also slowed somewhat, and because the EIA found 400,000 barrels per day of the 434,000 barrels per day that went missing from the Petroleum Balance Sheet during the week ending April 15th, our surplus crude oil in storage rose by 2 million barrels to another new record on April 22nd. Wednesday's reports from the Energy Information Administration showed that our imports of crude oil fell by 637,000 barrels per day to average 7,550,000 barrels per day during the week ending April 22nd, down from the average of 8,187,000 barrels per day we were importing during the prior week. That lowered our 4 week average of oil imports to 7.7 million barrels per day, which was just 1.2% above the same four-week period of last year...

At the same time, production of crude oil from US wells fell for the 13th time in the past 14 weeks, dropping by another 15,000 barrels per day, from an average of 8,953,000 barrels per day during the week ending April 15th to an average of 8,938,000 barrels per day during the week ending April 22nd. That's now 4.6% below the 9,373,000 barrels per day we were producing during the same week last year, and 7.0% below the 9,610,000 barrel per day peak of our oil production that was established during the week ending June 10th of last year...

Meanwhile, U.S. refineries’ crude oil inputs averaged 15,847,000 barrels of per day barrels during the week ending April 22nd, which was 257,000 barrels per day less than the 16,104,000 barrels of crude per day they processed during the week ending April 15th, and 1.6% less than the 16,104,000 barrels per day they used in the same week last year, This was as the US refinery utilization rate fell to 88.1%, down from 89.4% the prior week and quite a bit below the utilization rate of 91.3% that was seen during the week ending April 24th last year. As that’s an unusual slowing for this time of year, it could have been in part due to an unusual rash of refinery problems, which saw a Shell refinery in Deer Park, Texas, and Houston Refining's plants shuttered last week, and a Motiva refinery at Port Arthur Texas shut down this week.

At any rate, with less oil being refined this week, our refinery production of gasoline fell to the lowest level in 4 weeks, dropping by 231,000 barrels per day to 9,507,000 barrels per day during week ending April 22nd, down from our gasoline output of 9,738,000 barrels per day during week ending April 15th. That was still 1.4% more than the 9,374,000 barrels of gasoline per day we were producing during the same week last year, however, as our year to date gasoline output is still running well ahead of last years pace. In addition, our refinery output of distillate fuels (diesel fuel and heat oil) fell by 90,000 barrels per day to 4,622,000 barrels per day during week ending April 22nd, which put our distillates production 4.4% below the 4,837,000 barrels per day we produced during the same week of 2015. Although our year to date distillate output is below the pace of 2015, the milder than normal winter in the heat oil consuming states of the Northeast means we've used that much less...

However, even with the lower refinery output of gasoline, our gasoline inventories rose for the first time in 3 weeks, increasing from 239,651,000 barrels on April 15th to 241,259,000 barrels on April 22nd. Part of the reason for that was an increase of 107,000 barrels per day in our imports of gasoline, which at 898,000 barrels per day were at a 7 month high. We also saw a 129,000 barrel per day drop to 9,315,000 barrels per day in gasoline supplied, which is a metric considered to be a proxy for gasoline consumption. All that meant our gasoline inventories were 6.1% higher than the 227,451,000 barrels we had stored on April 24th last year, which was at that time the highest gasoline stores for the 4th weekend in April in EIA records going back to 1990. Thus the EIA categorizes our gasoline stores as "well above the upper limit of the average range" for this time of year. At the same time, our distillate fuel inventories fell by 1,695,000 barrels to end the week at 158,240,000 barrels, driven by a surge in diesel fuel consumption in the central US, likely associated with spring planting. But because distillate inventories were already bloated after a warmer than normal winter, they remained 22.4% higher than the 129,270,000 barrels of distillates we had stored at the same time last year, which although not a record, is still characterized as "well above the upper limit of the average range" for this time of year.

