Like many people, I loathe the idea of a housing "bailout" for the greedy, the reckless, and the spendthrift. Certainly those bankers and borrowers had no problem "privatising their gains" in the early part of this decade. I see no reason why they should look to the prudent and the thrifty now, especially when so many millions of those prudent and thrifty are those whose own dreams of owning a home of their own at a reasonable price were frozen out by the housing mania.

But out of crisis comes opportunity. In this case, the opportunity for the Democratic party to show average Americans what a Democratic majority would do for them and their financial well-being. The opportunity to earn their trust and their votes for years to come. To show that a party that believes in governance for the average citizen can separate the wolves from the sheep, penalizing the former and acting with basic humanity to the latter.

There are plenty of perfectly awful proposals out there, including one being given a deferential hearing by the GOP right now! But there are also 2 very good proposals being circulated by Democrats and by regulators that deserve the full-throated support of the democratic grass roots. I describe them below.

I. A quick pictorial recap of the mortgage crisis

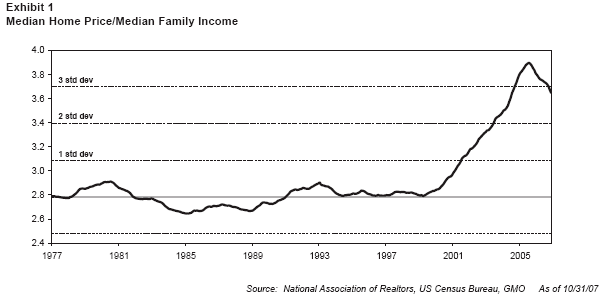

By now everybody knows there was a housing bubble in the first half of this decade. The average price of a house exploded into unaffordability compared with the income earned by the average (median) American household, as shown here:

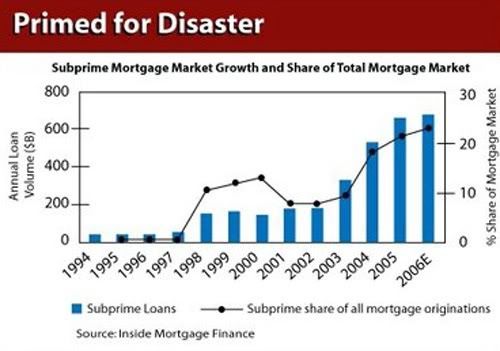

As traditional, sober loans no longer allowed many Americans to afford the housing to which they aspired, more and more "subprime" loans were written, many with low "teaser" rates that were set to balloon 2 or 3 years later. By 2006, these "subprime" toxic loans accounted for nearly 25% of all loans issued, and amounted in total to over $2TRILLION dollars!:

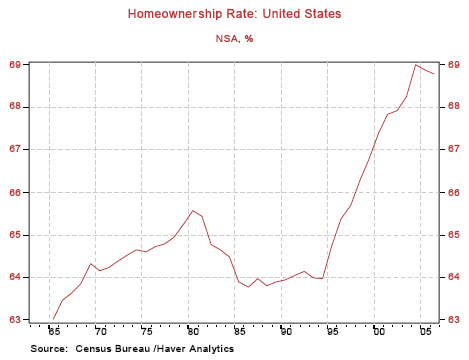

This giving of loans to anything that could fog the mirror caused a sudden dramatic increase in the percentage of Americans who "owned" homes:

