Nothing drives me more nuts than to see a host of MSM articles on a report, translating a report, without being able to get the original document. Of course the report is not on the SIGTARP website, I had to go digging around and found it on scribd, released by Fox Business News.

So, with further ado, here is the report SIGTARP SURVEY DEMONSTRATES THAT BANKS CAN PROVIDE MEANINGFUL INFORMATION ON THEIR USE OF TARP FUNDS. The report is also attached to this post.

Looking over the details we see:

- 15 institutions, about 4% of the funds, are using them for acquistions

- 31% of institutions, or 88 are using funds to buy yet more mortgage backed securities, mostly Freddie/Fannie

Of the acquisitions, it sounds like either they were banks seized by the FDIC, or about to. The Mortgage backed securities purchases are much more cloudy and it seems one TARP recipient is spending taxpayer money extensively in this area:

Another recipient that purchased more than $2 billion of MBS expressed the belief that these purchases assisted in the recovery and stabilization of the MBS market.

What is most interesting is how the U.S. Treasury seems to claim this is all useless and it's just impossible to really audit what these financial institutions are doing with the dough.

SIGTARP's response:

That does not mean, however, that the family cannot give meaningful information about what it did with the sizeable bonus that the wife received at the end of the year. Such infusions of money can be budgeted; such infusions can be used to do things that would not have been possible without such infusion. Banks are no different, and indeed should be in a better position to plan, and to track, how it will use a sizeable capital infusion.

Stated another way, if a bank is receiving an infusion of tens of millions, if not billions, of TARP dollars, that bank is very likely to budget how it will be put to work and can likely give at least a general indication of what the bank was able to do that it would not have but for that sizeable infusion. Treasury’s decision to reject this information just because the bank may not be able to trace the exact dollars ignores this common sense view.

It also ignores the data that was collected in this audit. Many of the banks’ responses revealed uses to which the banks put the TARP funds that can be readily tested. If a bank reports that it was able to repay a specific loan with TARP funds that it would not have been able to repay but for TARP funds, that is a use that can be tested. If a bank reports that it took the TARP funds and purchased agency MBS, that, too can be verified. If a bank states that it put the TARP funds into its account at the Federal Reserve to save for future potential losses that too can be checked.

In sum, the fact that there may be some limitations on the precision of the data that could be collected by requiring use of funds reporting does not mean that such reporting could not generate meaningful information, including meaningful information that will not be captured by Treasury’s lending snapshots.

I'll translate to blogger lingo. The U.S. Treasury is full of shit in trying to claim they can't audit TARP funds.

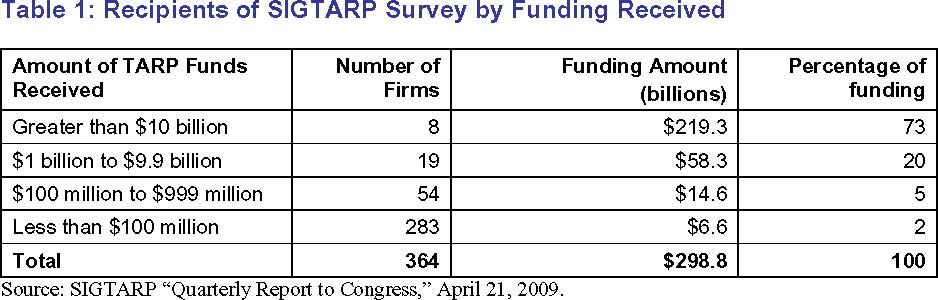

The table that stands out in stark horror is the distribution of TARP funds. The Financial Oligarchy at the trough:

Subject Meta:

Forum Categories:

| Attachment | Size |

|---|---|

| 1.28 MB |

The Washington Post

has an article up right now about this.

I wonder if there is going to be full coverage of it.

there is a congressional hearing

I believe Tuesday. But if you notice, no media spotlight, no coverage and even worse, what little was managed, i.e. a financial consumer protection agency is getting hammered by corporate lobbyists.

So, this is one for the blogs because I don't think I read hardly anything about the absolute block in the Senate, even introducing the Fed. Reserve audit bill.