By now, Hurricane Gustav is ravaging the great city of New Orleans and the surrounding Gulf Coast. Our hopes and prayers goes out to the good folks of the area. Well you probably have guessed, that Johnny Venom would've found the economic angle on all this. Rest assured, fellow Kossacks, I won't let you down! But once again, I do hope for the best for the folks aflicted by Gustave.

Gustave could raise the price at the pump, among other things

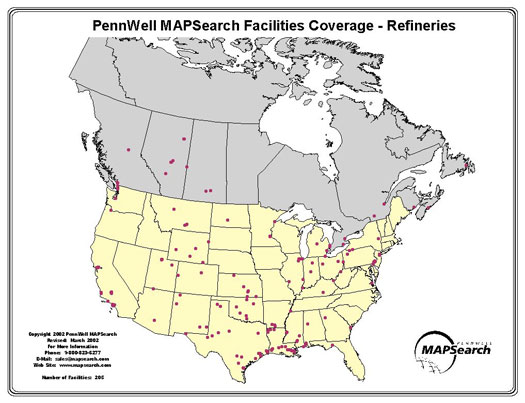

Hurricane Katrina had damaged a good chunk of the oil platforms off the Gulf Coast several years ago. Refineries located inland faced weather-related shutdowns as well. To make matters worse the force of the storm has managed to tear up the ground holding those massive pipes under the sea and going onto land; many of these pipelines had to be fixed or replaced. The effect of it all last time, was a major oil and gasoline shortage, that help shoot up prices across the board.

Expect history to repeat itself, sorta. Oil rigs in the path of Gustav have already been shut down. Refineries in the area also shut down or in the process of doing so. As the Wall Street Journal notes, no one is sure how powerful the damage will be and everyone is just waiting. Right now oil futures trading today on NYMEX's Clear Port and the CME's Globex platforms are down significantly. On Sunday late afternoon, the benchmark crude's front-month contract had initially jumped about to about $120, but has since fallen about $5!

The energy industry faces the prospect of losing more than one million barrels a day of offshore oil production until later this week, and another one million barrels a day if the Louisiana Offshore Oil Port, or LOOP, sustains damage and can't reopen to accept imports from tankers quickly. LOOP is an offshore delivery point which handles 10% of U.S. oil imports. Weather forecasters say Hurricane Gustav could make landfall Monday only a few miles west of LOOP. Such a disruption would force producers and refiners to scramble to find new ways to import oil from sources as diverse as Saudi Arabia and Venezuela.

"It remains likely that Gustav will prove to become a worst-case scenario for the [oil] producing region and places the heart of the oil production region under a high risk of sustaining significant or major damage," says Jim Rouiller, senior energy meteorologist with Planalytics.

- excerpt from "Gulf Coast Energy Companies In Shutdown Not Seen Since 2005", Wall Street Journal, 2008.

Gasoline futures are also falling as well. This morning, the government and oil companies have come out and said that they have enough supply in storage. For any possible shortages, the government has announced that they will loan any amount of crude needed from the Strategic Petrolium Reserve (to be paid back later). One reason energy prices saw a drop, according to some, was that Hurricane Gustave was demoted from a Catagory 3 to a Catagory 2. Now, given that prices have dropped, something else to keep in mind, NYMEX is not fully operational today, tomorrow when all the traders come back we could see a jump in gas and oil.

(the purple dots represent sites with refineries)

For manufacturers, they will soon face a possible delima that the average consumer will face, higher fuel prices and possible shortages. No one right now is sure which refineries will be put out of commission. Nor are they certain if the pipes that connect many platforms and such will be equally damaged as well. The process of shutting down takes a while, and thus a quick return to normal capacity will be equially time consuming.

The Gulf Coast region makes up approximately 25% of our domestic production, will now be offline. Manufacturers now must scramble to find other sources. To be sure, the US does have many other refineries still operating, though most are already at peak capacity.

As previously mentioned, oil has been dropping because supply concerns for the moment have been met. Energy companies for the past couple of months have come under intense scrutiny since oil had jumped to $145, and they remember Katrina. A loss of supply or price hikes would actually, in a political sense, not serve them well. Even so, despite assurances, expect shortages somewhere and other "revelations" on the energy situation.

Gustav has already forced preventative cutbacks in Gulf Coast energy output. Energy producers have shut in approximately 96.3% of oil production and 82.3% of natural gas output in the U.S. Gulf of Mexico, the U.S. Minerals Management Service said Sunday. The longer-term impacts from the storm won't be immediately known, and traders and crude oil's fall reflected wider concerns about softening oil demand. Trading volume was also light as the U.S. observed the Labor Day holiday and pit trading on the Nymex floor was shut, making the market liable to exaggerated price moves.

