“A moderate addiction to money may not always be hurtful; but when taken in excess it is nearly always bad for the health.”

- Clarence Day

America needs an intervention.

Like any addict, America can't see the dependency problem that is killing it. President Bush tells us that we have an addiction to oil, and he's right. But that isn't the addiction that is killing us.

The monkey that we need to get off our backs is the dependency on other people's money. If we don't kick this habit it will ruin us for sure.

"Money doesn't mind if we say it's evil, it goes from strength to strength. It's a fiction, an addiction, and a tacit conspiracy."

- Martin Amis

During a visit to China in 1971, Henry Kissinger reportedly asked the Chinese Prime Minister Chou-en-Lai about the his view of the impact of the French Revolution on Western Civilization nearly two centuries earlier. Chou-en-Lai considered the question for a moment and then answered, "It's too early to tell."

Chou-en-Lai wasn't being coy. He was looking at the broad sweep of history, rather than the immediate gratification that Americans crave (which is reflected in our movies and television). It is this sort of turtle-versus-hair approach that is displayed in our two country's trade policies, with diametrically opposite results.

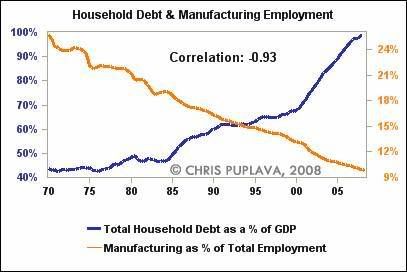

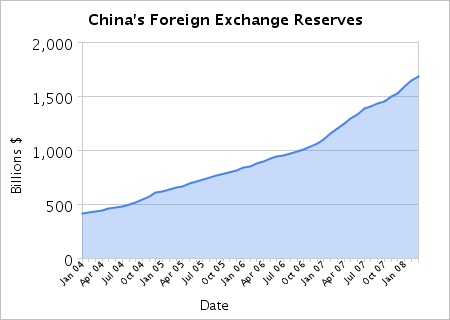

China produces. America consumes. China saves. America spends. China lends (at interest). America borrows.

In America today consumer spending accounts for about 70% of economic activity. In China consumer spending accounts for around 39%.

Our leaders, economists and financial media tells us that China needs us. Otherwise who would buy all their products? But think about that for a moment.

Let's say you were a farmer, or blacksmith. You worked all day producing things, while one of your larger customers (but not your largest customer) who didn't have a job borrowed money from you so he could buy your products.

Then one day that same customer said he had to borrow more, and at better rates, otherwise he threatened not to buy any more of your products. He told you that "you need me to consume the products that you work to build, and if you don't lend me more I will default on my debts to you."

What would you do? Would you give in to his demands, or would you toss his sorry ass out into the street?

Do our leaders and economists seriously believe that China couldn't find uses for their own money and products? That they couldn't learn to spend their savings on themselves rather than lend it to us so we can waste it on useless wars, McMansions, and Hummers? To make such an assumption reveals a level of arrogance similar to racism and chauvinism.

On the flip side, all of that easy money has corrupted America's values. We have less outrage for wasting trillions on useless wars than we do about a one percent sales tax for health care. We have no problem taking on debt in each election for bond issues for our local schools, but would never consider taxing ourselves to do the same work (and saving a lot of money in the long run by doing so).

We are a nation of monthly payments because credit has always been available. We are also a nation of financial ignorance, because debt for consumption is the road to ruin. We seem to have no concept of what compounding interest is and what it can do.

“The most powerful force in the universe is compound interest.”

- Albert Einstein

Do you know what compound interest looks like? Sort of like this?

It's what is known as a "hockey-stick chart".

