As Calculated Risk points out, economic cycles typically run in an order. The first portions of the economy to turn positive are typically personal consumption expenditures and residential investment -- even during the recession. Afterward, investment in durable goods such as equipment and software. Finally, after the recession (in terms of GDP bottom), unemployment and non-residential investment.

Research has shown that most economic pundits miss turning points because they just project past and current trends into the future. The best way to look into the economic future is usually just to look at the Conference Board's Index of Leading Economic Indicators.

In April, Leading Economic Indicators surged 1% as 8 out of the 10 turned positive or at least neutral. With May over, let's take a preliminary look at what those indicators might show.

Here is a list of the 10 Leading Economic Indicators, with the weights given each indicator by the Conference Board:

- real money supply (35%)

- average weekly manufacturing hours (25%)

- interest rate spread (10%)

- manufacturers' new orders for consumer goods (8%)

- supplier deliveries (7%)

- stock prices (4%)

- consumer expectations (3%)

- building permits (3%)

- average weekly initial claims for unemployment insurance (inverted) (3%)

- manufacturers' new orders for durable goods (2%)

We already know what by wight over 50% of the above will be for May. Real money supply is still strong as the Fed continues to re-liquify (or re-solvenc-fy) the banking system. The yield curve is even more strongly positive than before, due to the backup in long term rates while short term rates are still essentially 0%. Stock prices (over the last 90 days) have also strongly rallied. Consumer expectations about the future are also rising sharply. Average initial claims for unemployment insurance were basically flat for the month. By weight, that's 52% positive, and 3% neutral.

This week, we'll receive information on over 30% more of that weight: supplier deliveries are reported tomorrow, manufacturers' new orders on Wednesday, and average weekly manufacturing hours on Friday. Of these three, the last one is the most important, not just because of its 25% weight in the index, but also because it was dropping like a stone until turning slightly upward in April. Whether April's increase was just a blip of data, or whether it presaged a real manufacturing turnaround may well be determined this week.

Two other versions of leading economic indicators, one public, one private, are updated weekly and so we already know what they showed for May.

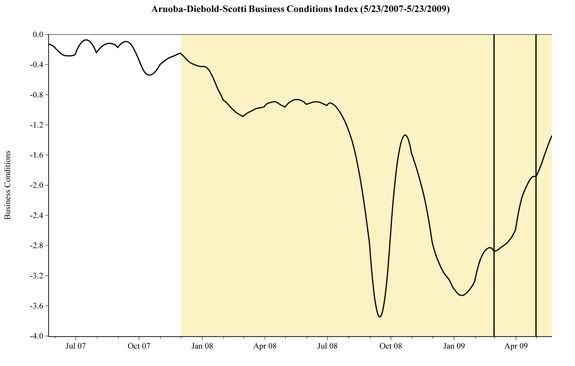

The Aruoba-Diebold-Scotti Business Conditions Index is derived by the Philadelphia Federal Reserve Bank. It continued to show strong positive momentum through May:

The ECRI weekly leading business conditions index is another, privately derived index of leading business indicators. ECRI has been doing this for over 100 years, including the Great Depression era. Their index continued to show strong positive momentum throughout May, Although the below graph only goes to the 15th, the index continued to increase through May 29 :

ECRI says that 8 of 9 times their indicators have turned this decisively positive, a recovery was only a few months away. The exception -- 1931.

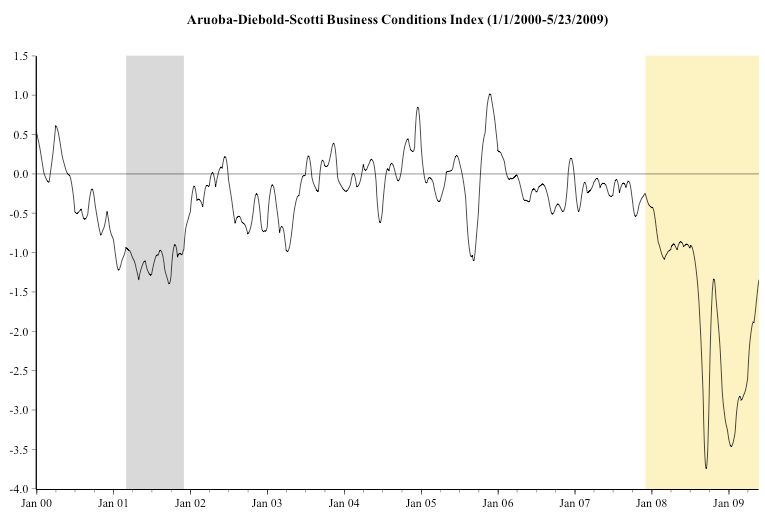

With that sobering qualifier in mind, it is important to note that while the short term movement has all been in the correct direction, nevertheless both show that business conditions aren't signaled as "positive" yet. A longer-term view of the graphs shows that both have risen to the level of previous "soft" recession bottoms, e.g., 2001:

I'll update this review at the end of this week, when the new indicators, especially average manufacturing hours, have all been reported.

