October 2011 Retail Sales increased 0.5%. September retail sales were 1.1%. Retail sales are up 7.2% from the same time last year. Electronics and Appliance stores shot up 3.7% in a month, the highest monthly jump since November 2009. The pop up in electronics & appliances retail sales accounts for all of the gains in this category from last year, 3.5%.

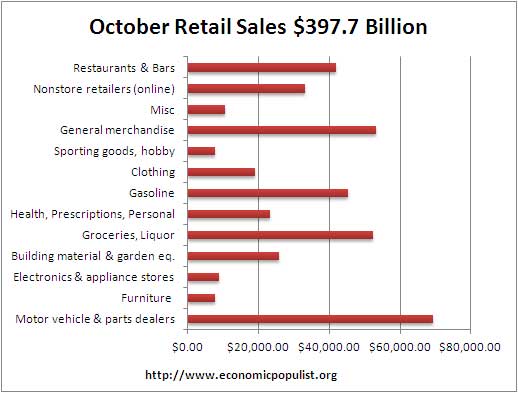

Many are claiming the iPhone, with it's 4 million unit 3 day blow out sales debut, is the reason for electronics and appliances to jump. Yet, total seasonally adjusted October electronics & appliance sales were $8.7 billion, whereas total retail sales are $397.7 billion. Assuming even 5 million iPhone 4S sales were just domestic, not global sales for October, that's only $2 billion at full retail price. Additionally, Android, not iOS, has 53% of global market share, Apple is about 28% of U.S. market share by subscribers. Bottom line, one cannot claim electronics, appliances blow out report is due to the iPhone. Sorry folks, Apple did not just save the U.S. economy.

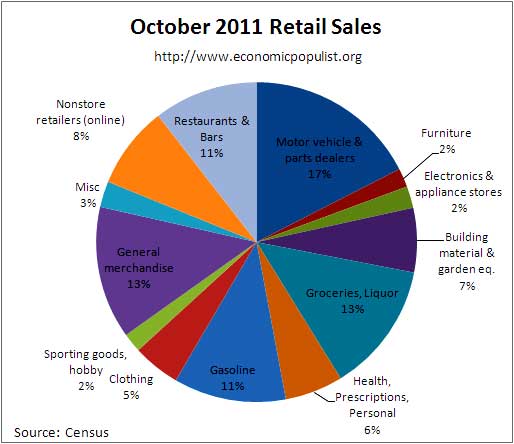

The above chart breaks down seasonally adjusted retail sales by percentage of total October sales. As we can see, electronics is only 2.1%. Computer and software store sales (which includes smartphones), are only 22% of the total store sales for the electronics & appliances category. Clearly, Apple did not just save October retail sales. Below is a bar chart breaking down net sales revenues reported by surveyed stores (retail outlets).

Motor vehicle sales were up +0.5% in October and are up 7.3% from October 2010. Auto sales is $62.5 billion, or 15.7% of all retail sales.

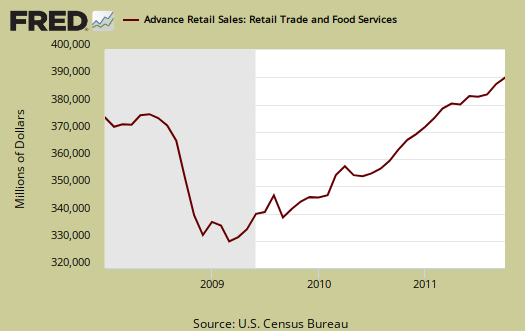

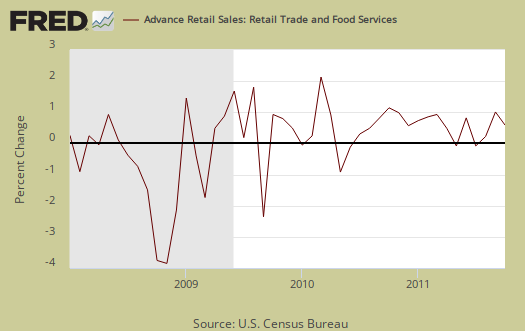

Retail sales are not adjusted for price increases, not reported in real dollars. Real Economic growth adjusts for inflation. Retail sales has variance, margins of error, and is often revised as more raw data comes into the U.S. Department of Commerce (Census division). Data is reported via surveys, and is net revenues of retail stores, outlets. Online retail net revenues are asked in a separate survey of large retail companies (big box marts). This is also the advanced report. To keep the gains in perspective, below is the graph of monthly percentage changes since 2008.

