This is from a quote from Mervyn King, Governor of the Bank of England. Here is the full quote:

It's the level, stupid -- it's not the growth rates, it's the levels that matter here

I got this quote from reading Mohamed El-Erian's article in the Financial Times. Dr. El-Erian coined the phrase the "New Normal" for economic growth. While I agree with his conclusion, I don't entirely agree with his analysis for the "New Normal".

In his FT article he talks about how are we are reverting back to same analytical framework that encouraged "short-termism" and got us into this mess.

Investors have not yet accepted his [Mervyn King's] insight that the absolute levels of income, debt, wealth and unemployment, not just the rates of change, are what matters today. They need to, and soon.

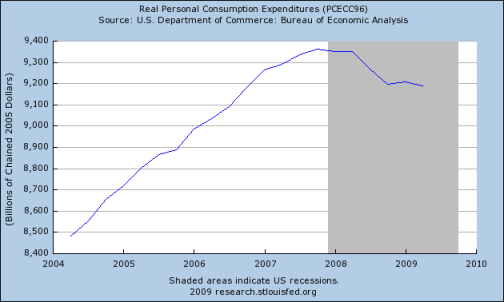

And we see this analytical framework at work everyday in the traditional business news media. Take a look today, a day in which new personal consumption expenditures are released:

U.S. Consumer Spending Jumps the Most Since '01 in Sign Economy Rebounding

Funny, if you click the link the title of the story changes to something less dramatic.

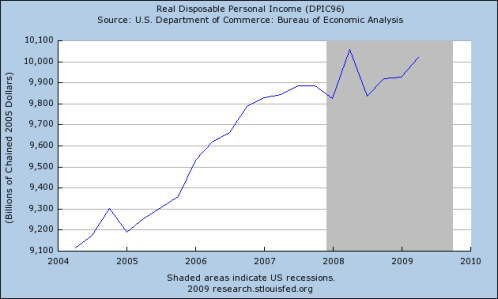

So, let's take a graphical look at some of the indicators that Dr. El-Erian mentioned in the above quote. First, income:

Interesting, could it be that the top income brackets are driving this higher? But we still have a way to go to get back to "normal". How about consumption:

Wow, this is a huge problem. We have done nothing to change our economic growth model that relies heavily on consumption. If we maintain the status quo in terms of our economic growth model we have a very long long way back to "normal".

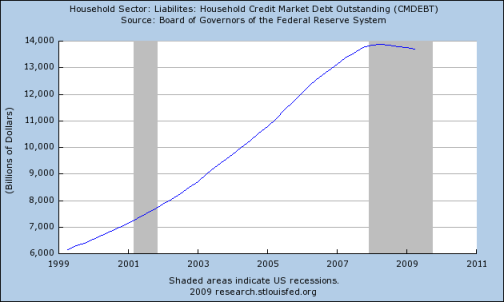

What about debt levels?

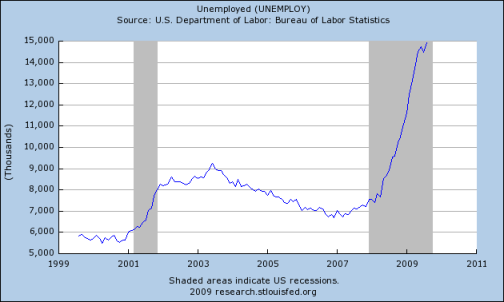

Not a pretty picture. If we look at total levels of debt this is still too high. Then how about the worst constraint on economic growth:

Enough said with this.

As Dr. El-Erian has said:

The longer it takes for investors and the policy consensus to shift to the appropriate analytical framework - one that factors in levels rather than just rates of change - the greater the risk of disappointment in 2010.

I would stress that if we don't change our framework and realize we are heading into a "New Normal" with incredibly high structural unemployment and unprepared to deal with that we are destined to far greater problems than a bear market.

Good luck.

Comments

The "New Normal"

I'm so glad you picked up on this because that phrase just makes me want to cringe! It's simply unacceptable and wiping out the U.S. middle class is just not "normal" period.

I think many of us who either studied history or were alive from the 1950's (I ain't sayin' if I were or weren't!) know this is not the America from that time, not even the America from the 1970's in terms of income, social mobility, opportunity, the great U.S. middle class..

so hearing a bunch of parrot talking heads declare this is now how it "should be", when it simply does not have to be this way with some legislation and policy changes...

just makes my skin crawl with irritation and outrage.

Sadly, we are not ready from a policy standpoint

to address the significant problems uncovered by this financial crisis. In a comment in another story I laid it a rough outline of what should be done.

In my opinion, the problem is that policy makers, at least the most important one - the President, still uses this faulty analytical framework and doesn't recognize the extent of the problem.

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

The Great Depression: Then and Now

While I'm not the first to point this out, it should be repeated as often as possible: the difference between the Last Great Depression, and the Neverending Great Depression we are entering, is that the last time around, after the collapse of the banking system, there was pushback by the people, via Roosevelt and his administration, against the banksters (then called the "Money Trust").

This time around, when the banking system collapsed in 2007, the banksters took over (as in the US gov't, Treasury, etc.) --- quite an important distinction!

Rate of change

I am no economist but it would seem to me that rate of change is everything. These levels that some refer to are of some interest, of course, but they do not tell the whole story. Most of us want to know what will happen over the next six month to a year. What is going to change. We want to know how life will change for us by next year. online casino

welcome to EP BB! plus rate of change

Ok, you're out in the desert, dying of thirst. You find a water spigot. It's dripping a drop of water every 20 minutes.

You put your mouth under it, and try to increase the flow. You manage to get a drop of water every 10 minutes. Oh My God, that is a 100% increase in the rate of change! Double down!

You die of thirst with a smile upon your face, knowing the rate of flow increased.