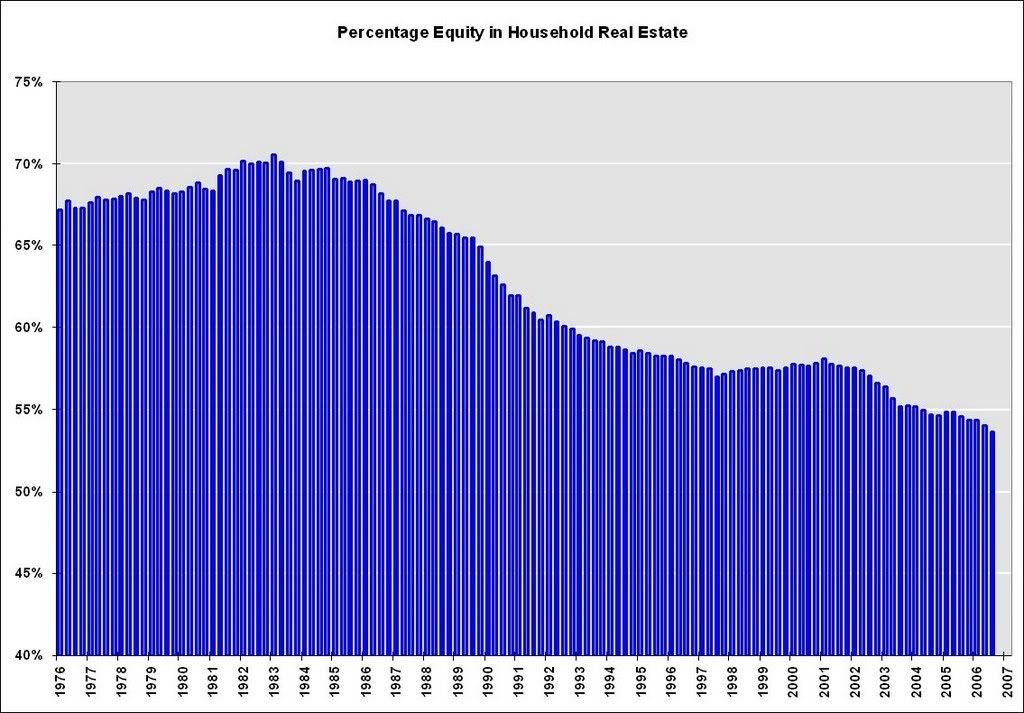

but simultaneously caused a dramatic decline in the amount of equity (i.e. how much was actually "owned") in those homes:

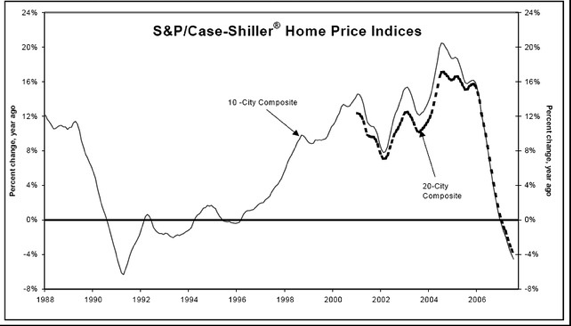

Now with house prices actually declining substantially:

many homeowners with those "adjustable rate" mortgages are in dire straits, foreclosures are soaring, and all sorts of financial institutions are finding that they "own" billions of dollars worth of toxic loans that stand almost no chance of being repaid, so much so that much of the credit markets have frozen up, chiling the economy as a whole.

II. The relationship of median house price to median income will be restored, the question is how and with how much pain.

The title of this section pretty much says it all. Look at the first graph up top again. That graph, one way of the other, is going to get restored to its long term median of 2.8-3x income for the median house. That's how the bubble is going to bust. There are two ways that can happen: (1) median income can rise (dramatically), or (2) house prices can fall (dramatically).

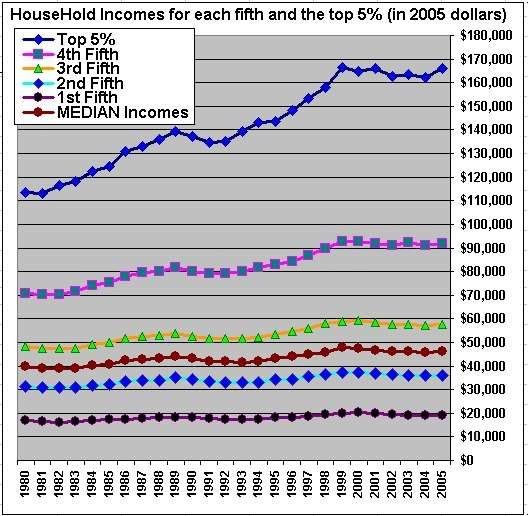

If anyone thinks that the income of the average American is about to rise dramatically in the near future, I have a graph to remind you of what has happened to Americans' incomes in the last 30 years:

Unless you're in the top 20%, your income has barely budged. While we as democrats can agree that this graph is one we'd like to change dramatically in the future, it ain't gonna happen anytime soon. Certainly not soon enough to make a difference to the mortgage crisis.

That leaves the second option: house prices have to fall, dramatically. Any "bailout" such as an A.R.M. freeze that rewards the reckless, penalises the prudent, and fails to return housing prices from their stratospheric levels, is not fair to the American people and only prolongs the agony.