Comments

This is the part that worries me:

This is not the typical recession. Consumer psychology is absolutely important with timing a recovery. As I said yesterday, consumers, while upbeat, may be happy because they see what is happening in the stock market and the stock market is somewhat happy because consumers are happy. But the intervening factor, and the reality may be, is that people don't have the disposable income necessary to make significant purchases.

NDD, I truly appreciate the balance and perspective you provide.

RebelCapitalist.com - Financial Information for the Rest of Us.

I'm less worried about that

Remember, in 1931 the Federal Reserve was standingly idly by while banks were failing in large number. Even worse, they were raising interest rates to defend the gold standard. The chances of either of those happening now are zero.

The GM bankruptcy concerns me, but at least Chrysler's didn't go too bad. The states' fiscal positions concern me, but at the end of the day, politically, Washington will bail them out (probably with strings attached about repayment: I wouldn't want to be a state pension-holder).

The possibility of a real Oil price spike killing consumer disposable income again is my biggest worry.

My main point is that this not a typical

recession. All the things you mentioned that concern you are related and almost a vicious circle. If people don't have money they can't spend. They can't spend it on cars that generate sales revenue for state governments. Then you have the problem of oil prices eating up more income providing even fewer household dollars for spending which makes the states revenue issues worse. Not to mention the problems with states that rely heavily on real estate property taxes are being hurt because of decreases in property values.

This recession seems to be made up of continuing vicious circles that are extremely hard to break.

RebelCapitalist.com - Financial Information for the Rest of Us.

There are people who can spend who are not doing so.

In this much, we are in the same situation as prior recessions since WWII ... the downturn in consumption demand is not only those who cannot spend, but also those who are not sure whether or not they can spend.

When the economy hits the trough and there is a widespread perception that things have become as bad as they are going to get, those who find that they escaped the ax this time will engage in consumption that was postponed during the period of greatest uncertainty.

The problem is deeper than that ... the problem is, that resiliance by itself is not likely to be sufficient for a strong and sustained recovery ... and absent a Job Guarantee program, a strong and sustained recovery is required to see a substantial increase in employment.

Absent government policy, the four available growth drivers are investment in productive capacity, construction investment, debt-financed consumption, and exports.

Construction investment and debt-financed consumption are squashed as potential growth drivers by the ongoing weakness of balance sheets in the Finance Sector. Investment in productive capacity and exports are quashed by the determination to maintain an overvalued exchange rate, to maintain the lie about the affordability of our network of over 700 overseas bases, and the determination to maintain slack labor markets in service of the profits of large corporations.

And the Stimulus spending already in place is by design intended to cover less than half of the gap between current output and full employment output.

So absent government policy change, the recovery is likely to be sluggish at best, and could well run out of steam once postponed consumption has been met ... it could turn out, in other words, to be the GDP equivalent of the dead cat bounce.

Government policy can address that, but only if Congress decides to do so. And in order for Congress to decide to address the problem, we need a different Congress.

This is quite like the situation in the early years of the Roosevelt administration. If we only had the policies of the first two years of the "New Deal", it would have been a fairly miserable failure. It was, rather, the election of the New Dealers to Congress that led to the political pressure that created the far more important "Second New Deal".

One month, however, may be a blip ...

... three months of positive moves on the LEI and we are looking at a recovery, and then raising the next question ... what kind of recovery will it be?

ECRI has nuanced view on 1931 experience

Re ECRI -- they seem to say that the growth rate cycle upturn failed to catch on, and the depression ensued. But, that their leading index(es) anticipated the renewed weakness. This is my understanding of what they say on their site (I may be wrong), www.businesscycle.com, where they also raise the issue of a 'giant error of pessimism' near the end of recessions.

Oil prices and gas prices will be a factor.

And the ability of banks to provide credit. If they are not in position to lend then this will also be a drag on the economy.

RebelCapitalist.com - Financial Information for the Rest of Us.

Stabilization, Schmablization.

Clearly, the whole thing rides on the back of the recent government giveaways to the banks and to the auto industry. One chink in that armour and down comes the whole edifice, the most obvious future vulnerabilities being the dollar and hyperinflation. Our dear savior may be able to keep the wolf away from the door short-term but time is inexorable and history utterly unforgiving.

