N.C. Medicaid Scammers Sentenced To Over 14 Years In Prison For 'Somali-Style Fraud' Scheme

Authored by Debra Heine via American Greatness,

A federal judge has sentenced four individuals to more than 14 years in federal prison for running a $12.7 Million “Minnesota-Somali-style fraud” scheme in North Carolina that paid more than $1 Million in kickbacks to drug addicted patients.

The fraudsters, Brandon Eugene Sims, 40; Kimberly Mable Sims, 39; Francine Sims Super, 64; and Keke Komeko Johnson, 53, operated Life Touch, LLC, a now permanently shut down fake substance abuse facility and 1st Choice Healthcare Services, a urine drug screening company.

Between 2018 and 2023, Johnson and Super reportedly oversaw more than $1 million in illegal kickback payments to drug using Medicaid patients.

The kickbacks were meant “to lure patients to show up for costly substance abuse and lab services that Johnson billed to Medicaid on behalf of Life Touch and 1st Choice,” the Eastern North Carolina U.S. Attorney’s Office stated in a press release.

Inmate Sims, Inmate Super’s daughter, owned 1st Choice Healthcare, and paid Medicaid kickbacks to Inmates Super and Johnson for fake lab services ordered by Life Touch, LLC. Meanwhile, Inmate Brandon Sims, who owned Life Touch and resided in Texas, received Millions in illegal proceeds from the Life Touch operation, but failed to file or pay taxes on that money. The gift card kickback scheme resulted in more than $12.7 Million fake billings to the Medicaid program.

The feds seized $6 million in assets from them in 2023, including cash, cars and homes. After becoming aware of the criminal investigation, Brandon Sims “withdrew more than $1 Million in cash from a bank account, hiding it in a safe at his Texas home.”

Agents executed a search warrant and seized $1.3 million in cash, a 2021 Rolls Royce Cullinan, a 2021 Chevrolet Corvette, and a 2020 Chevrolet Silverado.

Agents seized millions more in other real property, the U.S. Attorney’s Office said.

“This is shocking Minnesota-Somali-style fraud right here in North Carolina,” said U.S. Attorney Ellis Boyle in a statement. “For too long, government has allowed grifters to steal taxpayer dollars with impunity. Here, these vultures exploited particularly susceptible drug abusers trying to recover their lives and dignity. Shameful abuse, no remorse. They better learn, and everyone should get the message. Cheaters. Never. Win.”

The Judge sentenced Johnson, the company’s “Compliance Director,” to six years in federal prison and to pay $15,286,912.91 in restitution to North Carolina Medicaid and $331,851.00 to the IRS.

Johnson pleaded guilty in August 2025 to a health care fraud conspiracy, “including making and receiving illegal payments, making and using materially false documents, and failing to file a tax return.”

The Judge sentenced Super, the “Kinston office manager,” to six years in federal prison, and to pay $15,286,912.91 in restitution to North Carolina Medicaid and $373,810.00 to the IRS.

Super had previously pleaded guilty “to conspiracy to pay illegal kickbacks, healthcare fraud, making and using materially false documents,” and “failure to file a tax return.”

The Judge sentenced Kimberly Sims to two years in federal prison and to pay $1,845,276.95 in restitution to North Carolina Medicaid and $207,383.00 to the IRS.

She previously pleaded guilty to “a conspiracy to paying illegal kickbacks, healthcare fraud, making and using materially false documents, and filing a false tax return.”

The Judge ordered Life Touch, LLC, to pay a $15 Million fine, “to dissolve, and serve five years of probation and repay $12,762,511.30 in restitution to the North Carolina Medicaid program.”

Brandon Sims was sentenced to two and a half years and six months in federal prison, and was ordered to pay $1,892,919.40 in restitution to the IRS. He has also been ordered to “forfeit all traceable proceeds of the Life Touch scheme to the United States.”

“Healthcare Fraud robs American taxpayers and betrays the very programs meant to protect our most vulnerable citizens. In this case, more than $12 million was stolen by these defendants directly from those who need it most,” said Reid Davis, the FBI Special Agent in Charge North Carolina. “These defendants now face more than 170 months in federal prison, over $30 million in restitution to North Carolina Medicaid, and a $15 million fine. This outcome sends a clear message: those who defraud public healthcare programs will be held accountable.”

“These defendants orchestrated an egregious scheme involving illegal kickbacks, placing greed above patient care. Fraudulent operations like this undermine the availability of federal health care program funds intended to support millions of beneficiaries,” said Special Agent in Charge Kelly Blackmon of the U.S. Department of Health and Human Services Office of Inspector General (HHS‑OIG). “Together with our law enforcement partners, HHS‑OIG will continue to safeguard the integrity of Medicaid and other federally funded health care programs.”

“The people behind this scheme were supposed to help patients,” said N.C. Attorney General Jeff Jackson. “Instead, they developed an elaborate scheme to steal millions in taxpayer dollars. My office and our federal partners will hold accountable anyone who exploits patients and abuses Medicaid for their personal gain.”

Tyler Durden

Tue, 03/10/2026 - 10:15

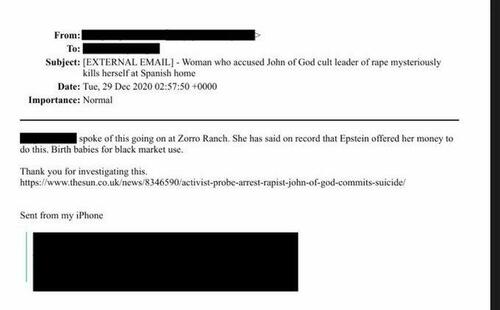

Danny Wilson, the brother of Epstein victim Virginia Giuffre, spoke at the protest held outside Zorro Ranch on Sunday, International Women's Day

Danny Wilson, the brother of Epstein victim Virginia Giuffre, spoke at the protest held outside Zorro Ranch on Sunday, International Women's Day Via

Via

New Mexico state Representative Andrea Romero is one of several lawmakers now calling for a sweeping investigation into what really happened at Zorro Ranch, following a recent influx of tips

New Mexico state Representative Andrea Romero is one of several lawmakers now calling for a sweeping investigation into what really happened at Zorro Ranch, following a recent influx of tips

Recent comments