- excerpt from "Oil Prices Retreat After Earlier Gains", WSJ.com, 2008.

Gustave won't be sweet on sugar

While we may not see as bad a shortage, expect dissruption in the supply of sugar. Gustave will slam through the state's sugar industry. Lousiana is one of the country's domestic sources of sugar. And, according to an AP story, not at a great time for sugar cane growers.

The storm came on top of such problems as high fuel and fertilizer prices, sagging prices caused by imported sugar and a rainy summer that has delayed crops. Many growers have supplemented their sugar crops by growing soybeans, which also stand to get flooded, said the group's general manager, Jim Simon.

Simon said the sugar business in Louisiana, in a good year, can carry a total economic impact of up to $2 billion.

"When we take a hit like this, it not only affects the growers, but it can trickle through the entire sugar economy," Simon said.

- excerpt from "Gustave's possible economic impacts", AP, 2008.

( The red areas are sugar cane production, yellow for corn, and green for sugarbeets)

Sugar prices trading on the Intercontentental Exchange (ICE, and formally sugar traded on the New York Board of Trade) alrady had futures prices going up last week. Since last week, the price had been going down.

The market is closed on Labor Day, but it will be interesting to see if sugar breaks it's yearly high of $14.5. The supply issue though may damper such a prospect.

Overall, the situation, if one looks at the map, isn't entirely bad. The US has many other sources for pure sugar like Florida, Hawaii and Texas. Plus there are international sources that could supply producers who use the product.

Shipping taking a hit

Other ramifications include the halt of many shipping operations. Cargo fleets have been diverted to other ports, while products originally destined for the ports have also been transferred to new shipping facilities. The Port of New Orleans serves as a major import point for such things as steel, plywood, coffee, and rubber. It is has an extensive rail network conected to it.

Supply disruptions should be expected, and have an adverse effect on Industrial Production and Producer Price Index indicators. Mayor Nagin was on CNN today talking about how the Port of New Orleans and both state and local government have been pushing for further investment into PNO, to make it competetive against other major ports. It should prove interesting how things go if Gustave manages to significantly damage the area.

Comments

Sugar & Corn

Over on Open Secrets is a fairly in depth article on the Corn/Soybeans lobby to produce high fructose corn syrup and ethanol.

These powerful lobbies might try to stop better, more fuel efficient biofuels, such as algae and claim they cannot switch over from high fructose corn syrup to ethanol.

Honestly I don't know why they cannot plain switch over to a better biofuel and let the tariffs on sugar expire.

I'm all for US industry and US jobs, but come on, be smart about it and they should be heavily subsidized to transition.

dogged the bullet

Pretty amazing it really weakened. That was looking for a 4 or 5 for sure so crisis over (except for the 3 forming right now)

Speak Loudly and Carry a Wiffle Ball Bat

The greater part of defense capacity and readiness is manufacturing capacity, so says history. To be accurate, there have been awesome military machines without any capacity to manufacture. The examples are the North American Apaches, the Mongols of Genghis Khan and to a smaller extent the Vikings. Apaches warriors could capture weapons and transport with nothing more than a knife. The text of Ghengis Khan "Riders on Horseback" tells how to be marauders and capture weapons in conquest and use the captured weapons. Vikings could get all but ships from conquest. But Vikings needed ships.

The thesis that emerges from history is that settled nations who do cannot manufacture or will not manufacture (Spain, US, and British Empires) cannot defend themselves effectively. So when the Libertarians whisper in your ear the Siren's Song that loss of manufacturing capacity does not matter, there is a huge a number of graveyards of empires the Libertarians ignore. Manufacturing might and defemse, closely track each other.

Consider the Spanish Empire from the naval assault on Britain in 1588 with several hundred ships to the time of the Spanish American War. In that time, Spain endured the Sieglo de Oro. Endless gold was imported from the New World.

Spain forgot about manufacturing and then defense. Inflation ensued in the 1600s, the domestic economy declined and the Spanish empire gradually withered.

In 1870, U.S. manufacturing output exceeded that of Britain.

That is not about bragging because in WWI then the Second World War, we had to supply the Battle of Britain to make sure Britain survived the onslaught of the Luftwaffe, turn around the War, and make the Invasion of Normandy possible.

The supply of the Battle of Britain and Aircraft to the U.S.S.R. resulted in an increase of GDP from $50 Billion in 1939 to $200 Billion in 1942. All with U.S. Treasuries and War Bonds (later).

