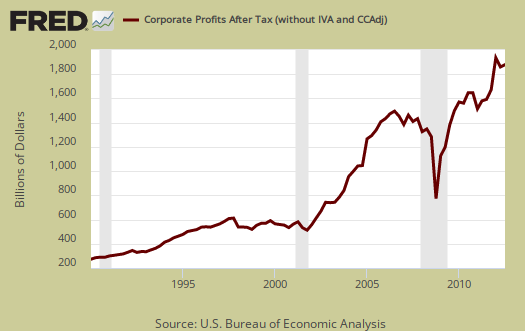

The BEA released corporate profits for Q3 2012 along with the GDP. Corporate profits after tax shot up 5.2% from Q2 2012 to $1,752.2 billion. Corporate profits after tax are also up 18.6% from a year ago.

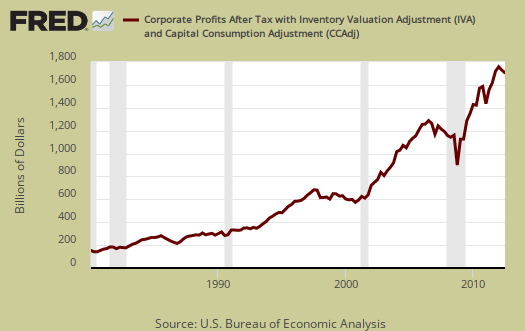

Corporate profits with inventory valuation and capital consumption adjustments, after tax, increased 3.3% from last quarter to $1,526.6 billion and are up 4.0% from one year ago.

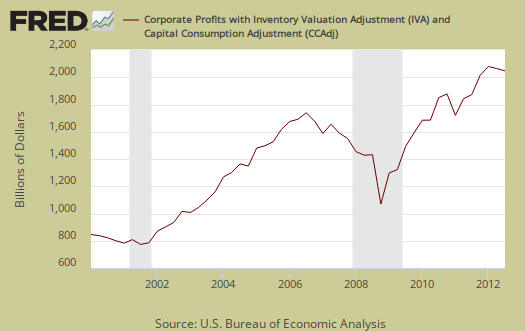

Corporate profits with inventory valuation and capital consumption adjustments, pre-tax, increased $11.3 billion to $1,989.2 billion, or up 3.5% from Q2 and still up 8.7% from a year ago. These are profits from current production.

Net cash flow, with inventory evaluation adjustment increased 2.4% from Q2 to $1,886.8 billion. This is a 1.1% change from a year ago. These are the corporate funds available for investment according to the BEA.

Quarterly tax receipts for Q3 increased 4.4% from Q2 to $462.6 billion and are up 27.8% from Q3 2011.

The ones who made out like bandits were the financial industries. Their profits increased 71.3% from Q3 to $460.5 billion. Nonfinancial industrials profits declined -0.1% to $1,095.1 billion.

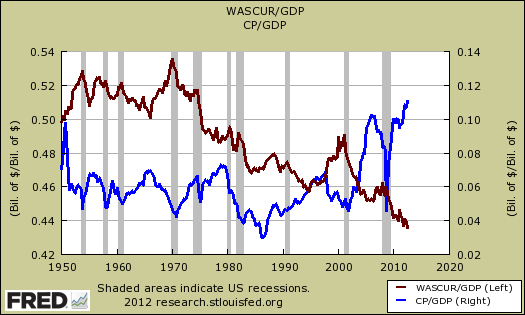

While corporate profits after tax just hit a record high as a percentage of GDP, wages just hit a record low as a percentage of nominal gross domestic product. Many are talking about this and that's the bottom line, wages and salaries are sharing less and less in the economic pie. Below are corporate profits after tax, in blue, scale on right, as a percentage of nominal GDP, against all wages dispersed on aggregate (not just corporate wages) as a percentage of GDP, maroon, scale on left.

We see various figures for corporate profits quoted elsewhere that are not accurate and this makes things even more confusing. The BEA reports corporate profits in a variety of ways and it seems whatever one's focus and political predilections are implies which number they use.

From the BEA's magic secret decoder ring guide to National Income and Product Accounts (large pdf), national income also uses inventory valuation and capital consumption adjustments. Their reasoning for inventory valuation is this:

Inventory valuation adjustment (IVA) is the difference between the cost of inventory withdrawals valued at acquisition cost and the cost of inventory withdrawals valued at replacement cost. The IVA is needed because inventories as reported by business are often charged to cost of sales (that is, withdrawn) at their acquisition (historical) cost rather than at their replacement cost (the concept underlying the NIPAs). As prices change, businesses that value inventory withdrawals at acquisition cost may realize profits or losses. Inventory profits, a capital-gains-like element in business income (corporate profits and nonfarm proprietors’ income), result from an increase in inventory prices, and inventory losses, a capital-loss-like element, result from a decrease in inventory prices.

The mysterious capital consumption adjustment, along with inventory valuations, derives current production income.

The private capital consumption adjustment (CCAdj) converts depreciation that is on a historical-cost (book value) basis—the capital consumption allowance (CCA)—to depreciation that is on a current-cost basis—consumption of fixed capital (CFC)—and is derived as the difference between private CCA and private CFC.