III. There are 2 pending proposals which will ease the pain of the housing bust, cause it to be over more quickly, and won't reward the greedy or reckless. They deserve our support as democrats.

Take a look again at the graph in part one showing how subprime loans enabled homeownership briefly to zoom from 64% to almost 70% of all Americans. It is estimated that by now 10% of all homeowners, a staggering 8,8 million people, are "underwater", that is, they owe more in their mortgage than their house is worth. The brutal, totally free-market method by which house prices will decline is for there to be hundreds of thousands, perhaps millions of foreclosures, tossing all of those who wouldn't have qualified for non-toxic loans (about 5% of all Americans!) "out onto the street". Probably they could move back into an apartment, but in the meantime 100,000s of vacant houses will deteriorate, and the neighborhoods around them -- owned by people who could afford the houses -- will deteriorate as well, creating a vicious spiral.

What we as democrats should want is for housing prices to decrease back to their traditionally affordable range, enabling the prudent and the young to buy houses. We should want the process to move as quickly as possible, so that the economy can start moving forward again. We should want the process to involve a minimum of "moral hazard" that rewards the greedy, the reckless, and the imprudent. And we should want a process that minimizes a wealth-destroying tsunami of foreclosures and keeps those who can pay a reasonable mortgage in their houses.

There are two proposals being floated right now that meet (albeit imperfectly) all of those criteria.

1. The first of the two proposals is to rescind that part of the 2005 Bankruptcy "reform" which took away from bankruptcy judges the ability to reduce mortgages (called a "cramdown").

The Senate bill to rescind the provision in the 2005 bankruptcy law that prevented bankruptcy judges from reducing mortgage terms was announced by Senate Majority Leader Harry Reid:

Senate Democrats introduced the Foreclosure Prevention Act of 2008 to ... Help Keep Struggling Families in Their Homes

....

Change Bankruptcy Code to Allow Judge to Modify Mortgage of Debtor. This title could help more than 600,000 financially-troubled families keep their homes by allowing them to modify their mortgages in bankruptcy. It eliminates a provision of the bankruptcy law that prohibits modifications to mortgage loans on the debtor’s principal residence for homeowners who meet strict income and expense criteria.

But as the following coverage from an AP article indicates, Republicans and the banking lobby are opposed to ending debt slavery:

Bankrupty Provision Added into Senate’s Housing Package

American Banker reported that Senate Democrats will allow the bill to bypass the usual committee review process and fast-track the legislation for consideration after Congress returns from recess:

“If you’re a financial services company that wants to derail this bill, you need to be very nervous,” said Jaret Seiberg, an analyst with Stanford Group Co. “This has a lot of provisions that play very well to voters, and you have a lot of members up for re-election, and in such a situation, bills that should be dead on arrival find themselves enacted into law.”

....MBA chairman Kieran Quinn offered a cautious outlook on the bill, praising some provisions but warning that the bankruptcy reform provision would be a strong sticking point.

“By including language to reform bankruptcy and allow judges to modify mortgage contracts, the bill threatens to hurt those it is designed to help,” Quinn said. “As long as this consumer-unfriendly provision is included, we cannot support the package as a whole.”

....As for the latest housing bill, it’s unclear if it will have bipartisan support; sources that spoke with HW suggested the bankruptcy provision will likely be a large sticking point for Republicans

But support is forming too. Just this morning, the Ocean County Register reports:

Experts favor changes in bankruptcy mortgage rules

Members of the American Bankruptcy Institute overwhelmingly favor a change in the law to allow bankruptcy judges to change the terms of a home mortgage.

Some consumer advocates say allowing bankruptcy judges to adjust the terms of a mortgage would help homeowners trapped with draconian subprime loan rates to keep their homes. Experts on the financial markets [my note: a/k/a the lenders], however, say it would lead to higher mortgage rates and even tighter lending standards that would prevent other people from buying homes in the future.

This legislative proposal deserves our support. It is not a bailout, certainly not more than bankruptcy has ever been a bailout. It penalizes unscrupulous lenders who should have known better, prevents debt slavery, and forces the delinquent homeowner to have the stigma of having gone through bankruptcy. Because it reduces the mortgage obligation, it serves to deflate the value of the house, rather than attempting to prop it up. By so doing, it helps hasten the day when median incomes and median house prices are back in line.

