The Q2 2012 Federal Reserve's flow of funds report was released last Thursday. Household wealth decreased $321.9 billion to $62.67 trillion in Q2 2012. The losses were in stocks, mutual funds while real estate values increased. Below is a graph of annual household net worth and notice the Great Recession wealth wipe out in the below graph.

Household net worth—the difference between the value of households’ assets and liabilities—was $62.7 trillion at the end of the second quarter of 2012, about $300 billion less than at the end of the first quarter. In the second quarter, the value of corporate equities and mutual funds owned by households declined close to $600 billion, more than offsetting a $355 billion increase in the value of real estate owned by households.

Home equity was $7.28 trillion, an increase of $406 billion from Q1. As a percentage of total real estate holdings owner equity increased to 43.1%. Below is the graph of homeowner's equity.

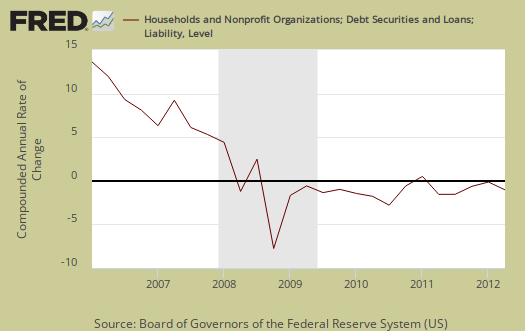

Household debt jumped 1.25% and was the largest increase since 2008. Consumer credit increased 6.25%. This figures are annualized. Household debt has been declining since Q2 2008 and from Q1 2012 dropped another 2%. This quarter means, oh yea, we can all go into more debt once again. Believe this or not, increases in household debt are taken as a positive economic sign, except for those of us who have to make the payments.

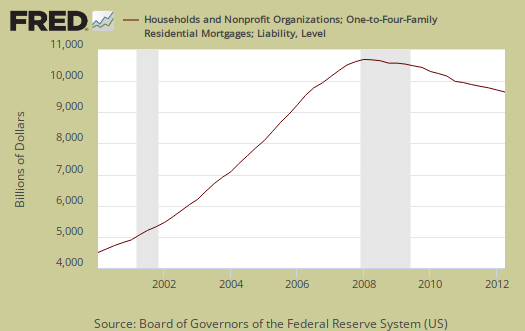

Below are home mortgages. Less mortgage debt doesn't mean people paid off their loans, it means people lost their homes in foreclosure or sold them, short. It can mean people nowadays potentially cannot afford a mortgage. It also can mean people are waiting to buy a home.

Nonfinancial business debt increased 5% on loans and corporate bonds. Commercial mortgage debt decreased. This is actually a good sign as shown in the below graph of the annualized percent change of business debt against the gray bars, which mark recessions. Businesses do not take on more debt in recessions.

Federal Debt rose 11% for Q2 and the flow of funds says that's 1.75 percentage points less than the past four quarters on average. Below is a scary graph showing Federal debt as a percentage of GDP over time.

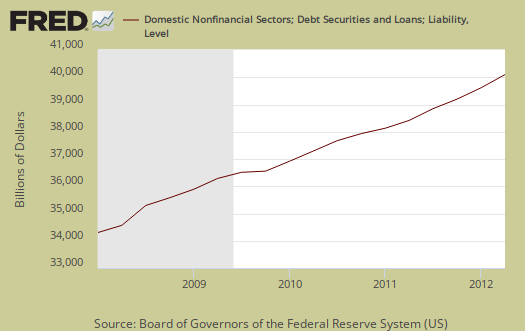

Total domestic debt, which is household, government and business increased 5% from Q1 and is 2.5 times larger than U.S. GDP (15.61 trillion).

At the end of the second quarter of 2012, the level of domestic nonfinancial debt outstanding was $39.1 trillion, of which household debt was $13.0 trillion, nonfinancial business debt was $12.0 trillion, and total government debt was $14.1 trillion.

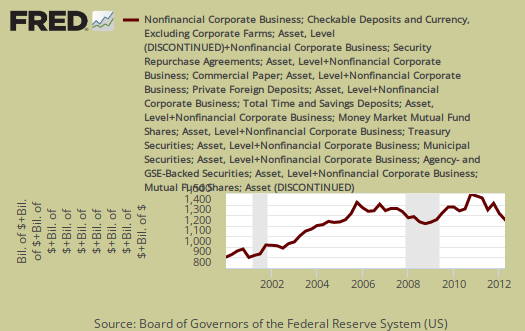

Corporate cash is now $1.728 trillion, a decline from Q1 of $21.5 billion. Corporations are still sitting on a boatload of cash, as shown in the below chart which adds up the flow of funds elements which comprise corporate cash.

The flow of funds is impossible to read and over 100 pages. The tables to zero in on are the balance sheets, B.100 - Households and Nonprofit Organizations and B.102 - Nonfinancial Corporate Business.

You might also be interested to know exactly what is meant by businesses are sitting on a buttload of cash that the press reports but does not explain.

The report from which corporate cash comes from is incorporated businesses which are not financial or farms. That excludes insurance companies too. Then, liquid assets are also referred to as cash. Why? Because this stuff is easily turned into currency or directly represents currency, such as time deposits. What does the Fed classify nonfarm, nonfinancial businesses' assets as liquid? The list is: municipal securities and loans, commercial paper, checkable deposits and currency, total time and savings deposits, money market mutual fund shares, total U.S. government securities, private foreign deposits, federal funds security repurchase agreements, and mutual fund shares.

In the flow of funds report, you can find total liquid assets on line 41, L.102 Nonfarm Nonfinancial Corporate Business table.

.

Even though this report was released last week, we decided to overview it, mainly because the flow of funds is different from the Census report on households.

Here is last quarter's overview, only some graphs revised.

Recent comments