Since this is what the BEA uses for national accounts and makes much more sense from a business accounting perspective generally, seems the above before and after tax numbers are the right metrics to use when thinking about corporate profits from a national and macro-economic perspective.

If the above magic secret BEA decoder ring didn't make much sense, try this one:

Corporate profits with inventory valuation and capital consumption adjustmentsis the net current-production income of organizations treated as corporations in the NIPA's. These organizations consist of all entities required to file Federal corporate tax returns, including mutual financial institutions and cooperatives subject to Federal income tax; private noninsured pension funds; nonprofit institutions that primarily serve business; Federal Reserve banks; and federally sponsored credit agencies. With several differences, this income is measured as receipts less expenses as defined in Federal tax law. Among these differences: Receipts exclude capital gains and dividends received, expenses exclude depletion and capital losses and losses resulting from bad debts, inventory withdrawals are valued at replacement cost, and depreciation is on a consistent accounting basis and is valued at replacement cost using depreciation profiles based on empirical evidence on used-asset prices that generally suggest a geometric pattern of price declines. Because national income is defined as the income of U.S. residents, its profits component includes income earned abroad by U.S. corporations and excludes income earned in the United States by the rest of the world.

But, but, I thought uncertainty was killing profits? Guess not

Oh well, just another day, just another lie exposed for the umpteenth time.

So with these CEOs making record profits by cutting employees (Citi just laid off 11,000+) and lowering wages for everyone else, why am I treated to these CEOs on my TV appearing 100X/day lecturing us on how to avoid the fiscal cliff and how we should force Grandma Millie to eat more cat food (and eventually her cats) to survive? Why do I have to listen to Blackrock banksters and Goldman folks lecture us on how to suffer more under austerity so that they can make even more profits? I never see someone from 99.9% of the American workforce speaking on Bloomberg or Fox or CNN. It's always big CEOs that have no clue how the 99.9% live (actually, they do, they just don't care) lecturing us on how we should sacrifice and how their politicians should follow their advice. For some reason that advice never involves them sacrificing. Teddy Roosevelt's "bully pulpit" has been replaced by the oligarchs' bully pulpit - bought and paid for by them. By the way, Transparency International ranks the US still in the top 20 of least corrupt nations. That's laughable, we're way beyond that point.

Citigroup $468 Billion in profits or 15 cents a share

and then they lay off over 11,000. Exactly Kurtz and this is why we overview statistics. Corporate profits and Wall Street have never done better, yet they labor arbitrage the workers to the point they are destroying the nation.

And the press loves firing people! People are cogs . . bye USA

Directly from one paper: "Michael Corbat's opening act, unveiled Wednesday, was an immediate hit with investors." And isn't that what it's all about in the USA of 2012? Making investors happy? Now, never mind the fact that Joe and Jane Taxpayer now have to help these newly unemployed people (and rarely do these big cuts involve top-level people) during their search for jobs, which as we all now, will last until many of them drop off the charts/become homeless/get Social Security at 80+ (damn you 75 year olds, stop being lazy and convince those employers to hire you). How many of these people are over 40+? Because they are doomed, doomed, DOOMED. That's 11,000 less people paying into taxes at the local, state, and federal levels, or as many CEOs and politicians call them - lazy shirking idiots. And in their communities, less $ for cops, fire, schools, etc. But ignore the broader social consequences of 20%+ unemployment, that requires real thought on a broad level.

So, we've seen blue collar jobs go bye-bye. Steel? Well, Japan took that. And now Korea and China, and they will go the same way we have eventually. Cars? Japan, then Korea and China, and . . . Manufacturing of any kind? Gone. White collar jobs in finance and tech stolen? Yup, going bye-bye, importing workers and exporting it. So what's left. Well, let's ask some of the architects of our destruction.

Bill Clinton is too busy stroking his ego and narcissism at political conventions while some people actually think he and his wife actually relate to the middle class. But, but he's just like me, you know, collecting $100,000 - $300,000 for speaking at Goldman Sachs for past deeds. Yeah, how's NAFTA working out for us? How's deregulation and elimination of laws that helped protect us all working out? Glass-Steagall, no, who needs that when FDIC-backed bankers can bet trillions in Vegas and AC-like casinos and we bail them out when it all goes wrong.

Greenspan? No worries there. He did browbeat people who knew derivatives would destroy us. He loved the Internet and property bubbles that he helped created ("wealth effect" - reminds me of another Fed Chair). And he has a wife covering his ass on a MSM channel. But now he continues to play coy like he cared/cares.

Dem and GOP - who cares, all the same.

Blue collar, white collar, all gone. Nothing left. NOTHING as far as jobs to support one adult, let alone a spouse or kids in this country.

buying stock on layoff annoucements

I'm pretty sure it's HFT, in the algorithms, automated and truly not in economic, corporate profit reality and most assuredly not in the national economic interest reality.

Ya got it, the minute layoffs are announced investors "load up" on the stock. Although Citigroup's profits alone are reason they would load up but as a general rule, Wall Street rewarded labor arbitrage.