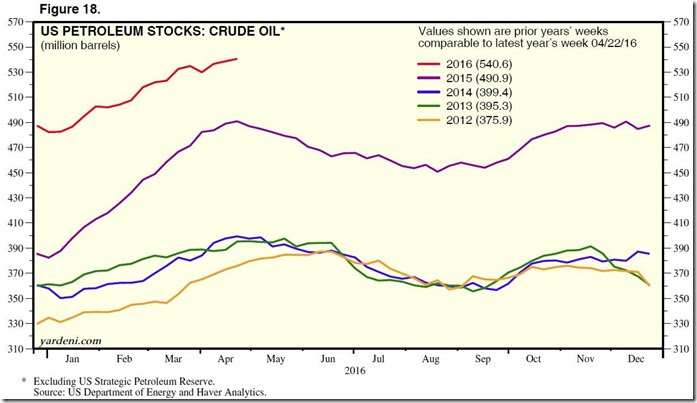

Finally, even with the large drop in oil imports, we still added nearly the same amount of oil to our stores as was recorded as added last week, mostly because last week the EIA's petroleum balance sheet came up 434,000 barrels per day short then (something i had missed at the time). This week, with the "adjustment" recorded on line 17 of the petroleum balance sheet (page 6 of the EIA's weekly Petroleum Status Report (62 pp pdf) a less significant 34,000 barrels per day, our stocks of crude oil in storage, not counting what's in the government's Strategic Petroleum Reserve, rose once again to a new record of 540,610,000 barrels as of April 22nd, up by 1,999,000 barrels from the record 538,611,000 barrels of oil we had stored on April 15th. That was 10.1% higher than the then record of 490,912,000 barrels of oil we had stored as of April 24th, 2015, which turned out to be the highest inventory level of 2015, and 35.4% higher than the 399,357,000 barrels of oil we had stored on April 25th of 2014. Below, we have a chart which illustrates this oil inventory growth...

The above graph comes from a weekly pdf booklet of petroleum graphs produced by Yardeni Research, a provider of independent investment and economics research. It shows the end of the week stocks of crude oil in millions of barrels for each week beginning with January 2012, up to and including this week's report for April 22nd, with graphs for each year color coded as indicated. Here we can much more clearly see how our oil inventories stayed in a narrow range between 2012 and 2014, represented by the yellow, green and blue bands, typically falling to 350 million barrels by the end of summer and rising to around 390 million barrels by early spring. However, at the beginning of 2015, represented by the grape colored graph, our inventories of oil started rising each week till they reached 490 million barrels at the end of April 2015, and then stayed elevated in a range 80 to 100 million barrels above the previous norms. That continued into 2016, represented by the scarlet colored graph, which shows that our oil inventories rose from what were already record levels to new records most every week since February. We've now increased our inventories of crude oil by by nearly 58.3 million barrels since the beginning of this year, while setting new records for the amount oil we had in storage in the US in 10 out of the last 11 weeks. And while we expect that these inventories of oil will begin to decline seasonally soon, possibly even next week, the key to relieving the glut will not really come until our stockpiles of crude drop below the elevated 2015 level and start to approach the norms of the 2012 to 2014 period.

This Week's Rig Counts

As mentioned, the week saw another record low for drilling rig activity in the US, for the 8th week in a row. Baker Hughes reported that the total count of drilling rigs in use in the US was down by 11 more rigs to 420 rigs as of April 29th, down from the 905 rigs that were working on May 1st of 2015, and down from the recent high of 1929 rigs that were drilling on November 21st of 2014. The count of rigs drilling for oil fell by 11 to 332, which was down from 697 rigs targeting oil a year earlier, and down from the recent high of 1609 working oil rigs that we saw on October 10, 2014, while the count of drilling rigs targeting natural gas fell by 1 to a record low of 87, down from the 222 natural gas rigs that were drilling during the same week a year ago, and down from the 1,606 natural gas rigs that were in use on August 29th, 2008. Meanwhile, a single rig classified as "miscellaneous" was started up, which was the only rig so classified operating this week, down from the 4 miscellaneous rigs that were in use a year ago.

