We've noticed a hell of a lot of political B.S. baffle going on, in particular on business taxes. What happens is politicians conflate small business taxes with the individual income tax and that is due in part to the actual tax code.

We've noticed a hell of a lot of political B.S. baffle going on, in particular on business taxes. What happens is politicians conflate small business taxes with the individual income tax and that is due in part to the actual tax code.

The GOP typical claim is a lower top personal income tax rate will allow businesses to hire more people. That is really a lie. Business profits can enable more hiring, tax refunds for hiring and retaining employees can incentivize new jobs, but the personal income tax rates for those who own businesses has negligible effect.

One thing that gets lost in the rancor are business tax deductions. An employee's salary and most benefits are a business deduction. The business owner would not pay taxes on the costs of hiring a new employee beyond the payroll taxes associated with hiring, about 6.2% of salary. The most important element to hiring is demand for goods and services provided by the business, not taxes.

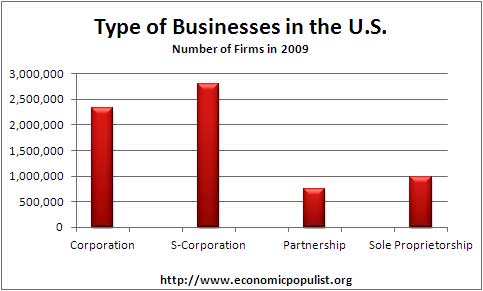

There are four most common business entities in the United States. Corporations, partnerships, S-corporations and sole proprietorships. Partnerships are primarily two types, a limited liability partnership (LLP) or a limited liability company (LLC). There are also other types of businesses, such as RICs, which are glorified investment vehicles with capital gains tax pass through. S-corporations also allow pass through taxes, although not as lenient as partnerships. Below is a graph of number of these firms by type, who had at least one paid employee during part of 2009.

Recent comments