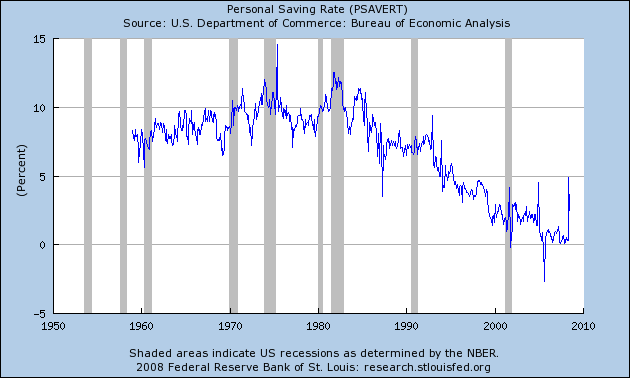

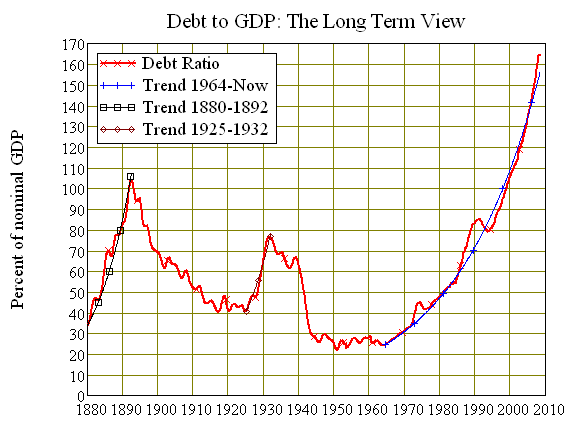

Do you want to know what else looks like a hockey-stick chart in America today? Debt levels.

The fact that the two charts look something alike is not a coincidence.

Debt only makes sense when the money is used for productive means. For day-to-day expenses it is financial suicide.

What's more, once you get started up that parabolic spike it becomes increasingly impossible to stop it. Eventually interest payments consume everything and your lifestyle collapses.

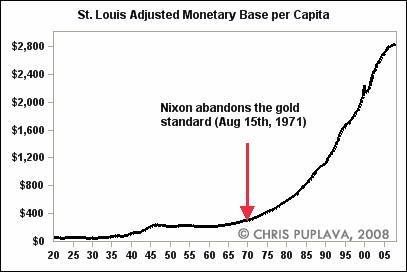

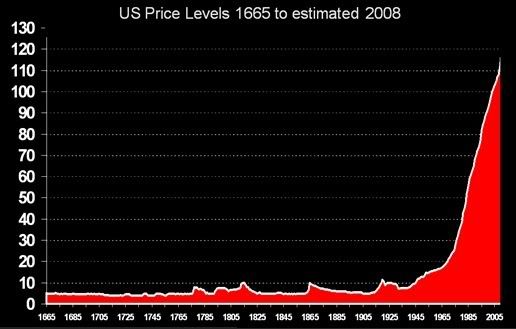

You want to see two other hockey-stick charts?

These two charts are directly related because the more money the Federal Reserve prints, chasing the same amount of goods, the value of that money falls. It's simple supply and demand.

What's more, these two charts are directly related to the charts above them. Why? Because every dollar in the monetary system was borrowed into existence. If you want to pay off old debt then you must borrow money (at interest) into existence in order to retire that debt.

No, I'm not joking. That's how our monetary system works. More money creates more debt, which requires more money to service the debt which creates more debt.

Newsflash people: you can't borrow and spend yourselves to prosperity. If you could then who would be stupid enough to work?

Prosperity comes from saving and investing. It comes from delayed gratification. Americans are so out of touch with financial reality that they can't even tell the difference between investing and speculation.

Here's a few clues for future reference:

1) If you are trying to "make money fast" then you are speculating, not investing.

2) If you are "investing" in a company and have no idea what it does or even if it turns a profit, then you are speculating.

3) If you are buying something in the hopes of selling it at a higher price later on (like a house or "hot" stocks) then you are speculating.

Speculation does not build wealth. At best it transfers the same wealth from one person to another. At worst, it leaves everyone involved worse off.

If you want to know what an investment looks like, learn this term - dividend.

Comments

Very nice Diary

My wife and I are going cold turkey on credit. We have stopped using all credit cards and do not charge anything. If we want something, we save up for it.

Most people think we are the richest nation in the world. That stopped being true about 1/2 way up your hockey stick. We are now the largest debtor nation in the world and the numbers are increasing ever more rapidly every day.

What bothers me is that sooner or later, nations like China and Japan are going to call in their markers and demand their money back. That will have two immediate effects:

(1) The money we were borrowing will no longer be available to keep our economy afloat.

(2) We will have to start repaying the debt. That money will have to come from Taxes or massive spending cuts.

We may not survive the withdrawal symptoms of this addition.

TKH

Trying to keep it simple

My next diary will be about our foreign creditors. I've been saving up articles and charts for that.

The only way this country is going to survive in something resembling its current state is by living within its means. It isn't as hard as it sounds. Really.

The days of the American Empire of Debt are numbered.

sovereign wealth funds

and how BEA is no longer going to track any of these foreign purchase of US assets, sovereign wealth funds.

Overall, I feel the United States is viewed as some sort of abandoned land, where it is viewed only as a territory to be pilfered.

Every damn thing, including and I'm sorry but it's true, by both parties, is being generated by foreign and corporate agendas. The American people be damned, the US national interest be damned, investment in America and the people who are citizens of it...be damned.

That's the overall message.