2.The second, regulatory, proposal from the Office of Thrift Supervision augments the first.

Yesterday brought some surprisingly fresh thinking. Specifically, the OTS floated an interesting plan to keep upside-down borrowers from abandoning their homes. It would allow those who owe more than their houses are worth to refinance into new loans equal to the CURRENT value of their homes.

The original lender would get part of his original loan paid off. He would also get a "negative equity certificate" equal to the difference between the current value and the original loan balance. The lender could redeem that certificate later on if the value of the house were to rise between the time of the refinance and the time the house was eventually sold.

Confused? This CNNMoney report uses an example to clear things up:

"If a house has a $100,000 mortgage originally," said Bill Ruberry, a press spokesman for the agency, "and the fair market value is $80,000, there's $20,000 in negative equity. The lender could refinance for $80,000 and a warrant [for the $20,000 in lost value]."

If the house later sold for $100,000, the lender would collect the $80,000 mortgage balance plus the $20,000. If the sale realized more than $100,000, the certificate holder might even get interest on top of the $20,000. Any profit beyond that would go to the borrower. The warrants could be publicly traded."

Reuters says Treasury is studying the idea. There's no way to tell if or when something will be put into practice. But it seems like a win for everyone involved.

* Borrowers who want to stay in their homes, but are having trouble making payments on large mortgages and are growing hopeless because they are so upside-down, get to refinance into smaller mortgages equal to the current value of their homes. This "rewards" those willing to stick around and tough out the downturn, and potentially lowers the amount of foreclosures the country would otherwise face.

* Lenders are forced to take a hit on their existing loans, hopefully eliminating the "moral hazard/bailout" problem. But they are given something in return for their willingness to work with their borrowers -- "call options" on the future values of the underlying homes.

* Lastly, the FHA gets smaller loans that leave the underlying borrowers paying a smaller chunk of their incomes on debt service (because the principal amounts being financed would be lower on the new loans than the old loans). Such loans would be more likely to perform over time.

(h/t Mike Larson of Interest Rate Roundup)

This is a good way to keep average borrowers in their homes rather than forcing them onto the street; it maintains some equity; it forces them to continue paying their mortgage; and it integrates a mark-to-market approach that will cause swift writedowns in the value of overpriced housing. Nobody gets bailed out. Moral hazard isn't created, and no public money, no bailout, is involved.

For good measure, perhaps the most informed blogger of all when it comes to mortgage issues, Tanta of Calculated Risk, supports these measures:

The mortgage industry's major lobbying group is coming out and telling you, explicitly, that cram-downs would ruin the party because we'd either have to disclose these bankruptcy-in-the-making loans to "the market" and watch it slap a punitive bid on the things, resulting in a rate the borrowers could never afford, or we'd have to stop making bankruptcy-in-the-making loans. Or perhaps we are being told that the MBA knows of no possible way to screen loan applications to cull out the ones most likely to end up in BK. That's rather a startling point of view from the folks who are supposed to be experts in mortgage lending.

To be perfectly honest, I'm not especially impressed with the rationale given for the cram-down proposal. I'm not convinced that 600,000 families are going to flock to Chapter 13 if the bill passes and end up financially better off and still in possession of their homes as a result. Most likely, they'll either be financially better off or still in possession of their homes, but not both. I support the bill, nonetheless, because giving residential mortgage lenders preferential treatment in BK proceedings has not worked out well for us, and if it takes the threat of cram-downs to sober everyone up on credit standards and pricing, then let's get on with it.

IV. And One proposal to oppose vigorously

When the Bush malAdministration gets involved in an economic problem, you know that it will be a windfall for crony plutocrats and deathly toxic to the average American. And not surprisingly, the push to bail out Wall Street and stick taxpayers with the losses is in full hue and cry:

From econbrowser:

A 'Moral Hazard' for a Housing Bailout: Sorting the Victims From Those Who Volunteered

A confidential proposal that Bank of America circulated to members of Congress this month provides a stunning glimpse of how quickly the industry has reversed its laissez-faire disdain for second-guessing by the government -- now that it is in trouble.

The proposal warns that up to $739 billion in mortgages are at "moderate to high risk" of defaulting over the next five years and that millions of families could lose their homes.