One of the rigs that was shut down this week had been drilling off the shore of Texas in the Gulf of Mexico, thus reducing the Gulf of Mexico rig count to 24 and the total offshore count to 25, as they are still working that offshore platform in the Cook Inlet off Alaska. That's down from the 33 Gulf of Mexico platforms and 34 total offshore that were in use on May 1st of 2015. A net total of 8 horizontal rigs were pulled out this week, leaving the count of rigs drilling horizontally at 324, which was down from the 699 horizontal rigs that were in use a year ago, and down from the recent record of 1372 horizontal rigs that were drilling on November 21st of 2014.. At the same time, 2 directional rigs were also shut down, leaving 46 directional rigs still drilling, which was down from the 93 directional rigs that were in use at the end of the same week a year earlier. In addition, a single vertical rig was also removed, cutting the vertical rig count back to 50, which was down from the 113 vertical rigs that were deployed nationally the same week last year...

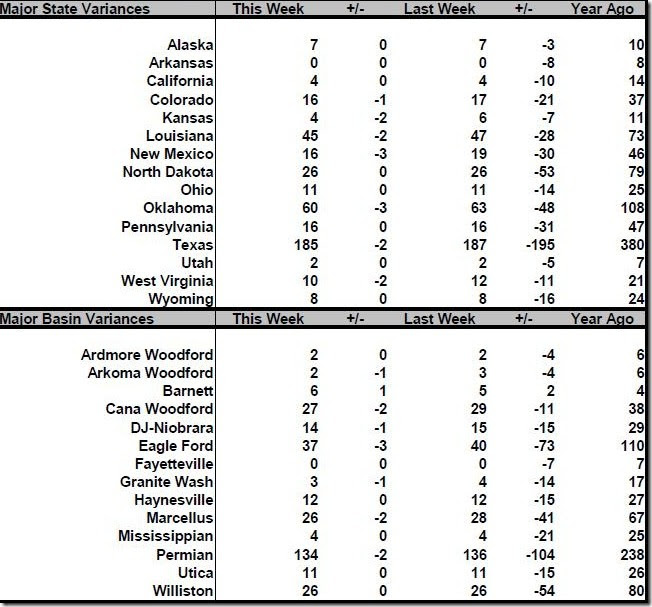

For the details on which states and which shale basins saw changes in drilling activity this past week, we're going to include a screenshot of that part of the rig count summary from Baker Hughes, which shows those changes...

The first table above shows weekly and annual rig count changes by state, and the second table shows weekly and annual rig count changes for the major geological oil and gas basins. In both cases, the first column shows this week's active rig count, the third column shows last weeks rig count, and the column in between shows the change, plus or minus, from that week to this one. Then, the year ago active rig count for each state and basin is shown in the column on the far right, with the column just to the left of that showing the change in active rigs from a year ago. For example, we can thus see that the active rig count in the Eagle Ford shale of South Texas was down by 3 rigs to 37, which was down from the 110 rigs that were working that basin a year ago, or in this case, on May 1st of 2015..

However, this table does not show active rigs for every state, as many have no drilling, and some have just one rig operating irregularly. Some weeks there are no changes in the rigs counts other than what's shown above, but this week we have additions of rigs in four states not shown above. The Baker Hughes state count tables indicate that one new rig was deployed in Illinois, one in Hawaii, one in Kentucky and one in Mississippi this week. For Illinois, the new rig was the only one active this week, same as the single rig drilling a year ago; for Hawaii, the new rig was also the only one active, but they had none a year ago; in Kentucky, they now have 3 rigs working, up from 2 rigs a year ago, and in Mississippi, they now have 3 rigs working, same number as they had on May 1st a year ago...

(note: the above was crossposted from Focus on Fracking)

Comments

nothing like prices divorced from demand

What is the projection for oil to stay low, the timeline?

projections

oh, everyone who has an opinion has a projection...probably the most cited projection comes from the IEA, who says they expect a global balancing of supply and demand the second half of this year, largely due to a big drop in US production...i dont see any evidence of that yet; US oil output has fallen 13 out of the last 14 weeks, but the average weekly drop has been between 15 and 20 thousand barrels per day...it will take more than a few months at that pace to balance the global oversupply, which is typically put at 2 to 2 and a half million barrels per day, especialy with Iran just now getting their production back online...

rjs