There is a certain unreality to the whole orientation of the government to this crisis no small part of which is an illusion about a future in which the past is recreated, a kind of me-generation's nostalgia for amoral, no consequences living, and a certain penchant for the psychopathological. One day these characteristics will, with justice, be so resented, so maligned in public life that Taliban-like treatment of them will seem mild in comparison.

wages

I'm reading those sets of EIs over and I am thinking about 2001 recession. It seems to me the U.S. never recovered from 2001 and that the U.S. income, i.e. workforce, middle class went more in debt and lost standard of living, income, retirement funds, wealth. It was covered up by the housing bubble.

So, the question is, has their been some sort of wage assumptions in the above set of EIs that has "gone over" a standard deviation and is now having a macro economic effect?

Very good post NDD, instructive for those who don't know about these EIs.

Obviously, there will be NO RECOVERY

Regardless of the contrived "a recovery just around the corner" business, the initial claims for unemployment insurance is flat because this is the summer, after all, with vacationing to put off futile job-searching, with a new wave of internships instead of hiring, and now, for a new first, families are financially bidding on internships at some of the more sought-after corporations, for their college grad-children.

It always returns to what's the economic engine of America? Other than the export of junk paper? Green jobs to be offshored?

The greatest innovation - which we are still existing off of - came from the investment in the largest government research program in history, the NASA/Apollo/Moon Project - and the WWII GI Bill provided the educational funding for the citizen workforce for that!

A never-ending recession is properly termed a Depression, and that is what we are living in.

CNN had a story on graduates

The stats where that in 2007, 51% could find a job, while in 2009 only 20% could. Folks thought well maybe they've gone on to graduate school, but then CNN followed up that only 1 in 4 went to grad school. Honestly, I think this past decade has been awful for college degree holders. A lot are finding that the promises made about getting that sheepskin were just that words. That isn't to say going to college is bad, I think the stats overall still point to higher wages. But now you're competing, especially if you're studying in a degree where the field has applicants all over the world or is prone to outsourcing, like never before.

You know, it always amazes me when someone who can't find a job starts their own business. There should be initiatives to promote such a thing, especially for young graduates fresh out of school. It just seems like so much talent is being lost or wasted, look if you're not going to be able to find an employer why not start a business? It's hard, it's a challenge, but if your only other alternative is the unemployment line, why not?

--------------------------------------------

www.venomopolis.com

Mrs. Johnson

Who would ever say a bad word about Mrs. Johnson, Centerville's perky, cheery 9th grade geography/history teacher. There she be, long headed, short haired and bespeckled, the very picture of modern womanhood, a shoe-in for Obama, self-pitying about being overworked, never missing an opportunity to remind you how she goes to her own expense to fund materials for the lesson plans she's devised, and, oh, so awfully empathetic, empathetic that is if you can take an airbrush to that late-term abortion over which she so vocally agonized to friends five years ago. The baby and St. Joseph are still having a tough time calling what she did back then "empathetic". But if you thought Mrs. Johnson didn't think getting a college education and an advanced degree at all costs wasn't essential to just about anyone having the experience of coming under her tutelage, you can forget about it.

Mrs. Johnson, as apparently benign as she might seem, together with the entire academic establishment at all levels has for years aggressively sold the idea of the centrality of education to human life, that despite reports that humanity managed to exist without it for roughly 99% of the time its drawn breathe. Wonder why? Could it be that Mrs. Johnson and physics professor Harwood over at State College have an axe to grind? Could it be that they are just as much a part of the whole corrupt song and dance that's been sold to the American people for years about preparation for life in the "new" economy? I think so. I think that Mrs. Johnson and Professor Harwood are as much a part of "the system" as any munitions maker, financier, politician, or AIPAC lobbyist. And, by the way, how much of a drag on your unemployment check is that student loan you took out 10 years ago?

May Retail Sales

Most U.S. retailers likely saw sales fall in May

Another article with great graphics -

The Fall of the Mall

May retail sales, EIs, government stats

Any stats, EIs like this, you might want to do an instapopulist on it and also go to the government statistics source online and use their reports/graphs.

If you write up EIs in a comment, we might not see them and on any of these things like the BLS, GAO, CBO, Fed., Treas. etc. they have really improved their websites and put up all sorts of graphs and details for us.

So, we might as well use their original work designed for public consumption.

I find going to the statistics source also very useful for I might see some detail that the press simply doesn't report.

We have a few of these government RSS feeds over in the bottom right hand column. (I think this is fantastic that government and fed agencies are now using web 2.0 technologies for information updates, their studies, reports).

Point taken

For most companies (especially public) it would be self-reports at this stage. The final numbers usually lag a month behind.

The raw article is here and notes the basket of retailers to which the author refers.

The fiscal month may not have ended for all retailers, yet.

Lastly, the author notes that the decline is gasoline prices (creating lower YoY sales) is included.

We trended lower in May whereas we had been flat 2009 (YTD).