To prevent that, Bank of America suggested creating a Federal Homeowner Preservation Corporation that would buy up billions of dollars in troubled mortgages at a deep discount, forgive debt above the current market value of the homes and use federal loan guarantees to refinance the borrowers at lower rates.

....

In practice, taxpayers would almost certainly view such a move as a bailout... . The arguments against a bailout are powerful. It would mostly benefit banks and Wall Street firms that earned huge fees by packaging trillions of dollars in risky mortgages, often without documenting the incomes of borrowers and often turning a blind eye to clear fraud by borrowers or mortgage brokers.A rescue would also create a "moral hazard," many experts contend, by encouraging banks and home buyers to take outsize risks in the future, in the expectation of another government bailout if things go wrong again.

If the government pays too much for the mortgages or the market declines even more than it has already, Washington -- read, taxpayers -- could be stuck with hundreds of billions of dollars in defaulted loans.

As you might expect, the Bush malAdministration is giving this Bailout for Billionaires a full and favorable hearing. This is Bush's "base", after all. Expect a big push to enact as much of this socialising-of-losses as possible.

Conclusion. The above two good, pro-middle-class, pro-responsibility proposals minimize "moral hazard" of somebody free riding on the system. Both borrowers and lenders are forced to the discipline of the market. Homeowners would get to stay in their homes as much as possible, loans get paid off, and the process of restoring balance to the housing market is hastened.

These proposals are the kind of ideas the democratic party ought to be about. We should support them, forcefully counter the opposition of the banking industry, tie opposition by the GOP as an electoral anchor around their necks, and keep careful watch on which democrats in the House and Senate are only interested in their corporatist sponsors, and which truly progressively interested in the welfare of the average American.

Comments

Bankruptcy bill

Was one of the biggest anti-worker, anti-middle class bills of all time. I agree, with your diary that these two pieces of legsilation should be supported. I hope all reading this consider writing their Senators in support.

Foreclosure Prevention Act of 2008.

This is the first I've heard of the second.

Stirling Newberry

FWIW, Stirling Newberry thinks "foreclosure in place" is a good idea too.

January foreclosures up 57%

The bill title is The Foreclosure Prevention Act of 2008 and the bill number is S.2636.

Very timely they are doing this since Jan . Foreclosures up 57%.

The Mortgage Crisis

Very well done article, however, I think it misses a major trend. The insourcing of foriegn labor, to replace older workers (and younger as well), has thrown millions of America workers out of good paying jobs. The subsequent jobs are paying as little as 25 to 50 percent of those that were lost: especially if you consider loss of benefits and other entitlements (e.g., matching 401-K's etc.).

At the same time the government has purposely masked the destruction of the US dollar by playing with the basket of goods in the CPI (consumer Price Index). The price of both milk and gas have increased over 200% in the last 6 years for goodness sake!

What is really needed is massive debt relief to Legal American workers. I think any American that has paid 1.5 times the principle, in monthly payments, should simply have thier mortages closed and forgiven. Perhaps giving every Legal America worker -- who was actually born in this country to legal Americans -- a $100,000 might be another approach.

But the bottom line is that the economic blood bath has just begun. Furthermore, it is absolutely required, for the preservation of the social fabric, that families have homes to live in. And after all it IS the fault of the elite that our jobs and factories have been moved abroad. In my mind these futhermuckers need to pay a price.

Massive debt forgiveness -- such as I have merely hinted here -- would preserve the wealth and equity of Legal American Citizens. It would also throw a wrench into what is really happening in America today: colonization by foriegn elites.

For more information on the "New Agenda for America" please check out the following link:

No More Immigration: Legal or Illegal

Just part of the "New Agenda for America (NAA)"

Let's Influence the 2008 Presidential Election

Support the "New Agenda for America (NAA)"

www.newagecitizen.com/naa.htm

2 housing crisis proposals

An ocean liner is usually a ship designed to transport people from one seaport to another along regular long-distance maritime routes according to a schedule. Liners may also carry cargo, and may sometimes be used for other purposes (e.g. for pleasure cruises or as troopships).

2 housing crisis proposals

Wow, this is a complete acurate review, I wonder how many people are actually aware of these aspects... It's true that the housing and mortgage industry is facing instabilities, this is one more reason we should pay more attention to future trends and start acting more cautious. I could use a mortgage calculator right now.