Today's BLS report: total hours worked DECLINED sharply in Q4 and AVERAGE real wage/benefit compensation per hour FELL.

After years of denial and spin about the financial condition of US households/consumers, you might think the newswires and salesmen on cable would be buzzing with the key findings in today’s BLS report on US hours worked, real compensation, output and productivity. You would be wrong; the debt industry’s misleading confidence game prevails with the key findings either not mentioned at all or they are relegated to an afterthought as space permits.

The key finding in today’s report is that the total number of hours worked (and paid) in non-farm businesses during 2007-Q4 FELL at an annual rate of -1.5%. Indeed, THE TOTAL NUMBER OF HOURS WORKED IN Q4 WAS LESS THAN IN 2006-Q4. The report shows total non-farm jobs also falling at a -0.5% annualized rate in Q4 and rising by only 0.4% yr/yr.

Furthermore, after adjusting for the increased costs of gasoline, health care, etc, real AVERAGE (not median) salary and benefit compensation for all US workers FELL at an annualized rate of -0.3% in Q4 and by -0.3% yr/yr. Since total hours worked fell even with meager yr/yr job growth, this means that average weekly and monthly hours paid per job were reduced along with the decline in real compensation per hour. With lavish soak-the-customers-and-shareholders bonuses on Wall Street lifting average compensation, the median decline in compensation was surely far worse.

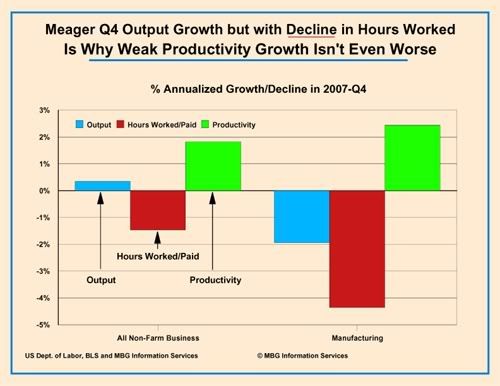

Non-farm business output grew at only an annualized rate of less than 0.4% in Q4. But since total hours worked fell at a -1.5% rate, output per hour of work – productivity – grew at a rate of 1.8%. The vital distinction between virtually stagnant production growth and 1.8% productivity growth is lost in the confidence spin and fairy tale assumptions.

An even better example is Manufacturing. Today’s report shows productivity in Manufacturing rising at a seemingly reasonable rate of 2.9% in Q4. Appearances can be deceptive; Manufacturing production FELL at a -1.9% rate and the number of hours worked in Manufacturing plunged at a -4.3% rate in Q4. That is, since employment plunged even faster than output, Manufacturing output per hour worked – productivity – appears healthy.

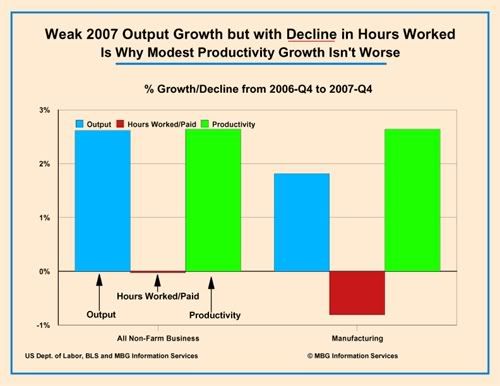

With total hours worked over the past year falling slightly for all non-farm business and by -0.8% in Manufacturing, weak output growth of just 2.6% for all nonfarm business and just 1.8% in Manufacturing translates into the same, misleadingly reassuring 2.6% productivity growth.

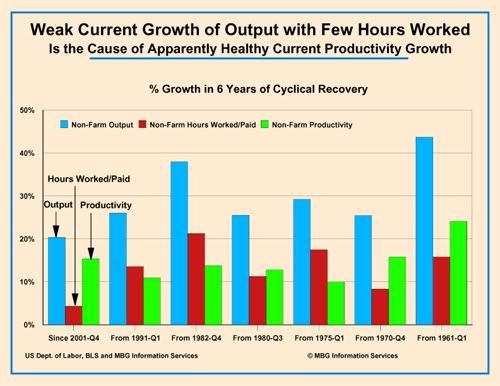

Indeed, this record weak output growth and virtually stagnant gain in hours worked has been the unique characteristic of the past six years of cyclical economic recovery from the recession that ended in November 2001.

Today’s report and the general ignorance of its key findings are again helping Wall Street attract new money after yesterday’s steep sell off. As with the debt fraud and recession, the time for “everyone” to be surprised will come later.

Comments

Economists spin

This is amazing, maybe some other economists should consider charting the data before they write.

Here's the NYTimes headline Productivity Growth Slows and the Costs of Labor Rise

Your graphs clearly show the costs of labor are not rising.