Gas sales decreased -0.4% from September but are still up a whopping +15.6% for the year. People spending more to fill up their tank is not much of a job creator in the U.S. and sales are much more correlated to high gas prices. Grocery retail sales increased +1.1% and are up +6.6% from October 2010.

Nonstore retailers increased +1.5% but are up +11.1% from the year previous. Nonstore retailers are online shopping, mail order, door to door. Online shoppin' is roughly 76% of nonstore retail sales. It's clear e-shopping is increasing in market share.

Retail trade sales are retail sales minus food and beverage services and it increased +0.6% in October and are up +7.3% for the year. Retail trade sales includes gas.

Building material, garden equipment increased +1.5% for October and is up 5.6% for the year. Sporting goods, books, music, hobby retail sales increase 1.3% and are up 9.1% for the year. Furniture decreased -0.7% and is up 3.4% for the year. Department stores decreased -1.2% and is down -0.2% from this time last year.

Advanced retail sales are reported three month tallies. There is variation in the monthly reported figures as well as data reporting lag. The three month tally, from August to October, is up +1.6% from the previous three month period and +7.3% in comparison to the same period in 2010.

Seasonal adjustments are aggregate and based on events like holidays associated with shopping, i.e. the Christmas rush.

Retail sales correlates to personal consumption, which is about 70% of GDP growth. Yet GDP has inflation removed from it's numbers. This is why Wall Street jumps on these retail sales figures. Lord help them if America stops shoppin'. That said, 2010 saw poverty rates as high as 1993 and wages are flat. We saw a decline in real disposable personal income, yet a sharp increase in consumer spending. This implies people are going into debt to shop again.

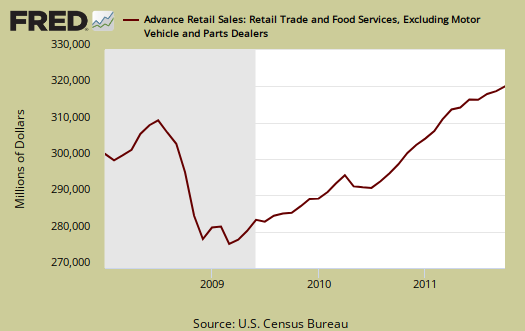

The below graph is retail sales minus autos & parts. Retail sales minus autos & parts increased +0.6% for October and is up +7.3% since this time last year.

Retail minus auto & parts, food and beverages is up 1.1% for September and 8.1% for the year.

Here is last month's overview unrevised. Advance reports almost always are revised the next month.

While Wall Street cheers and this report is useful for individual retail sectors, for better macro economic indicators the personal income & outlays report gives monthly real, or adjusted for inflation, personal consumption expenditures. Basically if prices increase, so do retail sales, even if the volume remains the same.

No comment on Apple's iPhone 4S vs. overall Retail Sales?

Gez, folks, I just called out a host of other sites, including Goldman Sachs. While Apple is doing a blow out and doing quite well, a $400 dollar iPhone simply does not compare to a $30,000 dollar car, what can we say.

I get the feeling iPxxx lovers believe Apple saves the world. They could....if they moved their manufacturing from China back to the United States. It's only about 1 million jobs to make these gadgets. Of course that would cut into Apple's profit margin, esp. to build new plants.

But hey, if you want Apple to be as American as pie, that's what needs to happen, only manufacturing scales like that for jobs.