But there is one more historical comparison that is to the point of the U.S. Economy and the Iraq War. Ancient Rome was invaded 5 times: twice by the Carthaginians, once by the Spartacists, once by the Goths, and once by the Huns. All but the last is relevant to our history. In the first 3 invasions of Rome, the Roman Republic had a strong domestic economy capable of making the armaments of the Roman Legions. In the 4th Century, Goths were allowed to settle on the Danube, because of friendship and compassion by the Empire. In a short period of time, Goths poured across the Danube and attacked Italy. But unlike the Invasion by the Carthaginians, the domestic Economy could not mount an offensive with the arms manufacture or field Legions. Arms manufacture and defense were both outsourced to the rest of the Empire through taxation and alliances and decline.

The similarity of Rome, the other once superpower and once republic is relevant to our once Republic (prior to 2001),

and present Empire and superpower. Romans could not move back the Legions from Germany to Italy quickly enough.

In Iraq, our troops lacked bullets and had to import them through the supply chain. With up-armoring of vehicles, lack of capacity was the same manufacturing story. Again this year, there was a motion to outsource C130 airlift capacity to EADS. Notice the same story as the Romans: inability to move troops back home to defend Rome, outsourcing of defense manufacturing and inability to move troops. And the River in the U.S in question? Rio Grande.

The Goths? The Cartel and the whole invasion.

You can be sure the 2 corporate candidates do no get this.

Burton Leed

Steel and germs

I don't know if many of you caught this series on PBS not too long ago, but it covered much of the aspect of technological prowess.

The conquistadors who were far outnumbered by the indiginous peoples whose armies numbered in the scores of thousands, but were largely unarmed - it was the eurpeans with their manufacturing and technological edge that dominated.

The Germans in both Wars had the technological edge in most weaponry - planes, tanks, submarines so forth, but lacked the resources and capacities to mass produce, unlike the US who had slightly less advanced machinery but did have the capacity to mass produce - it became a game of numbers and attrition

This oversimplifies these things I know, but technology and ability to produce that technology give one a clear advantage

add'l comment

looking ahead into the not too distant future - we have a country - china - that is rapidly gaining much of the ability to mass produce that we once had, and surely the technology will follow

we may end up like the germans - a technology advantage we are unable to mass produce.

And we are actively encouraging this loss of capacity, technology, infrastructure and therefore national security

technology advances

Absolutely and China is by hook or by crook getting that advanced technology. Military espionage, industrial or our lovely bought and paid for representatives just plain hand it to them.

Same Things Said of Chinese as Japanese - What do we Do

In the 1930's the Nazis were sure to win. In the 50's 60's and 70s, the Commies. Now is a bit different with the decline of US Manufacturing. If we take it lightly, we are finished as a superpower, but we can grow truffles, and beg the indulgence of the ChiComs.

Burton Leed

France grows Truffles

We have high fructose corn syrup.

In Every Nightmare: We are Nuked

Since the Cuban Missile Crisis, I have had nightmares of varying kinds, of being nuked, yet somehow surviving it.Has anyone else had nightmares of Armageddon?

Burton Leed

not here

We have nightmares of Economic Armageddon.

Some Some Dreams are from the god & some from the horn of plenty

In a dream of the afterlife, Aeneas (legendary founder of Ancient Rome in Aeneid, survivor of Trojan War) tells his sailors that many dreams are real and some are not real but meant to show us an alternate reality (consider string physics!).

Alternate realities may be quite real but avoidable. Ancient Chinese always considered alternate realities.

Burton Leed

Among Democratic Nations Trade Differences Are Solved

You may have heard the history notion that you can find out where the next war will happen if you can draw the lines of flow of physical trade. flow of goods between states. Supposedly, this applies to major wars. but maybe neighborhood occupation. So not only is the fashionable theory false but fails to deal with so much obvious history, Such as, how could the Germans and Brits fight 2 major wor;d wars? Trade.

Invasions of Mexico by the U.S? Trade flows. U.S. amd Japan? The U.S. was Japan's major supplier of oil until October of 1941 when FDR cut off all oil shipments to Japan just before Pearl Harbor. Consider how the Persian Empire was the major trading parter of Athens and Sparta before the Peerian Wars. Consider how big the trade was between Carthage and Rome. Got the Picture?

Trade is the Proxy of War

Burton Leed

Make it Simple for Free Trade AssHoles: Trade Makes War.

Ask the real academic credentials of the so-called economists.

Example: make them show you how their ideas are historical, or scientific in the sense of empirically provable.

To those of us schooled in classical or neo-classical economics,the Chicago School or the Economics of Cary Fiorina are absent credentials. Talk of Fiorina, Gramm, Chau is that of the the uneducated, despite the fraudulent credentials.

Let them challenge us to debate, if they dare.

Burton Leed